Get instant access to this case solution for only $19

Cooper Industries Inc Case Solution

Cooper Industries is the market leader in the manufacturing industry of heavy equipment and engines. Due to the industry being cyclical, the Vice President Mr. Cizik was planning to diversify its business risks and grow through acquisitions. Cooper Industries tried to acquire Nicholson files three years back but its offer was rejected by Nicholson management. Now that Nicholson is under threat of hostile takeover by H.K Porter Company, Nicholson management is ready to consider other favorable offers that will enable them to retain some independence. Mr. Cizik aware of the strategic benefits of acquiring control of Nicholson which include gains through potential profits and synergies due to extensive market coverage of Nicholson, and cost savings due to a decline in the cost of goods sold, should advise the management of Cooper Industries to purchase shares of Nicholson by offering preferred stock of Cooper in return. Cooper can also finance the stock purchase by taking on a loan, however, that will worsen the gearing of the company.

Following questions are answered in this case study solution:

-

If you were Mr. Cizik of Cooper Industries, would you try to gain control of Nicholson File Company in May 1972? What makes the target an attractive candidate for Cooper?

-

What is the maximum price that Cooper can afford to pay for Nicholson and still keep the acquisition attractive from the standpoint of Cooper’s shareholders? Do a DCF valuation of Nicholson, using a WACC of 9 %. How should you think about potential synergies?

-

What is the minimum price that Nicholson’s shareholders are willing to accept to sell the company? Assuming that the Cash Flows remain the same, how much does the WACC have to change in order to obtain the maximum price that Cooper is willing to pay? Provide a sensitivity analysis with respect to the WACC.

-

How should Cooper pay for Nicholson – stock or cash? What exchange ratio can Cooper offer before the transaction has a dilutive effect on Cooper’s earnings per share (EPS)? Is it important to consider EPS? Why(not)?

-

What are the concerns and what is the bargaining position of each group of Nicholson stockholders? What must Cooper offer different shareholders in order to acquire their shares? Discuss briefly how Cooper can control for the free-rider problem. Which methods (e.g. conditional offer on 51% of the voting rights) could Nicholson use to mitigate such a problem?

-

Assume that on March 2, the day before Porter’s offer, Cooper stock closed at $22 and Nicholson stock at $30. Moreover, assume that Cooper on the evening of May 3 offers Nicholson shareholders an exchange ratio of 2:1 (i.e.2 Cooper shares per Nicholson share). The next day, Cooper stock closes at $25 and Nicholson stock at $45.What are the minimum synergies required for this offer to make sense for Cooper’s shareholders? What is the market’s consensus opinion on the probability that the deal will close and the size of the synergies that a merger between the two firms could create?

-

What should Mr. Cizik recommend that the Cooper management do?

Case Study Questions Answers

1. If you were Mr. Cizik of Cooper Industries, would you try to gain control of Nicholson File Company in May 1972? What makes the target an attractive candidate for Cooper?

Cooper industries are planning on diversifying its product portfolio for which, Mr. Robert Cizik, the executive vice president of Cooper Industries is on the lookout for companies that can be acquired. One such company he is considering is Nicholson File Company. Cooper Industries had approached the board of Nicholson File Company three years earlier; however, the offer had been rejected by the company then. Now that Nicholson File was under threat of a takeover by H.K Porter Company which is alarming for the management of Nicholson File as Porter would potentially cut product lines, Cooper Industries was presented with an opportunity to gain control of Nicholson File by presenting a better offer.

Despite Nicholson File having a below-market price-to-earnings ratio and sales growth rate, the competitive strengths of Nicholson make it a suitable target for acquisition by Cooper Industries. Nicholson File is indisputably the largest manufacturer of hand tools and performs in the country and its reputation for quality precedes it in the market where it has captured a 9% market share. Moreover, it had a highly efficient and effective distribution system supported by promotional programs which maximize its coverage in the market. The products of Nicholson File are sold in 137 countries through 140 local representatives signifying its widespread global reach. It is these potential profit gains from obtaining control of Nicholson File that are attractive for Cooper Industries. The cost of goods sold is likely to be reduced from 69% to 65% and the general and administrative expenses will also decrease from 22% to 19%.

The acquisition of Nicholson File will allow Cooper access to a larger market share within the industrial and the consumer market due to the highly spread-out distribution system and large footfall of Nicholson File which could be used by Copper Industries to sell its hand tool lines. Sales of Cooper industries are also likely to increase as Nicholson File would pull more Cooper products into the industrial market. Based on these potential profit and cost-saving opportunities it is recommended that Mr. Cizik gain control of Nicholson File company.

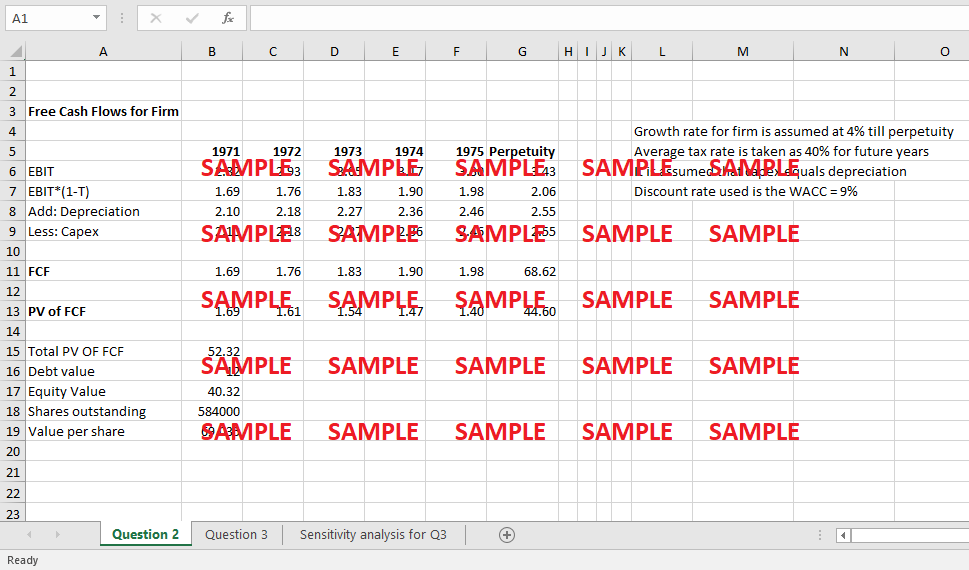

2. What is the maximum price that Cooper can afford to pay for Nicholson and still keep the acquisition attractive from the standpoint of Cooper’s shareholders? Do a DCF valuation of Nicholson, using a WACC of 9 %. How should you think about potential synergies?

At a 4% estimated growth rate for Nicholson File, the value of the firm is found as $52.32 million from which a debt value of $12 million is subtracted to find an equity value of $40.32 million. Hence the price per share is found to be $69. This means that the share of Nicholson is worth $69 and that is the maximum price that Cooper can afford to pay for Nicholson and still keep the acquisition attractive from the standpoint of Cooper's shareholders.

(Working shown in excel file)

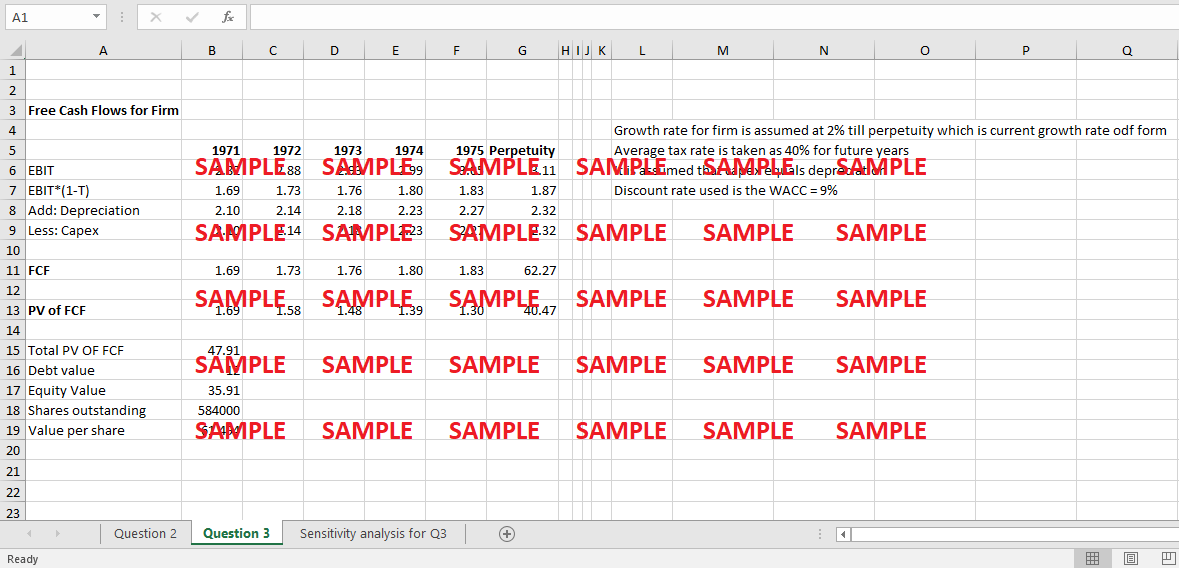

3. What is the minimum price that Nicholson’s shareholders are willing to accept to sell the company? Assuming that the Cash Flows remain the same, how much does the WACC have to change in order to obtain the maximum price that Cooper is willing to pay? Provide a sensitivity analysis with respect to the WACC.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.