Get instant access to this case solution for only $19

American Home Products Corp Case Solution

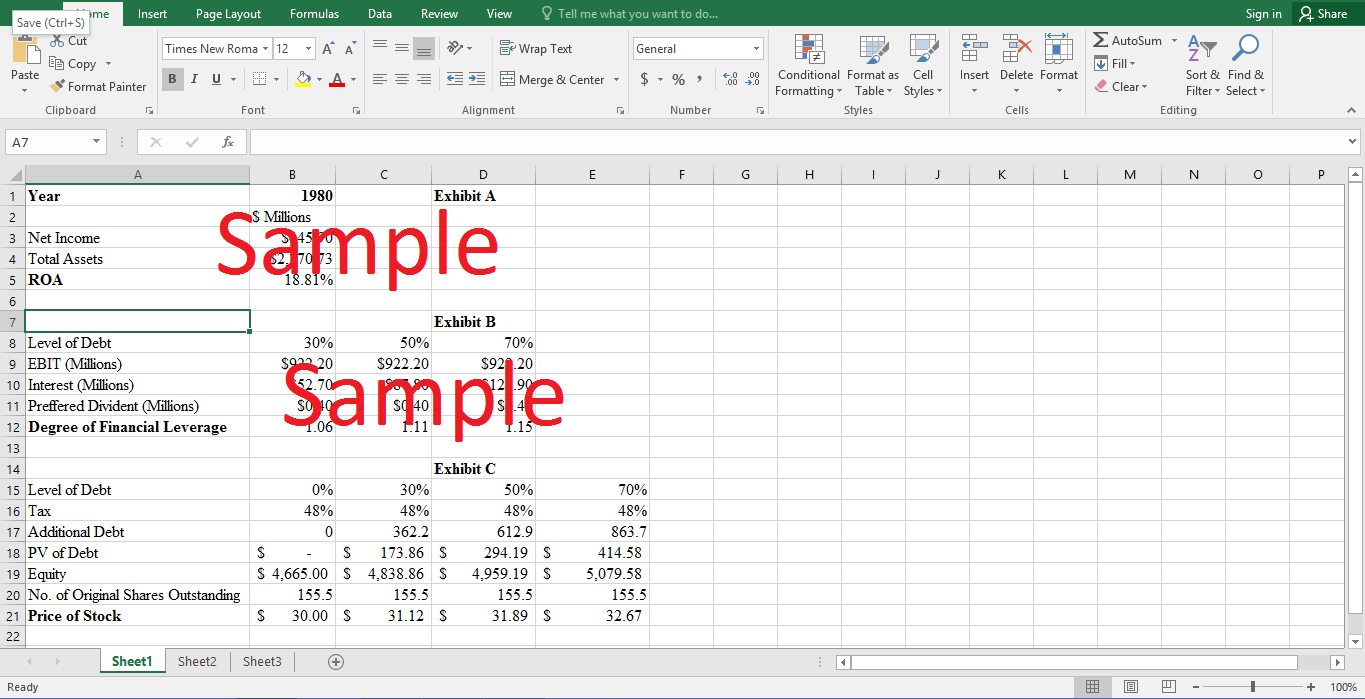

American Home Product Corporation had negligible business risk in 1980. It had a high net worth $ 1472.8 million and had an excess cash of $ 233 million (exhibit 1). American Home Product Corporation had a Return on Assets of 18.11% and had a profit margin of 11%, which was pretty healthy (Exhibit A). It had a high return on equity of 30.0 % (exhibit 1). In 1980, the company had both the ability to generate enough income from its assets and was earning healthy net income in comparison to the revenue it was making. However, growth in sales had dropped, which was 10% in 1979 to 8% in 1981(exhibit 1). Sales drop could have been due to American Product Corporation’s very low expenditure in Research and Development or due to its competitors picking up pace in sales from American Corporation.

At the 30 % level of debt, the Corporation had degree of financial leverage of 1.062. At 50% level of debt, the Corporation had a financial leverage of 1.106, while at the 70 % level of debt; the Corporation faced a financial risk of 1.115. The above ratio shows that the company faced more financial risk at an increased level of debt (Exhibit B).

The potential value the firm creates for its shareholders is measured from its Earnings per share and Dividends per share. At 30% level, the firm created Earnings and Dividends per share of $ 3.33 and $ 2. At 50% level, it created Earnings and dividends per share of $ 3.41 and $2.04, while it created the greatest level of Earnings and Dividends per share at 70% level of debt of $ 3.49 and $ 2.10. So, the company created highest potential value at 70% level of debt.

Following questions are answered in this case study solution:

-

How much business risk does American Home Products face? How much financial risk would American Home Products face at each of the proposed levels of debt shown in case Exhibit 3? How much potential value, if any, can American Home Products create for its shareholders at each of the proposed levels of debt?

-

What capital structure would you recommend as appropriate for American Home Products? What are the advantages of leveraging this company? The disadvantages? How would leveraging up affect the company’s taxes? How would the capital markets react to a decision by the company to increase the use of debt in its capital structure?

-

How might American Home Products implement a more aggressive capital structure policy? What are the alternative methods for leveraging up?

-

In view of AHP’s unique corporate culture, what arguments would you advance to persuade Mr. Laporte or his successor to adopt your recommendation?

American Home Products Corp Case Analysis

2. What capital structure would you recommend as appropriate for American Home Products? What are the advantages of leveraging this company? The disadvantages? How would leveraging up affect the company’s taxes? How would the capital markets react to a decision by the company to increase the use of debt in its capital structure?

American Home Product should adopt a capital structure of 70% debt and 30% equity. This is due to American Home Product’s primary policy of maximizing shareholder value. The valuation ratios can be used as a reference for the proposed decision. At 70% level of debt, American Home Product’s earnings per share increased to $3.41 from the actual $ 3.18 (Exhibit As, earnings per share has increased, so the amount attributed to each share of common stock had increased. The Dividend Payout ratio also increased from the actual figure of $ 1.9 to $ 2.10, which meant that the company could pay out more dividends to its shareholders with 70% level of debt, as compared to previously. At 70% level of debt, the company also had to pay less corporate tax. So, overall value of the firm’s shares increased.

The advantages are that the firm’s objective of maximizing shareholders value will beis achieved at 70% level of debt. At this level of debt, Earnings per Share and Dividends per Share are maximized. It gains advantage of tax shield in interest it pays. High earnings per share create value to the company and will increase stock price. The company will have tax benefit and will have to pay low corporate tax.

The disadvantages include that the company will now face more risk as demonstrated by the degree of operating leverage. As a result of high risk, firm’s bond rating will decrease, due to increased levels of debt that it has taken.

The effect of leverage on the taxes the corporation pays is that the corporation gains advantage of tax shield. As the interest is tax deductible, so, profit before tax comes out to be the lowest i.e. $ 799.3 at 70% level of debt. So, the more the company borrows, the lesser it pays in taxes. At 70% debt, it pays lowest tax of $383.7 (Exhibit 3).

Capital Market reaction would be based on change in stock price that is calculated (Exhibit C). There would be a change in stock price as shown (Exhibit C). At 30% level of debt, stock price would rise to$ 31.12, at 50% stock price would be $31.8, and at 70%, it would be $32. Also, there will be change in equity and assets of the company due to share repurchase and debt as a component in the capital structure of the company.

3. How might American Home Products implement a more aggressive capital structure policy? What are the alternative methods for leveraging up?

The first method for pursuing aggressive policy is through the repurchase of stock which had been proposed by analysts. By repurchasing stock, it will use proceeds from debt to buy back its own share and thus will raise the stock price. This strategy is good, as it will improve the market price of the Corporation’s stock and thereby fending chances of takeover attempts. It may be an ideal attempt as American Product Corporation has low debt in its structure and steady cash flow.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.