Get instant access to this case solution for only $19

American Connector Company A Case Solution

American Connector Company (ACC) faces a threat from the competitor market of electrical connectors. A very strong producer of connectors DJC is planning to expand to the USA. The company is well known for its high quality, low price connectors in the Japanese market. Its strategic location in Japan, its high fixed capacity utilization, inventory management, and technology investments has allowed it to produce low- cost connectors. In the American market, the costs for the company, DJC, will be significantly reduced because of market conditions. This includes the cost of raw materials and labor. The quality control at DJC is high while that in ACC is low. ACC needs to restructure its company and prioritize funds allocation in its plant to improve its position in the American market.

Following questions are answered in this case study solution:

-

How serious is the threat of DJC to American Connector Company?

-

How big are the cost differences between DJC’s plant and American Connector’s Sunnyvale Plant? Consider both DJC’s performance in Kawasaki and its potential in the United States.

-

What accounts for these differences? How much of the differences are inherent in the way each of the two companies compete? How much is due strictly to differences in the efficiency of the operations? How much of the differences are due to the market conditions? Focus your analyses on material, labor, and depreciation (capital) components of the total difference that you have identified in the answer to.

-

What should American Connector’s Management at the Sunnyvale plant do?

American Connector Company A Case Analysis

1. How serious is the threat of DJC to American Connector Company?

DJC setting up a manufacturing unit in the USA will pose a great threat to the American Connector Company. The reason is that DJC’s raw material costs will decrease for DJC because the raw materials in Japan are twice as expensive as in America. DJC is already producing low-cost products in Japan; the low-cost of raw materials will further decrease the cost. Furthermore, Sunnyvale’s high defect rates give an advantage to DJC, which has implemented process quality control. ACC’s work in process inventory costs is high as compared to DJC. This shows that in terms of cost, ACC’s costs are high disabling it to offer cheaper products.

The high level of customization is both an advantage as well as a disadvantage to ACC. It can offer a wider range of products to the companies, but as a result of this customization, efficiency is low. The production ability for DJC is high because of 100% capacity utilization and high output to input labor. Also, the delivery time at DJC is lower because of automated processes in production. As opposed to ACC that has a delivery time of more than one day because of greater time utilized in producing batches of several connector varieties. Furthermore, the raw material inventory costs for ACC are higher because the turnover is low. The turnover at DJC is five days whereas ACC has a 10.8-days turnover, more than twice that of DJC. These differences show that DJC is a very strong threat to ACC. Except for one advantage of customization and variety, DJC has an advantage in all other points of differentiation. It shows the extent of the seriousness of the threat.

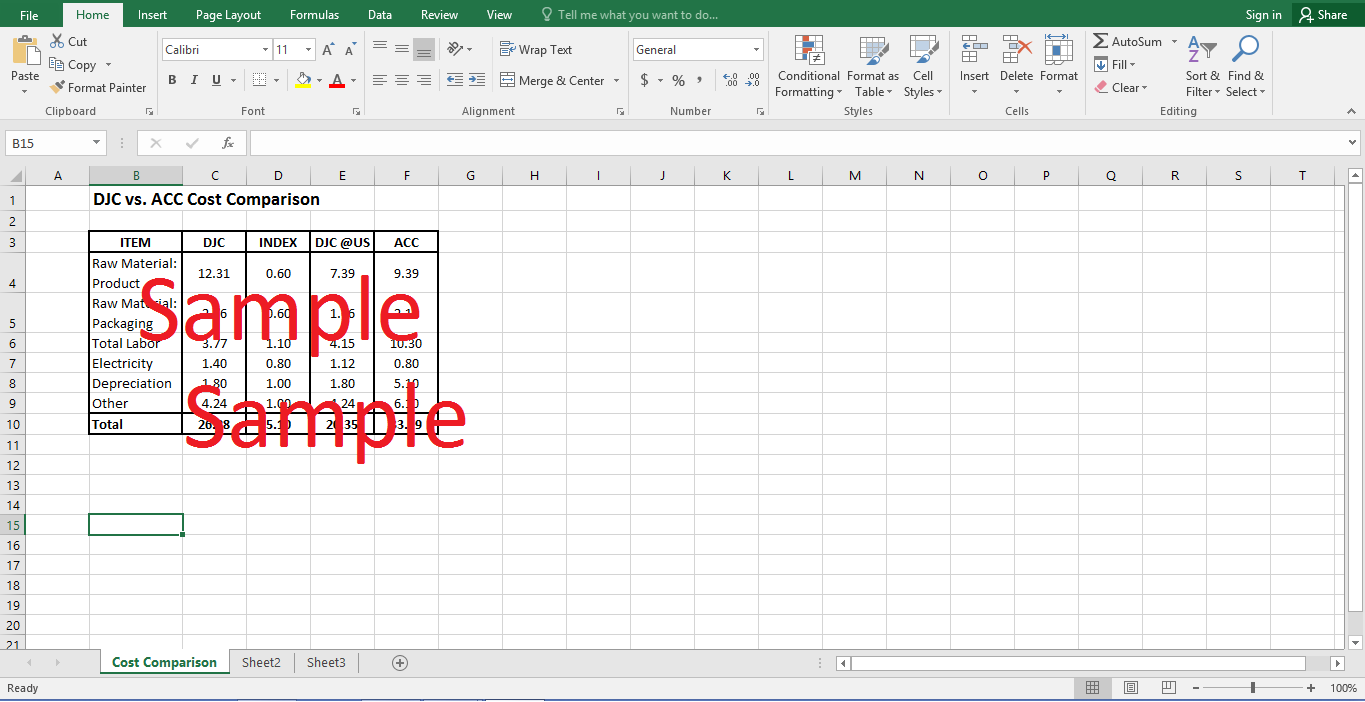

2. How big are the cost differences between DJC’s plant and American Connector’s Sunnyvale Plant? Consider both DJC’s performance in Kawasaki and its potential in the United States.

There are several points of difference in terms of cost between ACC and DJC. DJC has adopted advanced technology that has enabled it to reduce costs for its products and offer them at a lower price compared to the rest of the competitors. The raw material costs for DJC are high in Japan in the Kawasaki plant because of costly raw materials. If comparing Kawasaki to ACC, the cost differences are high with Kawasaki’s raw materials being more expensive. DJC, setting up a plant in the USA would mean considerable cost reduction for DJC.

i. Cost for raw material, product, and packaging

Kawasaki: $12.13 + $2.76 = $14.89

US Plant (DJC): $14.89 x 0.6 = $8.93

Percentage Change: 59.97% decline in raw material costs

Kawasaki plant has a technology for standardized packaging. Its packaging cost is, therefore, lower than Sunnyvale.

The labor costs for Sunnyvale is high because of greater work in process inventory and finished goods inventory. The excess space requires a greater number of labors because of the management of this inventory and the complex plan environment. Thus, the labor costs are greater. The greater electricity costs in Japan mean that the USA plant would have lesser electricity costs.

ii. Cost of Electricity

Kawasaki: $1.40

USA Plant: $1.40 x 0.8 = $1.12

(The electricity cost ratio is 0.8:1 for America and Japan respectively)

The higher lead time because of higher variations in production at ACC leads to a higher cost for the time lost in setting up new operations.

3. What accounts for these differences? How much of the differences are inherent in the way each of the two companies compete? How much is due strictly to differences in the efficiency of the operations? How much of the differences are due to the market conditions? Focus your analyses on material, labor, and depreciation (capital) components of the total difference that you have identified in the answer to.

a). The first reason for the differences in cost is the utilization of the fixed asset. DJC has a continuous process and, therefore, the utilization of the machinery is 100%. Therefore, the production is greater, the inventory turnover is higher, and the return on assets would be higher. Secondly, the raw materials in Japan cost higher than that in the USA. Third, the variety of batches produced in ACC means more lead time for setup. It also means lower expertise in the manufacturing of a single product, meaning low quality for every variant produced.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.