Get instant access to this case solution for only $19

American Chemical Corporation Case Solution

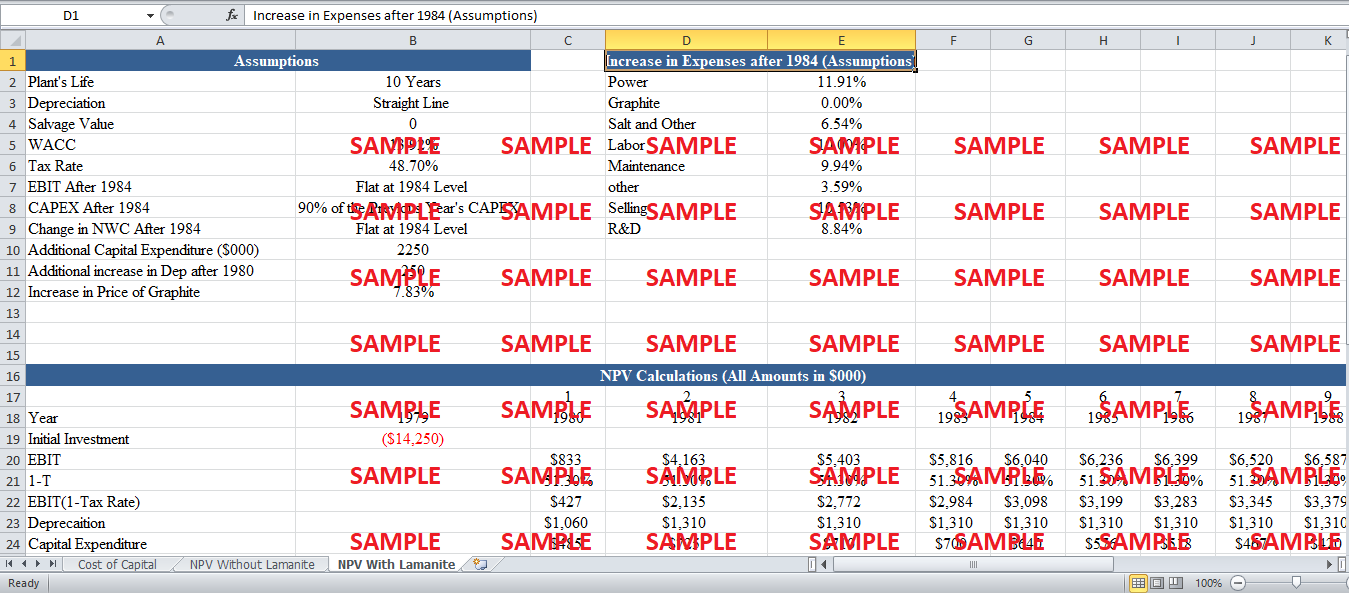

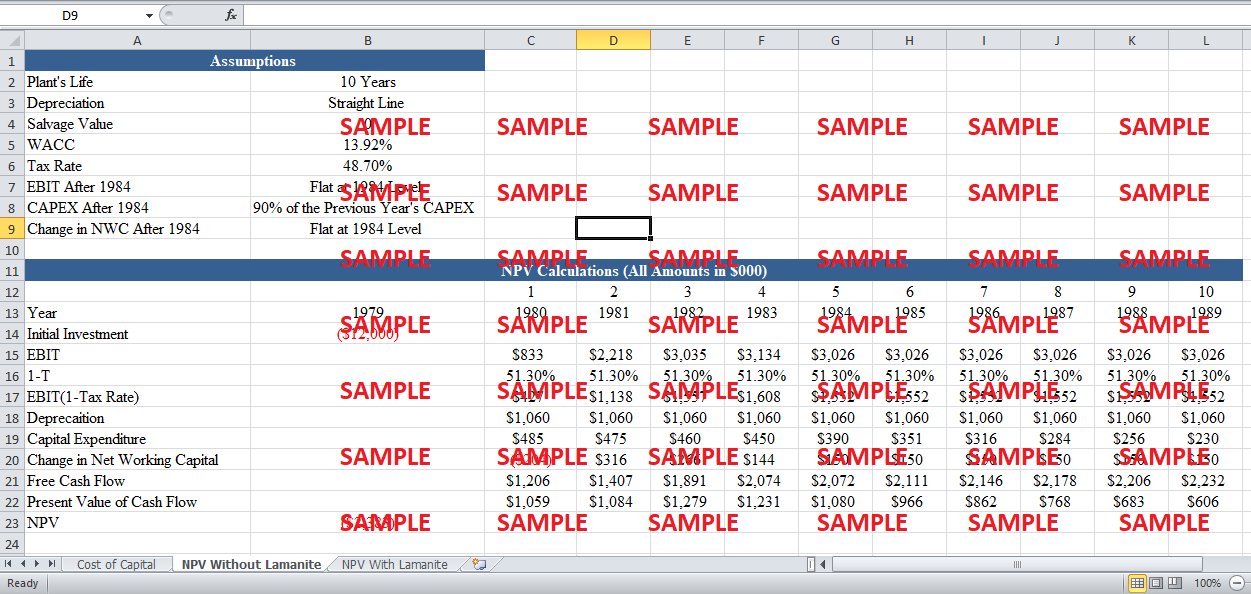

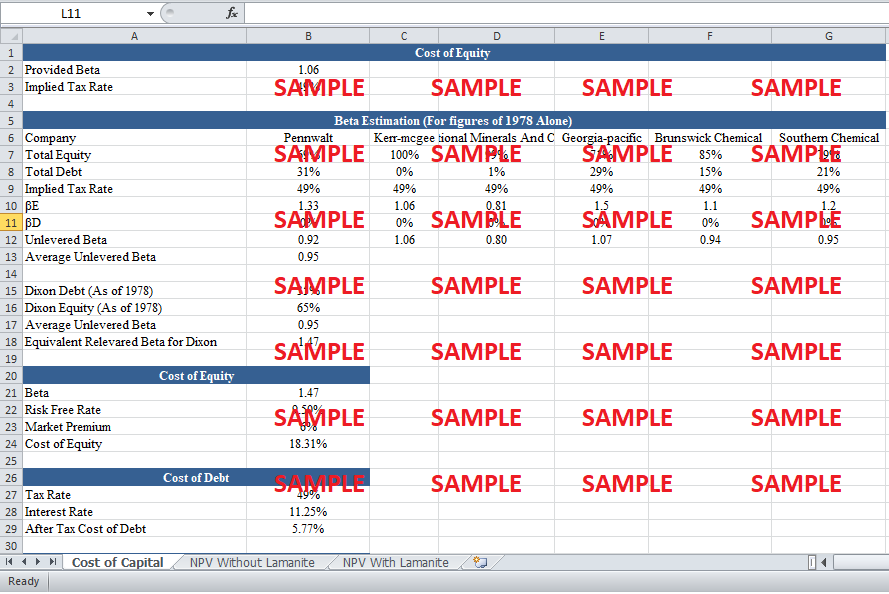

Dixon is looking forward to making an investment in the Sodium chlorate plant and wants to know about the economic feasibility of the project. The CAPM computations show that the relevered beta and cost of equity for Dixon are 1.47 and 18.31% respectively. The after tax cost of debt stands at 5.7%. The WACC for Dixon is estimated to be equal to 13.92%. The NPV analysis shows the NPV of the project with and without Laminate technology stand at -$2,833,000 and $1,830,000 respectively. The project is economically feasible only if the capital investment in the Laminate technology is carried out. Top recommendations from CEO include the perspectives of timely completion of the project and the formulation of forward power purchasing contracts with the concerned power companies.

Following questions are answered in this case study solution:

-

Estimate the weighted average cost of capital appropriate for discounting the Collinsville plant's incremental cash flows.

-

Project the incremental cash flows associated with the acquisition of the Collinsville plant without the laminate technology and estimate the acquisition's net present value. Project the incremental cash flows associated with the 1980 investment in laminate technology and estimate the investment's net present value.

-

Is the Collinsville proposal attractive on economic grounds?

-

As CEO of Dixon Corporation, would you approve the acquisition of the Collinsville plant at the price and on the terms proposed? Why, or why not? What alternatives, if any, would you suggest?

American Chemical Corporation Case Analysis

1. Estimate the weighted average cost of capital appropriate for discounting the Collinsville plant's incremental cash flows.

The cost of capital of Dixon is composed of two distinct factors, the cost of equity and the cost of debt. More specifically, the ‘relevered’ cost of equity is to be used in the computations.

i. Cost of Equity

The cost of equity of Dixon can be estimated by applying the capital asset pricing model. The formula of CAPM states that the cost of equity is equal to the sum of the risk free rate and the product of beta and market premium.

Re = Rf + β(Rm - Rf)

The beta of Dixon is mentioned to be equal to 1.06 (Appendix 7). However, as a matter of fact, this beta is unsuitable for the current investment project as Dixon is not a producer of sodium chlorate. Hence, this beta fails to take into account the systematic risk of the project. Therefore, the beta for the project should be estimated by taking into account the unlevered betas of the sodium chlorate producers. Although southern and Brunswick are the market representatives, yet they only represent 5% of the total market participation. Hence, it is essential to take into account other market players as well. The data for year 1978 is used to compute the average unlevered beta for Dixon. The unlevered beta is calculated by using the following formula:

βu = βE * E(E / (E + D)) + βD * D(D / (E + D))

The beta of debt for all companies is assumed to be zero. The average unlevered beta for the six companies comes out to be 0.95. This proves that without the inclusion of debt, the sodium chlorate industry shows low risk and low return trait. This beta needs to be ‘relevered’ with respect to the capital structure of Dixon. By using a target stable debt ratio of 35%, the beta can be relevered by applying the following formula.

βD = (1 + D / E) * βu

The relevered beta for Dixon comes out to be 1.47. Furthermore, the risk free rate is assumed to be equal to the yield on a long-term Treasury bond (9.5%). The risk premium is equal to the difference between the market return and the risk free rate. The market premium is assumed to be equal to 6%. The cost of equity, as computed by the CAPM, stands at 18.31%.

ii. Cost of Debt

Dixon can issue short and long term bonds at a rate of 11.25%. This rate is equal to the cost of debt that Dixon will face. However, one needs to take the cost of debt on an after tax basis. The implied tax rate is assumed to be 48% for Dixon. The following formula is used to compute the after-tax cost of debt:

After Tax Cost of Debt = (1 - Tax Rate) * Rate on Long term Bonds

The resultant cost of debt stands at 5.85%.

ii. Weighted Average Cost of Capital

The weighted average cost of capital is computed using the following formula:

WACC = 18.31% * (.65) + 5.85% * (.35) = 13.92%

2. Project the incremental cash flows associated with the acquisition of the Collinsville plant without the laminate technology and estimate the acquisition's net present value. Project the incremental cash flows associated with a 1980 investment in laminate technology and estimate the investment's net present value.

i. FCF and NPV without Laminate Technology

The free cash flows can be computed by using the following formula:

FCF = EBIT(1 - T) + Depreciation - Capital Expenditure - ∆Net Working Capital

Where:

Capital Expenditure = Change in Net Property, Plant and Equipment + Depreciation

Net Working Capital = Accounts Receivable + Inventory – Accounts Payable

It is also assumed that the life of the plant is ten years and the salvage value of the plant is equal to zero. Moreover, the forecasted figures show that the depreciation is not equally distributed and it increases with time. In the computation of free cash flows without the laminate technology, this is assumed that for every year, equal level of depreciation will be charged ($1,060,000). Moreover, for simplicity, the free cash flows calculations are extended over the ten years period with some assumptions in the computations. Firstly, the EBIT is assumed to be flat at the 1984 level. Secondly, the tax rate is also assumed to be static at 48.7%. Thirdly, after 1984, capital expenditure will decrease to 90% of the last year’s CAPEX (it follows the decreasing trend). Fourthly, the change in the net working capital is also assumed to be static at the 1984 level. The detailed calculations for free cash flows and NPV are shown in the following table.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.