Get instant access to this case solution for only $19

Allied Office Products Case Solution

‘Allied business products’ is offering commodity products to its customers by rooting their services on value added services motto. Currently, it has a traditional absorption costing system which allocates costs to all customers based on an overhead rate, ignoring the activity of customers. ‘Allied office products’ is considering introducing SBP pricing system. Based on the analysis, it is found that Allied should incorporate this system in the business as it will provide them with vital information on their customers. The analysis showed that ‘customer A’ is less loyal; however, it is comparatively profitable to the company. It is also recommended that Allied should implement ‘just in time’ inventory service.

Following questions are answered in this case study solution:

-

Using the information in the text and in Exhibit 2, calculate "ABC" based services costs for the TFC business.

-

Should TFC implement the SBP pricing system?

-

What managerial advice do you have for allied about the Total Forms Control (TFC) business? How does Exhibit 6 relate to this question?

Allied Office Products Case Analysis

1. Using the information in the text and in Exhibit 2, calculate "ABC" based services costs for the TFC business.

Any company that manufactures and sells products has the leverage of operating any relevant and legally compliant costing systems for its inventory. In order to find out the exact or accurate costs of products, 'Allied office products' wants to evaluate their costing system for ABC costing system. ABC costing stands for ‘activity based costing’. The traditional costing methods allocate the product cost based on the number of labor hours and purchased raw materials etc. On the contrast, the activity based costing tends to establish a relationship between the overall costs and overhead rate by utilizing the information related to the number of activities consumed by products. This is a more accurate costing system as compared with the traditional ‘absorption costing’ where a single overhead rate is used.

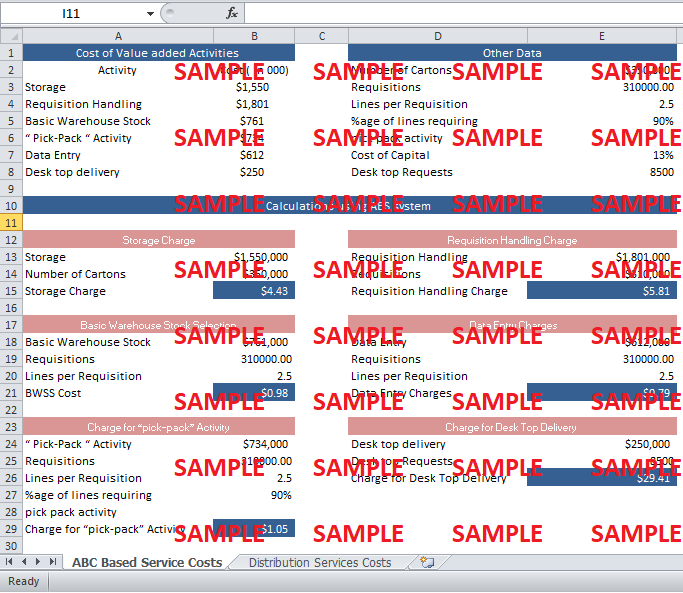

In order to find out the ABC based service costs for TFC business, first you should list the relevant activities and determine the total cost exploited by them. The following table depicts the costs of value added services as calculated by Tim and John.

Table 1: Cost of Value added Activities

|

Cost of Value added Activities |

|

|

Activity |

Cost ( in 000) |

|

Storage |

$1,550 |

|

Requisition Handling |

$1,801 |

|

Basic Warehouse Stock |

$761 |

|

“ Pick-Pack “ Activity |

$734 |

|

Data Entry |

$612 |

|

Desk top delivery |

$250 |

The next step in the chain of calculations is the determination of level of activities and the rate or cost associated with them. The following table depicts the relevant activities and their cost or rate.

Table 2: Other Activities

|

Other Activities |

|

|

Number of Cartons |

$350,000 |

|

Requisitions |

310000.00 |

|

Lines per Requisition |

2.5 |

|

%age of lines requiring pick pack activity |

90% |

|

Cost of Capital |

13% |

|

Desk top Requests |

8500 |

|

|

|

Now by capitalizing on this data, the ABC service costs for each value added activity can be calculated. Let’s start from storage charge.

Storage Charge

Based on the data pertaining to the storage cost and number of cartons, the storage charge or rate can be calculated as follows:

Table 3: Storage Charge

|

Storage Charge |

|

|

Storage |

$1,550,000 |

|

Number of Cartons |

$350,000 |

|

Storage Charge |

$4.43 |

Requisition Handling Charge

Requisition costs when divided by the number of requisitions, will yield requisition handling charge.

Table 4: Requisition Handling Charge

|

Requisition Handling Charge |

|

|

Requisition Handling |

$1,801,000 |

|

Requisitions |

$310,000 |

|

Requisition Handling Charge |

$5.81 |

Basic Warehouse stock selection charge

The overhead charge for this activity can be calculated by the following formula:

Table 5: Basic Warehouse stock selection charge

|

Basic Warehouse Stock Selection |

|

|

Basic Warehouse Stock |

$761,000 |

|

Requisitions |

310000.00 |

|

Lines per Requisition |

2.5 |

|

BWSS Cost |

$0.98 |

Data Entry Charges

The formula for calculating data entry charges is as follows.

Table 6: Data Entry Charges

|

Data Entry Charges |

|

|

Data Entry |

$612,000 |

|

Requisitions |

310000.00 |

|

Lines per Requisition |

2.5 |

|

Data Entry Charges |

$0.79 |

Charge for Pick pack activity

Charge of pick pack activity is calculated by utilizing the following formula:

Table 7: Charge for Pick pack activity

|

Charge for “pick-pack” Activity |

|

|

“ Pick-Pack “ Activity |

$734,000 |

|

Requisitions |

310000.00 |

|

Lines per Requisition |

2.5 |

|

%age of lines requiring |

90% |

|

pick pack activity |

|

|

Charge for “pick-pack” Activity |

$1.05 |

Desktop Delivery Charge

The charge for desktop delivery is calculated by dividing desktop costs by desktop requests.

Table 8: Desktop Delivery Charge

|

Charge for Desk Top Delivery |

|

|

Desk top delivery |

$250,000 |

|

Desk top Requests |

8500 |

|

Charge for Desk Top Delivery |

$29.41 |

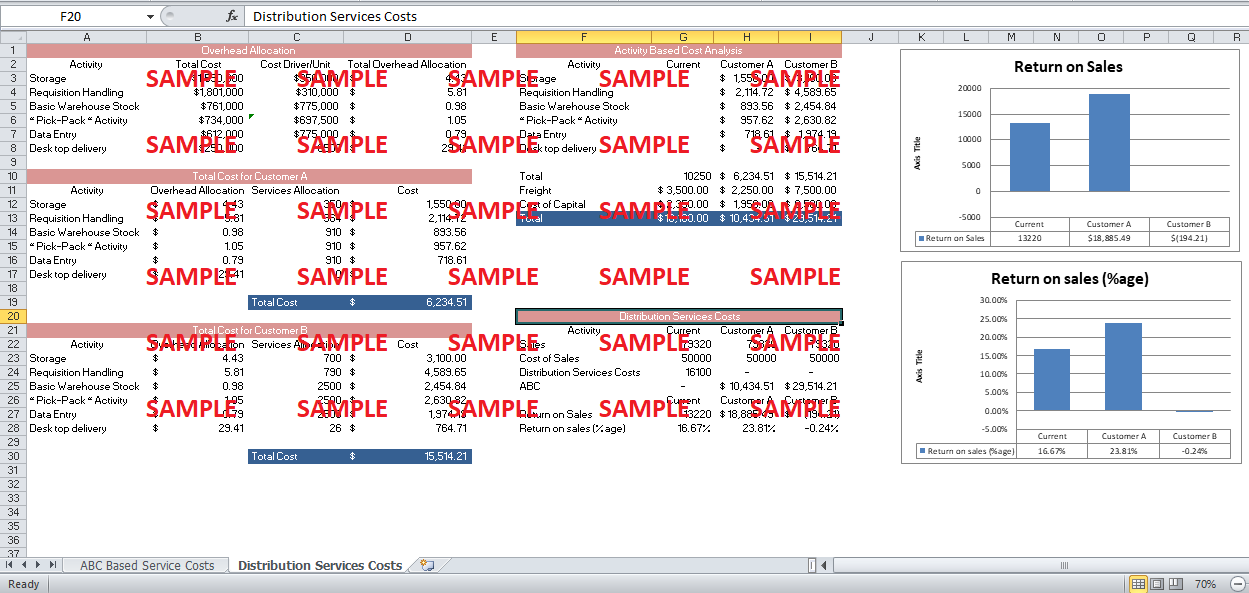

Using your new costing system, calculate distribution services costs for "Customer A" and "Customer B."

Before calculating the distribution costs for both customers, we need to find out the total costs associated with both of them. This can be accomplished by using the overhead charge or rate calculated in the first part. The total costs for 'customer A' are calculated as follows:

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.