Get instant access to this case solution for only $19

Blaine Kitchenware Case Solution

Blaine kitchenware has maintained a consistent dividend per share in the past few years, which is usually a good indicator. However, the company has also issued a substantial amount of shares in the past three years in order to fund its acquisitions. Unfortunately, the company is holding a substantial amount of cash, which could have been invested to maximize profitability. As a result, the profits have not grown proportionately with the capital raised through ordinary shareholders. The company's earnings per share have decreased, while it has tried to maintain its dividend per share. Therefore, the company's payout ratio has increased considerably from 35% in 2004 to 52.9% in 2006. The company operates in a competitive environment and needs to invest its profits in profitable opportunities in order to maintain its competitive edge. Therefore, the increase in payout ratio is not appropriate, as the company will be better-off reinvesting these funds within the company.

Following questions are answered in this case study solution:

-

Do you believe Blaine’s current capital structure and payout policies are appropriate?

-

Should Dubinski recommend a large share repurchase to Blaine’s board? What are the primary advantages and disadvantages of such a move?

-

Consider the following share repurchase proposal: Blaine will use $209 million of cash from its balance sheet and $50 million in new debt-bearing interest at the rate of 6.75% to repurchase 14.0 million shares at a price of $18.50 per share. How would such a buyback affect Blaine? Consider the impact on, among other things, BKI’s earnings per share and ROE, its interest coverage and debt ratios, the family’s ownership interest, and the company’s cost of capital.

-

As a member of Blaine’s controlling family, would you be in favour of this proposal? Would you be in favour of it as a non-family shareholder?

-

How does the proposal in question 3 differ from a special dividend of $4.39 per share?

-

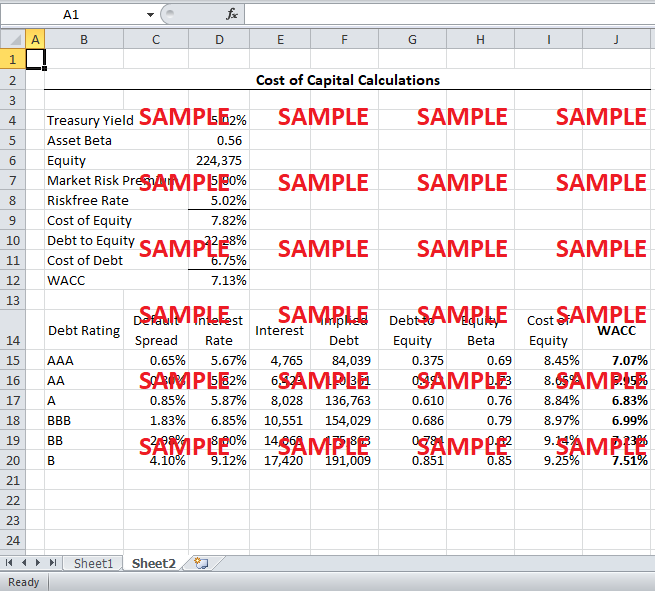

Suppose that Mr. Dubinsky has obtained from Blaine’s banker the quotes below for default spreads over 10 year Treasury bonds. What do these quotes imply about Blaine’s cost of debt at the various debt levels and credit ratings? Compute BKI’s weighted average cost of capital at each of the indicated debt levels. What do your calculations imply about Blaine’s optimal capital structure? Based on these calculations, how many shares should Blaine repurchase?

The Blaine Kitchenware Company Case Study Answers

1. Do you believe Blaine's current capital structure and payout policies are appropriate?

Blaine is mostly equity financed and has only obtained long-term financing twice in its long operating history. The decision to remain unlevered might have been popular for its conservatism in the earlier part of the twentieth century. However, researchers such as Miller and Modigliani have clearly elaborated on the advantages of maintaining a healthy amount of debt. It is a palpable notion in corporate finance that debt adds value to the company in the form of a tax shield provided by the tax-deductible interest on the debt. Therefore, companies find it prudent to maintain some amount of long-term debt on their balance sheets. Although high levels of debt can be risky, as there are distress costs associated with high leverage, it is widely accepted that a medium level of leverage can augment a company's value to a significant extent.

2. Should Dubinski recommend a large share repurchase to Blaine's board? What are the primary advantages and disadvantages of such a move?

The share repurchase can have some drawbacks. The company will have to use a majority of its cash to repurchase the shares. This means that the company will no longer have the flexibility to meet its short-term working capital requirements through internal means. Blaine might need to obtain a revolving credit line from its bank. For a small company of Blaine's stature, the bank might impose restrictions on the credit limit, and charge a significant amount for overdue funds. Moreover, the company will also be foregoing interest on its marketable securities that is purchased from surplus cash. The company might also have to pay significant fees to its bankers for executing the repurchase program. Blaine might have to buy the shares at a premium if shareholders are not willing to sell at the market price. This effect could be magnified if the management believes that the company is already overvalued.

Despite the downside, there are some significant advantages associated with the repurchase program. Although the company is expected to earn the risk-free rate on its surplus cash by investing it is treasury securities, the investors demand a much higher rate on their investments. Therefore, if the company does not have any attractive opportunities in the near future, it might be a good strategy to return the cash to shareholders in the form of share repurchase. Moreover, the share repurchase is also an excellent way to reduce the dividend payout ratio without reducing the dividend per share. There is a strong negative sentiment associated with a decrease in dividend per share, as it is usually seen by investors as a sign of weakening performance of the company. The repurchase program will allow the company an ideal opportunity to decrease its dividends (and hence its payout ratio) without decreasing the dividend per share. Furthermore, the share repurchase will increase the company's value by promoting more debt in its capital structure. Keeping these benefits in view, Dubinski should recommend the share repurchase, as it will also allow the family to exercise more control over the company.

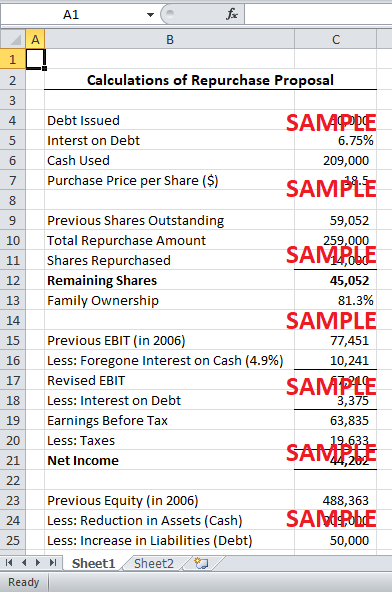

3. Consider the following share repurchase proposal: Blaine will use $209 million of cash from its balance sheet and $50 million in new debt-bearing interest at the rate of 6.75% to repurchase 14.0 million shares at a price of $18.50 per share. How would such a buyback affect Blaine? Consider the impact on, among other things, BKI's earnings per share and ROE, its interest coverage and debt ratios, the family's ownership interest, and the company's cost of capital.

A repurchase of 14 million shares would reduce the outstanding shares to 45.052 million. However, the company's net income is also expected to decrease as it will forego interest received from cash investment, and will have to pay additional interest on its debt. Therefore, it is not clear if the company's per share earnings will increase because of the leveraged recapitalization. The net income is calculated by first restating the revised earnings before interest and taxes (EBIT) for the loss of interest on cash investments. Then, the EBIT is adjusted for the interest on debt and taxes to calculate the net income. The resulting net income is significantly less than the net income before the share repurchase decision. However, the earnings per share have increased from $0.91 per share to $0.98. Therefore, the repurchase program has allowed the company to earn more income on each dollar of its outstanding equity capital.

The book value of equity is also expected to change due to the repurchase program. There are three causes of a change in equity value. First, equity decreases because current assets (cash) are reduced. Second, equity decreases because of liabilities (debt) increase. Third, equity also decreases net income (and hence retained earnings) decrease. The magnitude of the decrease in book value of equity is more than the decrease in net income. Therefore, the return on equity increases to 22.3%. It is expected that a significant portion of the increase in return of equity can be explained by looking at the increase in asset multiplier ratio - a component of the Du-Pont equation. The asset multiplier increases with the increase in debt to equity ratio, which has increased from zero to 22.3%. The additional debt is not expected to cause any bankruptcy concerns, as the company enjoys a comfortable interest coverage ratio of almost 20 times. Therefore, the repurchase program is expected to improve the company's operating results.

4. As a member of Blaine's controlling family, would you be in favor of this proposal? Would you be in favor of it as a non-family shareholder?

The share repurchase program will benefit the members of the controlling family, as it will give the members more control over the company's operations. The stake of the family members is expected to increase from 62% to 81% under the share repurchase program. The repurchase program will give the members a super-majority voting power, which will give them the power to make any decision without requiring the support of minority shareholders. On the other hand, the minority shareholders will be on the losing side as they will not be able to influence any decision. They will be completely dependent on the choice of family members in all decisions, including dividend payments. Therefore, they may not favor the repurchase program if they do not want to sell their stake in the company.

5. How does the proposal in question 3 differ from a special dividend of $4.39 per share?

A special dividend of $4.39 would involve the same outflow of cash as the repurchase program. However, the special dividend does not lead to a reduction in outstanding shares. Therefore, the special dividend will increase the leverage of the company, but it will not lead to higher earnings per share. Moreover, the company will not be able to reduce its payout ratio without reducing its dividend per share. For continuing shareholders, the special dividends could be taxed at a different rate than the capital gains resulting from share repurchase. For instance, if the tax on dividends is higher than the tax on capital gains, the shareholders might experience higher after-tax gains from a share repurchase. The situation will be reversed if the tax on dividends is lower than the tax on capital gains.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.