Get instant access to this case solution for only $19

Astor Park Hotel Case Solution

This report provides a solution to Astor Park Hotel case study. Starwood, the world’s largest hotel operator, intends to purchase the Astor Park Hotel out of the bankruptcy proceedings. The Vice President of Starwood sees potential in the business as well as the market for a luxury hotel and that is why decides to reposition the current positioning of the hotel. According to the analysis conducted, Starwood should reposition the hotel in financial distress as a luxury hotel, in line with W hotels which is an existing brand of Starwood. As a part of the deal, Starwood should take over the management of the property for a fee equal to 3% of revenue. Moreover, Starwood wants to take 11% preferred return while the remaining share will be divided between Starwood and Pimentel in a 90 to 10 ratio to preserve a carried interest of Pimentel. Finally, the sensitivity of the proposed option is not very high with respect to the demand, tax rate or payment to Equitable. So, even if Equitable settles for a little higher than $ 33 million, the investment is still highly profitable.

Following questions are answered in this case study solution:

-

Case Solution

-

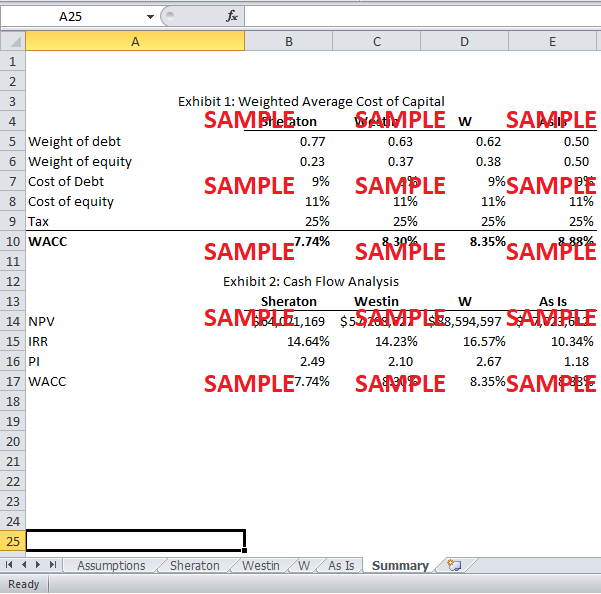

Weighted Average Cost of Capital

-

Summary of Results

-

Sensitivity of W

-

Sensitivity of Sheraton

Astor Park Hote Case Analysis

1. Case Solution

Astor Park is one of the exclusive hotels in the Pacific Northwest. The current owner, Pimentel, purchased the property in 1979 and has been operating it since then. Owing to the economic downfall in the Pacific and increased competition in the hotel industry, the sales and profitability of Astor Park has been falling. Consequently, the hotel got a debt of $ 63 million. That is why, Pimentel has filed for bankruptcy proceedings under Chapter 11.

On the other hand, the Executive Vice President of Acquisitions and Developments of Starwood, Steve Goldman, is working on a proposal for Astor Park. Goldman has been working on finalizing a restructuring with the current owner and creditors of Astor Park. Since Starwood is the world’s largest hotel operator, the main motive behind the investment is to generate attractive return from the undervalued property. The two main issues faced by Goldman in formulating the proposal are repositioning of hotel and financing of the acquisition and repositioning.

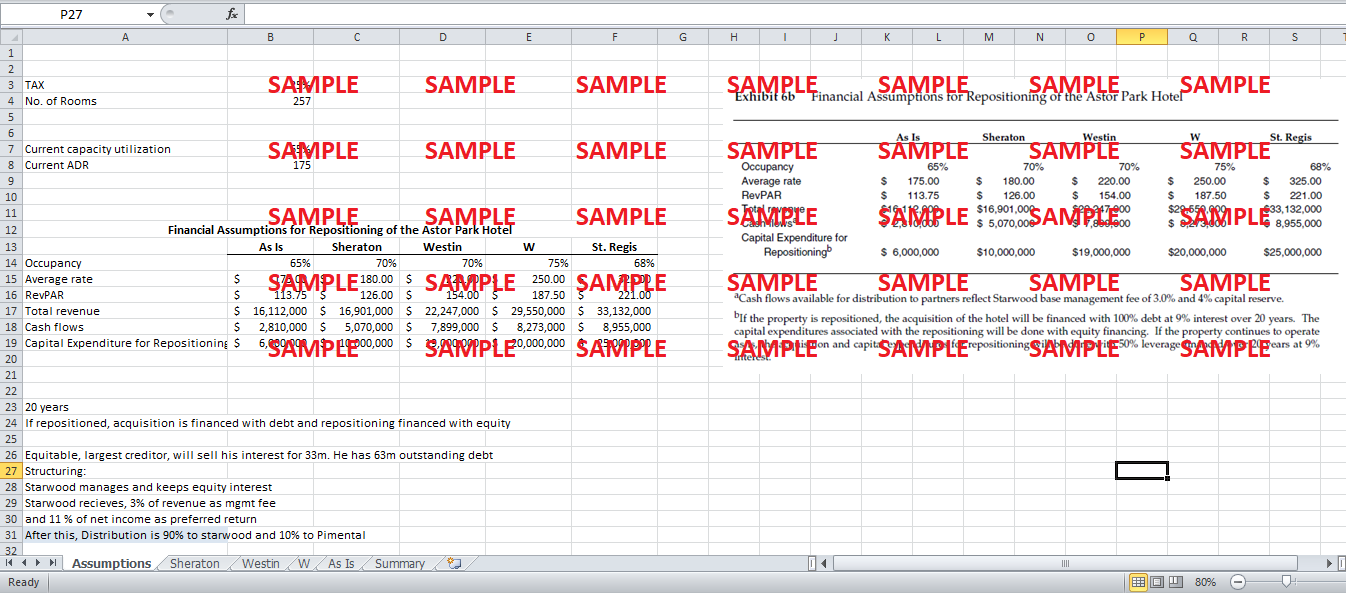

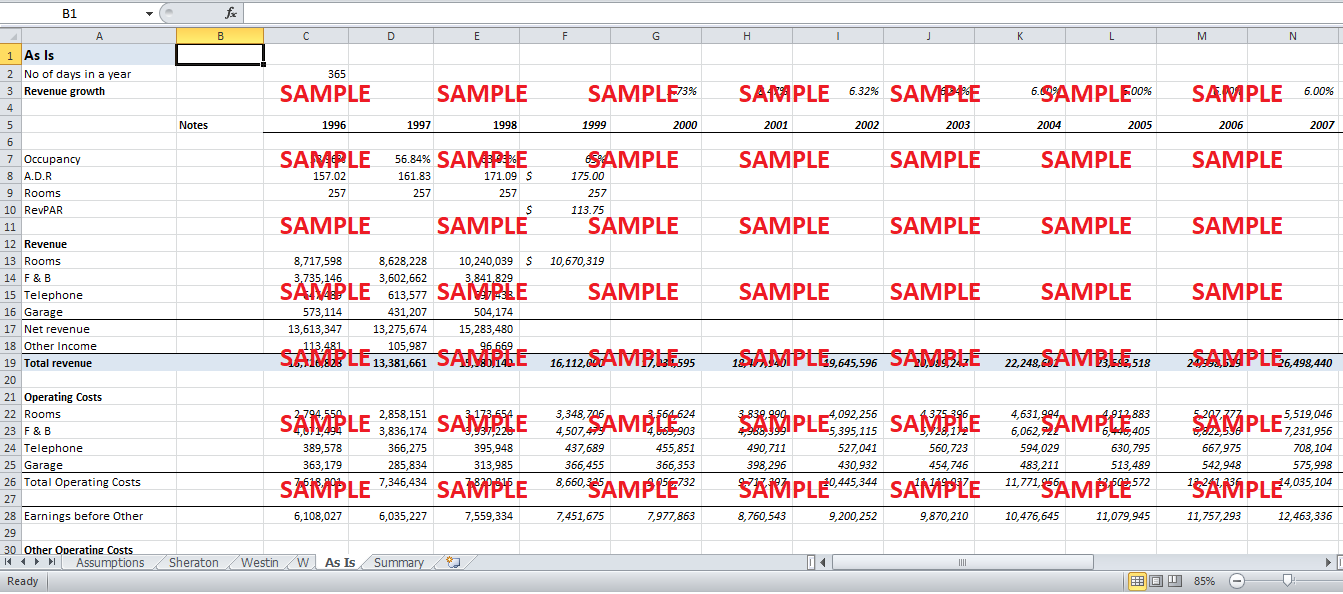

Firstly, Goldman deems that the Astor Park hotel has the potential for both growth and profitability given the right positioning. Currently, the hotel is positioned as a mid-end hotel with average daily rates of $ 165 and 65% occupancy rates. Goldman believes that the financial condition of Astor Park can be drastically improved by repositioning the brand in line with one of the brands that are already being operated by Starwood. Starwood operates five major brands of hotels named St. Regis Luxury Collection, Westin Hotels and Resorts, Sheraton Hotels and Resorts, Four Points and W Hotels. Four Points would further downscale the property of Astor Park while Goldman believes the locality of Astor Park can afford a high-end hotel. Hence, this option is ruled out. Moreover, according to exhibit 6, the average daily rates for St. Regis are $ 325 which is significantly higher than the industry average. The industry average of the luxury hotel competitors of Astor Park is approximately $ 225. The primary reason for which Astor Park cannot sustain the St. Regis brand is that it is situated in a relatively weaker locality as compared to other luxury hotels in the region. Hence, it would be unrealistic for Starwood to operate Astor Park with the brand of St. Regis.

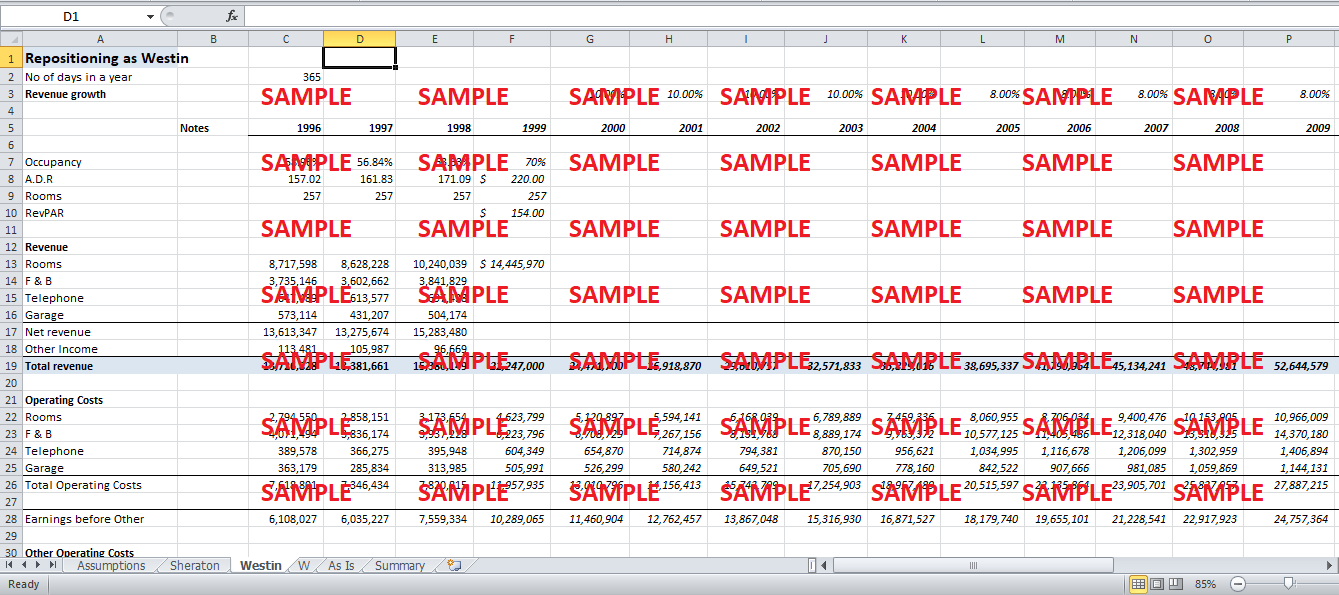

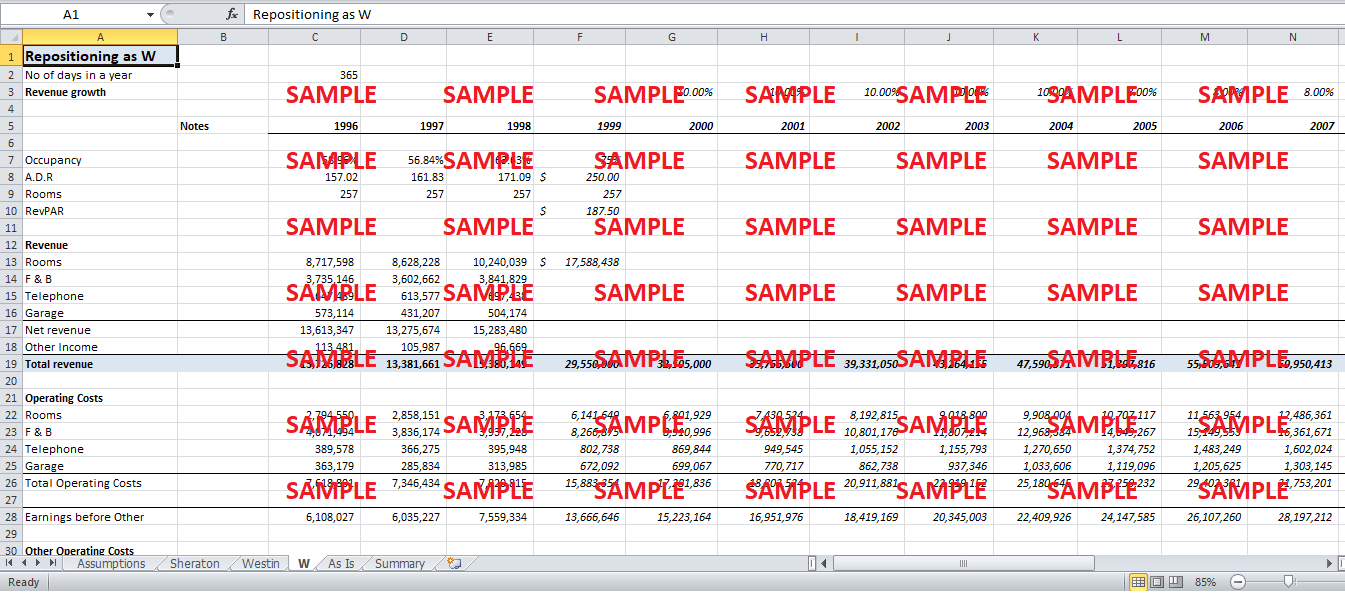

As a result, this leaves us with Westin, Sheraton and W hotels. A careful free cash flow analysis for all of these options has been conducted. In addition to these, the free cash flow analysis of continuing to operate Astor Park hotel as it is (without repositioning) has also been conducted. As already mentioned, the second main issue faced by Goldman is the financing decision. Since both the decisions cannot be separated from each other, a combined analysis has been conducted. Astor Park Hotel has an outstanding debt of $ 63 million which is due to Equitable. As part of the out of court settlement allowed by chapter 11 of the bankruptcy proceedings, the consent of creditors to the restructuring is essential. Equitable is ready to sell its interest in the hotel for $ 33 million. This is an opportunity for both Pimentel and Starwood. In this scenario, Starwood would have to pay $33 million to Equitable in order to buy Astor Park Hotel out of bankruptcy. Furthermore, in order to accommodate Pimentel’s carried interest, he will get a 10% share in the company after satisfying the management fee of Starwood, i.e. 3% of revenue, and 11% preferred return of Starwood.

Moreover, in addition to the acquisition, Starwood has two options in relation to the positioning of the hotel. As already mentioned, it can either continue operating the hotel as it is or reposition it as a part of one of its existing brands. Hence, Goldman also needs to propose the financing of repositioning of the hotel. It has been assumed that the repositioning of the Astor Park Hotel will be financed with equity while the acquisition, i.e. the $ 33 million payment to Equitable, will be financed through debt at 9% rate of interest. However, if no repositioning is done, then both acquisition and repositioning will be financed with 50% debt and 50% equity.

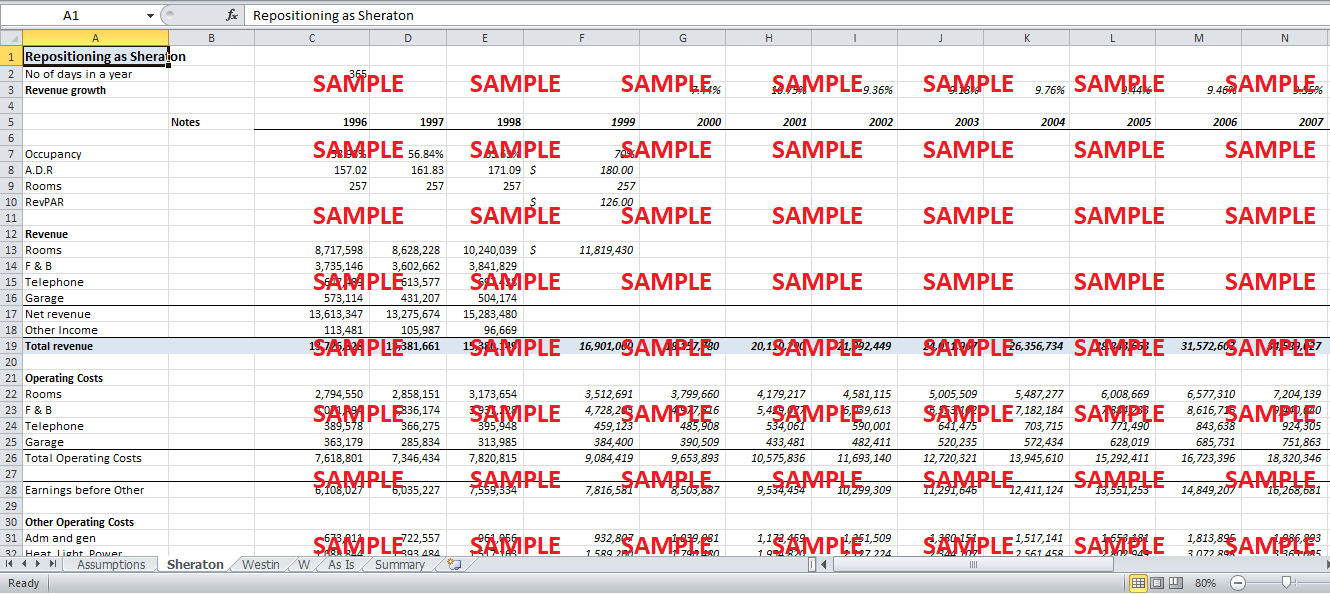

Based on the above-mentioned financing decision, the cash flow analysis of all four options has been conducted. The total number of rooms has been taken 257 and the total number of days in a year have been assumed as 365. The revenue for rooms has been obtained by multiplying the revenue available per day per room (RevPAR) with the number of days in a year and the total number of available rooms. Furthermore, the total revenue for all the cases has been assumed as given in Exhibit 6b of the case. To estimate the operating costs, the average of past three years, as a percentage of total revenue, has been used. The other operating costs, as well as real estate taxes and insurance, have been estimated with the same method. Moreover, the management fee to the owner has been taken as 3% of total revenue. Finally, the depreciation expense has been projected to grow by the average growth rate of past two years. Finally, the tax rate has been assumed as 25% as given in the case.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.