Get instant access to this case solution for only $19

Penelopes Personal Pocket Phones Case Solution

Penelope is considering whether it is a worthwhile investment to launch new mobile phones besides a very competitive market. This case is about how to deal with real options. Penelope would have to launch the first-generation phone and then later he may launch the second and third versions of the phone. For analysis purposes, a simplified version is taken by considering the NPV of launching only the first generation. Then there is an opportunity to sell the assets at end of year two so this opportunity is combined with the first and the total scenario is analyzed. In the end, the effect of launching second-generation phones on the feasibility of the first one is analyzed.

Following questions are answered in this case study solution

-

Ignore the follow-on opportunity in the second generation project for the time being. What is the net present value of Penelope’s first-generation phone?

-

Ignoring the option to invest in the second-generation phone, how valuable is the ability to sell equipment in Year. Would you recommend that Penelope invest in the first project under this scenario? Why?

-

Now consider the second generation project. What is the minimum expected present value of the second-stage project in order to justify a $10 million investment in the first year on the first generation phone project? Show numerically what happens to the present value of the opportunity to invest in the second generation project if the volatility of the expected project value increases. We need the binomial option tree and calculations in Excel.

Case Analysis for Penelopes Personal Pocket Phones

1. Ignore the follow-on opportunity in the second generation project for the time being. What is the net present value of Penelope’s first-generation phone?

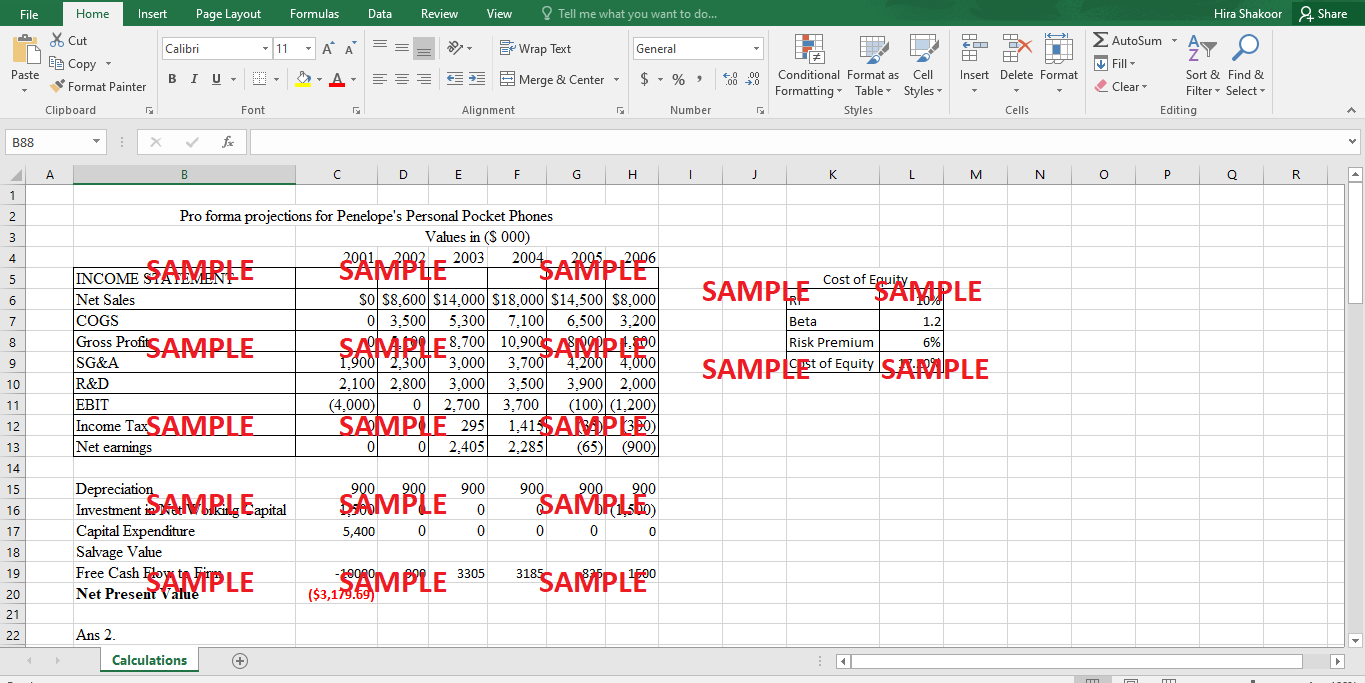

In order to calculate the net present value of Penelope’s first-generation phone, free cash flow to the firm is calculated which would be discounted at an appropriate cost of capital. Since this project is financed fully with equity, the cost of capital for the project would be the cost of equity. The cost of equity is calculated through the CAPM formula. The risk-free rate is taken to be 10%, being yield of 10 year Treasury bond. Unlevered Beta of the company is 1.2. The market risk premium is assumed to be 6%. Using the CAPM formula, the cost of equity comes out to be 17.2%.

Free cash flow to the firm is calculated by the formula:

FCFF = EBIT (1 - t) + Depreciation - Capital Expenditure - Change in net working capital

EBIT (1-t) is equal to net income, in this case, being a total equity firm. Depreciation and net working capital are given in exhibit 1. All amounts are presented in “000”. It is given that annual depreciation for 6 years is $900, each year so initial investment in the form of capital expenditure would be $5,400and no capital expenditure after that. Salvage value for that capital expenditure at the end of year 6 is assumed to be zero. So there would be no terminal cash flow calculations involved in this scenario. After calculating free cash flows to the firm, the Net Present Value of only 1st generation phone is calculated which comes out to be ($3,389.79). Since it is less than zero, this is not a worthwhile project alone and Penelope should not go for that project.

2. Ignoring the option to invest in the second-generation phone, how valuable is the ability to sell equipment in Year. Would you recommend that Penelope invest in the first project under this scenario? Why?

In order to calculate the value of the option to sell equipment in the year, different scenarios are under consideration. It is given that either cash flows would increase by 64.90% or would decrease by 39.30%. Since cash flows in year 1 are reasonably certain, cash flows in year 1 are taken at the same level as done in the earlier analysis. This cash flow variation would start from year 2. Cash flows would either increase by 64.90% or would decrease by 39.30%. If the cash flows increase by 64.90%, then either company is going to continue the project till the end of year 6 or would sell the machinery and would shut odd the division. If the cash flows increase by 64.90% and the company continues the project, NPV comes out to be $294.23. If the cash flows increases by 64.90% and the company still want to sell off its assets, then the company would get $4 million from the resale of fixed assets and $1,500 is realized because of a reduction in working capital. NPV of this scenario comes out to be ($3,447.84). Since it is lower than the first scenario, even negative, it is concluded that if cash flows of a firm increase by 64.90% in year 2, then the company should continue the project instead of liquidating its assets.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.