Get instant access to this case solution for only $19

AutoZone Inc Case Solution

The retail market for car components is counter-cyclical, which means that during economic downturns, businesses in the sector often see higher profits than in boom times. Since the typical American has less money to spend when the economy is doing badly, this makes sense. Due to fewer people being able to afford brand-new automobiles and an increase in the number of vehicles over ten years old, an increased need for auto parts shops is expected. The global economy has just emerged from its worst slump since World War II, which began in the last quarter of 2010 and continued into 2011. As a result, investors are increasingly drawn to the auto components sector due to its high potential for growth and steady profits. AutoZone is becoming one of the most formidable rivals in the aftermarket auto parts retail sector. There are 4,728 locations in the US, Mexico, and PR under the company's umbrella.

Following questions are answered in this case study solution:

-

How has AutoZones stock price performed over the previous five years? What other financial measures can you cite that are consistent with the stock price performance?

-

How does a stock repurchase work? Why would a company use this tactic? What impact does it have on: EPS? ROIC?

-

How much of AutoZones stock price performance should we attribute to the share repurchase program?

-

Assume that AutoZone is planning to stop its share repurchase program. What would be the best alternative use of those cash flows? Why?

-

What should Johnson do about his holdings of AutoZone shares?

Case Study Questions Answers

1. How has Auto Zones' stock price performed over the previous five years? What other financial measures can you cite that are consistent with the stock price performance?

Auto Zone Stock Performance for Five Years:

Investors in AutoZone have reaped the rewards of the company's sustained growth and strong performance since 1997. Stock prices have risen steadily during the last five years, from $125.63 in February 2007 to $347.88 in February 2012, a total gain of 277%. The buyback of shares has been a significant contributor to the rise in the stock price.

The economic downturn is also contributing to this spike in stock prices. It's no surprise that AutoZone operates in the Automotive Parts sector. It's a sector with a negative correlation to economic growth. Consequently, the average consumer is reluctant to invest in a brand-new vehicle owing to the current economic climate. The need for maintenance and the subsequent consumption of Auto Parts rises in tandem with the vehicle's age and the number of miles traveled. Accordingly, the uptick in AutoZone's stock price might be attributed to the cyclical nature of the industry.

Other Consistent Financial Measures:

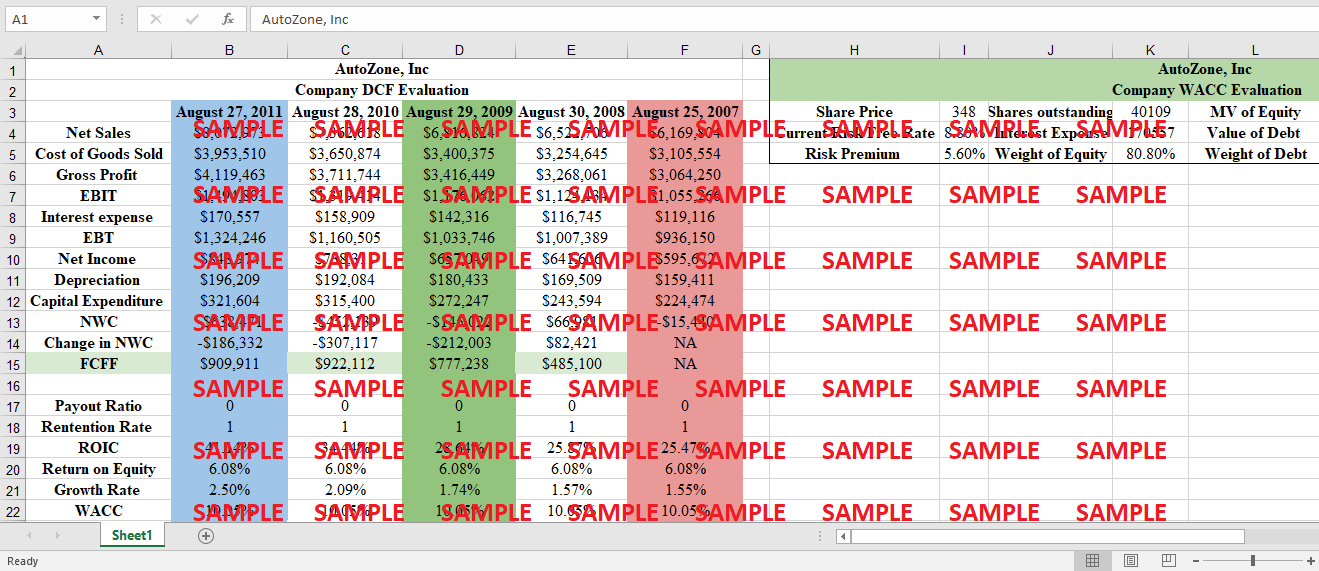

The growth in the stock price is in line with growth in other financial metrics as well. From August 2007 to August 2011, net sales climbed at an annualized rate of 6.97% and at a cumulative rate of 30.85%. The cumulative percentage rise in the cost of sales, on the other hand, is 27.30 percent lower. Over the last five years, the operating profit margin has grown from 17.1% in August 2007 to 18.52% in August 2011. Stock price growth is reflected in the table below by improved financial indicators.

|

At year ended |

Stock Price $ |

Net Sales Growth % |

Operating Margin % |

Earnings per Share $ |

EPS Growth % |

Price Earnings Ratio |

PEG Ratio |

|

25-Aug-2007 |

121.29 |

|

17.10% |

8.53 |

|

14.21 |

|

|

30-Aug-2008 |

137.23 |

5.72% |

17.23% |

10.04 |

17.63% |

13.66 |

0.81 |

|

29-Aug-2009 |

147.25 |

4.51% |

17.25% |

11.73 |

17.26% |

12.55 |

0.79 |

|

28-Aug-2010 |

209.78 |

8.01% |

17.92% |

14.97 |

28.09% |

14.01 |

0.45 |

|

27-Aug-2011 |

307 |

9.65% |

18.52% |

19.47 |

30.73% |

15.76 |

0.46 |

Earnings per Share (basic) are a leading indicator of stock performance, and it has been rising at a rapid clip, growing by a total of 130.97% from August 2007 to August 2011. Alternatively, Diluted EPS has grown by 128.25% compared to the prior-year period. Earnings-to-Price Ratio has likewise been on the rise, from 13.92 in August 2007 to 14.97 in August 2011. The declining Price Earnings to Growth ratio is encouraging for the firm and its investors since it signals increased profits with reduced capital expenditures.

2. How does a stock repurchase work? Why would a company use this tactic? What impact does it have on: EPS? ROIC?

Stock repurchases:

Buying back a company's own shares of stock is called a stock buyback. In order to accomplish this repurchase, the corporation may use the market or go directly to shareholders who plan to sell their shares. In this sense, it is a kind of dividend payment to stockholders. When a corporation repurchases its own stock, the number of outstanding shares falls, benefiting both the firm's owners and the stock's market value.

Stock repurchase as a tactic:

The following are examples of strategies that may include stock repurchase:

-

Assert one's worth to potential buyers

-

In order to forestall a hostile takeover,

-

Purpose: To improve the appeal of financial metrics

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

- Marketing at The Vanguard Group Case Solution

- Keurig From David to Goliath The Challenge of Gaining and Maintaining Marketplace Leadership Case Solution

- Lenovo Building a Global Brand Case Solution

- Maintaining the Single Samsung Spirit New Challenges in a Changing Environment Case Solution

- Managing Diversity at Cityside Financial Services Case Solution

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.