Get instant access to this case solution for only $19

Hanson Ski Products Case Solution

Hanson Ski manufactures high-quality ski equipment in Colorado. Hanson operates in a strongly growing high-end segment of the market, and is among the ten largest firms when measured by revenues. The nature of the business is highly seasonal in nature. Orders for ski equipment are usually taken over summer season (March to July), whereas shipments take place from early fall till December. The company manufactures the equipment throughout the year and usually carries a significant amount of inventory during off-season periods. Moreover, the sales are made on credit and the credit terms are in line with the industry convention of upto three months. Therefore, the company carries a high amount of current assets during the period ranging from September to November. Understandably, the company needs to finance this working capital through some form of financing. Historically, the company had been using short-term loans from a range of creditors including banks, finance companies, and principal shareholders. These sources of short-term loans were costly and inefficient. In an effort to manage its cash flow, the company has now been able to obtain a line of credit amounting to $4.2 million from its bank. However, the line of credit is also restricted to a maximum of 70% of inventories and 80% of receivables at any point in time. The company now needs to determine if this loan balance will be sufficient to finance the working capital requirements of the company for the fiscal year 1987. To further complicate matters, the company also needs to repay a loan of $841,000 in the month of November. The repayment of this loan is essential to the owner maintaining control of the company’s operations.

Following questions are answered in this case study solution:

-

Introduction

-

Projected Balance Sheets

-

Loan Repayment

-

Conclusion

Hanson Ski Products Case Analysis

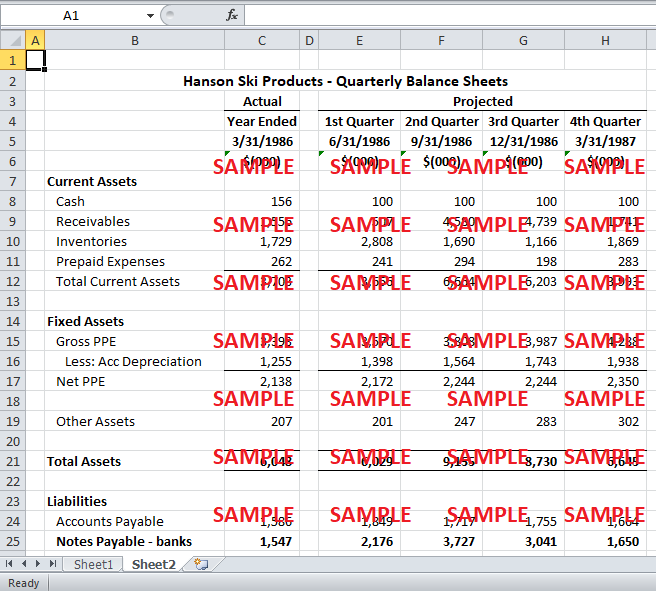

2. Projected Balance Sheets

We have already been provided with the balance sheet for the fiscal year 1986, and some projections for the fiscal year 1987. The projected balance sheet for the fiscal year 1987 can be constructed by using the current balance sheet (exhibit 2), the projected income statement (exhibit 3), and the selected balance sheet projections (exhibit). The balance sheet projections can be used to construct the asset and current liabilities positions at the end of the year. The long-term loans of the company have been paid out. The retained earnings for the next year can be calculated using the projected income statement for the year 1987 (exhibit 2). The cash balance is expected to remain at the projected $100,000 for 1987. The only remaining amount in the projected balance sheet is the notes payable to the bank, which represents the credit line provided by the bank. The notes payable can be visualized as the plug figure that causes the asset and liabilities side of the balance sheet to balance. In other words, the notes payable represent the amount of revolving credit that needs to be taken in order to maintain the projected cash balance of $100,000. The projected balance sheet reveals that the notes payable are expected to be well below the credit limit offered by the bank. However, the balance sheet only reveals the amount of debt at the end of the fiscal year. Since the cash flows are subject to seasonality, there exists a possibility that the company may need a higher level of financing at some point during the year. Therefore, we need to project the level of notes payable at the end of each quarter.

The notes payables for each quarter can be best determined by constructing the projected quarterly balance sheet for each of the quarters of the fiscal year 1987. The quarterly balance sheets can be constructed in the same in which the yearly balance sheet was prepared. The exhibits of the case study also contain the quarterly data for income statement projections (exhibit 2) and balance sheet items at the end of each quarter (exhibit 3). The appendix details the projected quarterly as well as yearly balance sheets, as constructed from the data in the case study. The quarterly balance sheets reveal that the notes payable are considerably high at the end of the second and third quarters. Although the levels of notes payable are lower than the maximum credit limit of $4.2 million, the credit line has an additional covenant that the maximum borrowing should not exceed 70% of inventories and 80% of receivables. Therefore, we need to investigate if the amount of notes payable exceeds the amount mandated by the covenant associated with the borrowing. The following table compares the credit limit for each quarter with the actual credit required. The credit limit has been lowered in the quarters in which the amounts of receivables and inventory are not sufficient to support the maximum possible credit of $4.2 million.

|

|

1st Quarter |

2nd Quarter |

3rd Quarter |

4th Quarter |

|

Receivables |

507,000 |

4,580,000 |

4,739,000 |

1,741,000 |

|

Inventory |

2,808,000 |

1,690,000 |

1,166,000 |

1,869,000 |

|

Credit Limit |

2,371,000 |

4,200,000 |

4,200,000 |

2,701,000 |

|

Credit Required (notes payable) |

2,176,000 |

3,727,000 |

3,041,000 |

1,650,000 |

The table reveals that the company is able to finance its cash requirements through the credit line at the end of each quarter. However, the high levels of notes payable in the second and third quarter imply that the company will be stripped off cash during the period from August to December. Therefore, it is not certain if the company will have enough cash to meet its loan repayment during the month of November.

3. Loan Repayment

It is important for the smooth running of the company that the loan is repaid on its schedule, which is in November. Since the loan amount is significant, it is not certain if the credit line will provide the company with sufficient cash to repay the loan. We already know that the company has sufficient credit to meet its obligations at the end of September (end of second quarter) and at the end of December (end of third quarter). However, we need to check the cash requirements in the months of October and November. The following table provides a summary of net cash requirements in each of these months as provided in exhibit 5 of the case study:

|

|

October |

November |

December |

|

Cash Inflow |

1,000,000 |

1,054,000 |

2,518,000 |

|

Cash Outflow |

953,000 |

2,024,000 |

909,000 |

|

Net Cash Flow |

47,000 |

(970,000) |

1,609,000 |

We already know that the notes payable at the end of September are $3.727 million. This means that we can only borrow less than $500,000 in the coming months. We are expected to get additional cash inflow of $47,000 in the month of October. However, the cash outflow is expected to be 970,000 in November if we want to repay the entire loan as scheduled. The credit line will be insufficient to cover this outflow. Therefore, we need an additional source of financing to cover the additional cash requirement. The credit position improves significantly in December with net cash inflow of over $1.6 million. Therefore, the additional cash financing is needed for only one month.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.