Get instant access to this case solution for only $19

Groupe Ariel S A Parity Conditions And Cross Border Valuation Case Solution

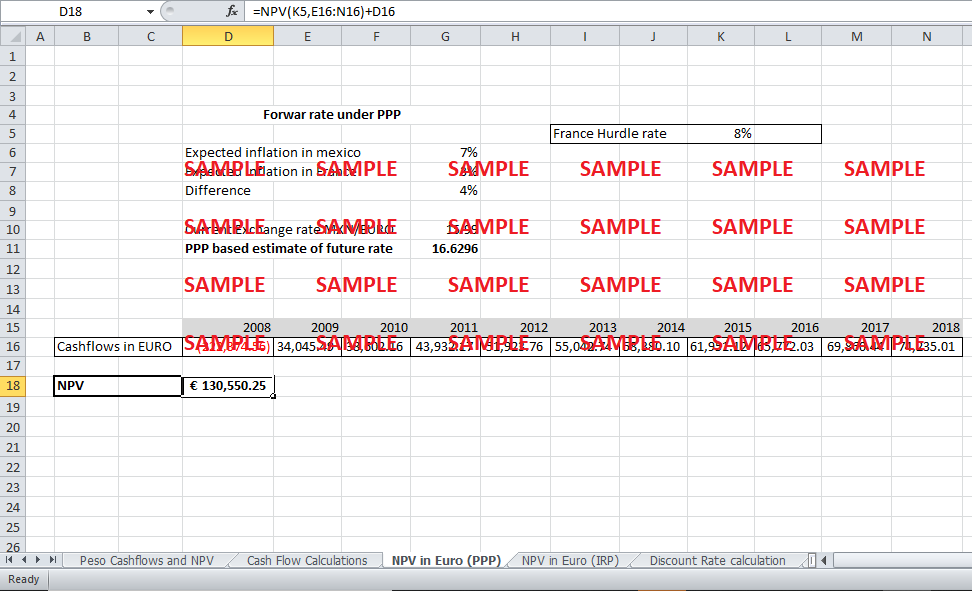

The NPV for EURO based cash flows calculated in accordance with the PPP condition is €130,550. It is clear that the NPV in euro, as well as pesos, are Positive. It can be concluded that the feasibility of a project will not be affected by the exchange rate being used to convert the cashflows as long as the cash flows are being converted at the same exchange rate. A positive relationship exists between the two NPVs. If a project is profitable in pesos. It will also be feasible in Euros.

Following questions are answered in this case study solution

-

Estimate the cash flows of Groupe Ariel’s Mexican recycling project. These cash flows should be denominated in Pesos.

-

The expected inflation rate for the foreseeable future is 7% (as given in Exhibit 2 of the case). Assuming that the expected inflation in France over the same future period is 3%, what is Groupe Ariel’s discount rate in Pesos? (We should not use the inflation rates provided in Exhibits 3 and 4 because those are past rates; we need future / expected rates for our calculation.)

-

Using answers from #1 and #2, what is the NPV of this project in Pesos?

-

How would the estimate for Peso discount rate be different if we used interest rates (instead of inflation rates) to convert the Euro discount rate into Pesos? (I.e., how would the discount rate change if we used IRP instead of PPP?) Use 9.12% and 4.81% as the risk-free rates for Mexico and France, respectively. (For convenience, I picked them from Exhibits 3 and 4.)

-

What is the Peso-based NPV using this IRP-based estimate of discount rate?

-

Now let’s calculate the Euro-based NPV of this project. First, convert the cash flows from #1 into Euros using PPP-based estimates of future Spot rates.

-

Discount these at the Euro discount rate and find the NPV. How is it different from the Peso-NPV in #3 – is there an obvious relationship between the two?

-

What if we convert the cash flows into Euros using the IRP-based estimate of future Spot rates? Write down these new cash flows.

-

Discount these at the Euro discount rate and find the NPV. How is it different from the Peso-NPV in #5 – is there an obvious relationship between the two?

-

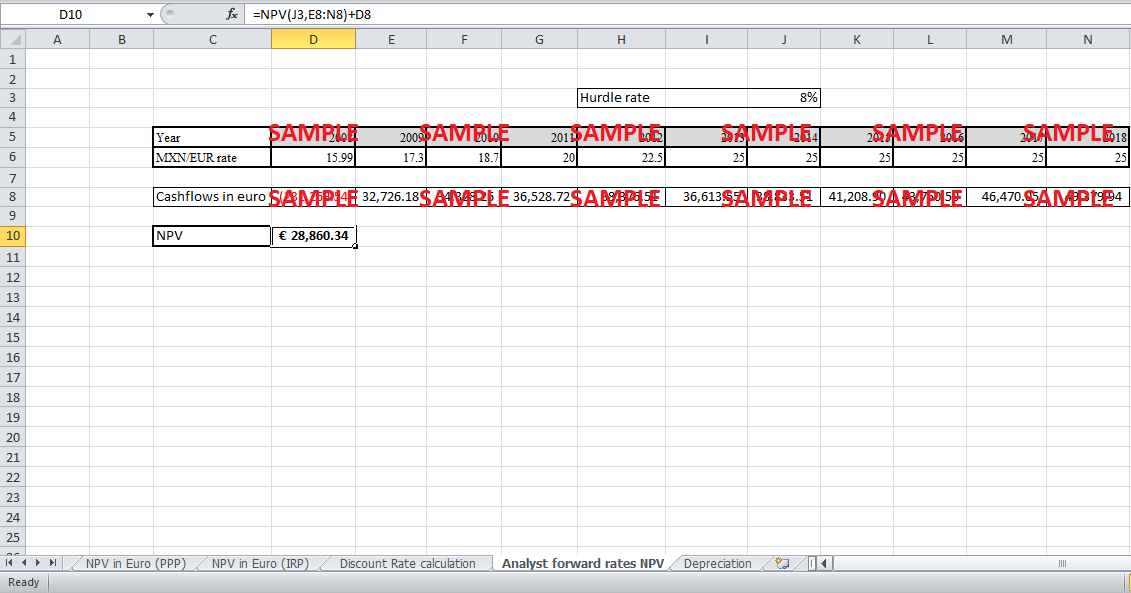

What is the NPV in Euros if we were to use the analysts’ estimates of future Spot rates (as given in the last paragraph of the case on pg. 4)? We are given that the MXN/EUR rate is 15.99 in 2008, expected to be 20.00 by 2011 and, say, 25.00 over 2013–2018. Let’s assume that this means that the rates are as follows:

|

Year |

2008 |

2009 |

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

|

MXN/EUR rate |

15.99 |

17.3 |

18.7 |

20 |

22.5 |

25 |

25 |

25 |

25 |

25 |

25 |

11. In your conclusion, comment on whether the project is profitable in: Mexican Pesos and Euros. Finally, how would using the analysts’ forecasts change your answer – does it make the project look less profitable or unprofitable? Explain what that implies about international capital budgeting decisions.

Case Analysis for Groupe Ariel S A Parity Conditions And Cross Border Valuation

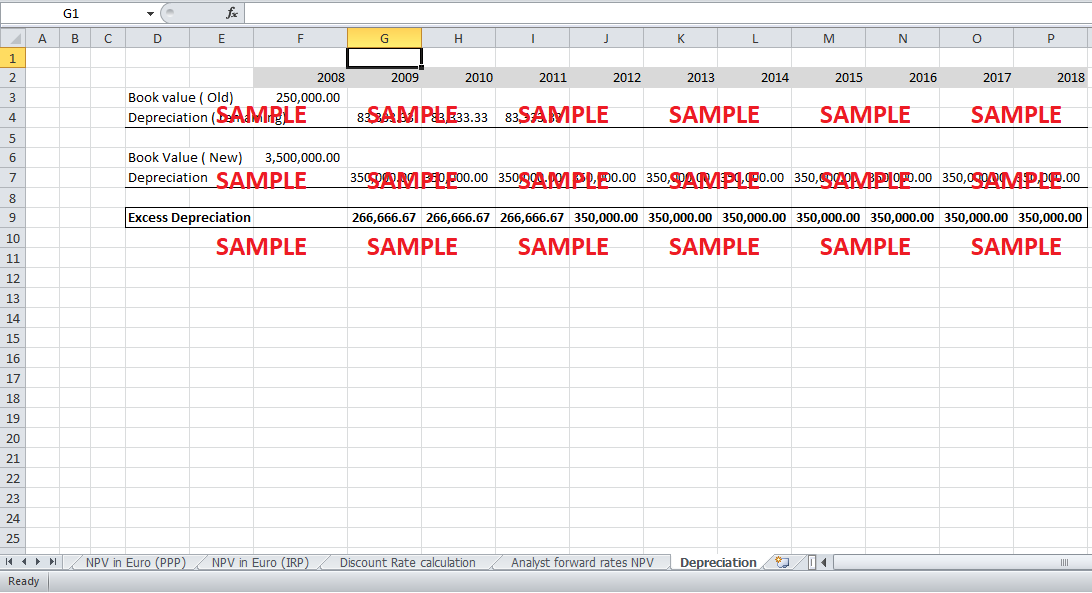

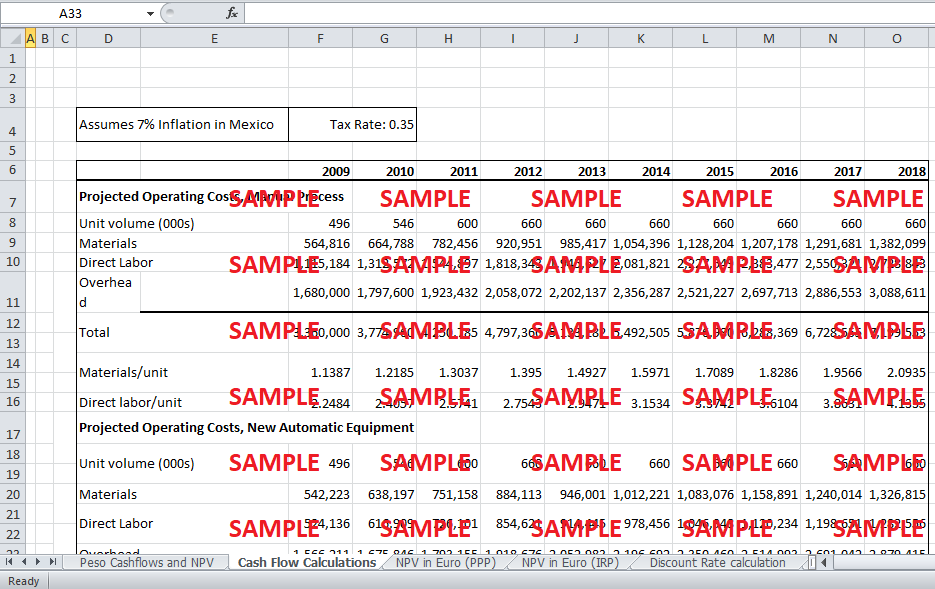

1. Estimate the cash flows of Groupe Ariel’s Mexican recycling project. These cash flows should be denominated in Pesos.

|

|

2009 |

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

|

-3,698,000.00 |

566,162.83 |

641,938.53 |

730,574.48 |

863,471.40 |

915,338.80 |

970,837.75 |

1,030,222.40 |

1,093,762.50 |

1,161,751.20 |

1,234,498.55 |

These are the cash flows in pesos.

Since this is a replacement project, only the incremental cash flows of the project are being considered.

2. The expected inflation rate for the foreseeable future is 7% (as given in Exhibit 2 of the case). Assuming that the expected inflation in France over the same future period is 3%, what is Groupe Ariel’s discount rate in Pesos? (We should not use the inflation rates provided in Exhibits 3 and 4 because those are past rates; we need future / expected rates for our calculation.)

Ariels discount rate in pesos is 12 percent. This is calculated in accordance with the purchasing power parity condition. According to the PPP, the difference in the interest rate in country A and B is equal to the difference in the expected inflation of country A and B. Using the PPP condition, discount rate in country A can be calculated given the discount rate in country B and also the inflation rate in country A and B.

Nominal rate(A) – Nominal rate(B) = Inflation(A) – Inflation(B)

The detailed calculations are given in the Spreadsheet.

3. Using answers from #1 and #2, what is the NPV of this project in Pesos?

The NPV of the replacement project is MEX$ 1,123,443.85.

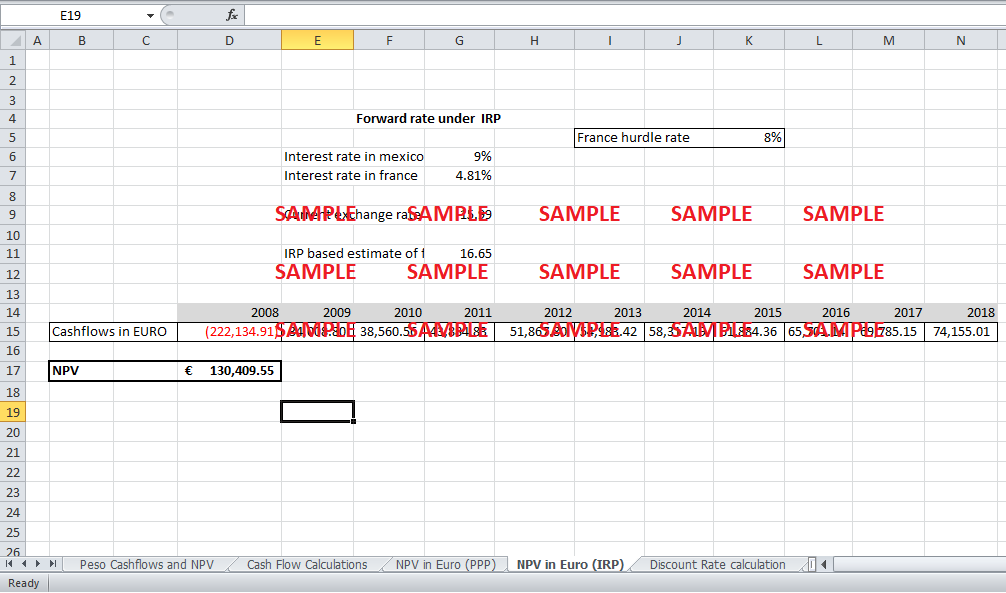

4. How would the estimate for Peso discount rate be different if we used interest rates (instead of inflation rates) to convert the Euro discount rate into Pesos? (I.e., how would the discount rate change if we used IRP instead of PPP?) Use 9.12% and 4.81% as the risk-free rates for Mexico and France, respectively. (For convenience, I picked them from Exhibits 3 and 4.)

If the interest rates are used instead of the inflation rates in order to find the discount rate for Mexican pesos, it will be in accordance with the interest rate parity. According to the IRP the difference in the discount rate of country A and country B is equal to the difference in the interest rate in country A and interest rate in Country B. Therefore, using the Discount rate in country B and the risk free interest rates in country A and B, the discount rate in Pesos can be found.

Nominal rate(A) – Nominal rate(B) = Risk free rate(A) – Risk free rate (B)

The detailed calculations are given in the Spreadsheet.

5. What is the Peso-based NPV using this IRP-based estimate of discount rate?

The peso based NPV using the IRP based discount rate is Mex$ 1,053,961. This is less than the PPP based discount rate NPV because the discount rate under IRP is greater.

6. Now let’s calculate the Euro-based NPV of this project. First, convert the cash flows from #1 into Euros using PPP-based estimates of future Spot rates.

The Euro-based cashflows converted according to the future rate based on PPP are as follows:

|

|

|

2008 |

2009 |

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

|

Cashflows in EURO |

|

-222,374.56 |

34,045.49 |

38,602.16 |

43,932.17 |

51,923.76 |

55,042.74 |

58,380.10 |

61,951.12 |

65,772.03 |

69,860.44 |

74,235.01 |

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.