Get instant access to this case solution for only $19

Cintas Y Lazos, Inc Case Solution

Carmen Diaz opened a small ribbon and ribbon accessories shop on April 1, 2007. To open this shop, she took a loan from cousins, got the legal fee waived and rented the shop for a cheaper rate. Three months into the business, Carmen wanted to know the profitability of her business. She asked her friend, an economics professor, to prepare an operating report for her to compare her revenues and costs with the industry’s average. The operating report showed a 46% operating loss. A proper income statement and balance sheet are required for a better comparison with the industry and determination of financial position.

Following questions are answered in this case study solution:

-

Prepare an income statement for three months operations of Cintas y Lazos, through June 30, 2007. Was the company profitable? Why did its cash in bank decline during the three-month operating period?

-

Prepare a balance sheet for Cintas y Lazos on June 30, 2007.

-

How successful has Cintas y Lazos been during the initial three months of operations? Which income statement - yours or the economist’s- did you find more useful for making this determination? Which financial statement was the more relevant? More reliable? Explain your answer.

-

When Carmen’s economics professor friend broke “loose from the artificial boundaries of accounting,” what basic GAAP accounting rules and concepts did he violate? Do you believe the “boundaries” of GAAP should be expanded to include this non-GAAP accounting? Explain your answer.

Cintas Y Lazos Inc Case Analysis

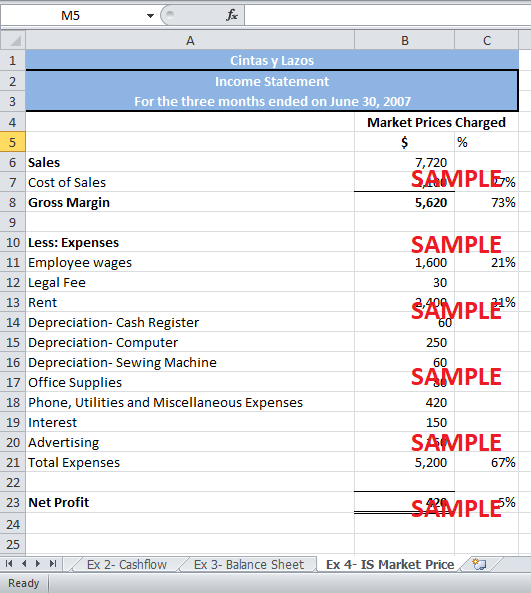

1. Prepare an income statement for three months operations of Cintas y Lazos, through June 30, 2007. Was the company profitable? Why did its cash in bank decline during the three-month operating period?

Exhibit 1 shows the income statement of the three months of operations ending on June 30, 2007. The operating report prepared by the Carmen’s Economist friend is very different from the income statement prepared by an accountant. In the accounting income statement, the opportunity cost of doing business is not included. Therefore, a lot of the costs charged in the economist operating report need not be charged in the income statement. These costs are not charged because they have not incurred. In accounting, only the costs, which have been incurred, are reported in the income statement. The costs excluded from the income statement are as given below:

-

The salary of $1300 Carmen would have earned per month had she been working in the local grocery store, rather than the business, are not relevant because they have not been incurred.

-

Carmen did not buy the fixtures for the shop. They were abandoned by the previous tenant. Hence, the depreciation of these fixtures would not be included in the income statement.

-

Carmen rented the store space from her cousin and paid $600 monthly rent rather than the market rent of $800. Therefore, a monthly rent of $600 would be charged in the income statement for three months.

-

Carmen’s uncle waived the legal fee and the cost of cash registers. Therefore, any expenses related to legal fee and cash register will not be included in the income statement.

-

Carmen took out $1,000 from the saving account to invest in business. Hence, the opportunity cost of $10 from interest on savings is not included in the income statement.

Apart from these expenses, all other revenue and expenses remain as they are. The income statement in Exhibit 1 could be compared to the expected figures in Florida Retailers of the average start-up fabric and notion stores.

The net profit from the accounting income statement is $1,110. This profit is 14% of the revenue. This is a lot better than the 30% loss indicated in the article. The reason for this is the lower rent and wage percentages with respect to the revenue. Hence, based on the new income statement, the company is profitable.

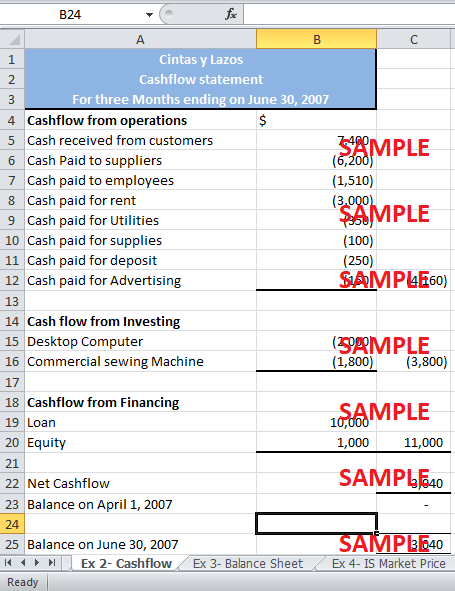

Exhibit 2 shows a cash flow statement to show the changes in cash over the three months of operations. The business is financed by the $1,000 equity from Carmen and the loan of $10,000. The main investment is buying the $2,000 Desktop Computer and a $1,800 commercial sewing machine. All other expenses are done on operations e.g. spending on inventory, supplies, advertising, rent, wages, deposit and utilities. The sale of $7,400 has been recovered from the customers. Therefore, the net cash flow after three months is $3,040.

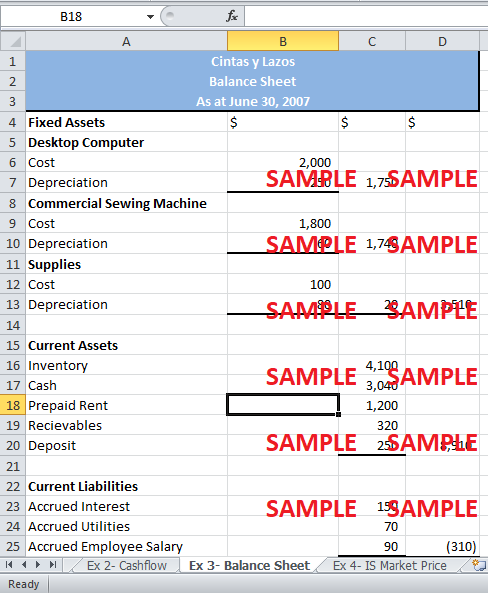

2. Prepare a balance sheet for Cintas y Lazos on June 30, 2007.

Exhibit 3 shows the balance sheet showing the financial position of Cintas y Lazos on June 30, 2007. The balance sheet shows net assets of $12,110. The fixed assets are the supplies, the commercial sewing machine and the desktop computer. Total net book value of the fixed assets is $3,510. The current assets are the inventory, cash at hand, prepaid rent, accounts receivables and deposits. Total current asset value is $8,910. The current liabilities are the rent, employee wages and interest which have not yet been paid. These unpaid expenses cost $310. Finally, the equity and loan with the retained earnings of $1,110 are reported in the balance sheet.

3. How successful has Cintas y Lazos been during the initial three months of operations? Which income statement - yours or the economist’s- did you find more useful for making this determination? Which financial statement was the more relevant? More reliable? Explain your answer.

Cintas y Lazos on its own is profitable. The income statement shows that, as Carmen is able to reduce costs by negotiating the rent and eradicating the legal fee, the business is showing a 14% profit. Exhibit 4 shows the scenario where Carmen is charged the market price for these expenses. Due to the market price of $800 for rent, the rent expense becomes 31% of the revenues. Similarly, the legal fee of $30 and the depreciation of cash register of $60 are also charged. This causes the profits to fall to $420 which is 5% of revenue. Hence, due to Carmen’s effort, the business is running successfully.

Also, when comparing the income statement to the figures in the article in Florida Retailers about the fabric businesses, it is obvious that Cintas is performing better than other businesses even if the market prices were charged. The costs incurred are low enough to produce a profit. For this reason, Cintas was successful in the three months of operation.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.