Get instant access to this case solution for only $19

Baker Adhesives Case Solution

‘Baker Adhesives’ is trying to venture into international markets. It has found a new client, Novo, Situated in Brazil. However, Novo is willing to pay all the money in the local currency ‘real’. Doug Baker is getting worried about the exchange rate risks posed by the sale as the payment is destined to be at a future date. Doug baker wants to use some options dictated by his banks. However, Doug wants to discover whether it would be beneficial for Baker, in dollar terms, to cater to these options or not. Currently, Baker adhesives can either use a hedge in the forward or the money market.

Following questions are answered in this case study solution:

-

How profitable is the original sale to Novo once the exchange-rate changes are acknowledged? How might the exchange-rate risk, which affected the value of the order, have been managed?

-

Assuming Baker agrees to the new Novo sale, determine the present value of the expected future cash inflow assuming: (1) there is no hedge, (2) the company hedges using a forward contract, and (3) the company hedges using the money market. Finding a present value is necessary for the following reason: With no hedge or a with forward-contract hedge, the cash flow will occur at the time of payment by Novo. With the money-market hedge, Baker receives a cash flow immediately.

-

Are the money markets and forward markets in parity?

-

How profitable will the follow-on order be? Would you make this new sale

Baker Adhesives Case Analysis

1. How profitable is the original sale to Novo once the exchange-rate changes are acknowledged? How might the exchange-rate risk, which affected the value of the order, have been managed?

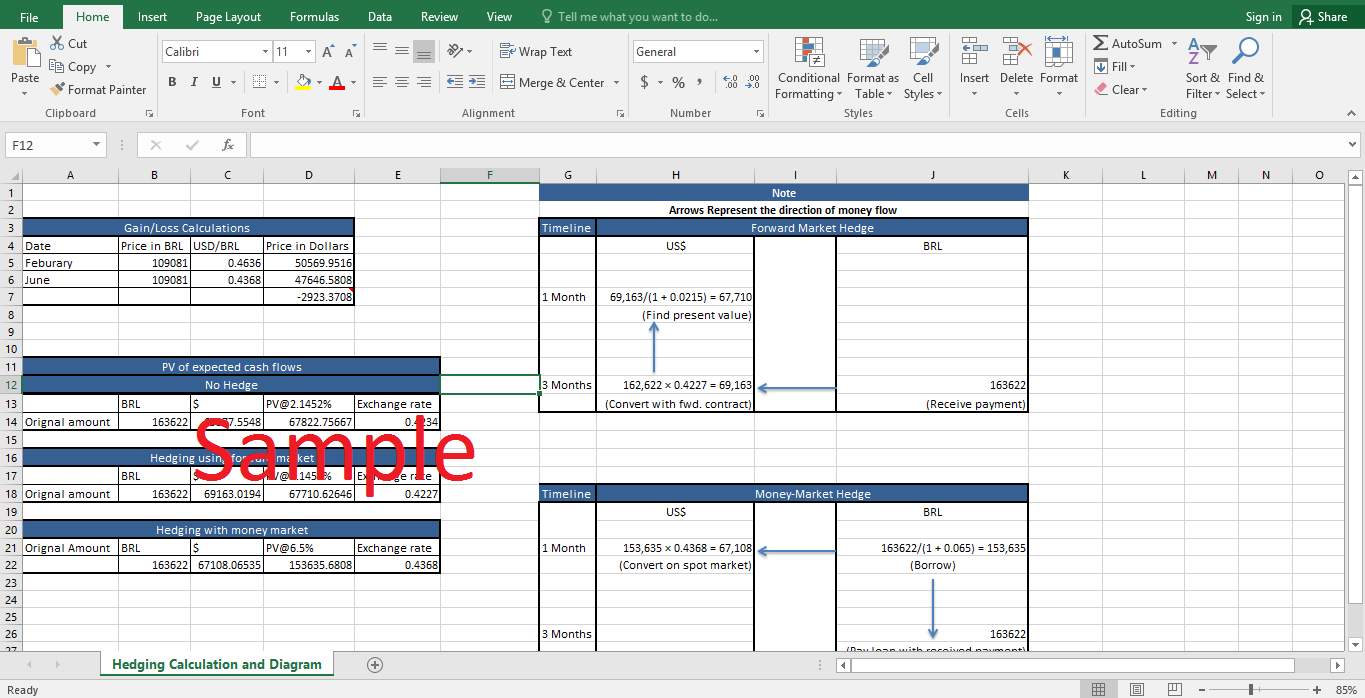

Baker adhesives had originally contemplated a profit margin of 12% on the sale considering the fact that exchange rate changes at a future date are not catered to for. The original bill in the BRL currency was 109,081. However upon converting the currency at the prevalent rate of exchange (February 2006), you get 109081*.4636 which is equal to $50,570. Yet if the calculations are made on June 2006 exchange rate basis, which was .4368 USD/BRL, the profit comes out to be lower than expected due to the downward movement of exchange rate { (109081*.4368)=$47647}. So, the loss on sale due to currency movement is $2923. The original Profit margin was $6068 which has now decreased to $3145. Assuming original number of $50570, the profit margin has decreased to 6.21% from 12%. As the bank recommended, the risk could have been best managed by hedging it in either money or forward markets. There are also many other options that can lead in lessening the exchange rate risk. First of all, Baker adhesive should use good negotiators to talk with the Novo. Two scenarios can be very beneficial for Baker. Firstly if the Novo pays the amount in dollars rather than BRL, it would be very resourceful. Secondly, as a compensation Novo pays a higher amount to Baker Adhesive for taking the risk of dealing in international markets.

2. Assuming Baker agrees to the new Novo sale, determine the present value of the expected future cash inflow assuming: (1) there is no hedge, (2) the company hedges using a forward contract, and (3) the company hedges using the money market. Finding a present value is necessary for the following reason: With no hedge or a with forward-contract hedge, the cash flow will occur at the time of payment by Novo. With the money-market hedge, Baker receives a cash flow immediately.

Case 1: When there is no Hedge

When there is no hedge, Baker is highly exposed to risks of currency exchange. This new order is similar to the previous order in all terms, except for the fact that it is 50% larger, which would make it 109,081*1.5 = BRL163, 622 in Brazilian terms. Baker Adhesive has to receive this amount in the September. Now before finding the Present value three months earlier, this amount has to be converted into dollar at the conversion spot rate of September 2006 which is equal to 0.4234 USD/BRL. The amount comes out to be $69,278. Discounting this amount at the effective 3 months bank rate of 2.1452%, you get $67,823.

Case 2: Hedging using Forward Market

In the case of hedging with the forward contract, the rate at which the bank will exchange currency is guaranteed and hence the potential currency risk is mitigated to quite an extent. In the current case, the rate at which exchange will take place is being guaranteed by the bank. The Exchange rate in this case is 0.4227 USD/BRL. Exchanging BRL163, 622 with this rate will give you $69,163. Again similar to part 1, you will discount the value with effective 3 months bank rate of 2.1452% and the resulting amount comes out to be $67,710.

Case 3: Hedging with Money Market

Let us first see how money market hedging is carried out. It has three distinct steps.

-

Find out the terminal value to be received. In this case, the terminal value is BRL 163,622.

-

Find its present value in the foreign currency bank offered rate. In this case, the effective rate comes out to be 6.5%. Then, borrow the same amount in foreign currency.

-

Convert this foreign rate to spot market rate and then invest the same amount in money market.

The present value of BRL 163,622 at 6.5% rate is BRL 153,635. Converting this rate at prevalent rate of 0.4368 USD/BRL you get, $67,108. This amount would be the present value of inflow.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.