Get instant access to this case solution for only $19

Dynashears Inc Case Solution

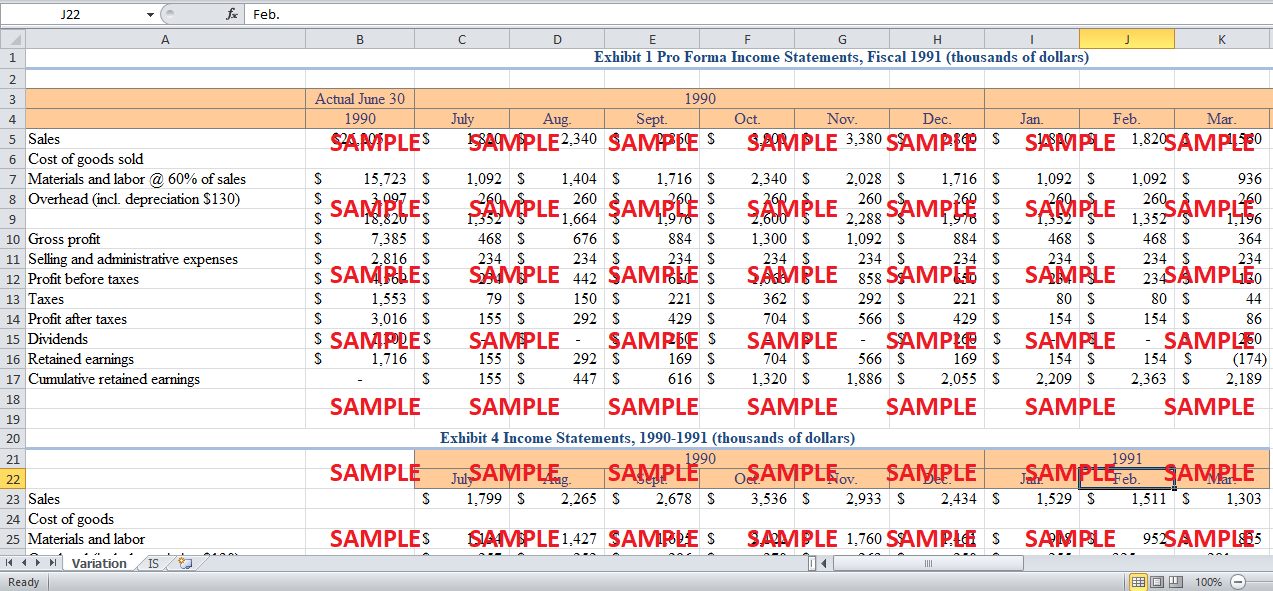

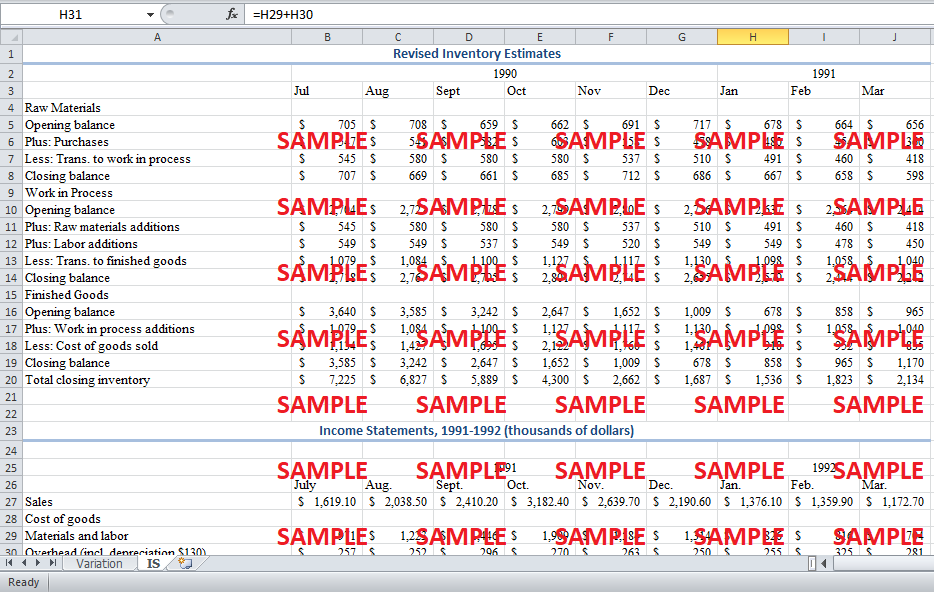

A brief examination of the pro forma and actual financial statements reveals that the foremost reason behind the inability to relinquish the debt payments arises due to a decline in sales. The sales were starting their decline from July 1990 and continued the trend till March 1991. The major reason for the decline in sales corresponds to the overall market recession. Secondly, the lack of proper environmental and market scanning led to a situation where the inventory production, and consequently the purchase of raw materials and labor expenses remained at the projected level in spite of a huge decrease in actual sales. The first signs of preventive steps appeared in February 1991 when the WIP and labor expenses were regulated.

Following questions are answered in this case study solution:

-

What are the reasons why the company could not repay its loans?

-

What can be done to correct the situation?

-

Will the company be able to repay its loans if it takes the corrective actions?

Dynashears Inc Case Analysis

This stability in the production process coupled with the declining sales resulted in a build-up of finished inventories (March 1991: $1,236,000). The final blow was made by the falling profits and retained earnings. Meanwhile, apart from the financial aspects, the fixed asset spending of the company also paved its way to withhold the loan repayment ($224,000). However, the inability to repay loan is largely credited to the declining sales, profits and lack of proper planning to curb WIP and other inventory charges.

2. What can be done to correct the situation?

At this point, it is crucial to discuss the ramifications of the build-up of finished goods inventory. The company offers a non-perishable item as its core products. Hence, the build-up of inventory does not essentially guarantees a long term crises (either liquidity or capital budgeting). A comparison of the actual and proforma ratios shows that the absolute position of the company is quite attractive. Not only is the current ratio high, the collection period and the inventory turnover are also quite close to the projected values. Hence, it is evident that the seasonal fluctuations in sales are the only issue that requires proper attention. The cyclical adjustment can easily be carried out via the inventory readjustment. In the period of readjustment, the existing inventory should be utilized in order to relinquish the sales demands. Hence, the production process will not essentially input large WIP inflows. The need of the hour is to make such a strategy that the sales and production are in line with each other so that the seasonal demands for debt can be tackled effectively. The company just needs to readjust its production in accordance with the revised demands forecasts (after the recession). As the core financials are intact, therefore, they should not be influenced.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.