Get instant access to this case solution for only $19

Bubble and Bee Organic The Need for Pro Forma Financial Modeling Case Solution

Bubble & Bee Organic (B&B), run by Greenwood and Thomas, has achieved great success in the natural skin care industry through its wide portfolio of organic products. Bubble & Bee Organic’s mission and philosophy were based on more than just selling its organic products, it also included educating others about the dangerous chemicals present in conventional skin care products. Up till now, growth at Bubble & Bee Organic has been financed through operating cash flow with some occasional debt financing. Now faced with the opportunity of expanding its wholesale and online presence, Greenwood and Thomas were considering either renting out additional space or buying a building for operations. Expanding to a 10,000 square feet facility would meet the anticipated growth of the company over the horizon of the next three to five years. A number of financial models with different scenarios are made to analyze the alternatives and choose the most financially feasible option.

Following questions are answered in this case study solution:

-

What factors, other than those considered by the lender, should Thomas and Greenwood consider before taking a loan?

-

Produce financial statements for all four scenarios, specifically, Income Statements, Balance Sheets, and Cash Flows.

-

What are the pros and cons of adding rental space, or buying a building?

-

How do you think financial modelling helped the lender and BBO make a more informed decision? How can it be improved?

-

What are your recommendations to BBO?

Case Study Questions Answers

1. What factors, other than those considered by the lender, should Thomas and Greenwood consider before taking a loan?

In order to grow and expand Bubble & Bee Organic, Thomas and Greenwood required capital. Capital could be in the form of equity or debt. Equity capital would mean giving up control of the company to an outsider who could influence the vision, mission and product portfolio of Bubble & Bee Organic, a factor Thomas and Greenwood need to consider. Since Thomas and Greenwood were hesitant to share control and maintaining the quality and brand image of their products was their utmost priority, equity financing was not possible. This left Thomas and Greenwood with the option of taking a loan to raise capital.

A number of other factors had to be considered in regards to the loan, such as the amount required according to the expansion needs of the company and the expected growth rate of Bubble & Bee Organic. Thomas and Greenwood need to consider which option would be better to finance buying a new building to expand or renting out additional space. Growth in revenue and demand after expansion also needs to be taken into consideration. Taking out a loan will worsen the cash flow position of the company as its current and non-current liabilities will increase.

The terms of the loan and interest rate needs to be considered. Thomas and Greenwood will have to predict if the company will be able to pay back loan installments timely. The cash flow position of the company also needs to be considered as interest payments on loan need to be made. Bubble & Bee Organic Company might have to pledge certain assets as collateral to get their loan approved. In case of non-payment of interest or repayment installments, it risks losing ownership of those assets. The financing from the loan should generate a return to be able to justify the costs of debt financing.

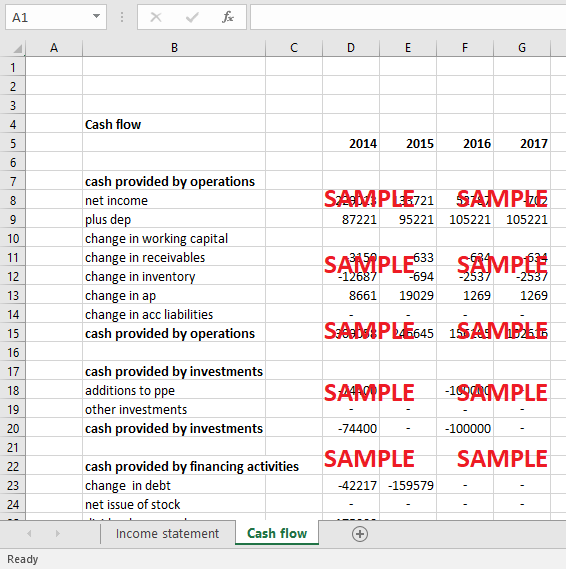

2. Produce financial statements for all four scenarios, specifically, Income Statements, Balance Sheets, and Cash Flows.

|

Cash flow |

|

|

|

|

|

|

|

|

2014 |

2015 |

2016 |

2017 |

|

|

|

|

|

|

|

|

cash provided by operations |

|

|

|

|

|

|

net income |

|

229013 |

133721 |

52787 |

-702 |

|

plus dep |

|

87221 |

95221 |

105221 |

105221 |

|

change in working capital |

|

|

|

|

|

|

change in receivables |

|

-3150 |

-633 |

-634 |

-634 |

|

change in inventory |

|

-12687 |

-694 |

-2537 |

-2537 |

|

change in ap |

|

8661 |

19029 |

1269 |

1269 |

|

change in acc liabilities |

|

- |

- |

- |

- |

|

cash provided by operations |

|

309058 |

246645 |

156105 |

102616 |

|

|

|

|

|

|

|

|

cash provided by investments |

|

|

|

|

|

|

additions to ppe |

|

-74400 |

- |

-100000 |

- |

|

other investments |

|

- |

- |

- |

- |

|

cash provided by investments |

|

-74400 |

- |

-100000 |

- |

|

|

|

|

|

|

|

|

cash provided by financing activities |

|

|

|

|

|

|

change in debt |

|

-42217 |

-159579 |

- |

- |

|

net issue of stock |

|

- |

- |

- |

- |

|

dividends-owner draws |

|

-175000 |

- |

- |

- |

|

cash provided by financing activities |

-212217 |

-159579 |

- |

- |

|

|

net increase in cash |

|

17441 |

87066 |

56105 |

102616 |

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.