Get instant access to this case solution for only $19

ALZA And Bio Electro Systems A Technological And Financial Innovation Case Solution

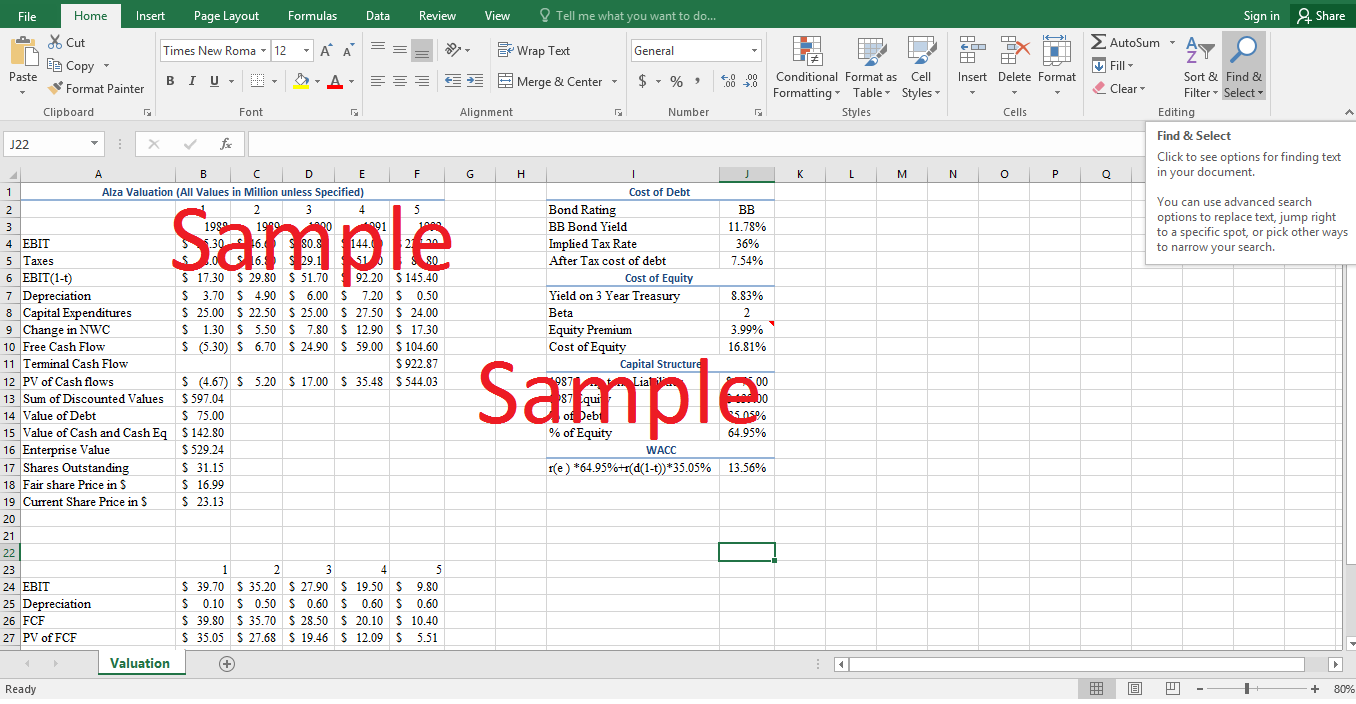

ALZA faces three different options for financing the future R&D of the firm. ALZA holds enough cash to finance the needs of R&D ($45 million). However, the use of the cash from the balance sheet will add up some R&D expenses. Hence, the possibility of depression in the forecasted earnings might manifest itself in the form of share price devaluation. The analysis shows that, at the current moment, the share of ALZA is overpriced by $6.3. Additionally, the option to venture with another pharmaceutical company is also not suitable. In the scenario where ALZA finances the product development, the counterparty might demand exclusive rights to the developed products. Additionally, ALZA possesses no relevant experience in handling such complex relationships. As a result, it is quite probable that ALZA will lose a major chunk of the future revenue stream from the developed products. In this scenario, it is only wise to opt for an option that retains the risk profile of the company while providing the benefits of full access to the future revenue streams.

ALZA and Bio Electro Systems A Technological and Financial Innovation Case Analysis

Among the listed options, the decision to take the R&D off balance sheet has many advantages. Firstly, by creating an off balance sheet entity, the earnings of the company can synthetically be boosted. Secondly, the off balance sheet entity BES, also assumes the risk profile of the risky future products. As a result, both the shareholders and investors demand low discount rates by not incorporating the risk of precarious investments. As far as the option to opt for the untested financing strategy is concerned, both the shareholders and investors should be made aware of the consequences of the transaction. In total, more than 4.5 million shares are issued alongside the warrants to buy the Class A shares of ALZA. The warrant exercise price amounts to $30. An analysis of the cash flows of BES indicates that the DCF outputted price is substantially lower than the calculated fair price. The subscription price stands at $11 while the fair value comes out to be $24.17. Hence, essentially, the option to purchase a share of ALZA is costing $13.17 to the prospective investors. Analysis also shows that the share of ALZA is currently overpriced. The fair value of a share of ALZA comes out to be $16.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.