Get instant access to this case solution for only $19

Angus Cartwright IV Case Solution

This memo is in connection with your decision to invest in the retail sector. As per your aspirations, it should be stated that the retail sector will surely constitute a profitable investment. Your available data with the firm indicates that you possess $35 million in the form of shares investment and that your annual income in excess of $1 million. Additionally, the company is also aware of the fact that you require a minimum return of 10% on the real estate sector investments.

Following questions are answered in this case study solution:

-

Investment Recommendation Memorandum

Angus Cartwright IV Case Analysis

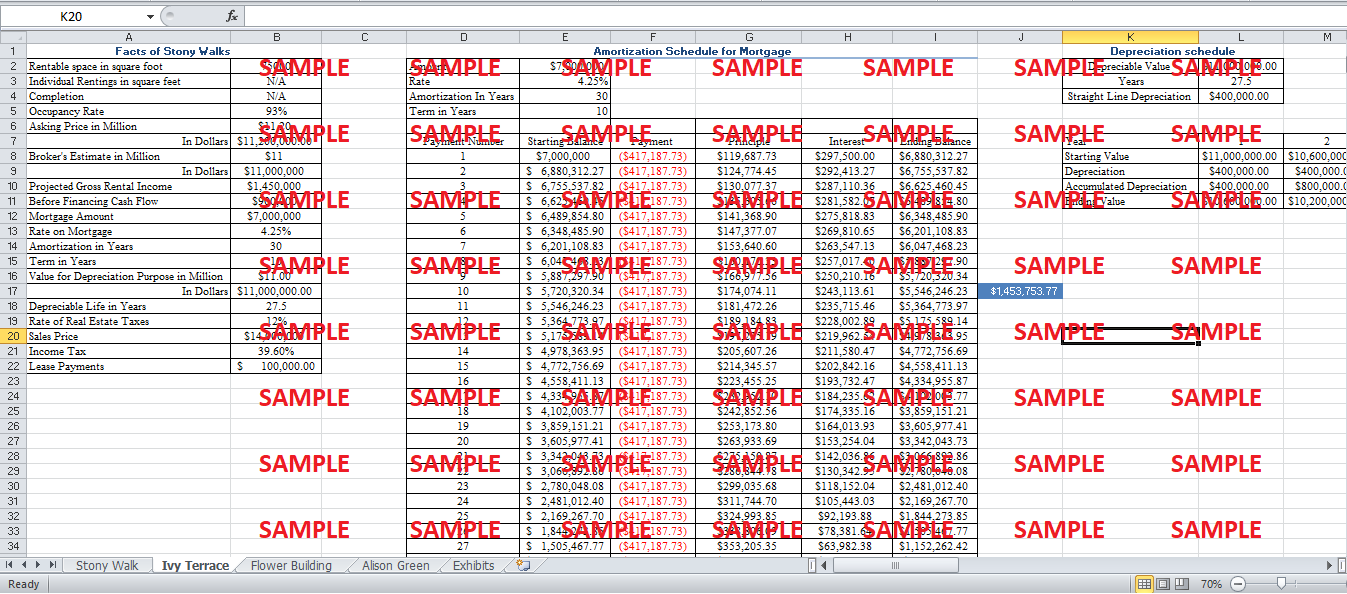

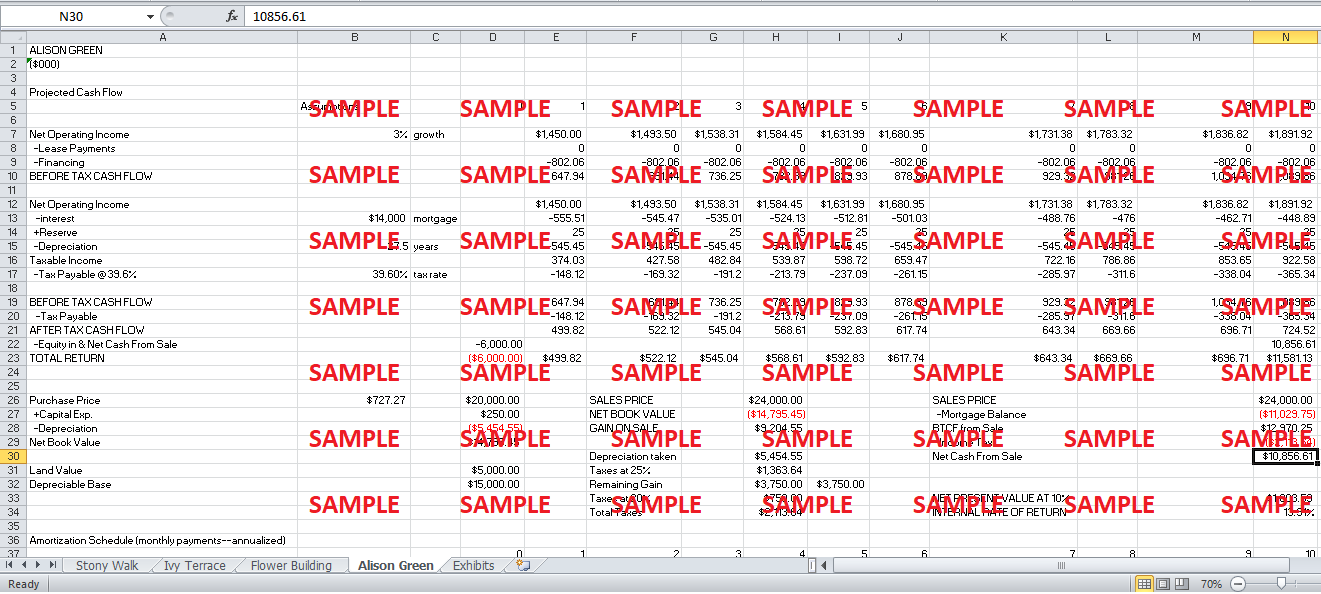

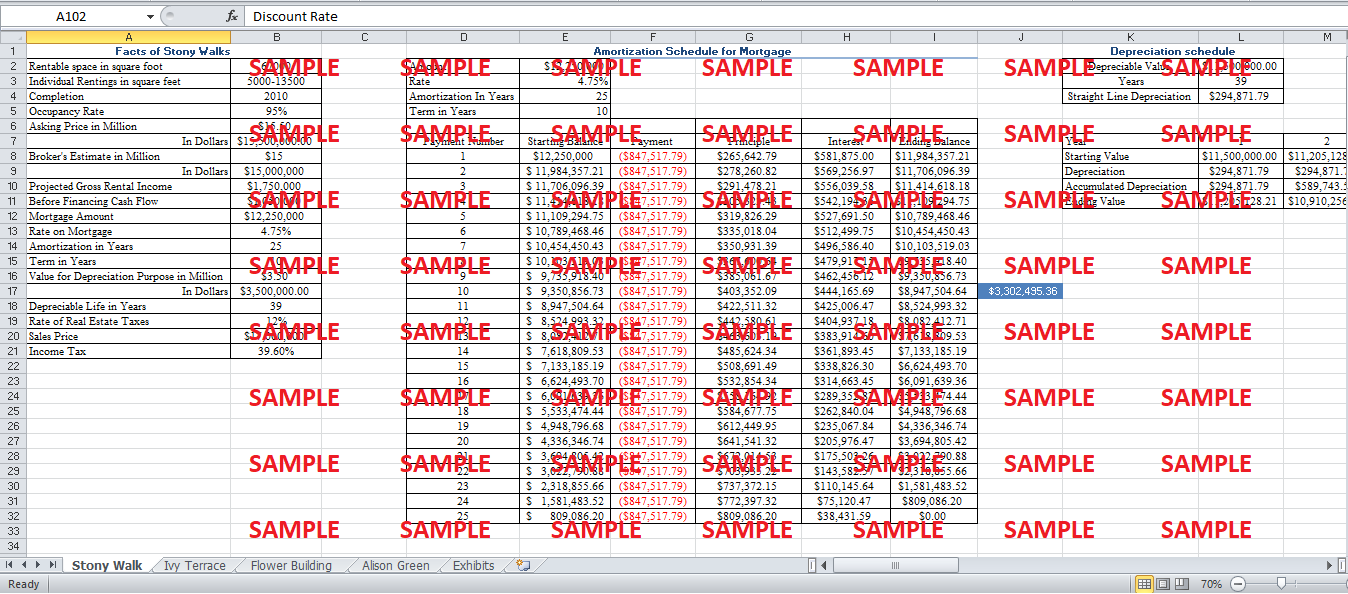

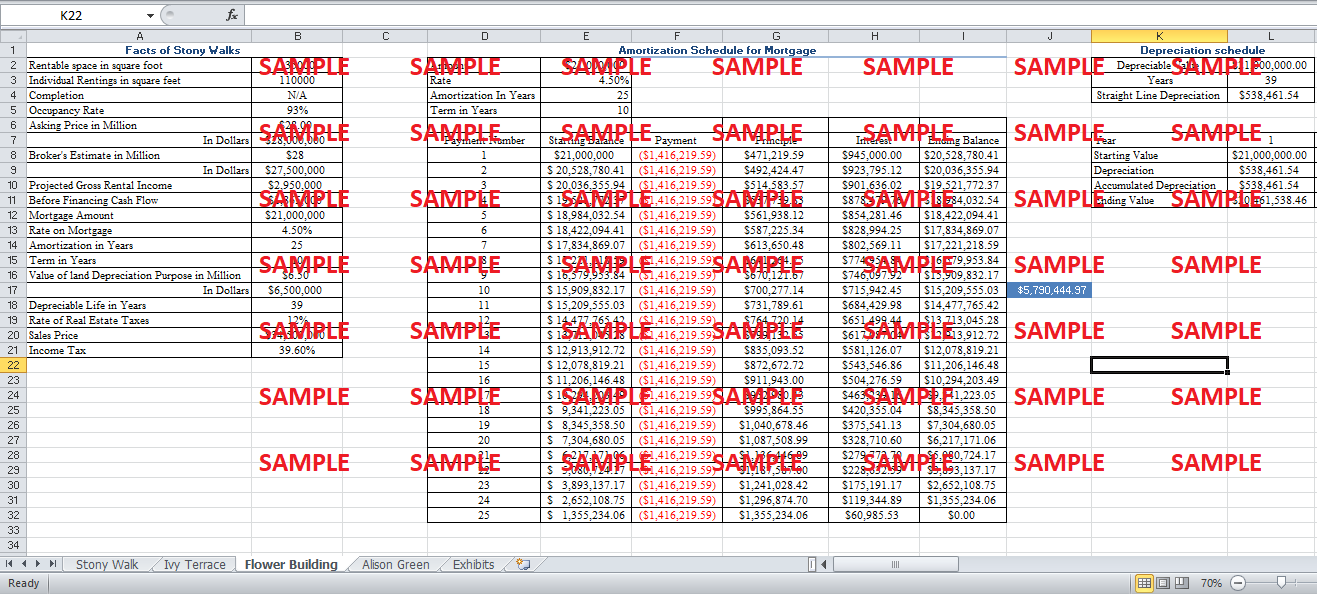

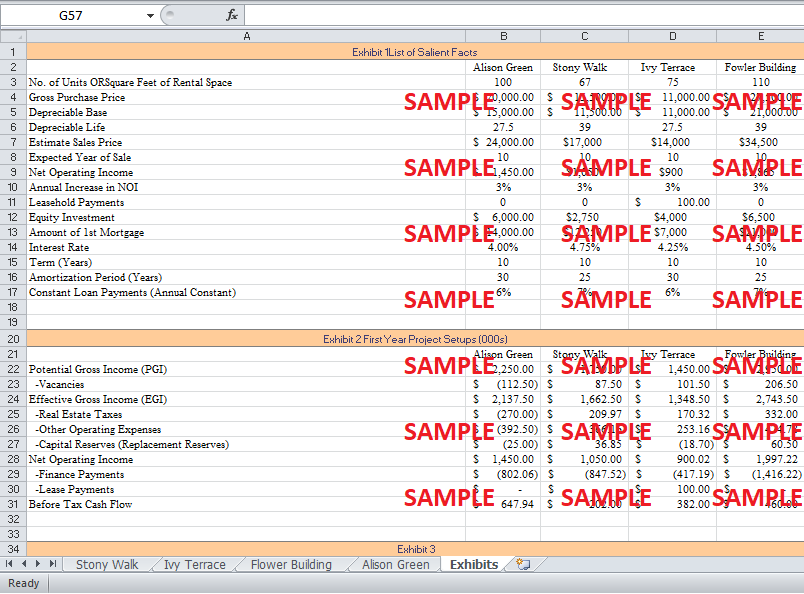

Angus CartWright has located four different properties at various location across the country. These four buildings are named as Alison Green, Stony Walk, Ivy Terrace and Flower building. The details of the area, life, worth and related features of the four buildings are listed down in appendix A. As depicted by the exhibit, your equity investment might range from $2.75 million for Stony Walk to $6.5 million for flower Building. As far as the initial equity investment is concerned, all the four building are suitable as their equity investment is in your financial range. The mortgage terms of the loans for the fur buildings are also different. However, these terms are of little significance as your related investment is projected for sale at the end of 10th year of investment.

A detailed cash flow analysis shows that Alison Green outputs relatively highest values of before tax cash flows. In this regard, the flower Building also yields high before tax cash flow figures. Only the Ivy Terrace building constitutes lease payments, and the rest only include the financing costs. At the end of 10th year, the net cash from sale for the four properties amounts to $10.856 million, $7.119 million, $7.613 million and $17.454 million respectively (in relation to names described above).

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.