Get instant access to this case solution for only $19

El Con Construction Incorporated Case Solution

The conditions of the company seem promising considering the past financial performance and the strong backing of the parent company. EL CON could be provided by a steady demand for services due to the business of the parent company. The company, however, has been suffering due to its poor resource management to manage new and bigger projects.

Following questions are answered in this case study solution

-

As Rob Lister, analyse El-Con's past financial performance.

-

Review and talk about the two years of projected statements for fiscal 2010 and fiscal 2011. Explain and understand how the line of credit can be used and is used as the "plug" figure on the projected balance sheets. Special attention should be placed on understanding the roll of Accounts Receivables and Accounts Payable in the working capital structure.

-

Preform a risk assessment for El-Con by examining the company's collateral, capacity to repay, conditions and character.

-

If the working capital loan and long term loan were granted what should the terms be? Why?

-

What is your decision? Provide facts to justify your decision.

Case Analysis for El Con Construction Incorporated

1. As Rob Lister, analyse El-Con's past financial performance.

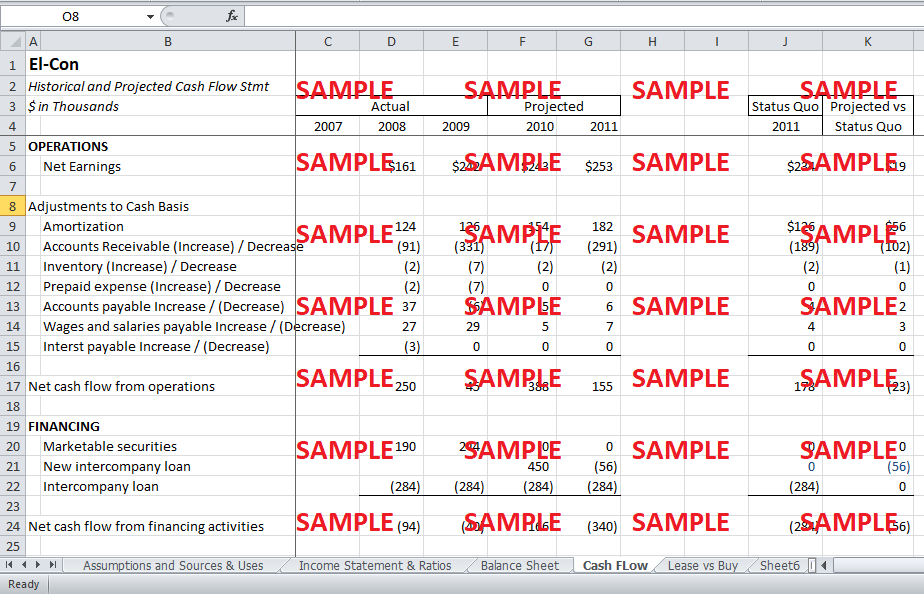

EL CON’s past performance is indicative of healthy growth in the company reflected by a 29% growth in the sales volume in the year 2009-2010 and a 32% growth in the gross profit in the same year. The return on assets have been increasing from -3% to 10% which indicates that the assets are being utilized for increasing sales efficiently. The total liabilities of the company have been showing a downward trend with no major change in the total assets. However, the cash flow statement of the company indicates that the financing and investing activities of the EL CON have been thinning the cash flow into the company mainly due to construction machinery and intercompany loan. The Financial ratios also suggest a strong financial position of the company. The current ratio of the company is well above the market norm which indicates the strong ability of the company to meet its short term and long term obligations.

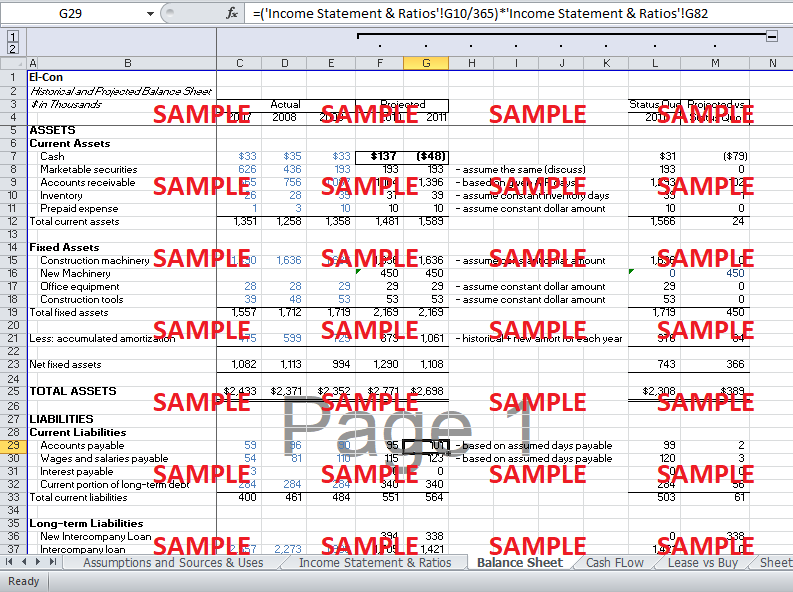

2. Review and talk about the two years of projected statements for fiscal 2010 and fiscal 2011. Explain and understand how the line of credit can be used and is used as the "plug" figure on the projected balance sheets. Special attention should be placed on understanding the roll of Accounts Receivables and Accounts Payable in the working capital structure.

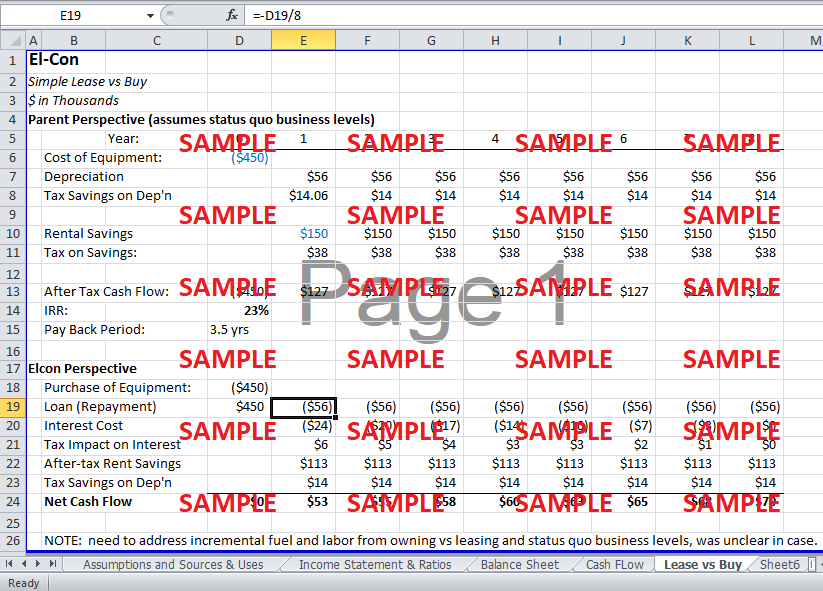

The projected statements for the year 2010 and 2011 shows that both internal and external sales will rise by large amounts for the company with a much smaller increase in the cost of sales. As a result, the gross profit earned by the company will be much larger with the truck than without the truck. The expenses will go down on equipment rental, but there will be increased amortization and fuel costs. The accounts receivable has shown a considerable increase due to the large projects with long deadlines taken by the company after the procurement of the truck. The same is the case with accounts payable which will rise to 101 by 2011 due to the interest payments due on loan acquired. The long-term debt will also increase due to the interest payments made for the truck

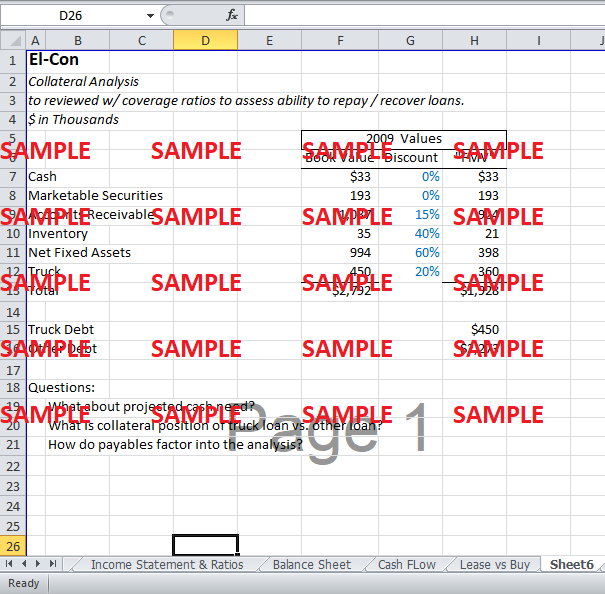

3. Preform a risk assessment for El-Con by examining the company's collateral, capacity to repay, conditions and character.

Company’s Collateral

Sheet 6 of the excel spreadsheet gives an analysis of the EL CON’s assets which can act as collateral for the purchase of the truck against the loan granted by Oakville Hydro. The accounts receivable made though the external and internal operations of the company make the major portion followed by the net fixed assets. The asset position of the company is strong against the truck loan and is sufficient to pay the truck loan in the agreed installments.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.