Get instant access to this case solution for only $19

Comfort Remote Site Services LTD Case Solution

The case analysis requires to complete an external and internal analysis of the factors that contribute to the decision-making leading to Young's choice to submit or not submit a bid on the Gregory Mine RFP (Request for Proposal). The analysis also requires a qualitative assessment of the Gregory mine opportunity. Ensure a differential analysis for the Gregory Mine bid is conducted in addition to a financial analysis for each of the catering, housekeeping and janitorial services for the Gregory Mine work. Based on the assessment and analysis decide, you should decide whether or not Young should submit a bid. This decision should be supported by an action plan, further a contingency plan needs to be clearly defined.

Following questions are answered in this case study solution

-

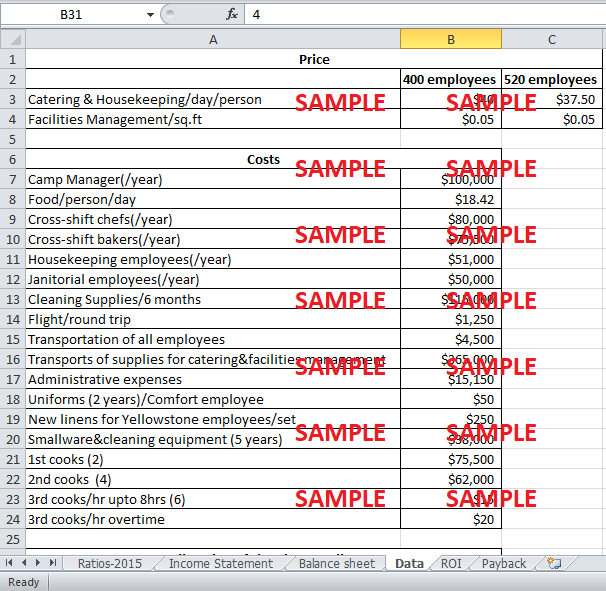

Identify trends in the Canadian mining and exploration industry giving consideration to how these trends affect the remote-site food service industry and Comfort Remote Site Services Ltd (Financial Analysis of Company’s services).

-

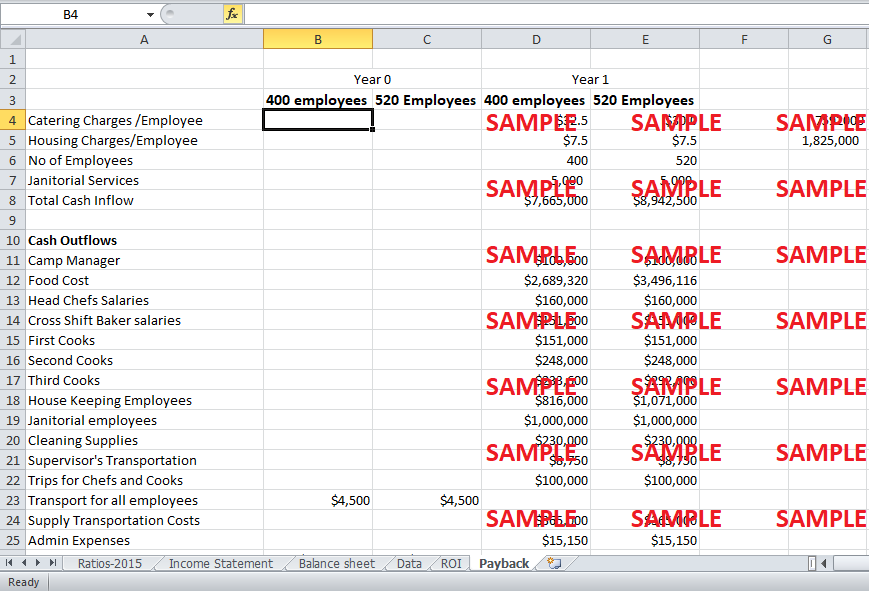

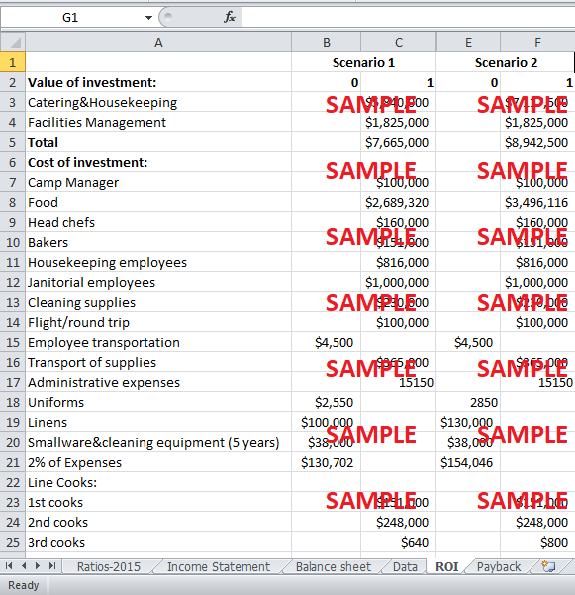

Prepare and calculate the ROI and payback for both the 400 and 520 employee scenarios.

-

Clearly outline the decision that Young has decided to make. Detail an action plan that supports this decision that both identifies risks and provides recommendations on how these risks can be best mitigated.

Case Analysis for Comfort Remote Site Services LTD

1. Identify trends in the Canadian mining and exploration industry giving consideration to how these trends affect the remote-site food service industry and Comfort Remote Site Services Ltd (Financial Analysis of Company’s services).

The Canadian mining industry, being a major stakeholder in the economy, contributed to 8.3% of the country’s Gross Domestic Product (GDP) in 2015, thereby indicating its correlation with the economic trends. The Canadian mining industry is quite prone to global economic trends. The companies' profitability depends on the commodity prices which are in turn affected by the global market forces of supply and demand (Marshall, 2017). Iron Ore is largely used in steel production which was experiencing; a boom in China due to is urbanization, and increased steel demand which lead to China importing 65% of Iron Ore mined worldwide in 2014. This chain of events eventually leads to high profitability for the ferrous mining segments. Furthermore, the remote-site food services industry is closely linked to the performance, and the prosperity of the mining sector since an increase in the costs for the mining sector will lead to companies deeming lesser and lesser of these services.

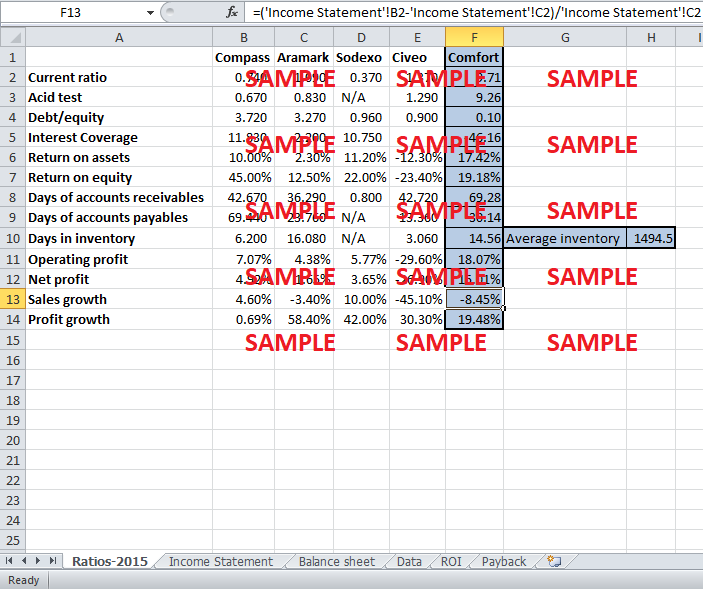

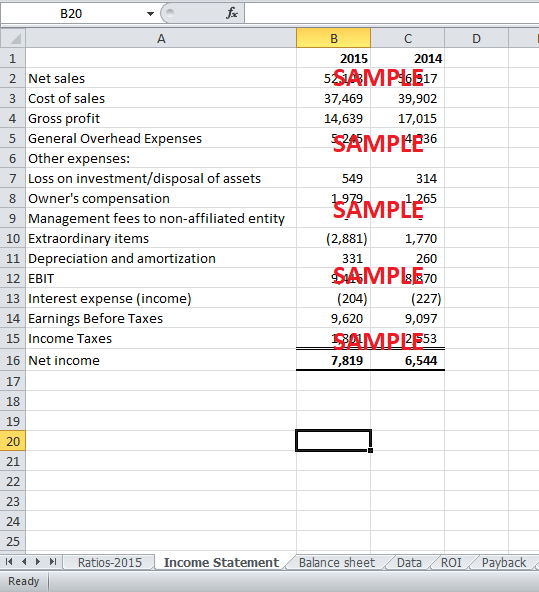

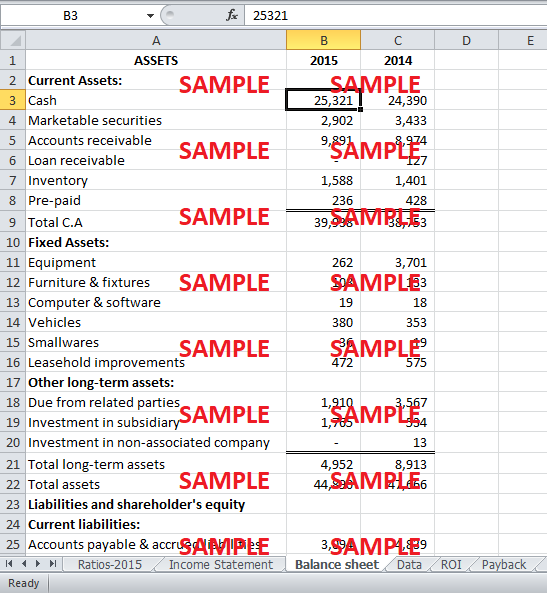

The current ratio demonstrates the company’s capability to pay back its short-term liabilities using its Current Assets (Saleem & Rehman, 2011). The Acid-test ratio or the Quick ratio measures a company's ability to pay off its current liabilities by using its most liquid current assets such as cash, cash equivalents and accounts receivables. (Eljelly, 2004) Even though the current and quick ratios, 9.71 and 9.26 respectively, are much higher than those of its competitors as well as the minimum acceptable value of 1, such high values mean that either the company is not utilizing its current assets as efficiently as it should, or there is a problem with its working capital management.

The Debt-to-equity ratio shows the firm's financial leverage, i.e. the proportion of debt and equity used by the company to finance its assets (Nissim & Penman, 2001). Comfort-site's debt/equity ratio is higher than that of Sodexo and Civeo but much lower than that of Compass and Aramark. The value of 0.10 indicates that only 10% of the company's total assets are liabilities which is a very safe position to be in since fewer liabilities means fewer chances of default risk. Hence, when compared to its competitors, Comfort-site Services has a strong Debt/Equity ratio.

The Return on Equity ratio aims to please the shareholders directly since it indicates the net income generated from the money invested by the shareholders (Easton, Taylor, Shroff, & Sougiannis, 2002). Comfort-site services seem to be under-performing against its competitors in this fiscal ratio as its value of 19.18% is better than the values for Civeo and Aramark only, with Compass outclassing it with a ratio value of 45%.

The Net profit margin shows the investors what proportion of the company’s sales is being converted into net profit (Misund, 2016). The higher a company’s net profit margin, the better off it is. Therefore, it can be seen from Comfort-site’s net profit margin of 15.01%, the highest by a wide margin amongst its competitors, that the company is fairly efficient at converting its sales into actual profit.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.