Get instant access to this case solution for only $19

Deep Roots Distillery Case Solution

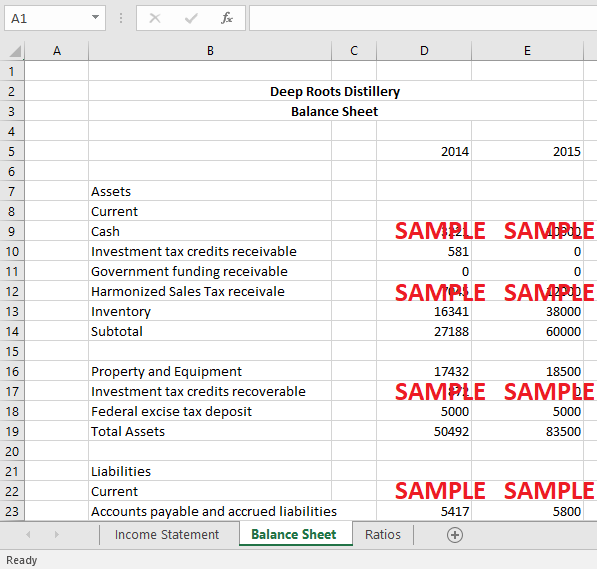

Based on the statistics presented, it is clear that more work is needed to ensure the firm makes significant revenue. This is because the majority of the assets are financed with debt. If the corporation cannot satisfy its commitments when they become due, this might result in a liquidity crisis. Certain challenges must be overcome to avoid future issues. The firm's current liabilities outweigh its current assets. This may pose issues since the existing assets cannot cover the present liabilities. The firm's costs should also be tracked. This is because if a firm has quite a lot of expenditures, most of the income is spent to cover them, lowering the net profit. The corporation should also consider strategies to boost the profit from sales.

This is accomplished through marketing and advertising strategies, which enhance sales and, eventually, profits. The Manifold View Handmade Brewery was established in 2006. Commanding the Newcastle Strait (the stretch of seawater that separates PEI from the mainland provinces in Nova Scotia, Nova Scotia, or Nova York), it received recognition as the "Businesses that of the nation's Firstly Licensed Distillery and Pie as well as Maritime the country's Initially Vodka, Gin, and Whisky." The distillery's greatest achievement consisted of a metal still via Deutschland.

Following questions are answered in this case study solution:

-

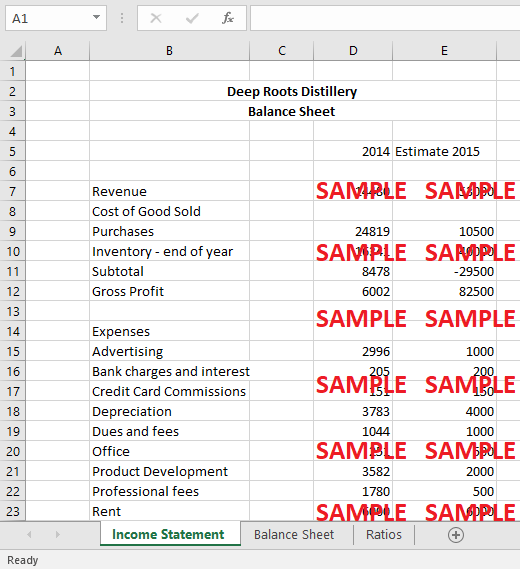

Explain what the balance sheet, income statement, and cash flow statement reveal about how the company is functioning.

-

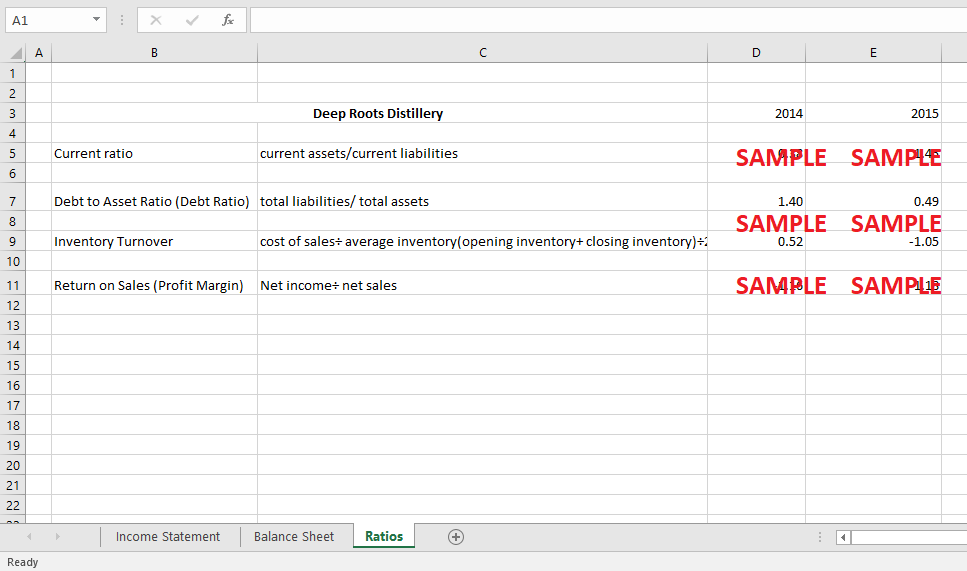

Calculate financial ratios and interpret what those say about the organization’s financial health. Support with specifics.

-

Identify the potential problem areas in the company as reflected in the financials.

Case Study Questions Answers

1. Explain what the balance sheet, income statement, and cash flow statement reveal about how the company is functioning.

The financial health of a business is critical to its success and prosperity. To ensure sustained growth and profitability, it is essential to carefully manage various financial metrics that impact the organization's performance. One crucial financial metric that can impact a business's performance is its current capital, which refers to the amount of cash and assets readily available to cover day-to-day expenses. A rise in current capital indicates that the business has additional resources that can be quickly converted into revenue, which can help the business cover its expenses more efficiently. Moreover, a higher current capital also lowers the liquidation ratio, as those with commodities can readily meet their monetary obligations while their assets become payable. This means the business can easily meet its financial obligations and avoid liquidity issues.

On the other hand, a rise in the company's current liabilities can harm its success. If the business cannot fulfil its commitments before they are due, it may face liquidity issues, hindering its operations and overall performance. As a result, current obligations and overall debt amounts should be closely monitored and managed. Sales are another essential financial metric that can impact a business's success. A rise in sales is beneficial to the efficiency and productivity of the organization, as it leads to increased revenue and a positive image of the business in the public eye. This can attract new investors and increase the trust of current ones. However, an increase in supplies may indicate that the business is not selling enough products. In such a scenario, the business should avoid accumulating excessive inventory and maintain the year's remaining shares.

Otherwise, increased supplies may result in lower sales and income, less storage room, and obsolete products. Therefore, monitoring supply levels and ensuring they align with the current demand is crucial. Lastly, a loss fall is a positive indicator that the business is earning the necessary profits and improving its revenue. This indicates that the organization is efficiently managing its resources, implementing effective cost-cutting measures, and generating revenue. As a result, the business is likely to experience sustained growth and profitability in the long run. Businesses must focus on minimizing their losses by identifying inefficiencies, streamlining processes, and investing in profitable ventures.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.