Get instant access to this case solution for only $19

Tesca Works Case Solution

With the increase in energy costs, there is a strong window of opportunity for energy-efficient appliances. The energy prices are rising, and the increase is expected to be permanent. On the other hand, households are becoming increasingly technology-dependent. Under the circumstances, energy-efficient appliances are the only remedy to minimize energy costs for households while providing the same or better utility. Moreover, Tesca Works will have the first-mover advantage as none of the competitors produces energy-efficient appliances. It is, therefore, a lucrative opportunity for Tesca Works to materialize this need. Conversely, most of the consumers already have refrigerators. Some people buy household appliances only when they move to a new home or the old ones are no longer working. Hence, although energy-efficient refrigerators provide a lucrative opportunity, it is necessary for Tesca Works to emphasize on the energy cost situation.

Following questions are answered in this case study solution

-

Importance of energy cost situation

-

Cost of Equity

-

Appropriate Discount Factor for Refrigerator Project

-

Compressor

-

Projected Cash Flows

-

Project Evaluation

-

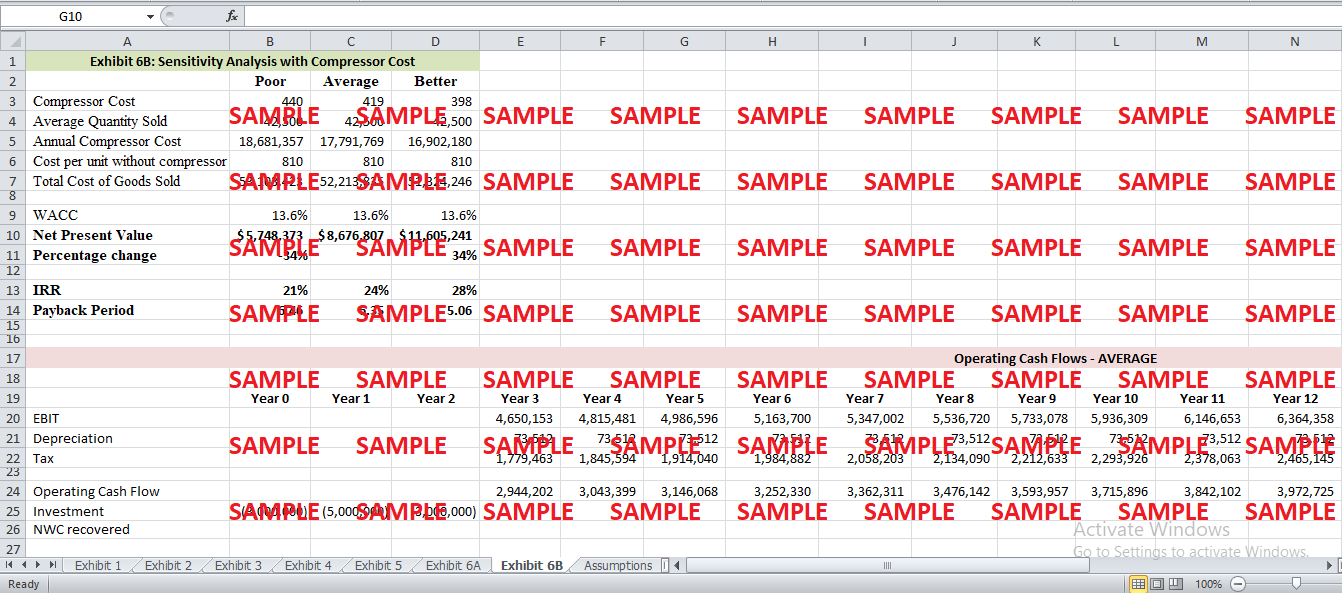

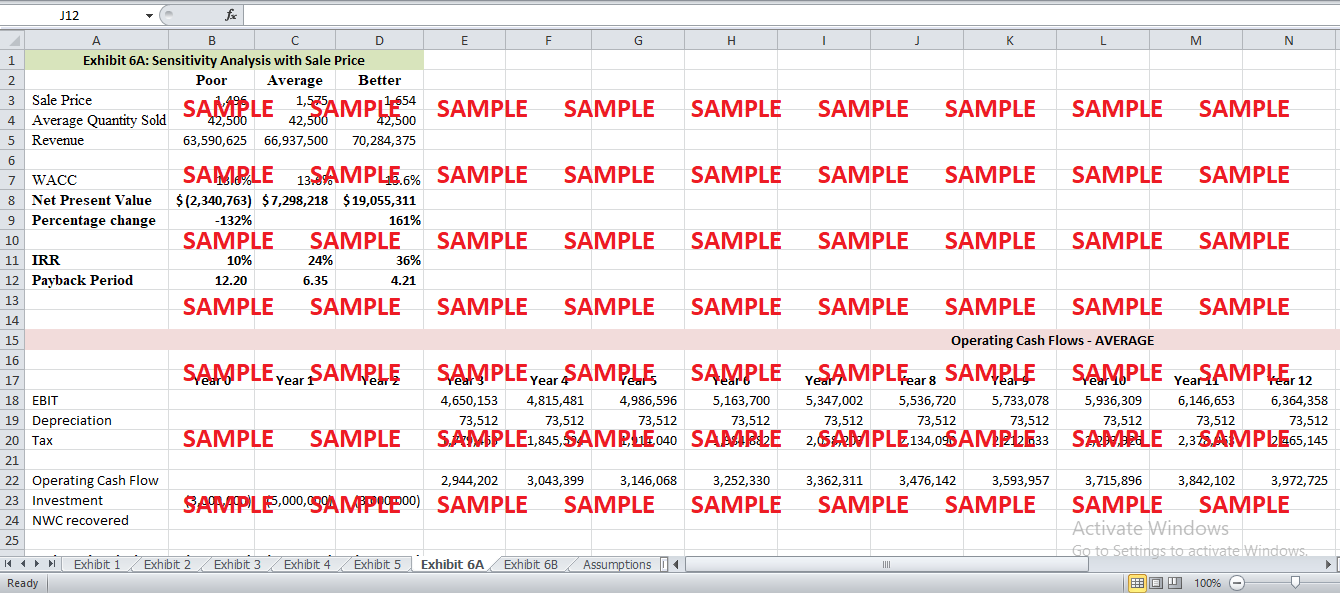

Sensitivity Analysis

-

Project Evaluation based on Sensitivity Analysis

-

Recommendation

Case Analysis for Tesca Works

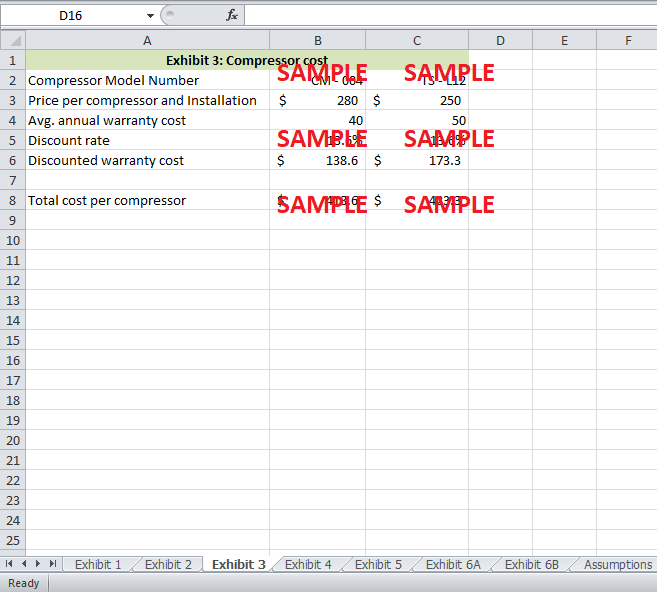

2. Cost of Equity

The cost of equity has been calculated using the Capital Asset Pricing Model (CAPM). The CAPM formula for the cost of equity is as follows:

Cost of equity = rf + β (rm-rf)

Where rf is the risk-free rate of return and rm is the market rate of return. The difference in the market rate of return and risk-free rate return is the market premium over and above the risk-free rate of return. Moreover, β is the company-specific risk factor. The 10-year Treasury note rate is used as a risk-free rate. Using the information given in exhibit 4, the cost of equity for Tesca Works comes out to be 16.3%. The calculations have been presented in exhibit 1.

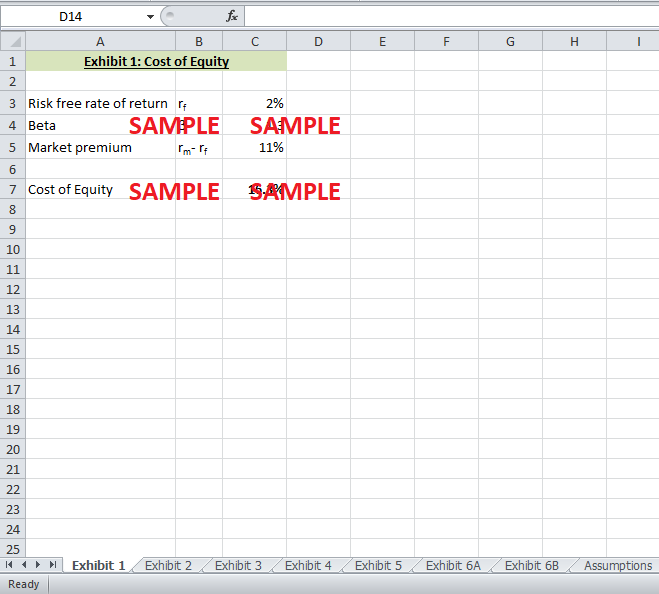

Appropriate Discount Factor for Refrigerator Project

The appropriate discount factor for the project is the Weighted Average Cost of Capital (WACC). The weighted average cost of capital incorporates the financing structure of the company i.e. the debt to equity ratio. Tesco Works maintains the debt to equity ratio of 0.4 which translates into a financing structure with 28.6% debt and 71.4% equity. Furthermore, the average for the interest cost range has been used for bonds of rating A i.e. 6.9% as given in exhibit 4. Using the following formula, WACC has been calculated:

WACC = WD*CD + WE*CE

The WACC for the project is 13.6%. The calculations have been presented in exhibit 2.

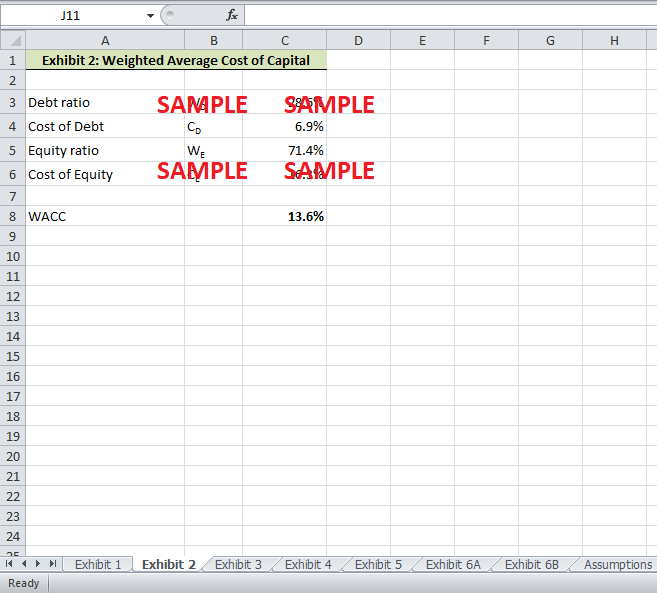

3. Compressor

Tesco Works has two options for the compressor to be used in the refrigerators. The two different models are CM-004 and TS-L12. On the one hand, CM–004 is more expensive to install but has a lower warranty cost. On the other hand, the TS–L12 is cheaper to install, but has a higher warranty cost. Exhibit 3 shows the calculation for the total long term cost of both the compressors. In addition to the price and installation cost of the compressor, Tesca would have to bear the annual warranty cost for the first five years since the suppliers are not offering any warranty for the compressor. The total warranty expense has been calculated by discounting the annual warranty cost for five years, for each compressor, using the weighted average cost of capital of 13.6%. As shown in exhibit 3, the total warranty expense for CM-004 is $138.6 while that for TS-L12 is $173.3. Hence, the total cost for CM-004 and TS-L12 is $418.6 and $423.3 respectively. Clearly, CM-004 is a better option to be used in refrigerators as the long term cost of CM-004 is lesser than that of TS-L12.

4. Projected Cash Flows

In order to project the cash flows for the next twenty years, the following assumptions have been made:

-

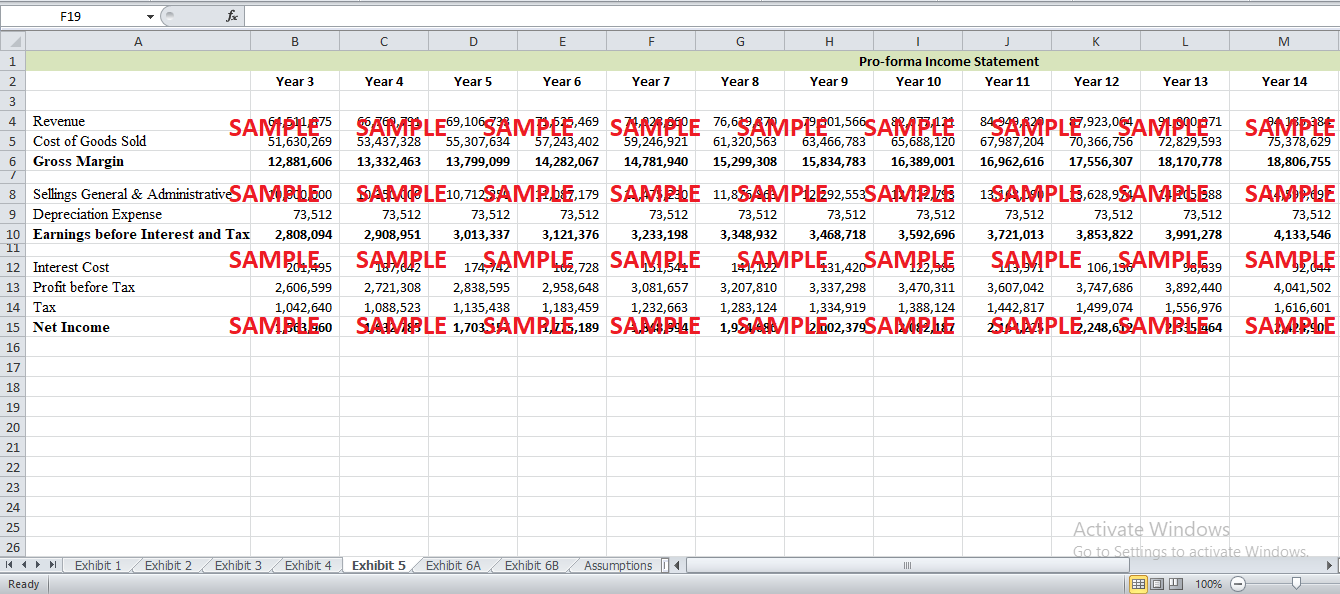

Revenue: Using the sales forecast, annual revenue per year has been estimated using the probabilities for weak, average and strong demand. After calculating the forecasted revenue for each scenario, the expected value of annual revenue has been calculated by adding the products of respective revenues and probabilities for each scenario. The expected annual revenue is $64,511,875.

-

Cost of Goods Sold: The cost per unit has been calculated by adding the labor cost, parts cost, compressor cost and warranty cost for each unit. The cost per refrigerator is $1,229. Moreover, the total cost of goods sold per annum, $51,630,269, has also been calculated using probabilities for each scenario.

-

Depreciation Expense: Since 15% of annual revenue is allocated to working capital, it has been assumed that the rest of the investment was made in capital assets. Using straight line depreciation for 15 years, $73,512 is the annual depreciation expense.

-

Interest Cost: Furthermore, it has been assumed that 28.6% of the initial investment has been financed through debt (debt to equity ratio of 40%). 6.9% of the debt is the interest cost for the project.

-

Terminal Cash Flow: The networking capital, equal to 15% of the revenue of year 20, is assumed to be recovered at the end of the project. The life of the project has been assumed to be 20 years since the refrigerators will become obsolete after that.

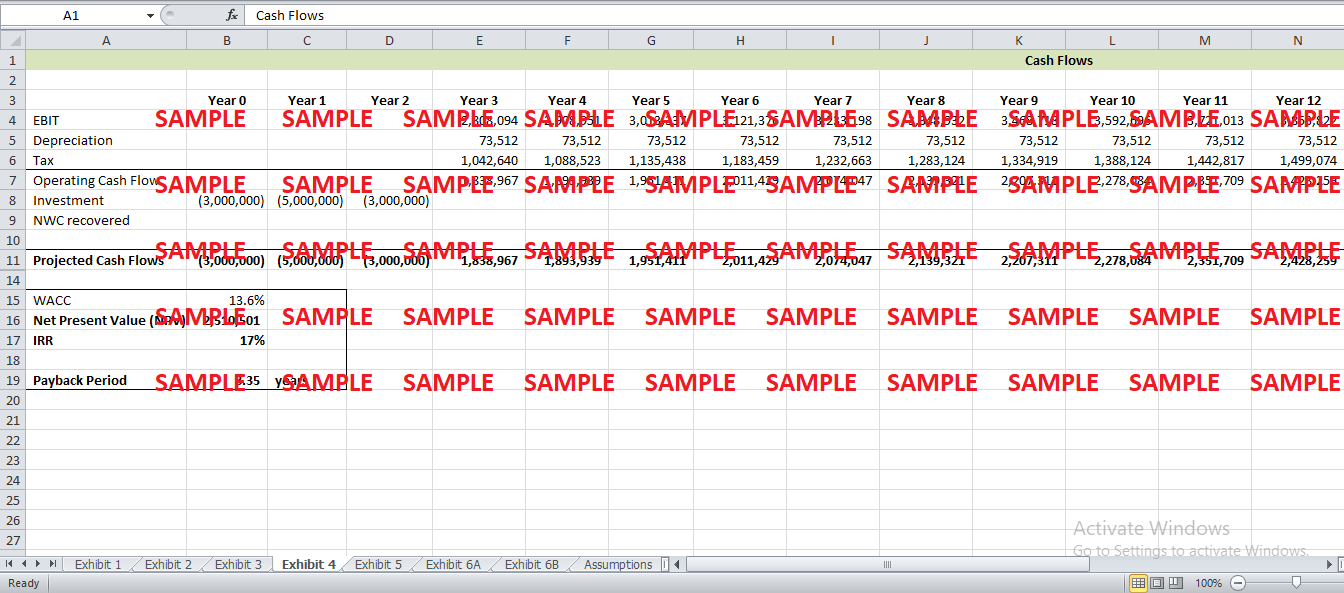

Operating cash flows have been calculated by adding back depreciation and subtracting tax expense from EBIT of the project. The projected cash flows of the project include the initial investment from year-0 to year-2. From year-3 onwards, the operating cash flows are the projected cash flows. Finally, the projected cash flow for year-20 includes the terminal cash flow along with the OCF of year-20. The Pro-forma income statement for the project is presented in exhibit 5 and cash flow calculation has been shown in exhibit 4.

5. Project Evaluation

The capital budgeting technique for the evaluation of the project includes various criteria including NPV, IRR and payback period. Net Present Value (NPV) of the project has been calculated using the cash flows calculated in the previous section. NPV gives the value of the project by discounting the projected cash flows at the required rate of return. As already stated in the previous section, WACC has been used for calculating NPV. If the NPV is positive, the project is a success. The second measure of evaluation is IRR. The Internal Rate of Return (IRR) is the discount rate at which NPV is zero i.e. the discounted cash inflows equate the initial investment. An IRR greater than the project’s required rate of return, WACC, indicates that the project is a success and should be accepted. Finally, the payback period is the period of time in which the project recovers the initial investment. If the payback period is less than the life of the project, it should be accepted.

As shown in exhibit 4, the NPV of the project is positive i.e. $2,510,501. The IRR of the project is 17% which is greater than the WACC (13.6%).

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.