Get instant access to this case solution for only $19

Freemark Abby Winery Case Solution

Free Abbey Winery located in St.Helena, California and produced premium wine from the best grape variety. It produced 25000 bottles of wine each year. William Jaeger was a partner in the firm. In September 1976, Jaeger had to decide whether to harvests the grapes immediately or wait for further ripening. If the grapes are harvested immediately, the firm will be able to earn $2.85 per bottle. However, if the grapes are harvested later, there is a high risk that the grapes might not be of appropriate quality and have to be sold for very low price. To structure the decision based on future possibilities, a decision tree is made. Using the decision tree, the payoffs of each option is analyzed to determine the most optimal decision

Following questions are answered in this case study solution:

-

Draw a decision tree to depict the choices and possible events Jaeger is facing. What are the decisions to be made? What are the chance nodes that will occur? What are the payoffs? (In drawing your tree, assume that Jaeger is an expected value maximizer, i.e. that he is risk-neutral.)

-

How would the optimal decision change if the reputation damage from bottling a thin wine were substantial enough that Jaeger would rather sell the grapes in bulk than bottle a thin wine?

-

How much would Jaeger be willing to pay for a weather forecast that would tell him with near certainty whether or not the storm will hit?

-

How would risk aversion affect the harvest decision?

Freemark Abby Winery Case Analysis

1. Draw a decision tree to depict the choices and possible events Jaeger is facing. What are the decisions to be made? What are the chance nodes that will occur? What are the payoffs?

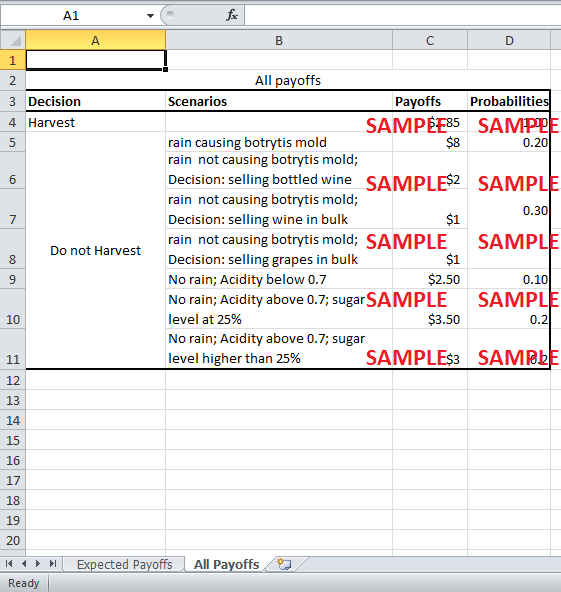

Freemark Abbey Winery produced premium wine from the grapes harvested in the northern Napa valley. In 1976, one of the partners of the winery, William Jaeger analyzed the decision to harvest grapes immediately or after some time. The 50 percent possibility of storm might result in high quality wine with a high selling price. The decision to wait for harvest might also result into very low quality wine, as well.

If Jaeger waits a while to harvest than it might face another decision if it rains and botrytis mold does not develop. It will have three options. First, it could make wine bottle it and sell it with the Napa Label at $2 per bottle. Second, it could produce wine and sell in bulk for $1 per bottle. Finally, it could sell the grapes in bulk for $1 too.

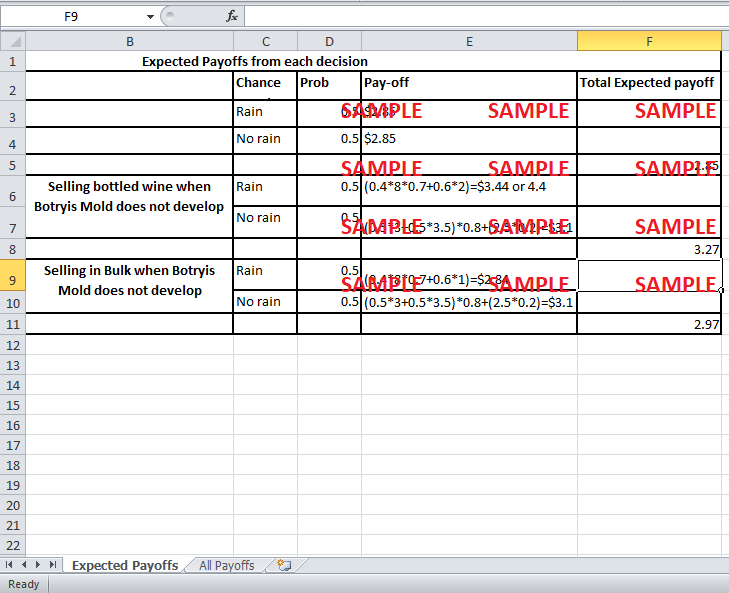

To shape the problem and clarify the outcome, a decision tree is a necessary tool. Exhibit 1 shows the decision tree necessary to structure the decision. There are mainly two options for Jaeger. He either could harvest immediately or wait a while for the rain before harvesting the grapes. If Jaeger decides to harvest immediately, the rain will not have any effect on the price of the wine made from grapes. Hence, the wine from these harvested grapes can be sold for $2.85 per bottle regardless of the rain. Therefore, this option has no risk. The revenue is certain as the expected payoff is $2.85 per bottle (Exhibit 2).

Jaeger could also decide to wait for the rain and harvest later. In this situation, if it rains, there is a possibility of the development of the botrytis mold on the grapes. The wine from such grapes will generate high revenue when it is sold for $8.00 per bottle. This revenue will be slightly offset by the 30% reduction in quantity of wine during processing. However, there is 60% possibility that the botrytis mold will not develop. In this case, the wine could be sold for $2 per bottle. Therefore, the expected payoff if it rains is $3.44 per bottle (Exhibit 2). However, Jaeger will also have the option of selling grapes or wine in bulk to avoid a loss of reputation in case the mold does not develop. The expected payoff if Jaeger decides to sell in bulk is $2.84 per bottle.

However, if it does not rain, the acidity level of the grapes needs to be monitored skillfully. If the acidity level remains above 0.7% and the sugar concentration is 25% then the revenue generated per bottle will be $3.5. In case, the concentration level of sugar is between 20%-25%, the wine will generate a price of $3.00/bottle. On the other hand, if the acidity level drops below 0.7% revenue generated per bottle will be $2.5 on any sugar concentration levels leading to lower revenue per bottle. Therefore, the expected payoff if it does not rain is $3.1 per bottle (Exhibit 2).

2. How would the optimal decision change if the reputation damage from bottling a thin wine were substantial enough that Jaeger would rather sell the grapes in bulk than bottle a thin wine?

In order to analyze the decision, it is important to establish the expected payoffs of each decision. In Exhibit 2, the expected possibility of each decision is given. If Jaeger harvests the grapes at once, the expected payoff will be $2.85 per bottle. There will be no risk of a lower price in such a case.

Conversely, if Jaeger decides not to harvest at once, the outcome is very uncertain. Exhibit 2 shows that the expected payoffs. If he decides to produce wine and sell for Napa label, in the situation it rains, but no botrytis mold develops, the expected payoff will be $3.27 per bottle. This decision to sell low quality wine under the Napa Label might damage the firm’s reputation. This might affect the future sales for the company.

Jaeger could also decide to sell the wine or the grapes in bulk. As both these options have the same payoff, the overall expected payoff for each of these decisions would also be same. Hence, the expected payoff in this case would be $2.97 per bottle. The advantage of selling in bulk would be that the goodwill of the firm will be intact even if the payoff is low.

Note that the expected payoffs for “not harvesting at once” option are higher than the expected payoff for the “harvest now” option, regardless of the decision made regarding the bulk selling or bottling. Even though this way “not harvesting now” seems a better option, but it is far more risky.

Similarly, for the second decision regarding whether to sell bottled wine or in bulk in case of no botrytis mold development, Jaeger will have to reassess the firm’s financial position. If the financial position is weak, the goodwill has to be sacrificed in favor of higher revenue. For the purpose of making the decision, it is important to notice that if Jaeger decides to wait a while before harvesting, there is 40% possibility of the wine being sold for a price below $2.85 per bottle and 30% chance of making the decision about selling in label or otherwise.

3. How much would Jaeger be willing to pay for a weather forecast that would tell him with near certainty whether or not the storm will hit?

In order to get the information about the weather forecast, Jaeger would be willing to pay up to $0.85 per bottle. This is because paying $0.85 per bottle will make equal the worst payoff from harvesting later and the payoff from harvesting now. Jaeger would become indifferent between the two. Hence, any amount below $0.85 per bottle would be feasible for Jaeger.

Moreover, the firm’s current financial position is also important to analyze. Jaeger should analyze if the firm is so financially strong to determine the price of weather information and to bear losses in case of rain and no botrytis mold development. If the firm is highly leveraged, it cannot afford to pay too much for the information. Another important consideration is the cost per bottle. If cost is low, the margin, when price is $2.85 per bottle, is high. In this case, the firm can afford to pay more for the weather forecast.

4. How would risk aversion affect the harvest decision?

Jaeger’s decision, regarding when to harvest, would be dependent on many factors. If Jaeger is risk averse, he would harvest now in order to get the certain revenue even if it is low. On the other hand, if Jaeger believes that the higher expected payoffs justify the risk taken, he will opt for harvesting later. It is clear from the payoff table in Exhibit 2 that the option to harvest later leads to a greater expected monetary value as compared to harvesting now, regardless of the occurrence of rain. So he will feel that it is better to wait and harvest later.

For the first decision of when to harvest, there is a trade-off between risk and return. Assuming that the winery is financially strong and able to take a risk, the option of harvesting later and waiting for the rain is better. In the circumstances, when the botrytis mold did not develop after the storm, the decision will have a trade-off between goodwill and return. If the firm remains financially strong at the time, the company should preserve its reputation of premium wine. This means they should opt for selling in bulk either the wine or the fruits.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

- Freemium Pricing at Dropbox Case Solution

- Frito Lay North America the Making of a Net Zero Snack Chip Case Solution

- From a Dinosaur to Chameleon Transformation of a Korean Bank Case Solution

- From In-House to Joint R&D: The Way Forward for Nokia Denmark Case Solution

- Frumherji Ltd Reykjavik The Vehicle Inspection and EmissionsTesting Process Case Solution

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.