Get instant access to this case solution for only $19

Hotel Perennial Case Solution

The investment strategy of any organization is crucial because it investment strategy tends to provide more information on the future direction of the company. ELI’s investment history can be analyzed to assess its investment strategy. ELI’s first major investment included a stake in Auburg resorts followed by an investment in St Baand Tides, rth Isle-e-France, Raleigh Hotel. All of these investments share a lot of common features which can be analyzed to deduce the investment strategy of ELI.

All of the companies operated in the high end luxury segment of the hotel industry and the primary consumers were mostly high net worth individuals. Furthermore, all of these investments were in different geographical areas through which one can deduce that ELI is looking to move global and target high end restaurants. In the last few years, ELI has become a major player in the hoteling industry not only expanding geographically but with the recent investment also expanding into other segments. This clearly indicates that the management of ELI is in the process of aggressive & ambitious expansion. However, the last investment was through an institutional investor in a distressed firm which might indicate a deviation from the firm’s investment strategy.

Following questions are answered in this case study solution

-

What is ELI’s Investment Strategy and do you think that the acquisition of the Hotel Perennial fits with that strategy? Why or Why not?

-

If you were advising DJ on his acquisition, what should he bid for the hotel? (Please recommend a single value amount, not a range). You may use the assumptions in question 3 below to aid you in your recommendations.

-

Calculate the projected unlevered IRR, unlevered cash flow multiple, levered IRR and levered cash flow multiple for the investment, assuming Jameson purchases the hotel at your recommended valuation from question 2 above. Use the pro forma underwriting and the following assumptions:

a. Closing (date that Jameson funds the initial investment capital) occurs on December 31, 2010 (ignore the timing of the $1 million deposit and assume that all purchase price proceeds, including the deposit, are funded at closing.

b. In addition to the purchase price, Jameson must pay off the mechanics’ liens – the payments owed to contractors for construction services that were never paid for by the previous owners. These mechanics’ liens total $3.85 million. However, ELI’s general counsel, Mike Lotio, has advised Jameson that he thinks that the claims can be bought out for 50 percent of the nominal value (i.e., for $1.925 million). This amount will also be payable on the closing date. Note: the discounted buyout is not guaranteed, which Jameson would like to take into account when negotiating a purchase price with United.

c. Closing costs totaling $225.000 (e.g. lawyer’s fees, due diligence costs); no other transaction fees, debt-related fees, or debt-related reserves are required during the holding period.

d. Ignore any working capital adjustments.

e. Assume that debt financing is arrange in time for the closing and that the Perennial is acquired using $5 million in debt proceeds on the closing date. (The rest of the purchase price and the buyout of the mechanics’ liens must be financed with equity).

f. Construction costs of $5 million are spent during the first six months of 2011. Jameson is able to finance these costs at 100 percent loan-to-cost (i.e. 100 percent debt financing).

g. Treat the $10 million in debt proceeds as a single, interest-only loan facility charging an 8 percent interest rate. For the purpose of simplifying the exercise, you can calculate interest expense off the average annual balance for the loan facility. The loan has multiple extension options and can be 0813 Hotel Asset Management © 2018 Florian Aubke extended indefinitely, so there will be no need for refinance. (This is not a realistic assumption in the real world, but it will serve to simplify your calculations).

h. Debt is not assumable and must be paid off upon disposition of the hotel.

i. Hotel Perennial opens on July 1, 2011 (already reflected in pro-forma underwriting).

j. Assume a five-year investment holding period.

k. Make an assumption on gross exit valuation; assume that closing costs of $225.000 are netted out of the gross proceeds to dispose of the hotel; make sure you exist valuation is defensible.

l. Ignore taxes (other than the property taxes already included in the pro forma).

m. Assume that all cash flows are incurred at the end of the calendar year (i.e. build an annual model). Calculate the IRRs and cash flow multiples on an annual basis using a year-end of December 31.

-

What are the potential opportunities and challenges for ELI in acquisition of the Hotel Perennial from a firm perspective?

-

Based on your approximation in 2., should ELI move forward with the acquisition? Provide a justification.

-

If ELI buys the Perennial. How should it be positioned? Flagged or independent. How would that impact ROI projections?

Case Analysis for Hotel Perennial

Furthermore, the sources of financing were through a syndication strategy that included high net worth individuals to form a group to subscribe to the investment. These investor demand high returns for these investments and most of this investment were on a short term basis.

The Hotel Perennial as constructed in 1928 and is located on the north side of Chicago. It is in a residential area and had approximately 194 rooms over an area of 95000 square feet. It has gone a lot of renovations and is currently under the ownership of United Bank of New York. However, now they are trying to sell their investment and have recently been accepting purchase bids for the hotel. United has an outstanding loan of 28 billion which it needs to settle before it is able to dispose of property.

Comparing it to Hotel Perennial, it can be clearly deduced that it is a deviation from the previous acquisitions of Perennial. The location of the Perennial Hotel is in an urban residential area and the primary consumer segment targeted are the economy segment. Hence, it can be deduced that the services provided will be limited and not full scale. Using Exhibit 2 each of ELI’s investments can be analyzed.

|

Classification Mode |

Features |

Perennial |

|

Service Level |

Full time |

Limited |

|

Location |

Resort |

Urban |

|

Property Type |

Hotel/Motel |

Hotel/Motel |

|

Chain Scale |

Luxury |

Economy |

The above diagram provides a summary of the differences between the characteristics between the acquisitions of ELI and Perennial Hotel.

2. If you were advising DJ on his acquisition, what should he bid for the hotel? (Please recommend a single value amount, not a range). You may use the assumptions in question 3 below to aid you in your recommendations.

There are various ways to calculate the purchase price. The most common and easy way is to multiply the number of rooms with the average rolling price in the last year. The price in the 2nd quarter for one room is $120,000; however, the moving average is around $ 110,000. This can be multiplied by the number of rooms (194). Hence, a target value can be achieved and then by adding the closing costs and the mechanic liens, the purchase price figure can be calculated. The resulting price will come out to be the following;

This is a very simplistic view of calculating the price, but this index does not differentiate between luxury or economy classes of real estate. So one would expect that this would be the upper band when the price is devised.

However, the property is appraised to be $ 46 million excluding other expenses which seem to be on the higher side. It is important to realize that this is a distressed property and using the valuation method used above the price per room would be around $ 240,000.

|

Total Price |

46,000,000.00 |

|

Rooms |

194 |

|

Price / key |

237,113.40 |

It is important to realize that such exorbitant prices per key were not witnessed even during the property boom years in the mid-2000s. By looking at the comparison, one can deduce that the appraisal provided is massively overvalued and highly inaccurate.

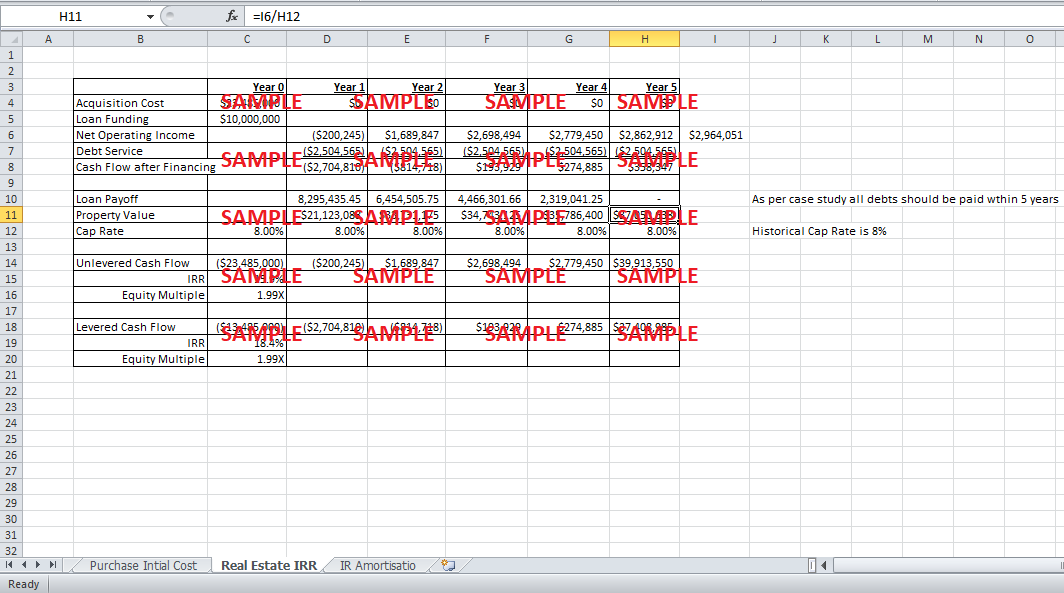

James will obtain a loan arrangement of 10 billion dollars while the rest will be financed with equity. The below table segregates the amount. The total debt funding will be charged at an 8% interest rate, and the debt funding will be comprised of around 43% of the total acquisition value.

|

Total debt funding |

10,000,000 |

|

Total Equity Balance |

13,485,000 |

The funding sources percentage is shown in the chart below.

The final price that James should bid for is 23.48 million and not 46 million as per the appraisal of the case study.

3. Calculate the projected unlevered IRR, unlevered cash flow multiple, levered IRR and levered cash flow multiple for the investment, assuming Jameson purchases the hotel at your recommended valuation from question 2 above. Use the pro forma underwriting and the following assumptions:

a. Closing (date that Jameson funds the initial investment capital) occurs on December 31, 2010 (ignore the timing of the $1 million deposit and assume that all purchase price proceeds, including the deposit, are funded at closing.

b. In addition to the purchase price, Jameson must pay off the mechanics’ liens – the payments owed to contractors for construction services that were never paid for by the previous owners. These mechanics’ liens total $3.85 million. However, ELI’s general counsel, Mike Lotio, has advised Jameson that he thinks that the claims can be bought out for 50 percent of the nominal value (i.e., for $1.925 million). This amount will also be payable on the closing date. Note: the discounted buyout is not guaranteed, which Jameson would like to take into account when negotiating a purchase price with United.

c. Closing costs totaling $225.000 (e.g. lawyer’s fees, due diligence costs); no other transaction fees, debt-related fees, or debt-related reserves are required during the holding period.

d. Ignore any working capital adjustments.

e. Assume that debt financing is arrange in time for the closing and that the Perennial is acquired using $5 million in debt proceeds on the closing date. (The rest of the purchase price and the buyout of the mechanics’ liens must be financed with equity).

f. Construction costs of $5 million are spent during the first six months of 2011. Jameson is able to finance these costs at 100 percent loan-to-cost (i.e. 100 percent debt financing).

g. Treat the $10 million in debt proceeds as a single, interest-only loan facility charging an 8 percent interest rate. For the purpose of simplifying the exercise, you can calculate interest expense off the average annual balance for the loan facility. The loan has multiple extension options and can be 0813 Hotel Asset Management © 2018 Florian Aubke extended indefinitely, so there will be no need for refinance. (This is not a realistic assumption in the real world, but it will serve to simplify your calculations).

h. Debt is not assumable and must be paid off upon disposition of the hotel.

i. Hotel Perennial opens on July 1, 2011 (already reflected in pro-forma underwriting).

j. Assume a five-year investment holding period.

k. Make an assumption on gross exit valuation; assume that closing costs of $225.000 are netted out of the gross proceeds to dispose of the hotel; make sure you exist valuation is defensible.

l. Ignore taxes (other than the property taxes already included in the pro forma).

m. Assume that all cash flows are incurred at the end of the calendar year (i.e. build an annual model). Calculate the IRRs and cash flow multiples on an annual basis using a year-end of December 31.

Using the purchase price as an initial value method the value for closing costs and mechanical liens can be added to the purchase price. The total purchase price hence becomes

Now coming to the cash flows from Exhibit 9 the EBITDA can be calculated as follows:

|

31/12/2011 |

31/12/2012 |

31/12/2013 |

31/12/2014 |

31/12/2015 |

||||||||

|

Total Rooms |

194 |

194 |

194 |

194 |

194 |

|||||||

|

Days Available |

184 |

366 |

365 |

365 |

365 |

|||||||

|

Total Room Days |

35,696 |

71,004 |

70,810 |

70,810 |

70,810 |

|||||||

|

ADR |

136 |

138 |

142 |

146.26 |

150.65 |

|||||||

|

|

|

1.5% |

2.9% |

3.0% |

3.0% |

|||||||

|

Occupancy |

40% |

60% |

76% |

76% |

76% |

|||||||

|

Occupied Rooms |

14,278 |

42,602 |

53,816 |

53,816 |

53,816 |

|||||||

|

RevPAR |

54.40 |

82.80 |

107.92 |

111.16 |

114.49 |

|||||||

|

|

|

|

|

|

|

|||||||

|

Departmental Revenue |

|

|

|

|

|

|||||||

|

Room |

1,941,862.40 |

5,879,131.20 |

7,641,815.20 |

7,871,069.66 |

8,107,320.14 |

|||||||

|

Food & Beverages |

0 |

0 |

0 |

0 |

0 |

|||||||

|

Parking |

0 |

0 |

0 |

0 |

0 |

|||||||

|

Other |

0 |

0 |

0 |

0 |

0 |

|||||||

|

|

|

|

|

|

|

|||||||

|

Total Departmental |

1,941,862.00 |

5,879,131.00 |

7,641,815.00 |

7,871,070.00 |

8,107,320.00 |

|||||||

|

Lease Income |

0 |

169000 |

174070 |

179292 |

184670 |

|||||||

|

|

Total income |

1,941,862.00 |

6,048,131.00 |

7,815,885.00 |

8,050,362.00 |

8,291,990.00 |

|

|||||

|

|

|

|

|

|

|

|

|

|||||

|

|

Departmental Expenses |

|

|

|

|

|

|

|||||

|

|

Room(24%) |

462,247.00 |

1,410,991.00 |

1,834,035.00 |

1,889,056.00 |

1,945,756.00 |

|

|||||

|

|

Food & Beverages |

- |

- |

- |

- |

- |

|

|||||

|

|

Parking |

- |

- |

- |

- |

- |

|

|||||

|

|

Other |

- |

- |

- |

- |

- |

|

|||||

|

|

|

462,247.00 |

1,410,991.00 |

1,834,035.00 |

1,889,056.00 |

1,945,756.00 |

|

|||||

|

|

|

|

|

|

|

|

|

|||||

|

|

Undistributed Expense |

|

|

|

|

|

|

|||||

|

|

General & Administrative |

183,326.00 |

566,840.00 |

583,474.00 |

600,978.00 |

619,007.00 |

|

|||||

|

|

Credit Card(2.5%) |

48,547.00 |

146,978.00 |

191,045.00 |

196,777.00 |

202,683.00 |

|

|||||

|

|

Sales & Marketing |

290,378.00 |

512,575.00 |

625,270.00 |

644,028.00 |

663,349.00 |

|

|||||

|

|

Repair & Maintenance |

240,616.00 |

424,860.00 |

437,605.00 |

450,733.00 |

464,255.00 |

|

|||||

|

|

Utilities |

343,737.00 |

354,050.00 |

364,671.00 |

375,611.00 |

386,879.00 |

|

|||||

|

|

Franchise Fees |

- |

- |

- |

- |

- |

|

|||||

|

|

|

|

|

|

|

|

|

|||||

|

|

Totl Undistributed Expenses |

1,106,604.00 |

2,005,303.00 |

2,202,065.00 |

2,268,127.00 |

2,336,173.00 |

|

|||||

|

|

|

|

|

|

|

|

|

|||||

|

|

Gross Operating Profit |

373,011.00 |

2,631,837.00 |

3,779,785.00 |

3,893,179.00 |

4,010,061.00 |

|

|||||

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|||||

|

|

Fixed Expenses |

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|||||

|

|

Property Expenses |

400,000.00 |

412,000.00 |

424,360.00 |

437,090.00 |

450,203.00 |

|

|||||

|

|

Insurance |

115,000.00 |

118,450.00 |

122,004.00 |

125,664.00 |

129,433.00 |

|

|||||

|

|

Management Fees |

58,256.00 |

176,374.00 |

229,254.00 |

236,132.00 |

243,220.00 |

|

|||||

|

|

|

|

|

|

|

|

|

|||||

|

|

Total Fixed Expenses |

573,256.00 |

706,824.00 |

775,618.00 |

798,886.00 |

822,856.00 |

|

|||||

|

|

|

|

|

|

|

|

|

|||||

|

|

EBITDA |

(200,245.00) |

1,925,013.00 |

3,004,167.00 |

3,094,293.00 |

3,187,205.00 |

|

|||||

|

|

Furniture |

0 |

235,166 |

305,673 |

314,843 |

324,293 |

|

|||||

|

|

NOI |

(200,245.00) |

1,689,847.00 |

2,698,494.00 |

2,779,450.00 |

2,862,912.00 |

||||||

The above table demonstrates the information of cash flows on Perennial five years’ investment portfolio. In the initial years the cash flows are negative, but as time progresses, there is a significant increase in the cash flows as the investment progresses on. As assumed the levered cash flow return exceeds the unlevered cash flow return. Furthermore, the equity multiple is calculated to be around 2 in the above illustration. The cap rate is assumed to be at 8% as per the illustration in the case study which is used to calculate the total property value using the net operating income. The capitalization rate or the cap rate can be looked at the needed profit percentage and is based on the assumption that there is a link between the income the property generates and the value of the property (Smith, 2002). The cap rate can be used to calculate the total property value however it is a very simplistic view and hence is considered inaccurate

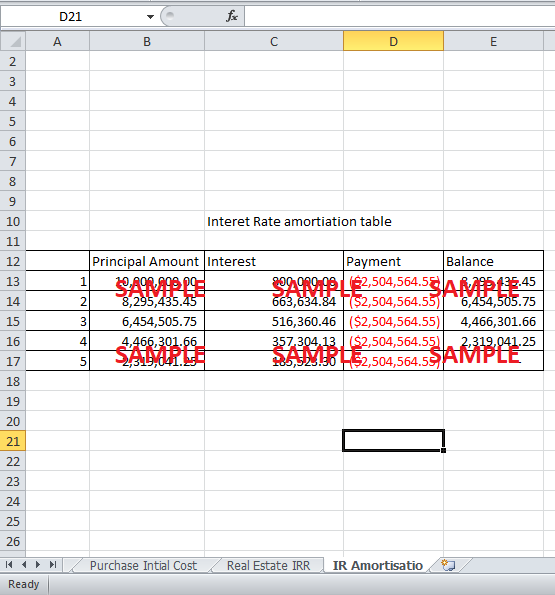

Furthermore, ELI has also been involved in a debt agreement of 10 million dollars, and the debt is to be retired within the time period of the investment. The loan amortization table is given below which can be used to calculate the total fixed amount that will be payable by ELI during the duration of the investment.

|

Principal Amount |

Interest |

Payment |

Balance |

|

|

1 |

10,000,000.00 |

800,000.00 |

($2,504,564.55) |

8,295,435.45 |

|

2 |

8,295,435.45 |

663,634.84 |

($2,504,564.55) |

6,454,505.75 |

|

3 |

6,454,505.75 |

516,360.46 |

($2,504,564.55) |

4,466,301.66 |

|

4 |

4,466,301.66 |

357,304.13 |

($2,504,564.55) |

2,319,041.25 |

|

5 |

2,319,041.25 |

185,523.30 |

($2,504,564.55) |

0.00 |

The EBITDA is an important calculation as it is unaffected by accounting estimations and differences in capital structure. However, even though the EBITDA has increased the EBITDA in its own is not a very useful method of analyzing real estate investments. Hence EBITDA multiples can provide a much more comprehensive view of the profitability of the investment.

|

EBITDA/Sales multiples |

|

-0.10 |

0.33 |

0.39 |

0.39 |

0.39 |

|

Gross Operating Profit |

|

19.21% |

44.77% |

49.46% |

49.46% |

49.46% |

|

Net Profit (excluding interest) |

|

-10.31% |

28.74% |

35.31% |

35.31% |

35.31% |

The above table gives a very comprehensive view of the profitability of the investment. It can be understood that in the last three years the figures have stabilized. EBITDA / Sales multiple now stands at 0.39 which can be used to predict future valuations. The total sales can be calculated by the total number of room days occupied, and the EBITDA multiple can then be used to estimate hotel values, etc. The other margins are profitability margins which have stabilized in the last three years.

The levered cash flow is calculated after a company has met all its debt obligations while an unlevered cash flows are calculated before the firm has met its financing needs. Unlevered cash flows are important because it is not affected by capital structure. In Exhibit 9 the EBITDA is effectively the unlevered cash flows as there are no working capital adjustments to be made. Furthermore, there are no more adjustments made to be regarding working capital and depreciation etc. The internal rate of return is the actual rate of return generated by the project (Baker, 2004). Furthermore, the equity multiple is calculated by adding the total equity, and the total profit generated divided by total equity. In other words, it is total equity and the operating income divided by total equity.

4. What are the potential opportunities and challenges for ELI in acquisition of the Hotel Perennial from a firm perspective?

ELI’ acquisition of Perennial will provide a lot of opportunities and challenges for the organization if the acquisition goes through. As discussed in the previous answers this acquisition clearly represents a deviation in the investment portfolio for ELI. While previously ELIs investment was in the luxury segment, Hotel Perennial caters to customers in the economy segment. This might imply that Hotel Perennial might want to use effective multi-segment marketing to target different customers. (Jonas & Diane, 2004)

One of the biggest opportunities that multi-segment marketing provides is that it allows companies to diversify their portfolios and reduce risk. (Kotler, 1999). ELI can now target the economy segment so even during difficult times it won’t have to rely on its luxury segment to be profitable as the economy segment generally tends to do well. Furthermore, the case study states the location for Perennial Hotel is attracting a lot of attention which implies that consumer demand is rising. This will give ample opportunity for Perennial Hotel to increase revenue and profitability. Moreover, this will also add another dimension to the services provided by ELI as the case study states that there are several events and the customer can access these places easily as the public transportations. It can be implied that Perennial Hotel operated in an area which is busy and often visited; hence the location of the Perennial Hotel looks promising. Furthermore, even though the segment is different ELI has been involved in the industry for quite a long time which means some of the expertise can be transferred to the new segment. New practices that were used in the luxury segment can be introduced in the economy segment as well. A successful economy will clearly put ELI at the top of the hoteling industry as it will show that ELI can now provide a diversified range of services to a wide variety of consumer with varying needs. Entering a new market will diversify the portfolio, allow ELI to gain a foot in the thriving economic segment and also allow ELI’s experience of the hoteling industry in a new segment.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.