Get instant access to this case solution for only $19

Clarkson Lumber Company Case Solution

Clarkson Lumber Company (CLC), founded in 1981, produced door products and plywood molding and sash. CLC main customers were the retail distributors. In 1994, Clarkson decided to buy Holtz share in the company for $200,000 in installments at an interest of 11%. Clarkson needed bank loan to finance this and a number of other activities. The business was growing rapidly, and Clarkson needed money to expand it. Moreover, CLC was facing a shortage of cash, so it needed finance to pay off its creditors. It became necessary for CLC to increase its borrowing from Suburban National Bank to $399,000 which was the maximum loan given by the bank to any one borrower. CLC faces a lot of cash flow problems due to increases in Accounts Receivable, inventory and loans. Mr. Clarkson has to approach another bank for a loan of at least $750,000 to solve this problem.

Following questions are answered in this case study solution:

-

Why has Clarkson Lumber borrowed increasing amounts despite its consistent profitability?

-

How has Mr. Clarkson met the financing needs of the company during the period 1993 through 1995? Has the financial strength of Clarkson Lumber improved or deteriorated?

-

How attractive is it to take the trade discounts?

-

Do you agree with Mr. Clarkson’s estimate of the company’s loan requirements? How much will he need to finance the expected expansion in sales to $5.5 million in 1996 and to take all trade discounts?

-

As Mr. Clarkson’s financial adviser, would you urge him to go ahead with, or to reconsider his anticipated expansion and his plans for additional debt financing? As the banker, would you approve Mr. Clarkson’s loan request, and, if so, what conditions would you put on the loan?

Clarkson Lumber Company Case Analysis

1. Why has Clarkson Lumber borrowed increasing amounts despite its consistent profitability?

CLC seems like a prosperous and healthy company. CLC has rising sales and rapid growth due to increase in demand. However, an in depth analysis shows that Clarkson Lumber is in need of a lot of additional funding because of the shortage in cash and plans to expand the business.

The main reason for Clarkson Lumber for borrowing funds was because it was facing a shortage of funds. The reason for this could be attributed to a number of things. Firstly, the profitability of the firm was low at 1.7% and was continuously falling over the years (Exhibit A). Another reason was that cash to sales ratio was also low at 1.2% in 1995. In the absence of sufficient liquid cash for day-to-day operations, it is obvious that Clarkson Lumber would be facing had a serious cash flow problems.

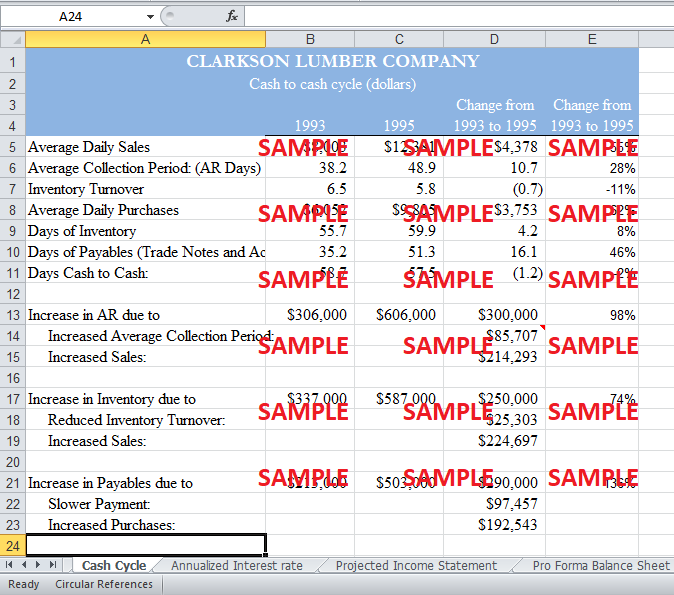

Additionally, the firm was unable to get the payments from its customers on time. Hence, the company's cash flows were severely affected. According to Exhibit B, the average collection period of the firm from 1993 to 1995 increased from 38 days to 48 days. Also, the accounts receivable also seem to age with every year.

Furthermore, Clarkson Lumber also kept a lot of inventory. According to Exhibit A, Inventory to sales ratio was around 13.0 in 1995. The ratio was expected to rise given the trend over the years. The value of inventories is significantly higher than the industry's average of 12% and 11.6% for low profit outlets and high profit outlets, respectively.

Moreover, as Clarkson Lumber was unable to pay its suppliers in good times and lacked liquid assets, the firm was unable to get the full advantage of trade discounts. In 1995, the company had to forgo a discount of $ 88,000 for the purchase of 4.4 million.

Due to the problems mentioned above, Clarkson Lumber had to delay the payments to its suppliers. In 1995, the firm took on average 51 days to pay its payables. Hence, to improve the flow of cash and increase its sales, Clarkson Lumber had to borrow increasing debt.

2. How has Mr. Clarkson met the financing needs of the company during the period 1993 through 1995? Has the financial strength of Clarkson Lumber improved or deteriorated?

Mr. Clarkson had to fulfill the financing need of the firm by taking up a loan and delaying payments to suppliers. As mentioned in the previous question, Clarkson Lumber was facing a lot of cash issues. The company had low operating margins. However, it maintained a leveraged trade credit and a bank note of up to $399,000. For the past few years, the firm was able to finance its operations using different means of funds. Eventually, in 1995, Clarkson Lumber could not increase the debt any further and had increasing current liabilities. This shows the over reliance of Clarkson Lumber on short term debt. Hence, it was also unable to take advantage of the trade discounts. This shows that the financial strength of Clarkson Lumber was deteriorating.

Exhibit C and D show how Cash and funds were generated and used. Exhibit C shows the cash flow statement of the firm. Clarkson Lumber has negative cash flow from operations on $80,000 in 1995. This is due to the mismanagement of Accounts Receivable and inventory over the period. The overall cash inflow seems to be financed by the bank loans while the significant outflow is in the investment in fixed assets.

Exhibit D elaborates on the change in the sources and uses of the funds to determine the problem with the company. The table shows that the main sources of finance are the trade payable and bank loans which contribute 33.8% and 45.5% to the overall source of funds, respectively. Similarly, the major cash outlay of 35% is due to the increase in accounts receivable and of 29.1% due to the increase in inventory. This figure shows a clear mismanagement of cash by CLC. Hence, the company avoids the fact that the cash cycle is mishandle, and the cash is not properly generated from operations. This is the main reason for the deterioration of the company's financial strength.

3. How attractive is it to take the trade discounts?

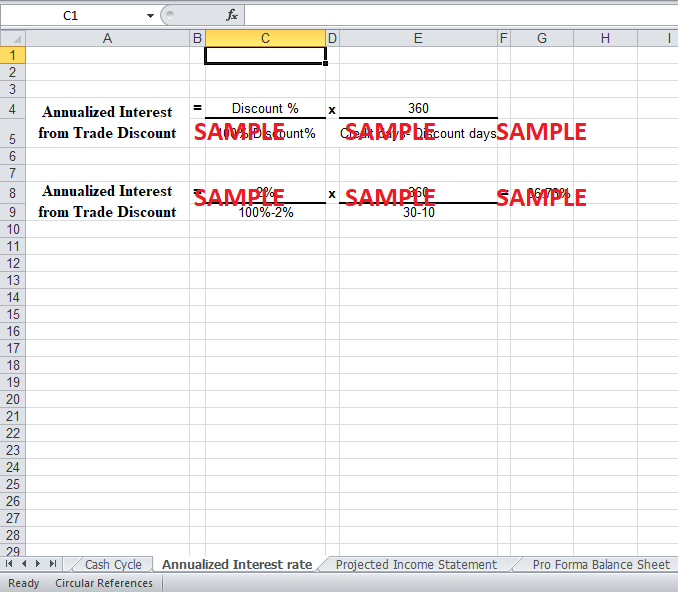

The trade discount would be deemed attractive if and only if the annual interest rate given the avails the discount is higher than the interest rate charged on the bank loan. There has been assumed that a 2% discount for payment after 10 days of purchase in 30 days of the credit limit is given. Exhibit E shows the calculation for the annual interest from the trade discount which turns out to be 36.73%. This means that if the trade discount is taken, Clarkson gets a large interest of 36.73%. Hence, for every discount on $ 1 million worth of purchase, CLC gets an interest of $367,300. Therefore, this clearly indicates that the trade discount is very significant and should be utilized.

4. Do you agree with Mr. Clarkson's estimate of the company's loan requirements? How much will he need to finance the expected expansion in sales to $5.5 million in 1996 and to take all trade discounts?

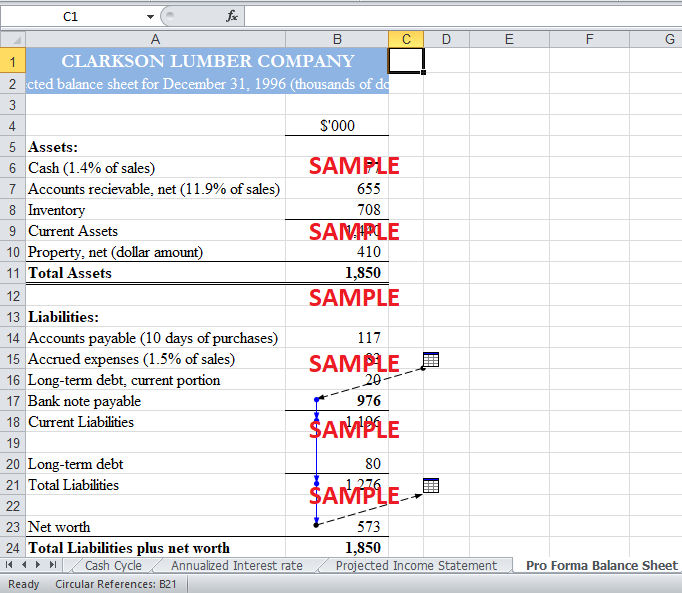

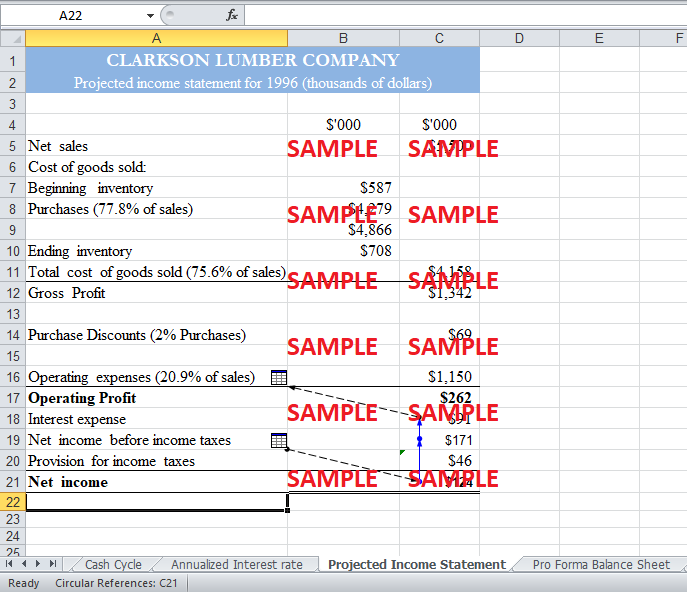

Exhibit F shows the Projected Income statement for CLC. Exhibit G shows the Pro forma Balance Sheet of the firm. From these forecasted tables, we can see that the income is expected to increase in 1996. This will make CLC capable of paying off the bank loan. Similarly, there is an increase in liabilities due to the borrowing of additional funds needed. These additional funds are needed to run the operations because of an increase in Accounts receivable and an increase in inventory. CLC also requires the fund to make payment to Mr. Holts for his share, to pay back $399,000 of the borrowed capital and gain the trade discount. Therefore, to do all the payments, CLC at least needs $750,000 of loan. This would improve the functioning of the business to a large extent.

5. As Mr. Clarkson's financial adviser, would you urge him to go ahead with, or to reconsider his anticipated expansion and his plans for additional debt financing? As the banker, would you approve Mr. Clarkson's loan request, and, if so, what conditions would you put on the loan?

As Mr. Clarkson's financial advisor, I would recommend Clarkson to take the additional loan for expansion. However, he needs to improve his Accounts receivable and inventory flow. For this, he could offer his customers trade discounts on early payments. Inventory should be reduced such that only the necessary inventory is maintained. Other strategies should be implemented to improve receivables and cash flows. With the expansion, the trade discount will also increase profitability. As the financial advisor, I would also recommend Mr. Clarkson to close down the low profit outlets because they show a negative return to sales, equity and assets (Exhibit 3 of the case). Furthermore, these outlets also have significantly more current liabilities and long term liabilities than High-Profits outlets. Hence, closing these outlets may reduce the cash flow problems of the firm. The borrowed money should be invested wisely in order to sustain the business in the long run.

On the other hand, as a banker, I will not approve Mr. Clarkson's loan request. Although Mr. Clarkson seems to have a good credit history and can be relied on, he is facing a lot of cash flow issues. Unless Mr. Clarkson finds a way to improve his cash flow his business will be at a risk; therefore, the bank cannot risk giving him a loan. It can also be deduced that Clarkson Lumber is expanding too fast. The industry growth is very slow and, therefore, Mr. Clarkson should focus on sustaining the current level of activity.

The spread for economic value added indicates whether the expansion Mr. Clarkson is trying to incorporate is beneficial for the company or not. If the spread is positive, the company should go for that change otherwise the company should stick to the current level of production. It can be inferred from the financial analysis that the spread for Clarkson Lumber's expansion program comes out to be negative. Therefore, CLC should not expand and continue with the current level of production.

Exhibit A

|

Clarkson Lumber Company |

||||

|

Ratio Analysis from 1993 through 1995 |

||||

|

|

1993 |

1994 |

1995 |

Average |

|

Percent of sales |

|

|

|

|

|

Purchases |

75.6% |

78.5% |

79.2% |

77.8% |

|

Cost of goods sold |

75.4% |

75.8% |

75.8% |

75.6% |

|

Operating expenses |

21.3% |

20.6% |

20.8% |

20.9% |

|

Profit Margin |

2.1% |

2.0% |

1.7% |

1.9% |

|

Cash |

1.5% |

1.5% |

1.2% |

1.4% |

|

Accounts receivable |

10.5% |

11.8% |

13.4% |

11.9% |

|

Inventory |

11.5% |

12.4% |

13.0% |

12.3% |

|

Fixed assets (net) |

8.0% |

7.5% |

8.6% |

8.0% |

|

Total assets |

31.5% |

33.3% |

36.2% |

33.7% |

|

|

|

|

|

|

|

Percent of total assets |

|

|

|

|

|

Current liabilities |

29.9% |

48.8% |

66.5% |

48.4% |

|

Long-term liabilities |

15.2% |

19.0% |

6.1% |

13.5% |

|

Equity |

54.8% |

32.2% |

27.4% |

38.1% |

|

|

|

|

|

|

|

Current ratio |

2.49 |

1.58 |

1.15 |

1.74 |

|

Return on sales |

2.1% |

2.0% |

1.7% |

1.9% |

|

Return on assets |

6.5% |

5.9% |

4.7% |

5.7% |

|

Return on equity |

11.9% |

18.3% |

17.1% |

15.8% |

|

|

|

|

|

|

|

Sustainable Growth: |

|

|

|

|

|

Margin |

2.05% |

1.96% |

1.70% |

|

|

Asset Turnover |

3.18 |

3.01 |

2.76 |

|

|

Leverage (using bop equity) |

2.30 |

4.40 |

|

|

|

Retention ratio |

|

1.00 |

1.00 |

|

|

Expected growth rate |

|

13.49% |

20.70% |

|

|

Actual Growth (Revenue) |

|

19.03% |

29.97% |

|

|

Actual Growth (Assets) |

|

25.90% |

41.49% |

|

Exhibit B

|

Clarkson Lumber Company |

||||

|

Cash to cash cycle (dollars) |

||||

|

|

|

|

Change from |

Change from |

|

|

1993 |

1995 |

1993 to 1995 |

1993 to 1995 |

|

Average Daily Sales |

$8,003 |

$12,381 |

$4,378 |

55% |

|

Average Collection Period: (AR Days) |

38.2 |

48.9 |

10.7 |

28% |

|

Inventory Turnover |

6.5 |

5.8 |

(0.7) |

-11% |

|

Average Daily Purchases |

$6,052 |

$9,805 |

$3,753 |

62% |

|

Days of Inventory |

55.7 |

59.9 |

4.2 |

8% |

|

Days of Payables (Trade Notes and Accounts) |

35.2 |

51.3 |

16.1 |

46% |

|

Days Cash to Cash: |

58.7 |

57.5 |

(1.2) |

-2% |

|

|

|

|

|

|

|

Increase in AR due to |

$306,000 |

$606,000 |

$300,000 |

98% |

|

Increased Average Collection Period: |

|

$85,707 |

|

|

|

Increased Sales: |

|

|

$214,293 |

|

|

|

|

|

|

|

|

Increase in Inventory due to |

$337,000 |

$587,000 |

$250,000 |

74% |

|

Reduced Inventory Turnover: |

|

|

$25,303 |

|

|

Increased Sales: |

|

|

$224,697 |

|

|

|

|

|

|

|

|

Increase in Payables due to |

$213,000 |

$503,000 |

$290,000 |

136% |

|

Slower Payment: |

|

|

$97,457 |

|

|

Increased Purchases: |

|

|

$192,543 |

|

|

|

|

|

|

|

|

Increase in Net Working Assets due to |

$430,000 |

$690,000 |

$260,000 |

60% |

|

Reduced Activity Ratios: |

|

|

$13,553 |

|

|

Increased Operating Activity: |

|

|

$246,447 |

|

Exhibit C

|

Clarkson Lumber Company |

|||

|

Cash Flow Statement, 1993 - 1995 |

|||

|

|

1994 |

1995 |

1993 to 1995 |

|

Cash From Operations: |

$'000 |

$'000 |

$'000 |

|

Retained Earnings |

$68 |

$77 |

$145 |

|

Less: |

|

|

|

|

Change in Accounts Receivable |

$105 |

$195 |

$300 |

|

Change in Inventory |

$95 |

$155 |

$250 |

|

Add: |

|

|

|

|

Change in Trade Payables |

$127 |

$163 |

$290 |

|

Change in Accrued Expenses |

$3 |

$30 |

$33 |

|

|

|

|

|

|

Cash from Operations |

($2) |

($80) |

($82) |

|

|

|

|

|

|

Cash from Investing |

|

|

|

|

For Fixed Assets |

($29) |

($126) |

($155) |

|

|

|

|

|

|

Cash from Financing |

|

|

|

|

From Bank Loans |

$60 |

$330 |

$390 |

|

For LTD Payout |

($20) |

($20) |

($40) |

|

Buyout debt |

|

($100) |

($100) |

|

Cash from Financing |

$40 |

$210 |

$250 |

|

|

|

|

|

|

Change in Cash |

$9 |

$4 |

$13 |

|

|

|

|

|

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

- Clean Edge Razor: Splitting Hairs in Product Positioning Case Solution

- Cleveland Clinic: Growth Strategy 2012 Case Solution

- Clifford Chance, Repotting the Tree Case Write Up Case Solution

- Coca Cola's New Vending Machine (A): Pricing to Capture Value, or Not Case Solution

- Coke vs. Pepsi, 2001 Case Solution

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.