Get instant access to this case solution for only $19

Aspen Technology Inc Currency Hedging Review Case Solution

Aspen Tech evolved out of the project Advanced System for Process Engineering (ASPEN), conducted at the Massachusetts Institute of Technology (MIT), in Cambridge, from 1976 to 1981. Later, it started developing simulation software for customers in process manufacturing industries, particularly the chemical industry. Lately, it was estimated that Aspen Tech gained 50% of the simulation market for the chemical sector. The rapidly growing company, Aspen Tech earned more than 50% of its software license revenues from customers outside the United States. The company had experienced many changes in its business, including the acquisition of British subsidiary, globally expansion of sales and expenses, and an initial public offering, which had transformed Aspen into a publically traded company. Sales and expenses in other countries had made Aspen Tech exposed to currency risk. Aspen has been trying to eliminate virtually all of the exposure arising from global sales through hedging programs.

Following questions are answered in this case study solution:

-

What are Aspen Technology’s main exchange rate exposures? How does Aspen Tech’s business strategy give rise to these exposures as well as to the firm’s financing need? Please make sure you catalogue the relevant exposures.

-

Calculate Aspen’s exposures by currency for the past year. What currencies is it long and short?

-

What goal would you recommend for the firm’s currency risk management program? Why? Based on your goal, what type of exposure should Aspen be measuring? Please make sure you provide your rationale in detail for your recommendation.

-

Should the firm maintain its policy of completely eliminating all exposure on booked sales? If not, what policy would you advocate and why? Please make sure you explain what evidence you employed to come to your conclusion.

-

How, if at all, should Aspen’s recent transition from a private to a publicly-traded firm affect its approach to risk management? Make sure your “forecast”: is linked to evidence from the case, evidence you derived from the analysis of the case, or other information.

Aspen Technology Inc Currency Hedging Review Case Analysis

1. What are Aspen Technology’s main exchange rate exposures? How does Aspen Tech’s business strategy give rise to these exposures as well as to the firm’s financing need? Please make sure you catalogue the relevant exposures.

By 1995, Aspen Technologic Inc. had licensed its simulation software to more than 450 companies primarily in the chemical industry. Its software is purchased by more than two-thirds of the world’s largest chemical companies among its clients. For ease of its customers, the sales made in the UK, Japan, Canada, Belgian and Germany are denominated in their local currency pounds, yen, Canadian dollar, Franc and marks respectively. As a consequence of the sales denominated in local currency, Aspen Tech had long been exposed to currency fluctuations. Specifically, the currency risk exposure can be subdivided into two kinds, sales related exposure and expense related exposure.

In the sales related exposure, the firm can experience loss while converting the installments, received in local currency, into US dollar, due to the appreciation of the dollar. 52% of the software license revenues came from customers outside the US. Financing is offered to the customers, which allowed them to pay equal installments over the period of 3 to 4 years. Appreciation of US dollar can lower the dollar value of the receivables installments. Under expense related exposure, depreciation in US currency, or appreciating local currency, would result in currency exchange loss to the company, as the dollar value of expense would rise. Expense related exposure arise due to the firm commitment to make local currencies payments abroad. Moreover, there could be a wide difference in the actual and projected expenses due to currency fluctuations. In the light of the risk management strategy provided in case, it can be argued that Aspen Tech is aggressively managing it sales-related exposures. Nonetheless, the financial contract and hedging options are not used, by the firm, to manage its expense-related exposure.

2. Calculate Aspen’s exposures by currency for the past year. What currencies is it long and short?

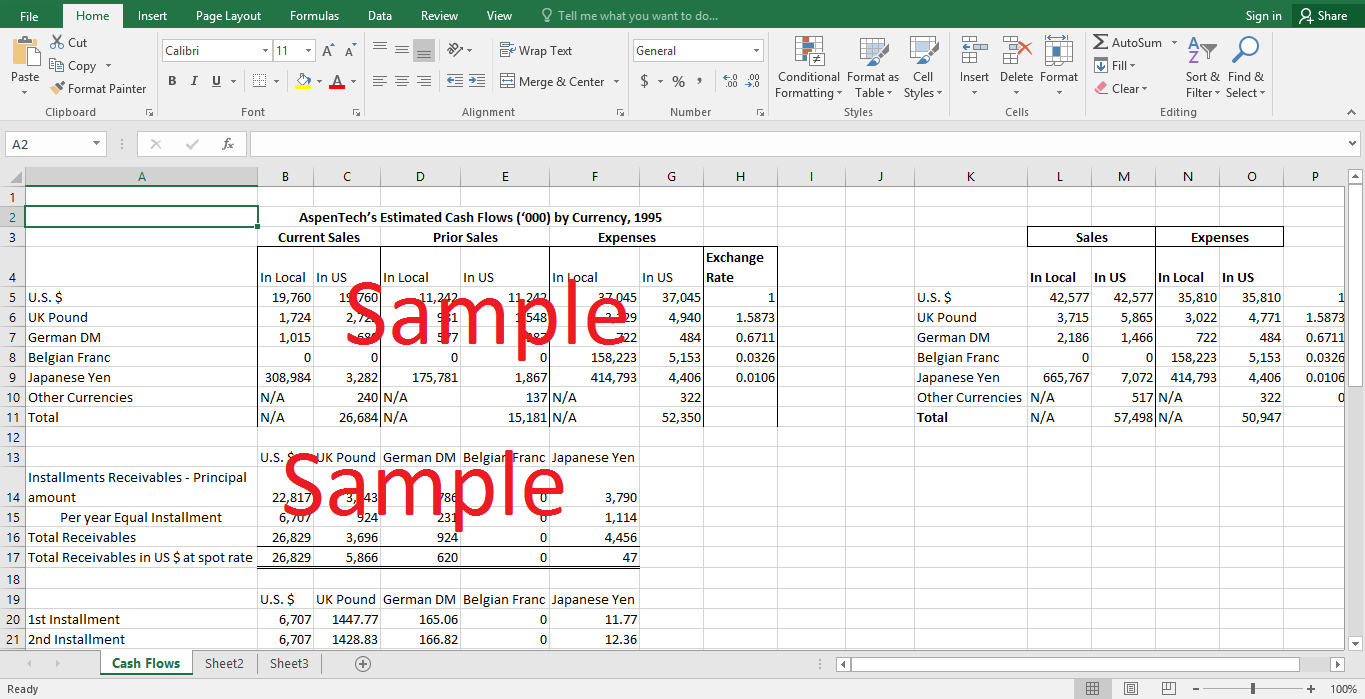

The policy of Aspen Tech is to eliminate all transactions exposure arising from foreign currency denominated license contract. In order to manage the currency fluctuation exposure, the company tries to eliminate all the sales related exposure, either by entering into forward currency agreements or through the sale of non- US dollar installments, having maturity of three to four years. In the former case, Aspen Tech hedged the first two equal installments by entering into one year and two year forward contracts. For the installments expected to receive after two years, Counterparties and banks are not willing to sign a long dated forward contract as the transaction was not large. To manage the risks related to these installments, firm has entered into a series of forward contracts, swapping each of the expired contracts for a new contract. The timings of the payments received, by the Aspen Tech, measure the exposures related to currency fluctuations. Company maintained contract by contract records of all of its licenses. By tracking the payments that were scheduled to receive under each contract, company measure the risk determined by currency. The Aspen’s exposures by currency for the past year is calculated, which comes to out to be negative $217,000 for UK pound, $44,000 for German DM, and $3,000 for Belgian Franc. The payments that were estimated to receive under each contract are assumed to be the same. As Aspen Tech would be looking forward to selling currencies, such as, UK pound; hence, it is short.

3. What goal would you recommend for the firm’s currency risk management program? Why? Based on your goal, what type of exposure should Aspen be measuring? Please make sure you provide your rationale in detail for your recommendation.

Currently, the goal of the firm’s currency risk management program is to eliminate all transactional exposure arising from foreign currency dominated license contract. Hedging, forward contract, and sale of non U.S. dollar receivables are the ways used to manage the risk. It is clearly visible in the firm’s strategy of risk management that only translational and transactional risk of the company are being focused, which is the risk related to the installments receivable in coming years. However, the risk management strategy program does not include expense-related exposure. Company had been committed to making non-dollar payments, which can be estimated for the future periods. Company’s goal for risk management program does not pay attention to this type of exposure. On the basis of above stated discussion, it is recommended that goal for the firm’s currency risk management program should be broader. It must not only pay attention to the sales related exposure but also on expense related exposure.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.