Get instant access to this case solution for only $19

Amtelecom Group Inc Case Solution

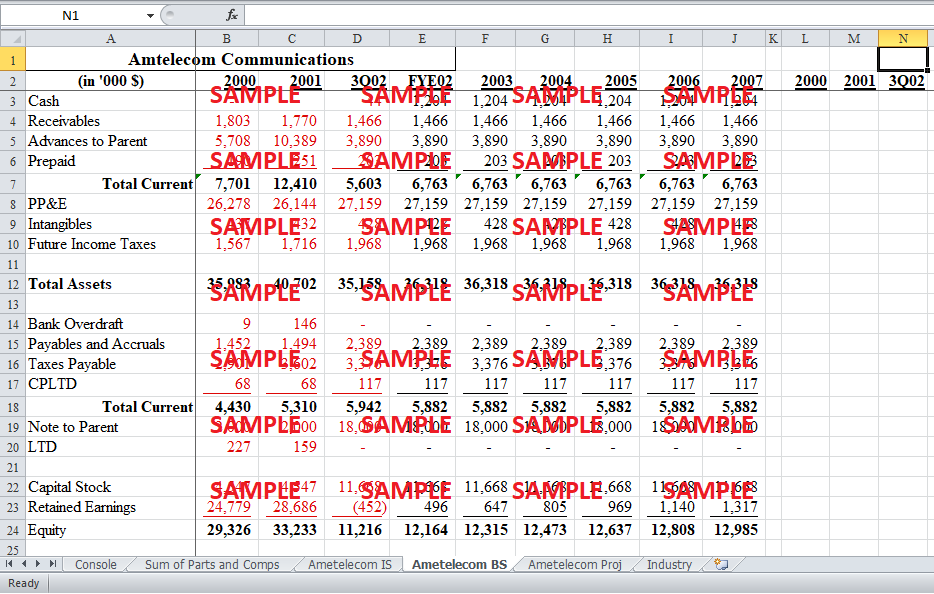

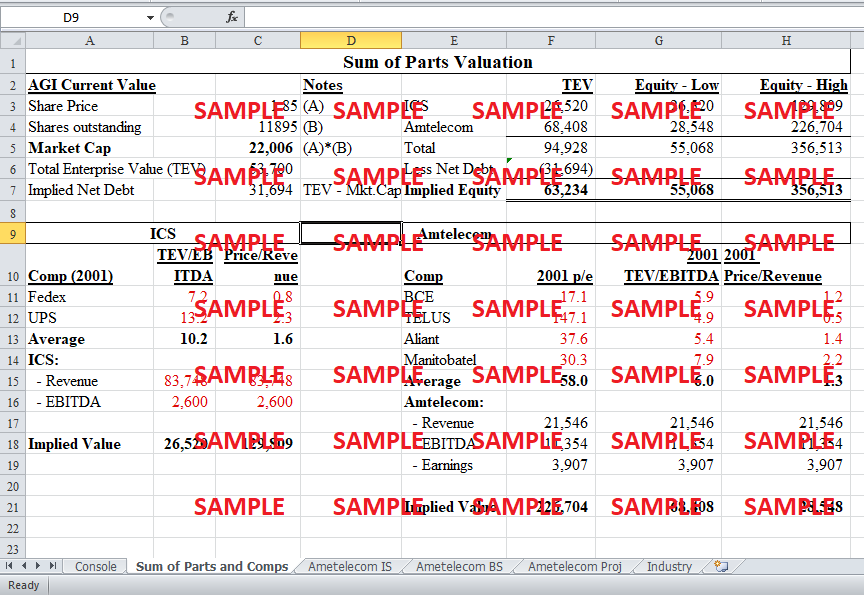

First, we need to value the two businesses of courier and communications separately and then compare it with the value of the group in order to see what the real value of the courier business is. We use comparable companies to value the separate businesses using multiples. The “sum of parts and comps” sheet shows the calculation of the valuation of the two businesses using multiples.

Case Analysis for Amtelecom Group Inc

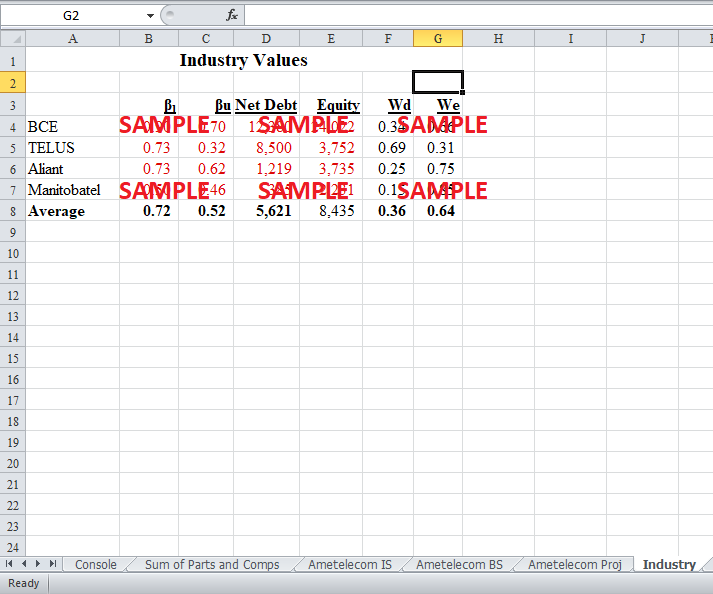

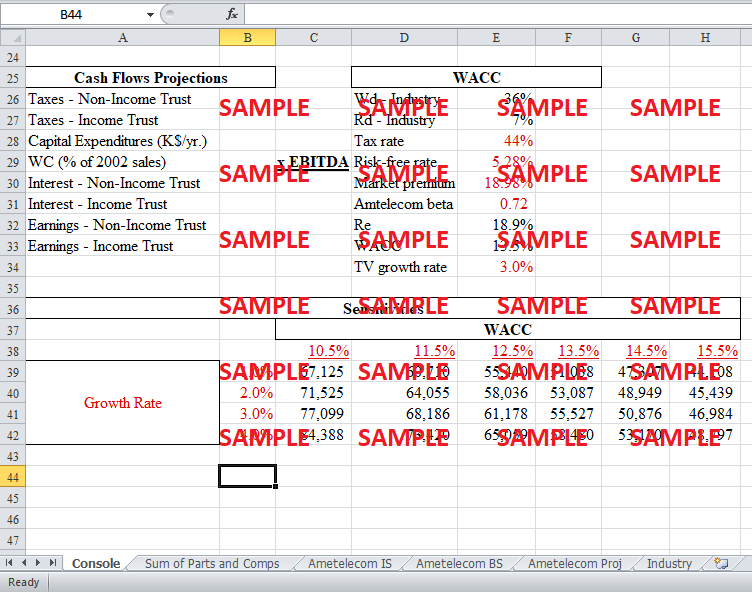

ICS was valued using the comparable courier firms of Fedex and UPS. We used total enterprise value to EBITDA as well as price to revenue multiples to estimate the implied value of ICS. The multiples, as given in the exhibits were multiplied with the revenue and EBITDA of ICS, which were also given in the exhibits. Similarly, we used four comparable firms to value Amtelecom Communications. The estimates that provided us with the enterprise value were used to calculate the equity value by subtracting the implied value of debt from the enterprise value. The implied value of debt was calculated by multiplying the share price by the number of outstanding shares to get the market capitalization and then subtracting it from the enterprise value of the group that is given in the case. That is, the implied value of debt was 31.7 million (53.7 million – 22 million) dollars. The implied equity calculated through TEV/EBITDA multiple was 63.2 million dollars for the entire group which was way higher than the market capitalization of 22 million. Similarly, other multiples gave a high-low range of the value of implied equity for the group which was from 55 million to 356 million dollars, all way above the current market capitalization.

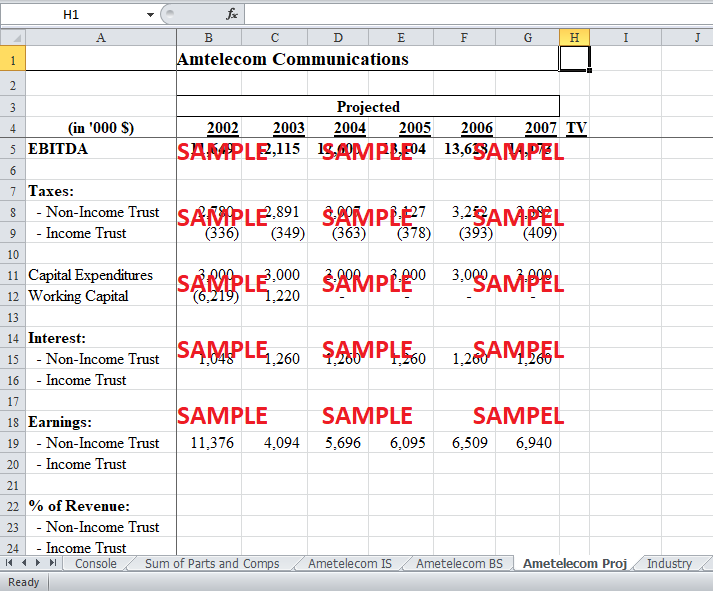

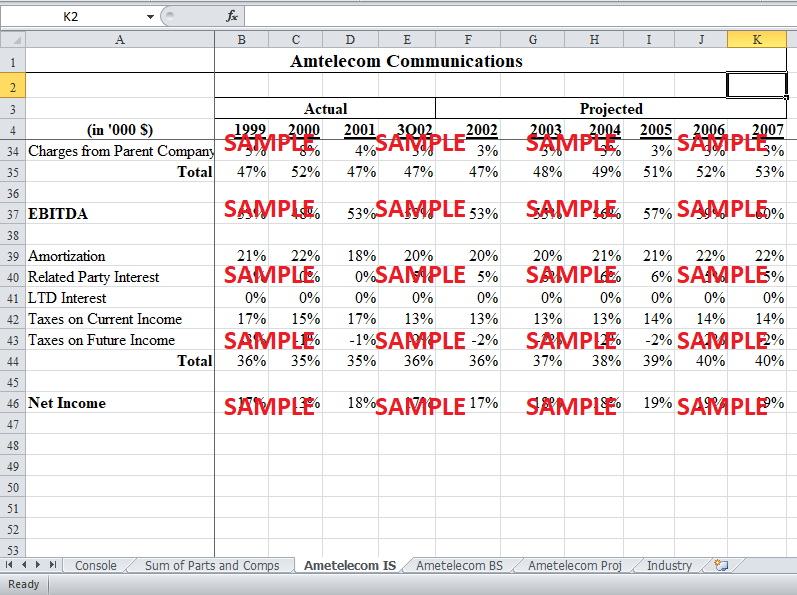

After the calculation of the multiples, the communications business had to be valued using a discounted cash flow method in order to identify whether the ICS business had a positive or negative impact on the equity value of the whole group. That is, if the discounted cash flow method showed that the communications business is worth more than 22 million, it would mean that ICS was having a negative impact on the equity value of the group.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.