Get instant access to this case solution for only $19

Arundel Partners The Sequel Project Case Solution

Arundel Partners is a financial company that is contemplating an unusual investment project. The company is looking to buy rights to possible sequels for prospective movies and profit by actually making the sequels for movies that become commercial success. The company has already initiated talks with some studios and projects that it can buy a portfolio of movie rights for $2 million per movie. The valuation of the project is tricky because of the uncertain nature of revenues in the movie industry. In order to value the project, we propose the use of net present value approach with an explicit adjustment for the option embedded in the proposal. It is estimated that the company might find it profitable to purchase movie rights from certain studios, but the uncertain nature of the calculation warrant further scrutiny with additional data.

Following questions are answered in this case study solution:

-

Why do the principals of Arundel Partners think they can make money buying movie sequel rights? Why do the partners want to buy a portfolio of rights in advance rather than negotiating film-by-film to buy them?

-

Estimate the per-film value of a portfolio of sequel rights such as Arundel proposes to buy. [There are several ways to approach this problem, all of which require some part of the dataset in Exhibit 6-9. You may find it helpful to consult the Appendix, which explains how these figures were prepared.

-

What are the primary advantages and disadvantages of the approach you took to valuing rights? What further assistance or data would you require to refine your estimate of the rights’ value?

-

What problems or disagreements would you expect Arundel and a major studio to encounter in the course of a relationship like that described in the case? What contractual terms and provisions should Arundel insist on?

Arundel Partners The Sequel Project Case Analysis

1. Why do the principals of Arundel Partners think they can make money buying movie sequel rights? Why do the partners want to buy a portfolio of rights in advance rather than negotiating film-by-film to buy them?

Arundel Partners is a financial company with limited experience in the movie industry. Valuing an original movie is a daunting a task and requires significant expertise on valuing artistic elements. It is due to this reason that many of the movies fail to succeed even when the specialized studios produce them. On the other hand, a successful movie’s sequel is much more likely to be a commercial success because they usually utilize the same artistic team as the original movie. Therefore, producing a sequel could be a financially viable proposition. Arundel partners probably believe that the price paid to buy a portfolio of sequel rights might allow them to earn a profit if a few of those sequels are actually produced, following the commercial success of the original movie. The idea is that proceeds generated from the few sequels that are actually produced will outweigh the cost of acquiring a larger portfolio of sequel rights.

Arundel Partners wants to make sure that they buy the sequel rights for a majority of a studio’s movie before the movies even go into production. The partners believe that once the movie goes into production, it might not be advantageous for them to negotiate the sequel rights with the studios. The reason behind this belief is that once the production starts, the studio will have more information about the movie than Arundel Partners. Such a situation will put the studio at an advantaged position and might lead to an unfair deal for Arundel partners. For instance, the studios might charge a higher price or refuse to sell rights for the films that they later believe to be of higher commercial value.

2. Estimate the per-film value of a portfolio of sequel rights such as Arundel proposes to buy. [There are several ways to approach this problem, all of which require some part of the dataset in Exhibit 6-9. You may find it helpful to consult the Appendix, which explains how these figures were prepared.

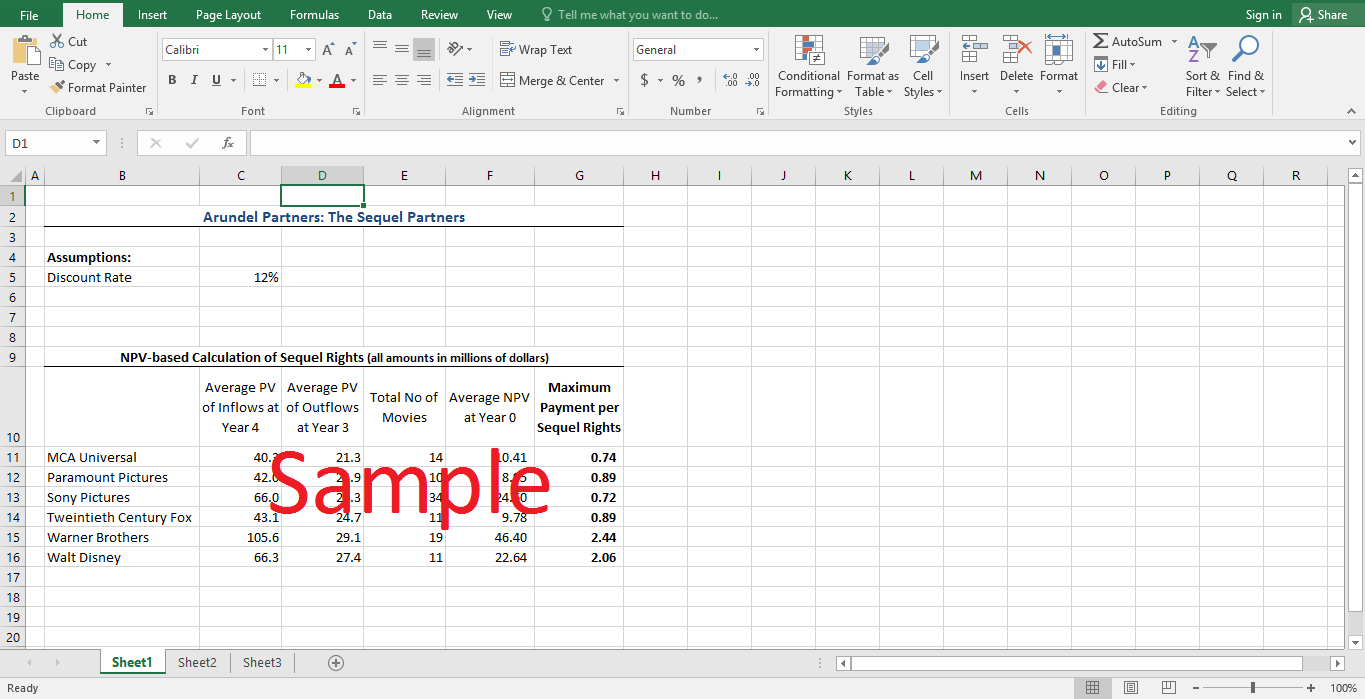

The profits for Arundel Partners depend on whether the value of the movie sequels is higher than the estimated two million required to buy the rights. There are two main approaches that can be used to forecast the value of the project. The NPV approach uses the cash flows for hypothetical sequels (exhibit 7) to calculate the average value of each sequel. The option valuation treats the sequel rights as an option to produce the movie in the future. The NPV approach is simplistic and uses historical data. Similarly, the option valuation is unrealistic because the assumptions required – constant variance, know volatility, normal distribution – for an option valuation model such as the Black-Sholes model simply do not hold. A possible solution is to use a hybrid model where it is assumed that the company will purchase the rights for all possible sequels, but will only produce those hypothetical sequels that have an attractive one-year return (exhibit 7). Thereby, the NPV is calculated for those hypothetical films that have a one-year return greater than the discount rate (assumed to be 12%). The attached appendix details these calculations for each studio. The maximum payment that Arundel Partners will be willing to make for each movie sequel’s rights is calculated by dividing the average NPV from hypothetical movies produced by the total number of movies for which rights were bought.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.