Get instant access to this case solution for only $19

Lansink Appraisals Case Solution

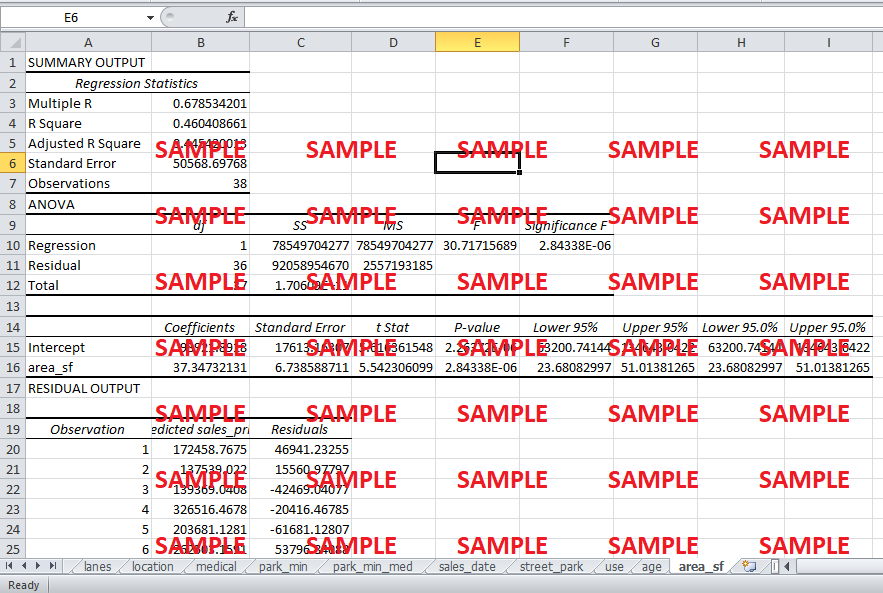

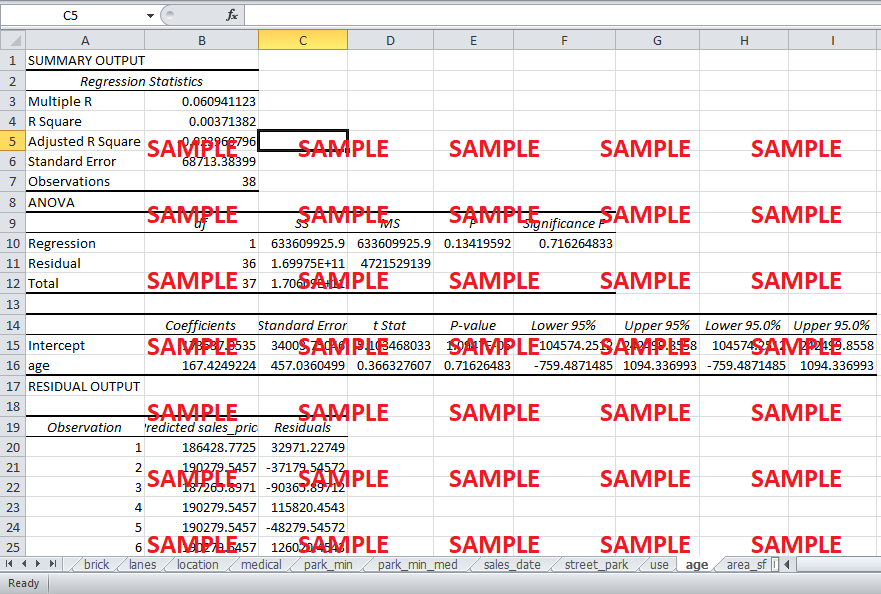

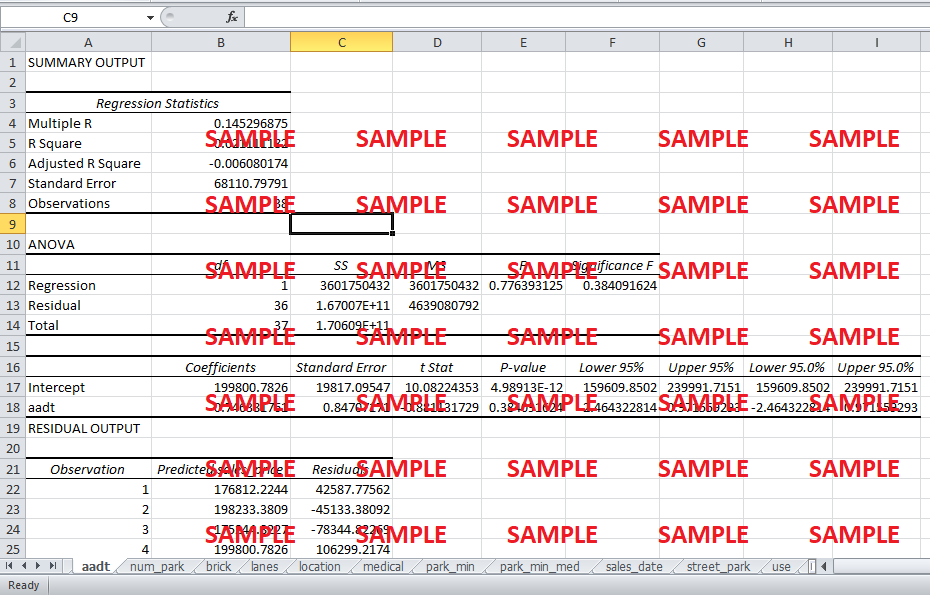

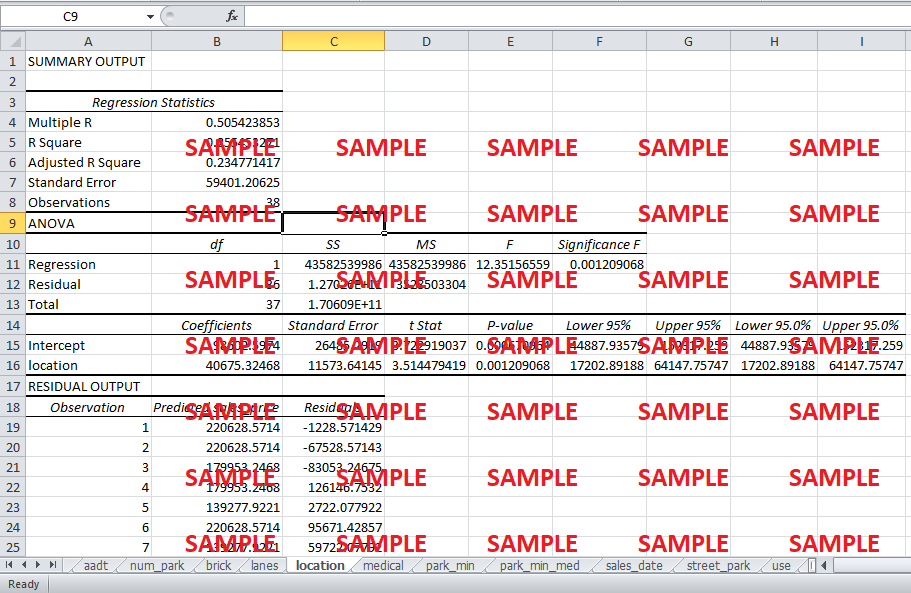

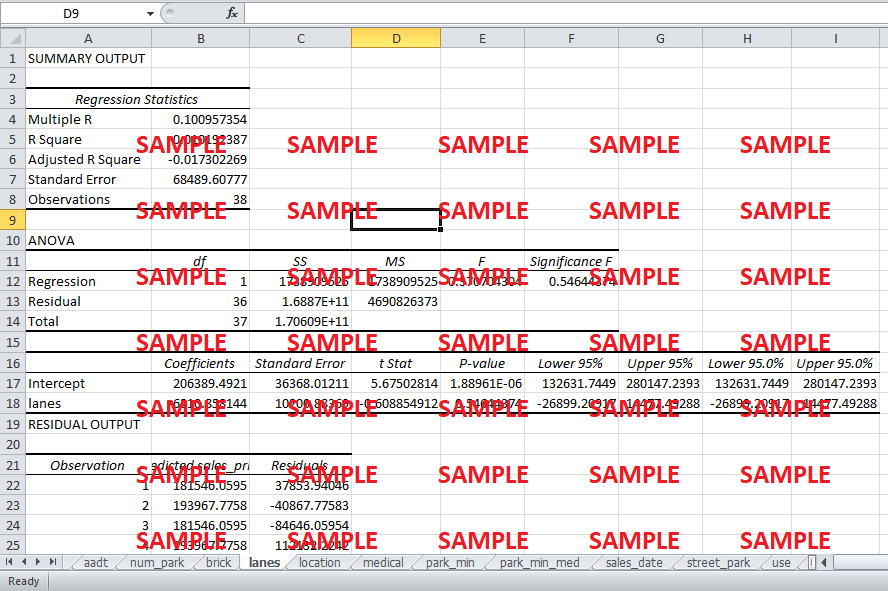

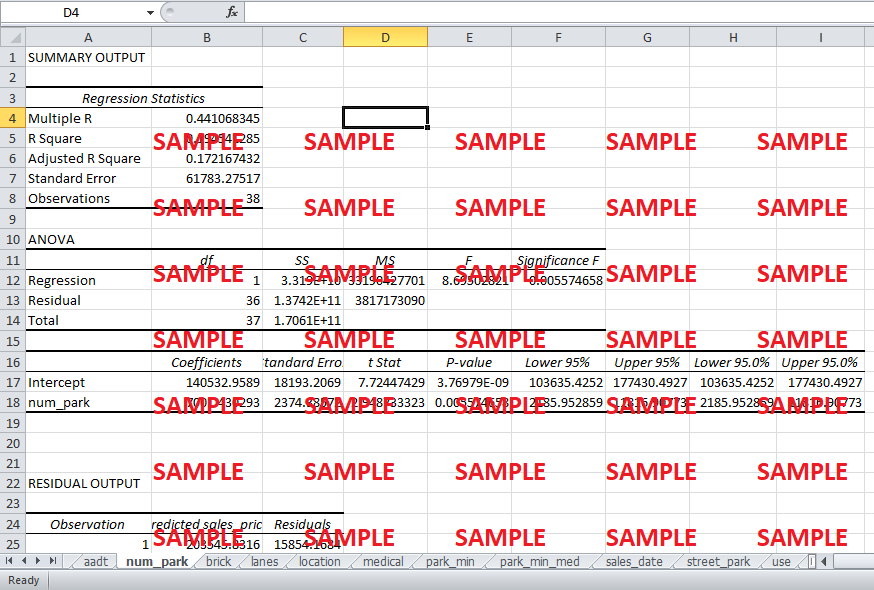

A high multicollinearity (correlation) among the independent variables can also explain the high R-square value in this case. In this analysis, the effect of any one single variable on sale price cannot easily be determined despite holding other factors constant primarily due to multicollinearity effect (Feldman & Berry, 1985).

Following questions are answered in this case study solution

-

Real Estate Valuation

-

Multiple Linear Regression Model Analysis

Case Analysis for Lansink Appraisals

This case discusses how real estate valuation problem has been approached using the multiple linear regression model.

1. Real Estate Valuation

Evidence suggests that a lack of real estate valuation mechanism has led to various problems in the past including the 2008-09 crisis involving subprime mortgages. Moreover, the UK property market crashes of 1970s and Asian financial crisis of 1990s have also attributed blame to the collapse of the property / real estate market across different regions of the world. Real estate valuation is vital to the operation and performance of market economies and therefore requires considerable attention. The International Valuations Committee has been assigned the task to establish real estate valuation mechanism that would allow appraisers to come up with an appropriate property value (Mooya, 2016).

Although there is no available valuation technique, however, the various methods to appraise property as suggested by Mr. Lansink may be rightly used to derive a value for the 8 parking spaces. Out of the three, the present value of the revenue streams generated by the property seems to be the most accurate estimate for this valuation. This method is similar to the DCF analysis used by companies to derive enterprise value using discounted cash flows.

2. Multiple Linear Regression Model Analysis

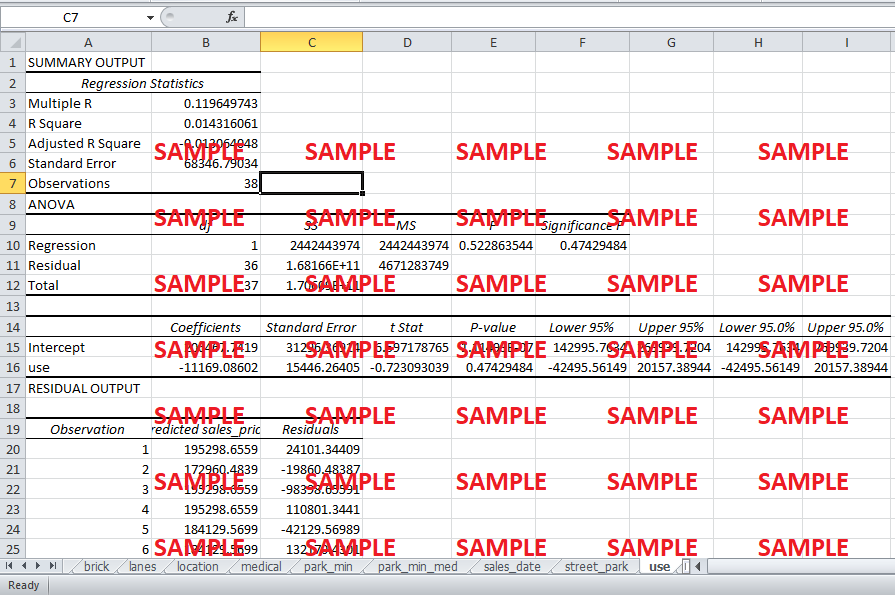

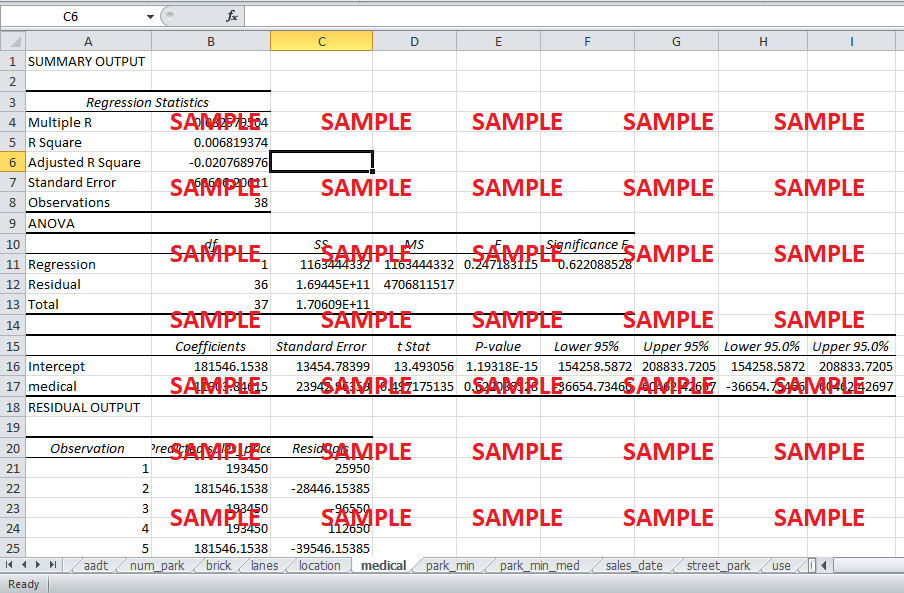

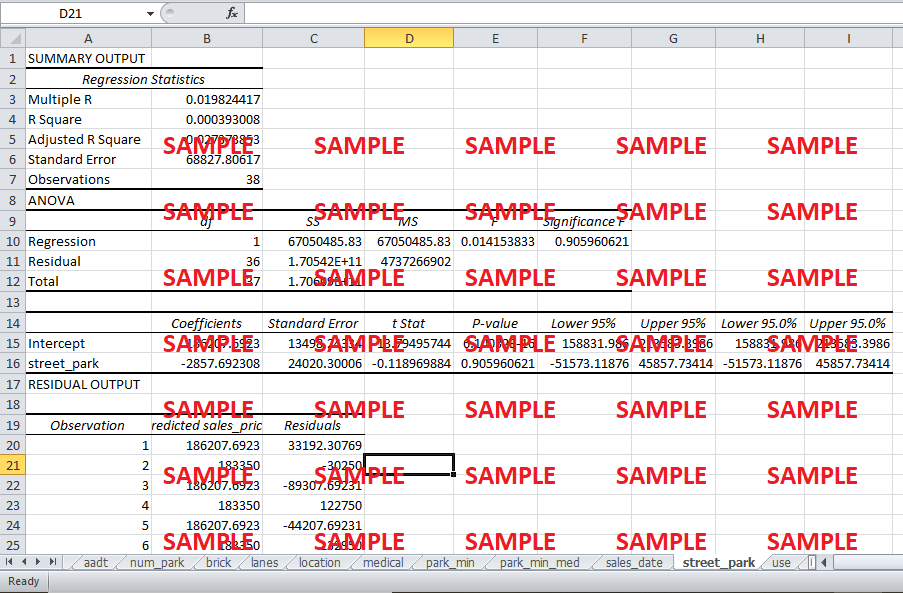

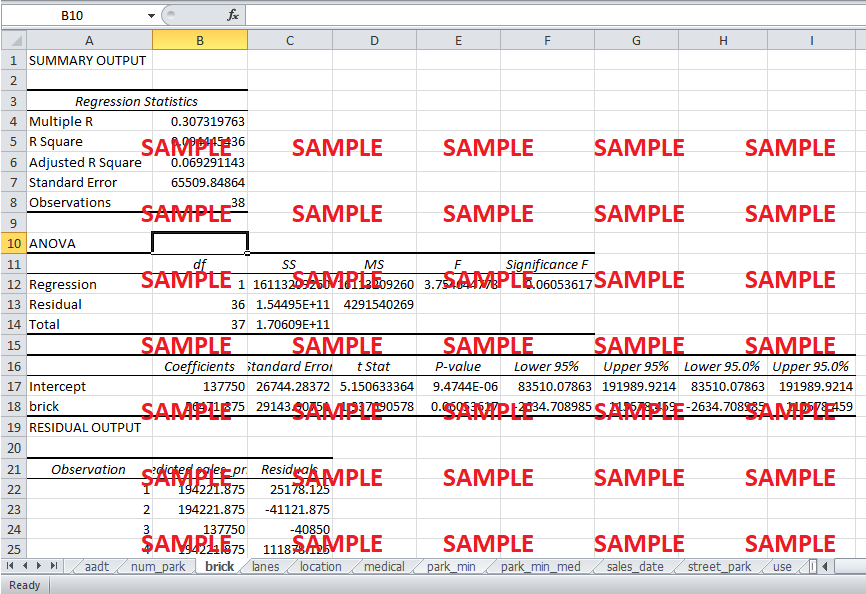

The output that Hamilton Appraisers have presented in the memorandum aims to define the relationship between the sale price of the property and different features of property. The result shows an R-square value of 95.74 percent which translates into a good fit which means that the different property features can significantly explain the variations in the sale price of that property. However, a rework on the same real estate data has been carried out in the excel file attached which has identified certain flaws in the original regression output.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.