Get instant access to this case solution for only $19

Chemical Bank Allocation of Profits Case Solution

Due bill raises revenues via three channels, the net interest income, trading income and the transaction fees. Currently, the Metro department can only demand a portion of the profits from the transaction fees as the other functions are not performed by it. However, as per the allocation rules, only the treasury department bags the entire revenue from the transaction fee. Hence, essentially there is no splitting up of profits for the transaction costs. The primary reason behind the demand for splitting up of profits arises from the concerns of Metro department. As per the goal driven reward system, the inability of the bank to share profits leads to the demotivation of the entire department. Moreover, as the entire process of client acquisition and handling was done by Metro, therefore, they also genuinely required a portion of the transaction fees in order for the departmental profits to be attractive.

Following questions are answered in this case study solution:

-

Show how to calculate split up profits and reasons behind it. Also, refer to organization architecture (Decision right, Reward system, Evaluation system)

-

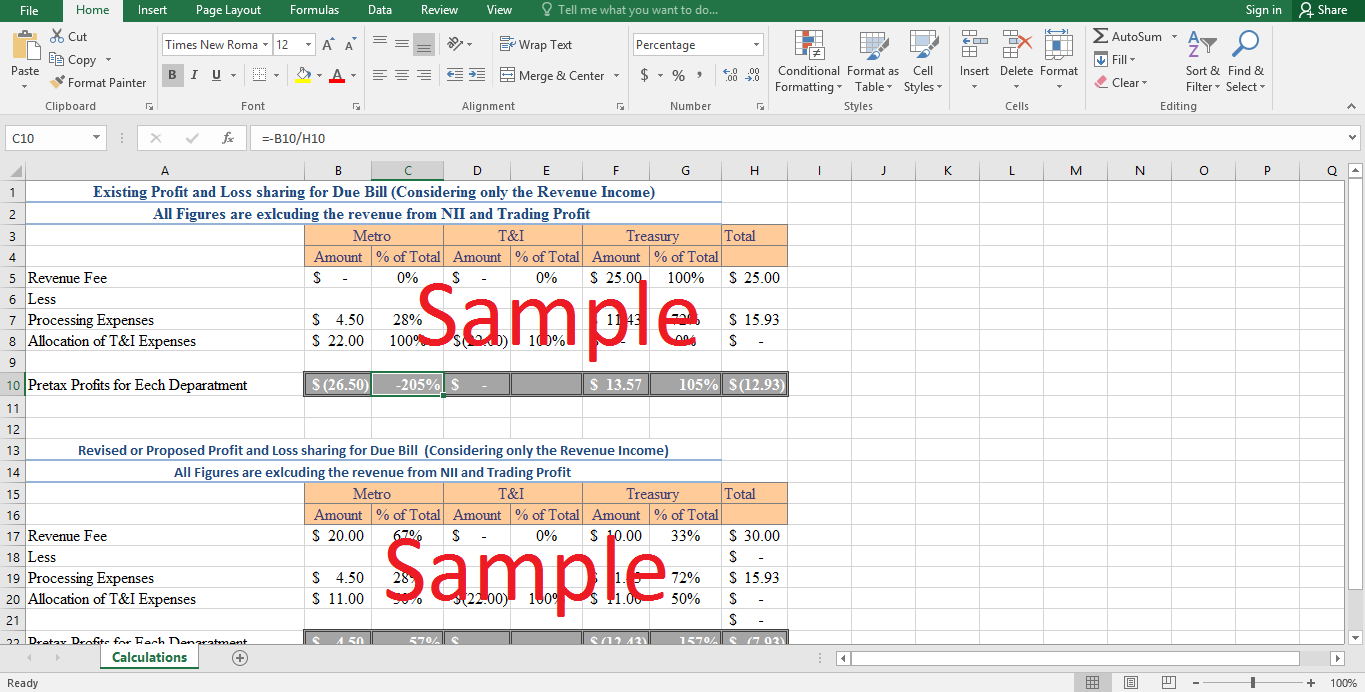

Appendix

Chemical Bank Allocation of Profits Case Analysis

The negative profits from the Due Bill adversely affected the operating figures of Metro department. Hence, it was vital that a portion of revenues should be divided between the departments. Additionally, at the current level of fees, the division of profits should be difficult. Hence, the sharing of transaction fees can only be carried out once it is raised to such an amount where the customer acquisition and the profits are optimized. For this reason, $30 fee tag was introduced. $20 revenue from the transaction fee will be credited to Metro department while the rest $10 will be shared exclusively be treasury group. Hence, 66.6% and 33.3% of the revenue will be shared by Metro and Treasury groups respectively. On a standard transaction of Due Bill, only 7% of the revenue will be shared by Metro group. The issue of reward and evaluation system can also be termed as one of those factors that contributed towards the profit sharing of Due Bill. Due to the pressure to maintain or increase departmental profit, every department was quite selective and prudent about its revenue or profit sharing percentage. On the other hand, the precious time consumption of branch level employees (with zero shares of profit or revenues) did not allow them to focus on their core goals (deposits and loans etc) and hence they failed to stick to the budgeted figures.

The organizational structure is depicted in the Appendix. The rights pertaining to the organizational and high-level managerial decisions are possessed by the Finance department. At the same time, the formulation of evaluation system and the compensation plans are also decided by this department. On the other hand, the ‘goal driven’ decisions are formulated and authorized at departmental level by the branch level managerial positions.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.