Get instant access to this case solution for only $19

Eddie Bauer A Case Solution

Eddie Bauer's method of reformation included a number of distinct actions. The primary aim was to restore the company's standing as an elite manufacturer of outdoor equipment. The company intended to reduce the size of its shops to 5,500 square feet and to continue favouring affluent shopping malls and major cities as sites for these stores in an effort to boost profits. Eddie Bauer shuttered 22 failing locations and built 16 new ones, all in an effort to enhance back-end operations by reducing suppliers, streamlining IT processes, and improving inventory management. Despite the closure of these 36 locations, national partnerships for eyeglasses, furnishings, and bicycles have remained. The reform included increasing direct sales, standardising storefront displays, and strengthening executive leadership. All distribution and fulfilment operations were to be centralised in one building in Groveport, Ohio, and the company's common stock was to be listed on NASDAQ in the future.

Following questions are answered in this case study solution:

-

What is Eddie Bauer’s strategy upon emerging from bankruptcy protection? What are the key success and risk factors associated with this strategy, for both the firm and its industry?

-

Where, if anywhere, in the financial statement are these success and risk factors reflected? Are any adjustments needed to better reflect economic reality?

-

How has Eddie Bauer performed in the past? What key measurers can be used to gauge the company’s success?

-

What are your expectations of Eddie Bauer’s future performance? Please evaluate management’s projections.

-

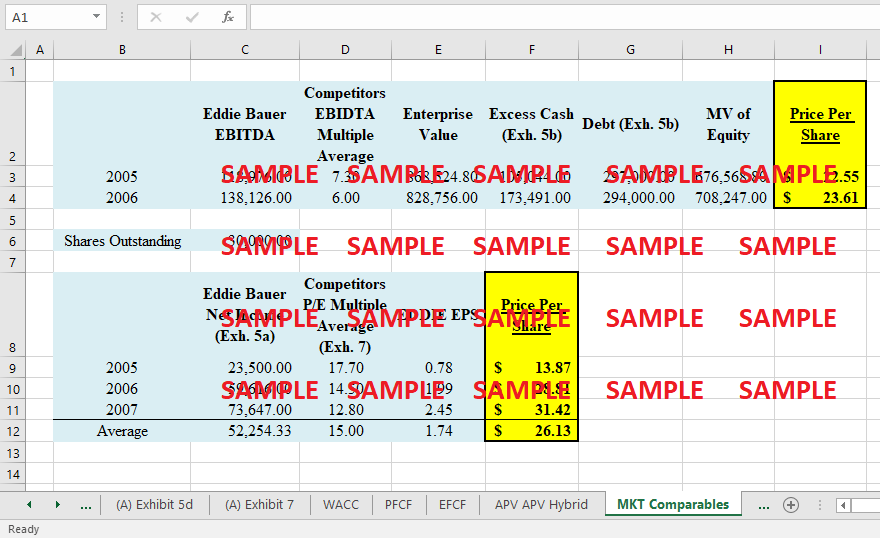

Should Bank of American and J.P. Morgan Chase continue to hold Eddie Bauer stock, or was the time to sell while it was valued at $24 per share?

Case Study Questions Answers

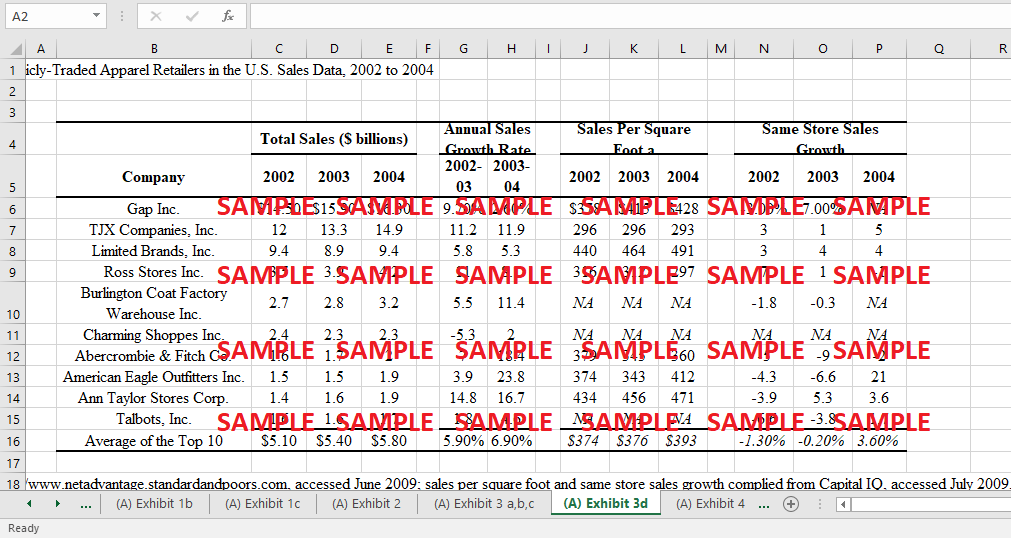

1. What is Eddie Bauer's strategy upon emerging from bankruptcy protection? What are the key success and risk factors associated with this strategy for both the firm and its industry?

When preparing for the restructuring after bankruptcy, Eddie Bauer had a number of strategic options to consider. The first order of business was to restore the company's image as a leading provider of products for the "urban nomad's" taste in outdoor recreation. Second, it needed to expand the size of its shops to 5,500 square feet and locate more of them in affluent regional shopping malls with strong foot traffic in order to boost profits. The third objective of management was to boost direct sales by enhancing the company's catalogue and online store to better represent the full range of the company's product offerings. Four, they intended to boost client satisfaction by developing brand loyalty via a visually attractive storefront display and unified branding strategy. When it came to the company's top brass, number five on the agenda was to keep adding to the ranks. Finally, they sought to increase efficiency in its back-end operations by decreasing the number of suppliers they worked with, centralising their IT infrastructure, and tightening their inventory management. For the company and the industry as a whole, this strategy carries with it a number of potentially disastrous outcomes. Increased competition and maturity in the retail sector, as well as the danger of operational losses due to a decline in overseas joint ventures and a focus on lower management, may limit future growth. Multiple critical success elements, including yearly improvements in sales growth and net income and simplified SG&A spending, help to offset these dangers. This new approach would broaden the market to include adolescents. The addition of high-traffic retail malls and specialised licencing partners would also help spread the word about the brand.

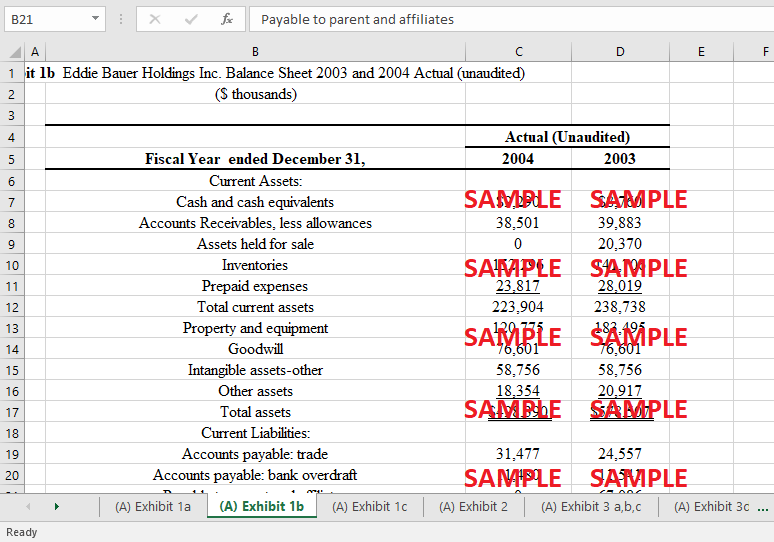

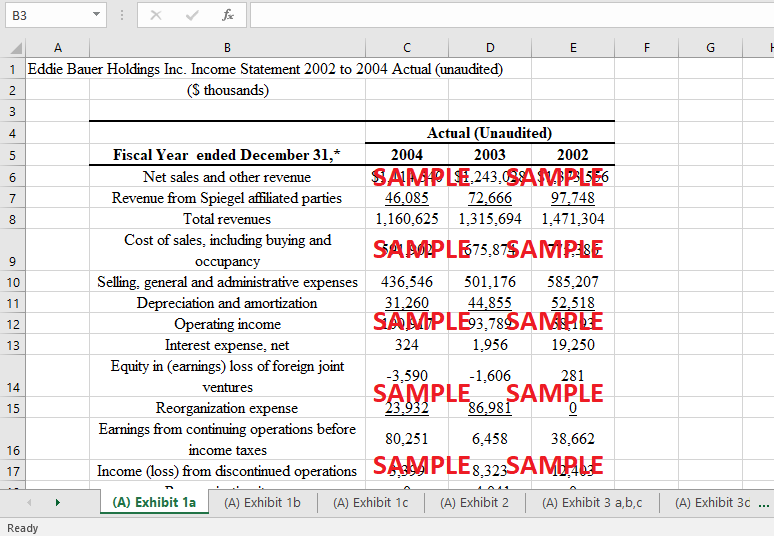

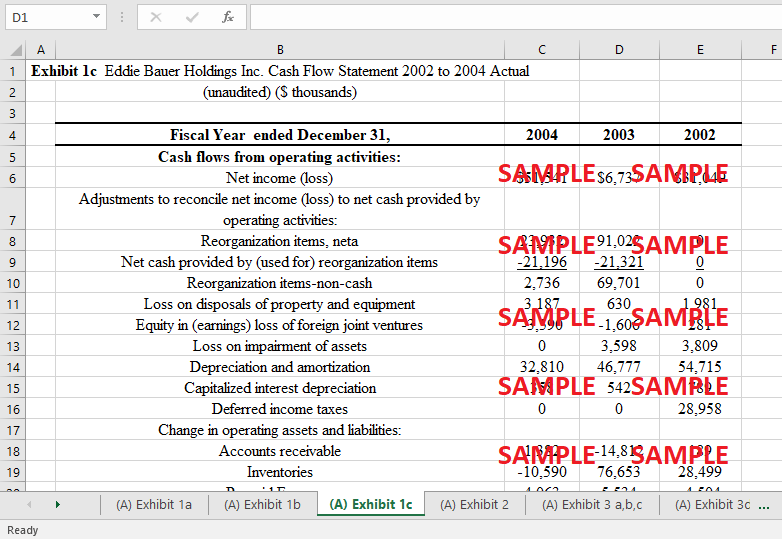

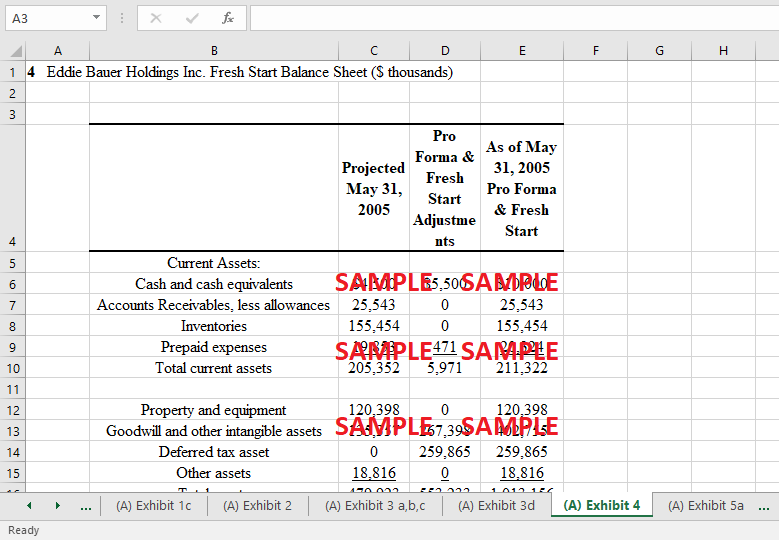

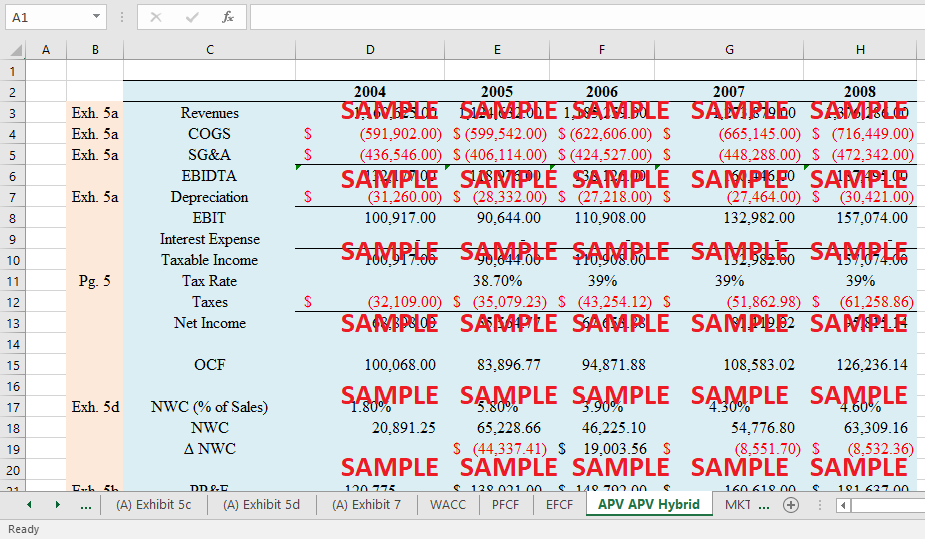

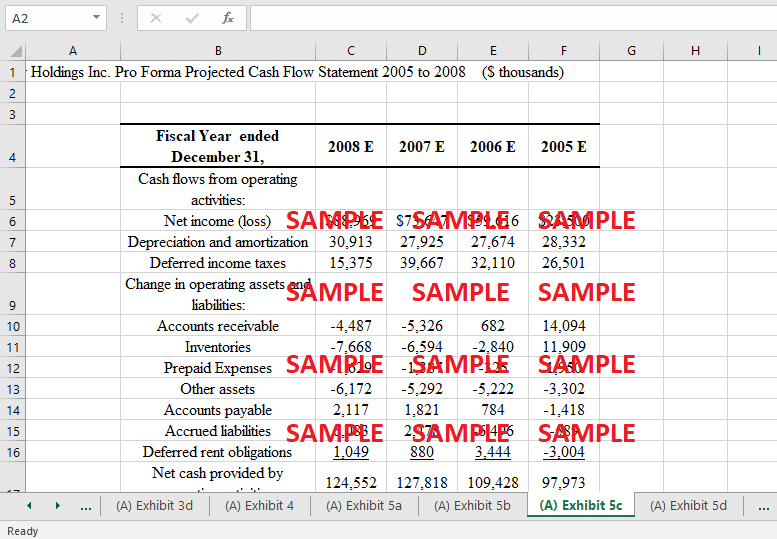

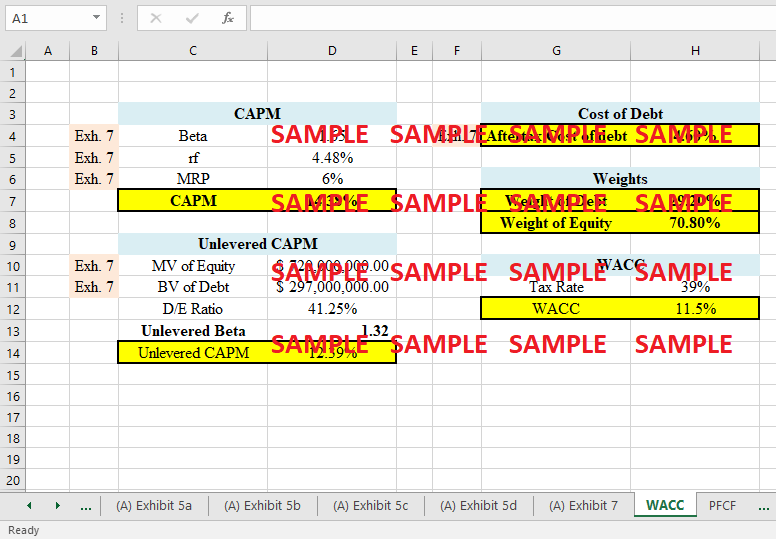

2. Where, if anywhere, in the financial statement are these success and risk factors reflected? Are any adjustments needed to better reflect economic reality?

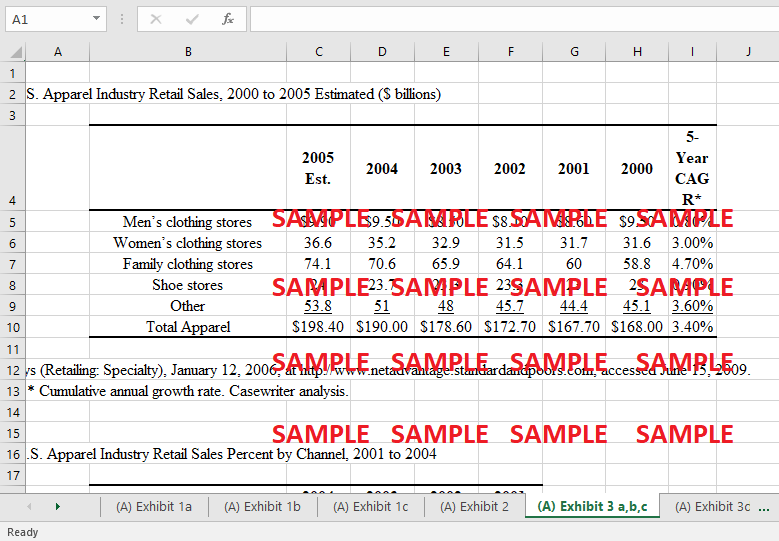

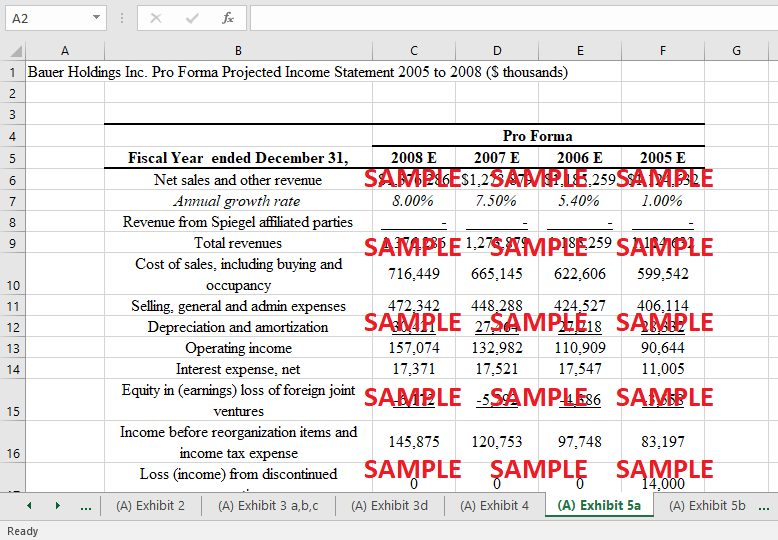

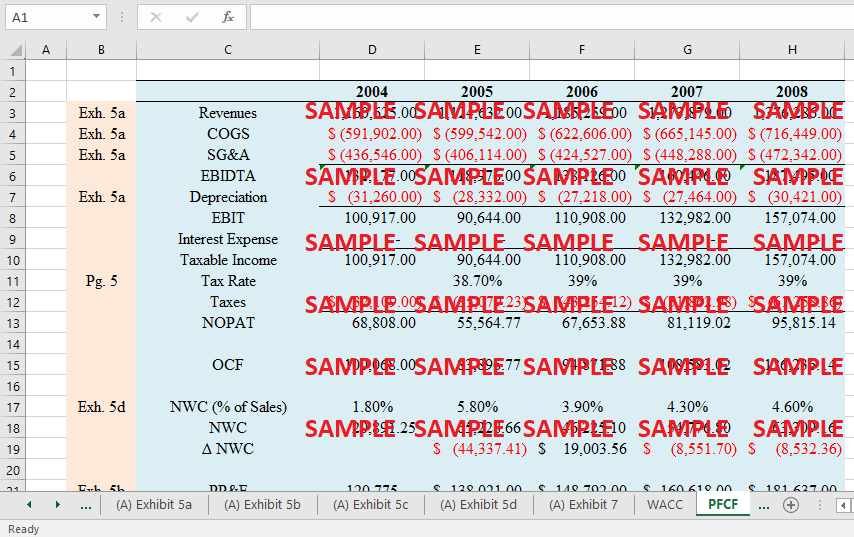

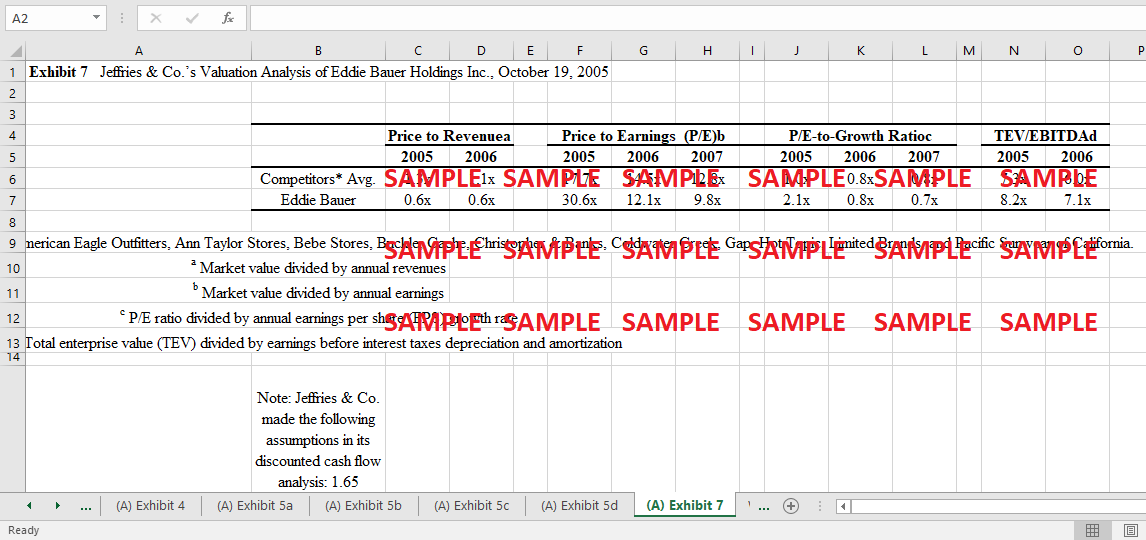

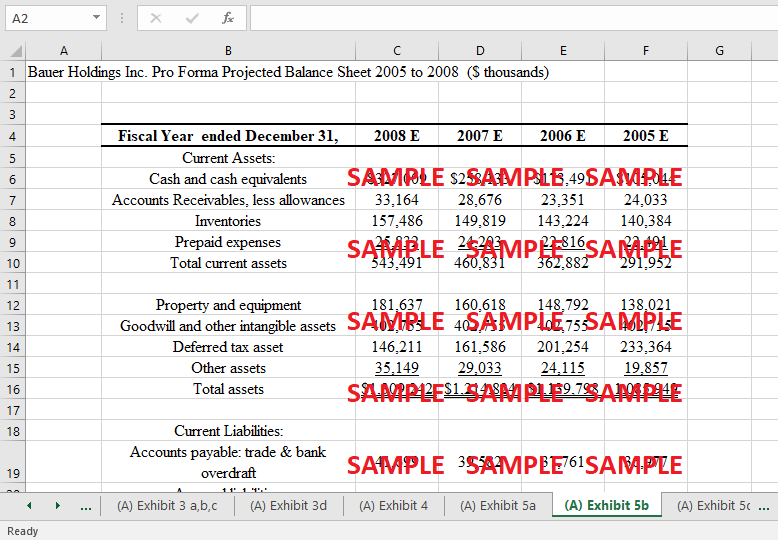

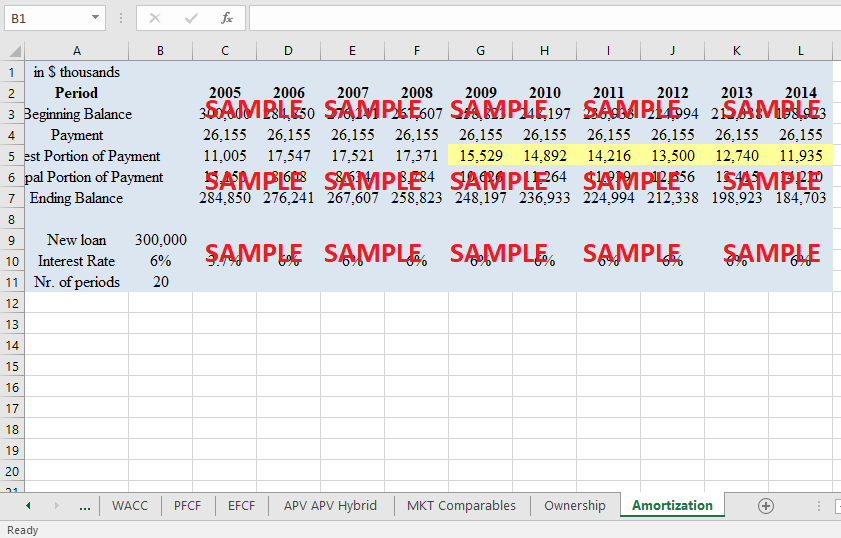

The financial projections show us the areas where success and danger are represented. With sales expected to rise by 3% in 2005, it was anticipated that annual sales and other revenues would climb at a more modest 1%. The firm saw significant development in 2006 as a consolation prize. The yearly growth rate is projected to increase from 5.4% in FY2006 to 8% in FY2008. In addition, 2008's net income was $89 million, up from $23.5 million in 2005. The reduction in store size is predicted to result in SG&A expenditures as a percentage of sales falling from 37.6% in 2006 to 34.3% in 2008. The cost of sales dropped from 53.3% in 2005 to 52.1% in 2008 due to the reduction in SG&A spending. In light of the dangers, the industry's level of competition and maturity makes expansion unlikely. Projections from operational management provide light on this. From 2004's -11.8% to 2005's -3.1%, annual sales growth has been falling steadily.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.