Get instant access to this case solution for only $19

Alpen Bank Launching The Credit Card In Romania Case Solution

Alpen Bank’s country manager of Romania, Gregory Carle, wants to launch a credit card scheme in Romania. Carle needs not only to decide whether to launch this project or not, he must also determine which market segments he is going to target. The decision was choosing between middle-income households and affluent households to target the credit cards too. Before Romania was part of the EU, Alpen management had turned down the proposal of launching a credit card in the country because of poor economic conditions. After Romania joined the EU, this decision had changed.

Following questions are answered in this case study solution

-

Introduction

-

Analysis

-

Break-even

-

The Decision

-

Effect on Core Business

Case Analysis for Alpen Bank Launching The Credit Card In Romania

2. Analysis

Carle needed to determine that the launch of the credit card would generate 5 million Euros within two years. The economics conditions in Romania were improving as a result of joining the EU. Total disposable income was rising in the country. Romania had 7.7 million households out of which Alpen bank had 200,000 customers. Romania had already seen financial cards and in 2006, the growth of debit as well as credit cards was around 35% as compared to 2005. Romania had approximately 9.5 million cards with 8000 ATM’s and 150,000 points-of-sale terminals for card transactions. The current customers of Alpen consisted mostly of the affluent households. The average net income in Romania for the affluent was 500 Euros per month with the top 10% of the population controlling 24% of the country’s wealth. Alpen considered households earning around 200 Euros per month to be part of the middle-income earners and if it were to expand its customer base, these households would be good prospects as they were a large part of the population.

The credit card industry works in a way that determines revenues by transaction volume. Annual fees along with penalty fees and interest income would become the sources of revenue from the credit card launch. Affluent Romanians were trending to purchase expensive imported products from the EU rather than cheap local products and preferred luxury items, as suggested by a consumer survey.

The strategic decision that Carle had to make was to either target the existing base of customers, which were the affluent households or target both the middle-income as well as affluent households.

3. Break-even

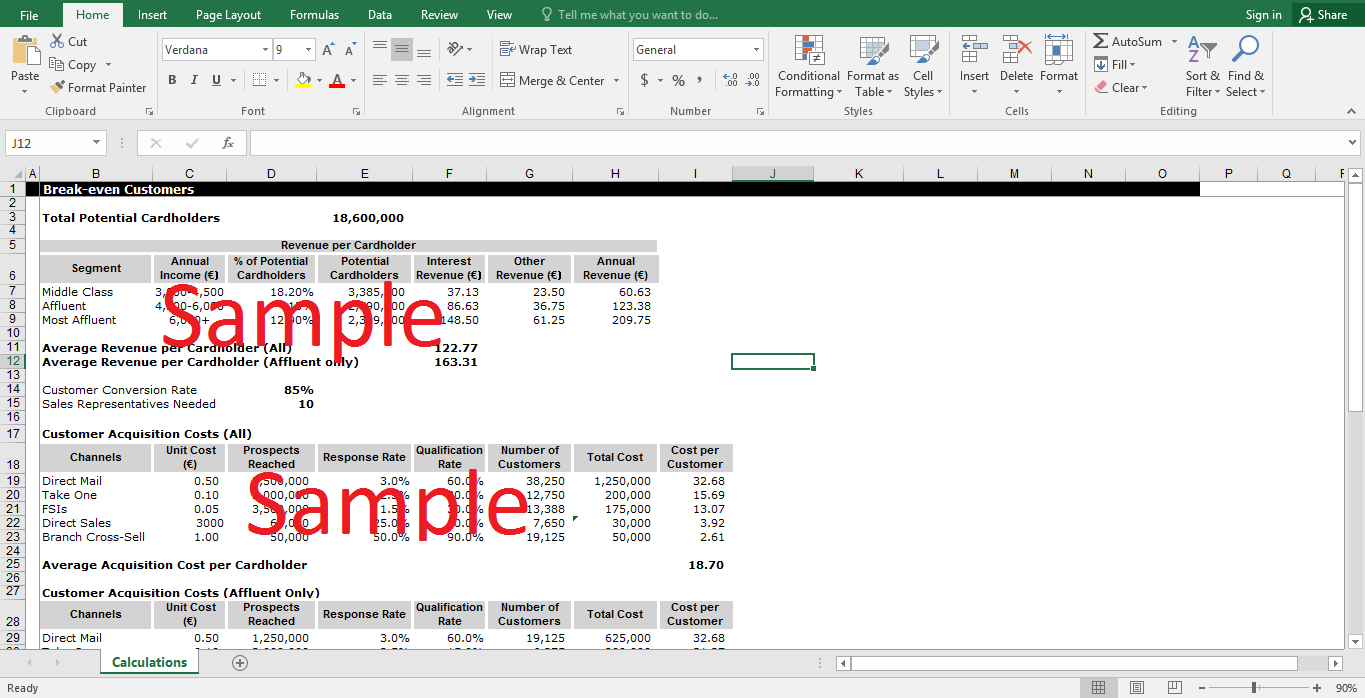

The average revenue per cardholder was first calculated by adding all the revenues per customer and giving corresponding weightage to each class of customers. The average acquisition cost was calculated using the response rate, qualification rate, as well as the customer conversion rate for each category. For targeting both the middle-income, as well as the affluent market segments, approximately 78,722 customers would be required to break-even. If only the affluent segments are targeted, then 53,603 customers approximately would be required to break-even. For the credit card project to generate a profit of 5 million Euros, a customer base of 130,570 customers would be required in the case of targeting all segments; whereas, the base of 92,820 customers would be required in the case of targeting affluent segments only. Detailed calculations are shown in the attached spreadsheet.

4. The Decision

The new card should be positioned as a high-end premium product because Alpen’s existing customers belong to the affluent segment. It would be convenient to position in the segment that the bank is already established in as compared to targeting new markets. Moreover, the affluent segment represents that wealthy class of Romania that controls almost a quarter of Romania’s wealth and these people are brand, image and status conscious. In countries like Romania, credit cards stick well which means if Alpen targets the wealthy, it will have a larger market share that sticks for a longer time.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

- Alto Chemicals Europe A Case Solution

- Amanco Developing The Sustainability Scorecard Case Solution

- ALZA And Bio Electro Systems A Technological And Financial Innovation Case Solution

- American Barrick Resources Corporation Managing Gold Price Risk Case Solution

- American Chemical Corporation Case Solution

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.