Get instant access to this case solution for only $19

Accounting For Nuclear Power Provisions At RWE Case Solution

D&D obligations should be recorded as provisions while the plant is operating, as prudence concept states that any expected future costs should be accounted for as provisions. This is because Dismantling obligations would not have to be fulfilled until a future date which is why it would be reasonable to record it as a provision for an expense that will have to be incurred in the future.

Following questions are answered in this case study solution

-

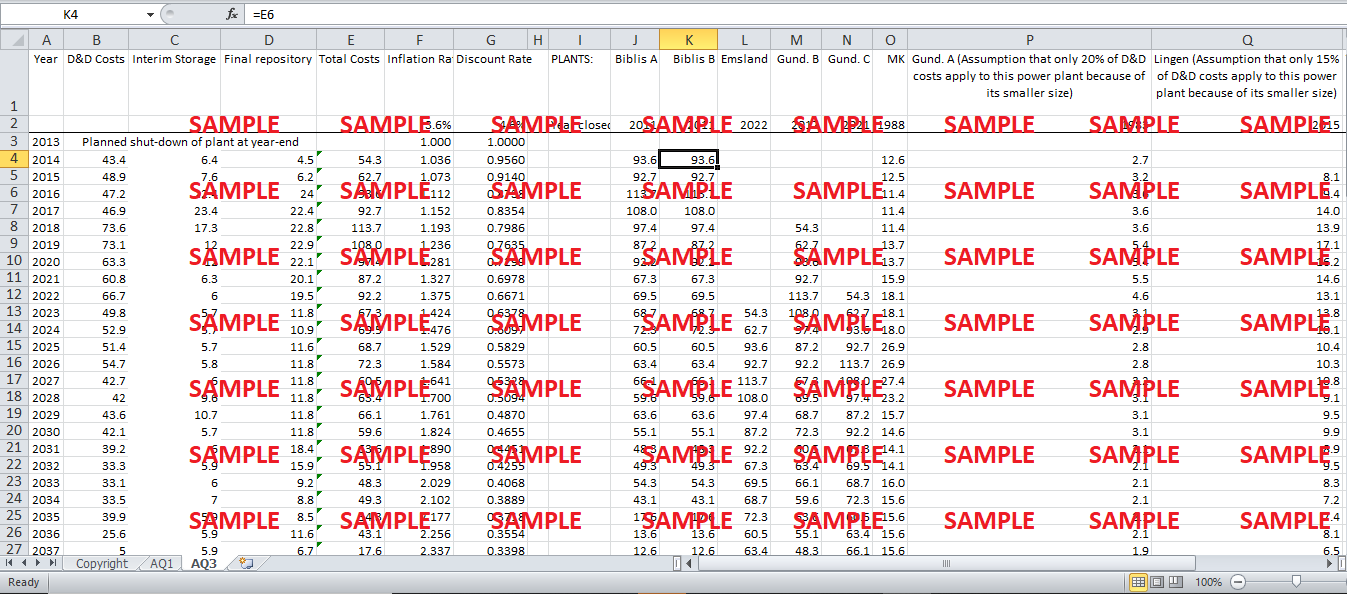

Use the excel file (sheet ”AQ1”) for your calculations of the following hypothetical example. Given the projected D&D costs reported in Exhibit 6,an estimated inflation rate of 3.6% per annum and a discount rate at 4.6%, what is the present value of D&D obligations for a newly-constructed nuclear power plant in 2013? Assume the plant was intended to be operational for 50 years before the start of the D&D process. Given your answer, prepare journal entries to record D&D cost transactions at the completion of plant construction and at the end of its first year of operation.

-

Use data from Exhibit 5 to prepare the journal entries for RWE in 2015 to record changes in the D&D provision. How would the entries differ if the unplanned increases / decreases in Exhibit 5 are related to plants that are still operating, versus plants that have closed?

-

Use the data in the Excel file (sheet “AQ3”) to estimate the value of RWE’s remaining D&D commitments for all its plants at the end of 2013. Is RWE’s D&D provision in 2013 sufficient to cover the projected D&D costs? How would a decline / increase in the forecasted interest rate affect the provision (assuming that inflation does not change)? What is the appropriate spread to use for D&D provisions? Why?

-

How does RWE plan to fund the D&D provisions? What risks do you see?

-

Should D&D obligations be recorded as provisions when the power plant begins operations? Why or why not?

-

The German government offers RWE to take over the obligations for intermediate and final storage for the price of the current present value of these obligations plus a 35% risk premium. As RWE, would you take the deal?

Case Analysis for Accounting For Nuclear Power Provisions At RWE

1. Use the excel file (sheet ”AQ1”) for your calculations of the following hypothetical example. Given the projected D&D costs reported in Exhibit 6,an estimated inflation rate of 3.6% per annum and a discount rate at 4.6%, what is the present value of D&D obligations for a newly-constructed nuclear power plant in 2013? Assume the plant was intended to be operational for 50 years before the start of the D&D process. Given your answer, prepare journal entries to record D&D cost transactions at the completion of plant construction and at the end of its first year of operation.

The following is the journal entry required:

Plant 129,414,190

Cash 129,414,190

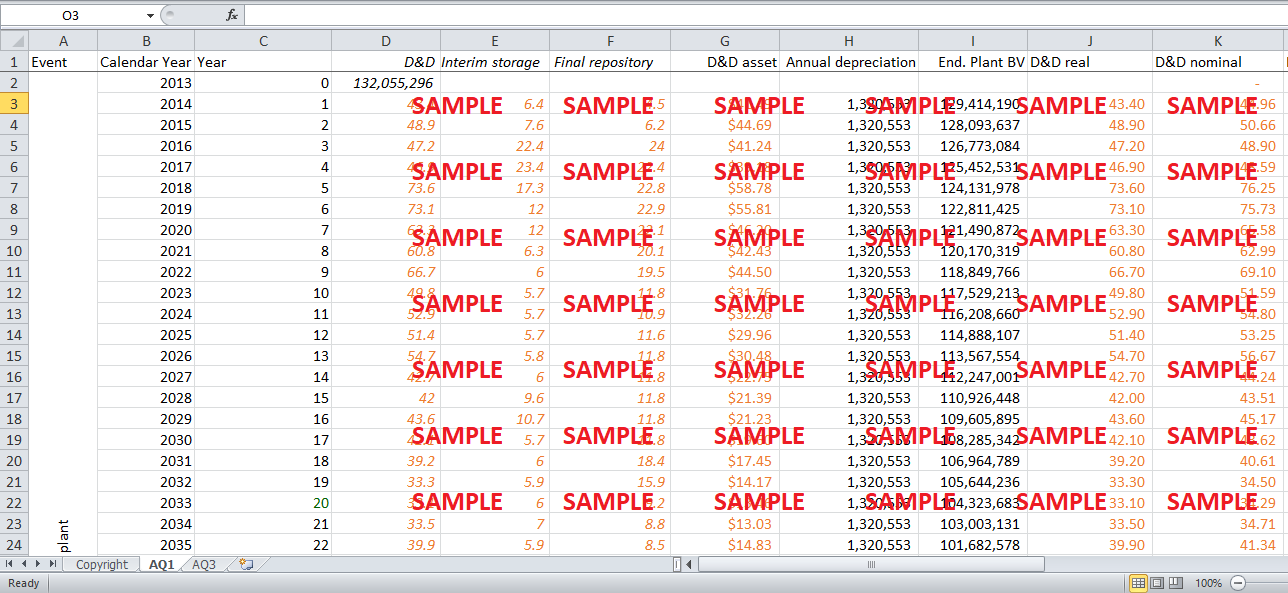

2. Use data from Exhibit 5 to prepare the journal entries for RWE in 2015 to record changes in the D&D provision. How would the entries differ if the unplanned increases / decreases in Exhibit 5 are related to plants that are still operating, versus plants that have closed?

The following are the journal entries required:

Depreciation 1,320,553

Accumulated Dep 1,320,553

Interest expense 5.45

D&D Provision 5.45

3. Use the data in the Excel file (sheet “AQ3”) to estimate the value of RWE’s remaining D&D commitments for all its plants at the end of 2013. Is RWE’s D&D provision in 2013 sufficient to cover the projected D&D costs? How would a decline / increase in the forecasted interest rate affect the provision (assuming that inflation does not change)? What is the appropriate spread to use for D&D provisions? Why?

D&D's provision is sufficient to cover future D7D costs. A decline in interest rates would cause the present value of D7D provisions to rise, resulting in higher dismantling provisions. This would further increase the expenses associated with the plant as the present value costs are directly associated with the total dismantling costs.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.