Get instant access to this case solution for only $19

Babcock and Wilcox Consolidated Forecasting Case Solution

Babcock and Wilcox (B&W) obtained the contracts for the supply of fuel material, boilers and services of the steam engine by bidding. It had many manufacturing facilities that operated internationally in China, India, Egypt, Mexico, Indonesia and Turkey. As acquisitions that started in 1978, the B&W Company became a big player in the fuel and power industry. However, since bidding on projects was a very expensive process, the company had to first evaluate the available orders to calculate the feasibility of the projects. It was estimated that an average bid could be as expensive as a million dollars. Therefore, it was necessary for B&W to bid for only those contracts that were highly probable to be converted to contracts within that year. Since the business of manufacturing boilers and other related products was highly capital intensive, it was necessary for the company to plan ahead of the contracts about the revenue the contracts are going to generate and to optimally utilize the manufacturing capacity. A failure in the estimate about revenue and the capacity utilization could be very crucial for the company because the costs associated with low capacity utilization or loss of revenue was very high. Therefore, it was critical for the company to take into account all the factors while planning ahead in the future about revenue and expenses. Since the company had limited resources, it had to select the best of all the available resources to maximize profit and the utilization of available capacity. The company could not simply selected the projects with the highest values without taking into account costs associated with the projects and the shop hours it would require from the manufacturing facilities. Therefore, probabilities were used to assess the expected profit, compare it with the number of shop hours required and then, finally selected the best projects that maximized the profit for the company.

Following questions are answered in this case study solution:

-

How is B&W using probabilities in their forecasting?

-

How might they quantify the uncertainty in their forecasts?

-

How might they estimate their business risk?

-

What business can B&W expect to win in the first quarter of 1988?

-

In the same quarter, for what range of business activity should they plan?

-

What are the key assumptions in the P1 and P2 that might account for what you see?

-

What might you suggest would work better?

Babcock and Wilcox Consolidated Forecasting Case Analysis

1. How is B&W using probabilities in their forecasting?

Babcock and Wilcox (B&W) obtained the contracts for the supply of fuel material, boilers and services of the steam engine by bidding. It had many manufacturing facilities that operated internationally in China, India, Egypt, Mexico, Indonesia and Turkey. As acquisitions that started in 1978, the B&W Company became a big player in the fuel and power industry. However, since bidding on projects was a very expensive process, the company had to first evaluate the available orders to calculate the feasibility of the projects. It was estimated that an average bid could be as expensive as a million dollars. Therefore, it was necessary for B&W to bid for only those contracts that were highly probable to be converted to contracts within that year. Since the business of manufacturing boilers and other related products was highly capital intensive, it was necessary for the company to plan ahead of the contracts about the revenue the contracts are going to generate and to optimally utilize the manufacturing capacity. A failure in the estimate about revenue and the capacity utilization could be very crucial for the company because the costs associated with low capacity utilization or loss of revenue was very high. Therefore, it was critical for the company to take into account all the factors while planning ahead in the future about revenue and expenses. Since the company had limited resources, it had to select the best of all the available resources to maximize profit and the utilization of available capacity. The company could not simply selected the projects with the highest values without taking into account costs associated with the projects and the shop hours it would require from the manufacturing facilities. Therefore, probabilities were used to assess the expected profit, compare it with the number of shop hours required and then, finally selected the best projects that maximized the profit for the company.

2. How might they quantify the uncertainty in their forecasts?

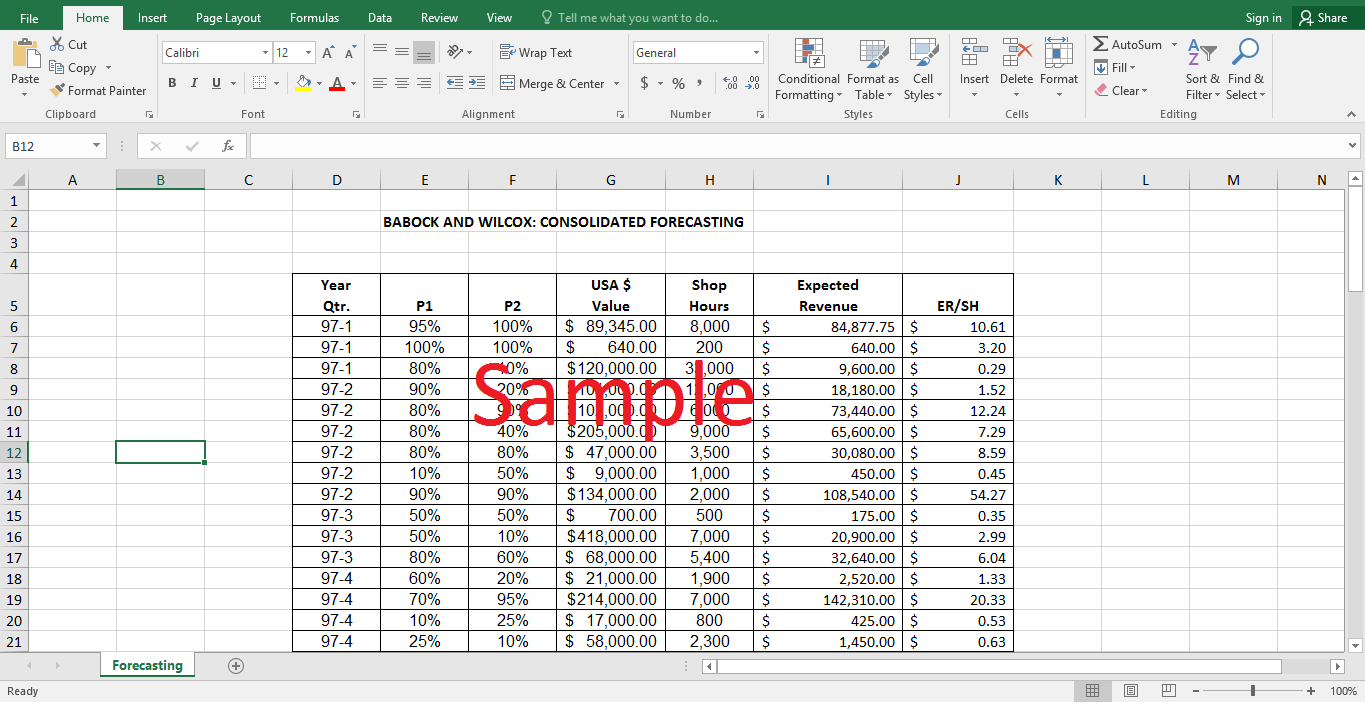

The value of the project and the probability that the bid is going to be successful were instrumental in financial and operational planning for the company. Although the value of projects could be estimated with reasonable certainty, the process of bidding and getting contracts was not that simple. The company had to take into account two major risks for the panning, as far as the award of contracts is concerned. The first risk is that the potential contract that the company wants to bid for may be delayed to next year due to some regulatory and other issues. So, P1 probability was used to take into account the risk that the contract may get delayed due to some technical issues. The second risk that had to be taken into account while forecasting for revenue was the risk that the company would not win the bid for the project. Although B&W was a big player in the industry and the probability of losing contracts to others was low, but still it was plausible to take into account to make the forecasts more and more realistic. So, probability P2 was used to take into account the risk that the company may not win a particular bid. So, the probabilities were used in essence to take into account the risk of not getting the contracts or the risk that the bidding process would take a long time and not finish in the current year.

According to probability theory, the probability that the project will be awarded in the year and the company would win the project can be calculated by multiplying the probabilities. The product of these probabilities should then be multiplied with the value of the project to find out the expected value of revenue. However, the value of dollar alone cannot be used to prioritize bidding for projects; the company should also take into account the shop hours associated with each project. Therefore, expected value of each project should be divided by the number of shop hours to find out the expected value per dollar. All the projects should be listed according to their values of expected value per sop hour and projects with the highest values of expected value per shop hour should be selected.

3. How might they estimate their business risk?

The business risk essentially means the risk that the company may begin to lose its business due to some external or internal unforeseen circumstances. The forecasts of revenues and expenses alone cannot tell about the business risk of the company. The business risk measurement of the company involves a comprehensive study of the market capitalization, market share of the company, its brands and it financial health. All of these aspects are studied together to know about the future of the company and how well it is mitigating its business risk. Babcock and Wilcox has become a big player in the market owing to recent acquisitions, due to which it has gained a competitive advantage over the others. In the context of mitigating business risk, the size of the company matters a lot because, the greater the size of the company, the higher the probability that the company will win the bid and get the contract.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.