Get instant access to this case solution for only $19

Apex Investment Partners A April 1995 Case Solution

Accessline, a rising player of the telecommunication industry has decided to raise additional funding for its operations. The analysis of the business operations highlight the ability of the firm to attain growth in the future. Till date, Accessline has only engaged in external financing in July 1994. High growth rate, increased market penetration, favourable industry dynamics, innovative products, services and experienced management are the strong aspects of Accessline. Meanwhile, the structure of the proposed financing and difficulty in the valuation mark Accessline to be a low to medium risk bearing firm. The cost of equity of Accessline comes out to be 9.58% while the free cash flow model outputs that the enterprise value stands at $158 million.

Following questions are answered in this case study solution:

-

Summarize the operations and past funding used by AccessLine. For a venture capitalist, does AccessLine appear to be an attractive investment opportunity? Identify the attractive and unattractive aspects along with the nature of the risks associated with the company.

-

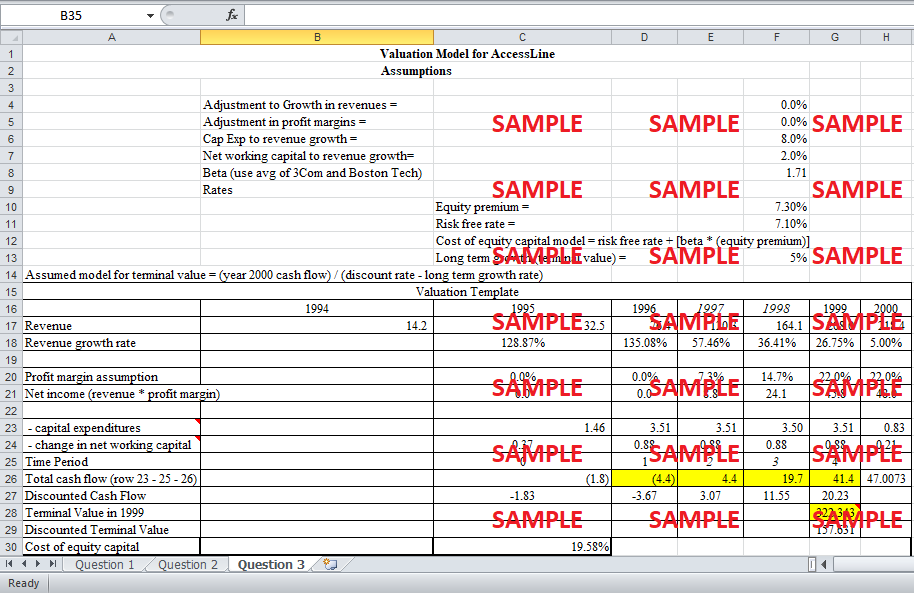

Discuss why the valuation of AccessLine is important to understand and what stakeholders are concerned with this value. Complete the valuation model template presented within the help spreadsheet. Include the model in your report document and describe the steps and the results.

Apex Investment Partners A April 1995 Case Analysis

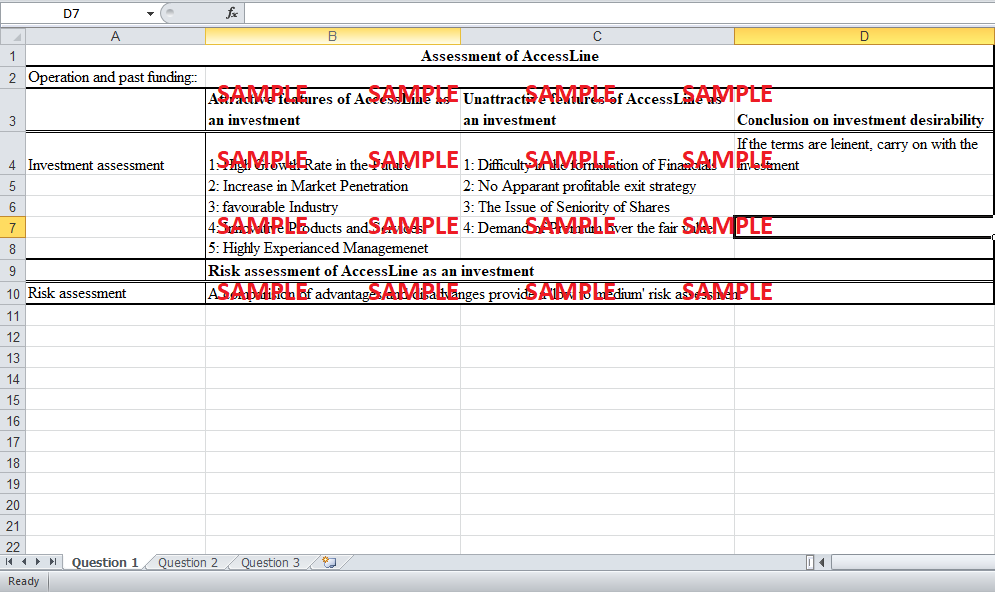

1. Summarize the operations and past funding used by AccessLine. For a venture capitalist, does AccessLine appear to be an attractive investment opportunity? Identify the attractive and unattractive aspects along with the nature of the risks associated with the company.

Accessline was founded in 1989, and it was originally known as Accessplus communication and it appeared to be a rising player in the telecommunication industry. Ever since its beginning, Accessline vision comprised of integrating several services with each other. In essence, Robert Fuller, the founder of the company focused on the issue of integration from the beginning. Accessline’s operations were a little different from the rest of the telecommunication companies as it focused on providing special unit services using the customer’s existing telephone number. The operational strategy of Accessline was also distinct from the rest of the competitors. Accessline sought to penetrate the market by developing new strategic alliances and nourishing the existing ones. This strategy was effective in various ways. Firstly, it was cost effective and furthermore it also helped the company is attracting financing. The company engaged in the first funding in July 1994. The financing round ended up by adding an aggregate of $15.54 million proceeds to the Accessline’s balance sheet. This funding has various peculiar characteristics. Firstly, the issued series A preferred also included the warrants to purchase addition stock. These series A shares have a liquidation and dividend preference. Hence, even though the ownership of the existing investors did not change significantly from the financing, their ability to dictate terms and policies was affected to an extent. Apart from this funding, no other financing decision was ever carried out by Accessline.

In terms of its ability to attract venture capital firms, Accessline possessed several striking factors. Firstly, from the perspective of financials, Accessline depicted high growth in the coming years. The cumulative penetration of the company will increase from 0.75% in 1995 to 10.61% in 2000. There was a clear and a certain probability of the huge increases in the subscriber base. Secondly, the industry in which Accessline operated was destined to obtain favourable figures in the future. As the access to the internet and computers increased, the communication sector was projected to grow at a stable pace in order to cater to the demands. Thirdly, the ‘one person, one number’ idea of Accessline was quite innovative, and the market and consumers might highly welcome this type of product. Fourthly, the experienced management of Accessline also made certain that their commitment with the cause of the company will remain strong in the future. All these advantages were countered by numerous shortcomings as well. Even though, the growth projections were optimistic, the formulation of the Accessline’s financials posed serious limitations. Additionally, the reaction of the existing investors and the expected protection clauses in the term sheet also showed that the risk of an adequate and apposite return was difficult to attain. Additionally, Apex partners or any other venture capital should also be provided with a clear and healthy exit strategy. As Accessline was stricter in its terms, the combined risk in the investment increased. However, in the midst of all these factors, the overall risk assessment should range between ‘low to medium’ risk.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.