Get instant access to this case solution for only $19

Globalizing the Cost of Capital and Capital Budgeting at AES Case Solution

AES has been using a single discount rate for all of its operations – an equity discount rate of 12% based on US data. This discount rate was quite appropriate in the past when most of the operations were based in US. However, the recent expansion of AES into different geographical areas has exposed the diverse operations of the company to varied amounts of risk. The company is now contemplating the use of different discount rates for each of its projects. It is suggested that the costs of equity and debt are adjusted for sovereign spread – the difference in the risk free rates of the local country and the US. The WACC is later adjusted for the project-specific risks based on a broad range of seven categories including exchange rates, regulatory environment, and operational complexities. It is determined that the new methodology results in a broad range of discounts rates – ranging from around 10% to 30%. However, the use of different discount rates for projects with varied risk in consistent with the theoretical basis of capital budgeting. The valuation of the Lal Pir project reveals the stark difference between the old and the new method of capital budgeting. Moreover, it is believed that the adjustments of sovereign spread and project-specific risk are consistent with the circumstances of AES. The amount of the adjustments may be disputed but any errors could be best addressed on the basis of empirical data obtained after the implementation of the methodology. AES should, therefore, implement the new approach with a view to improve it even further.

Following questions are answered in this case study solution:

-

Executive Summary

-

Statement of Problem

-

Summary of Facts

-

Analysis

-

Recommendations

Globalizing the Cost of Capital and Capital Budgeting at AES Case Analysis

2. Statement of Problem

The diverse overseas operations of AES demand appropriate adjustments to the discount rate, but the lack of any theoretical basis for using adjusted discount rates had led the company to use the same discount rates across all of its operations. The company is contemplating a new methodology to calculate separate discount rates for each of its overseas operations. However, the calculations are not an exact science and the results may not be agreeable with other valuations methods like multiples. The planning director, therefore, is not sure if the board of directors will appreciate his novelty or condemn him for overcomplicating things.

3. Summary of Facts

Capital budgeting used to be a simple task at AES Corporation. The company used a uniform discount rate for all of its operations. The cash flows were evaluated on the basis of those attributable to equity holder; and, therefore, an equity discount rate of 12% was employed. Majority of the debt of its subsidiary was non-recourse, which was deemed to have no impact on the parent company. The limited recourse debt of the parent company was, thereby, considered good. The justification for the uniform discount rate was that all dividend cash flows to the company were equally risky. This proved to be a gross miscalculation in the end.

Until the 1990s, the use of a single discount rate worked quite well because most of the operations were located in the US, and the limited overseas operations also had very similar risk characteristics when compared to the local operations. During the 90s, the company expanded into many overseas regions. The real problem started when AES began to apply the same discount to these new operations, which had very different risk characteristics. The company had failed to account for the increased currency, political, and sovereign risk of the new operations. During the early 2000s, a number of these additional risks materialized. There were currency devaluations in Latin America, adverse regulatory changes in Brazil, and decline in UK commodity prices. All these events affected the dividend inflows from the overseas operations of AES. This led to a domino effect of the stock price of the company as its market capitalization fell by approximately 95%.

Rob Venerus plans to address the problem by estimating a separate discount rate for each of the company’s projects in order to address their unique risk. Such an approach was not considered in the past because of the lack of any theoretical basis. However, the present crisis has forced the company to reconsider its approach. Venerus has come up with a comprehensive measure of calculating the discount rate that will be used for the total cash flows of the company and not just the equity cash flows. The company realized that the nonrecourse debt can also impact the operations by reducing the dividend flows from the subsidiary. Therefore, Venerus feels weighted average cost of capital is a more appropriate method that also takes leverage into account. Venerus has also developed extensive measures to calculate the country risk as well as project risk faced by each of the company’s operations. However, it cannot be determined with certainty that the new approach will deliver useful results without complicating things too much.

4. Analysis

i. Capital Budgeting Approach at AES

Companies often use a single discount rate to evaluate its projects. Although the use of WACC is more standard, the use of an equity discount rate using the equity cash flows is not unusual. However, the discount rate in capital budgeting is strictly selected on the basis of the riskiness of the cash flows. A company-wide discount rate represents the average riskiness of the project. Such a discount can be deemed appropriate in cases where the projects undertaken by the company exhibit the average risk of the company. If a particular project has more risk than the company average, the use of the company discount rate will overestimate the value of cash flows from the project. The consequence would be that the company will start to accept risky projects, which it might have rejected, because they appear more attractive than reality. Similarly, a project with lower risk than the company’s average risk will be underestimated under constant discount rate policy. Such a company will, therefore, tend to reject good projects and accept risky projects. Over time, the overall risk of the company would increase.

A very similar situation developed at AES. A single discount rate is suitable for companies who have projects with very similar risk. In such cases, the average risk of these projects, as captured in a single discount rate, can be an appropriate measure to use. However, if the risks of projects vary too much, the single discount rate will overestimate risky projects and underestimate attractive projects. Due to its diverse overseas operations, AES undertook projects with very different risks. Still, it used the discount rate that was only appropriate for its lowest risk operations in US. The operations in other countries exhibited other country specific risks, which were not accounted for in the calculations. Therefore, the expected cash flows from overseas operation of AES were over-optimistic. The process of capital budgeting clearly indicates that the discount rates should be modified to reflect the riskiness of the specific projects. The fact that AES could not find an empirical proven way to modify their discount rates does not its decision to continue using the wrong discount rate. The company is right to modify the discount rate to reflect the riskiness of each of its project. The question is: is the current approach taken by AES appropriate?

ii. The Adjustments to Discount Rate

Cost of Capital

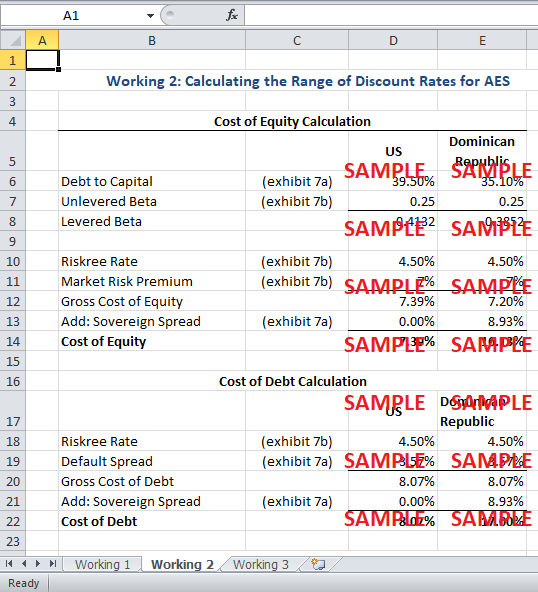

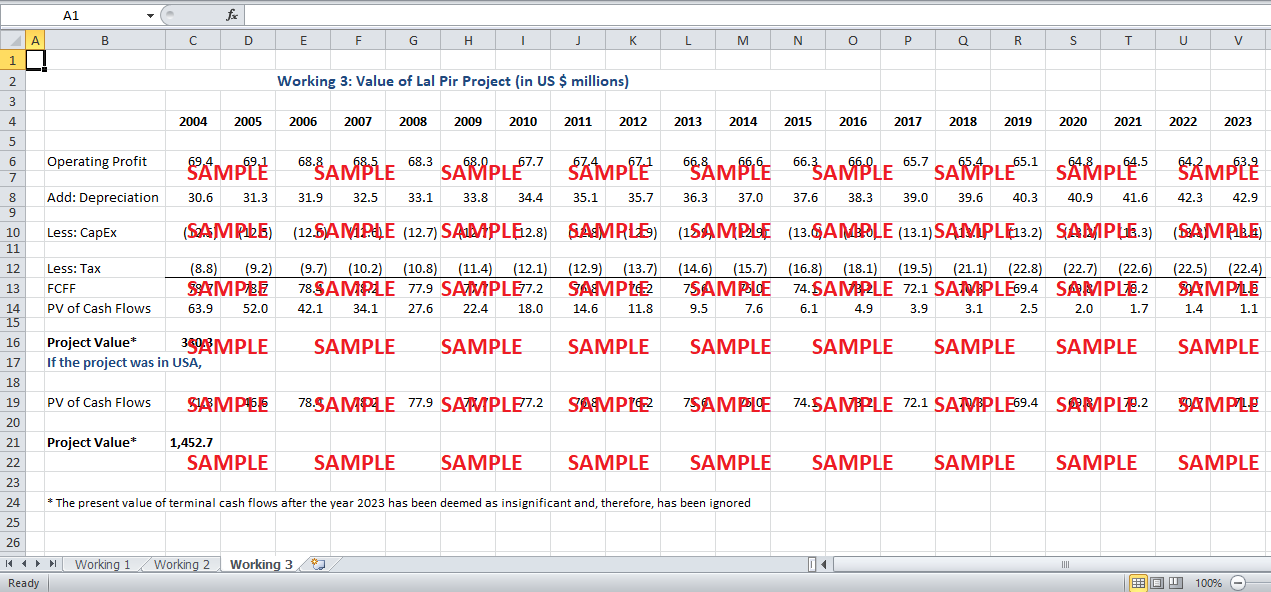

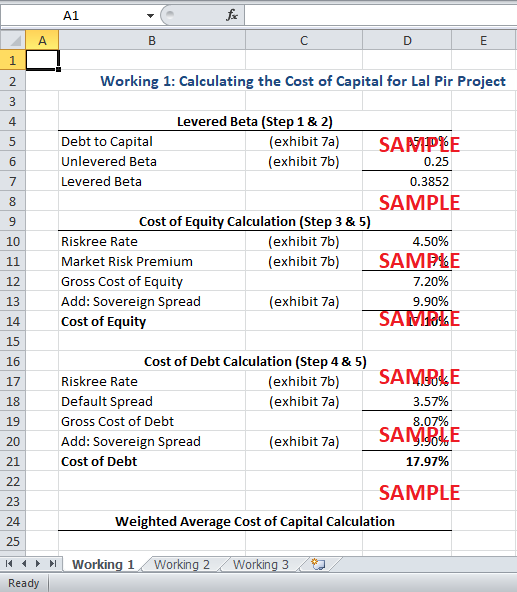

The new approach for calculating the discount rate for AES is comprised of five steps. These steps are outlined in exhibit 8 of the case study. The first step is to calculate the unlevered beta for each of the projects. The unlevered betas adjust the effect of leverage. The second step is to re-lever the betas at the appropriate capital structure for each project. The betas need to be adjusted because each project has different levels of debt. The company uses a simple approach of taking the unlevered beta and dividing it by the weight of equity. A more complicated and appropriate technique would use the Hamada’s equation to account for the differences in marginal tax rates as well. The third step calculates the cost of equity using the Capital Asset Pricing Model (CAPM). The relevant data to employ CAPM is provided in exhibit 7b. The fourth step is to calculate the cost of debt using the bond-yield plus risk premium approach. These four steps are very standard when it comes to calculate the weighted average cost of capital (WACC). Any company that employs WACC in its capital budgeting may be using these steps. However, it is the final step of the process that brings the innovation into the process.

Sovereign Spread

In its final step, AES adds a sovereign spread to its cost of debt and equity. The spread is defined as the difference between the local government bond’s yield and US T-bills yield. It makes perfect sense to add such a spread to the cost of debt. The cost of debt in step 4 has been calculated using the US riskfree rate, which is the equivalent of the US T-bill rate. Thereby, the addition of the sovereign spread to the cost of debt is similar to replacing the US riskfree rate with the local riskfree rate (the rate on local government’s bond). It would make sense to use the local riskfree rate to evaluate the local cost of debt for each project. On the other hand, the addition of sovereign spread to the cost of equity may be a little understated. The sovereign spread is only capturing the difference in riskfree rate between US and the local country. It does not capture the difference in equity market risk. The equity markets is US are very liquid and well-functioning. This may not be the case in other, less-developed markets. This implies that the cost of equity in such countries may need to be adjusted for the risk of the equity market. The sovereign spread, therefore, may be underestimating the cost of equity in some markets.

Project Risk

AES has devised seven different categories of business-specific risk. They have scored each of their businesses on a scale of one to three. The weighted average score on these seven factors will be multiplied by a factor of 500 basis points to arrive at a business specific risk. This risk will be added to the total WACC calculated for each project. The factors covered range from exchange rate risk to operational complexities. The seven different aspects of the risks appear to be carefully thought out.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.