Get instant access to this case solution for only $19

G.G.Toys Case Solution

The company case study analysis revolves around the issues of management accounting and review of product costing. G.G. Toys is a doll producing company with plants operating in Chicago and Springfield. In 2000, the company faced a decline in margins. In order to reduce the production cost, they planned to shift the production from Geoffrey dolls to specialty dolls. The firm was based on the traditional cost system which allocated all the overheads on the basis of direct labor cost. For the Chicago plant, this costing system was not appropriate. The new ABC system is recommended for the plant which showed that as the margin from specialty dolls is only 3%; it should be closed down. Using these new results, it is recommended that more Geoffrey dolls be produced. Moreover, the excess capacity in the plant could be used to manufacture cradles and shut down the Springfield plant. Also, the scraps from Pajamas can be used to introduce another product line. These recommendations will enable the firm to increase its profitability.

Following questions are answered in this case study solution:

-

Do you recommend that G.G. Toys change its existing cost system in the Chicago plant? In the Springfield plant, Why or why not?

-

Calculate the cost of a Geoffrey doll, the specialty-branded doll #106, and a cradle using the cost study conclusions.

-

Compare and contrast the profitability of each doll under the new and old systems. Based on your recomputed product costs, what actions would you recommend the company consider to enhance its profitability? What additional information would you like to have to make these recommendations?

-

How should G.G. Toys account for the excess capacity created to produce the holiday reindeer dolls? Qualitatively, how will this impact your calculated cost of the Geoffrey doll and the specialty-branded dolls in question number 2? Explain your method and its impact.

-

What explains the difference between forecasted and actual revenue for the Chicago plant during March of 2000? What other information would you collect to help explain this difference?

-

Do you recommend G.G. Toys produce the Romaine Patch doll? Why or why not?

G.G. Toys Case study Question Answers

1. Do you recommend that G.G. Toys change its existing cost system in the Chicago plant? In the Springfield plant, Why or why not?

G.G Toys should change their existing cost system. For G.G Toys overhead costs are very high. Therefore, an appropriate cost system is very important for appropriate costing. In Chicago, both the Geoffrey dolls and Specialty dolls are produced. For different types of dolls different amount of shipment, production runs, setups and machine hours are required. Furthermore, different costs have different cost drivers. Hence, the current traditional costing system in the Chicago plant is not suitable for allocating the overhead costs. According to the current cost system, allocation of all the manufacturing overheads are based on the only production run direct labor cost. However, different manufacturing overhead costs should be allocated based on the respective cost drivers utilized for different types of dolls. For instance, for machine-related expenses, a machine hour is a more appropriate cost driver. Hence, activity-based costing (ABC) is more suitable for the Chicago plant. This will result in different margins for different dolls. For the Springfield plant, the overhead costs are only 5% of the overall cost and only one product is produced i.e. cradles. Hence, the current costing system is appropriate for the Springfield plant.

2. Calculate the cost of a Geoffrey doll, the specialty-branded doll #106, and a cradle using the cost study conclusions.

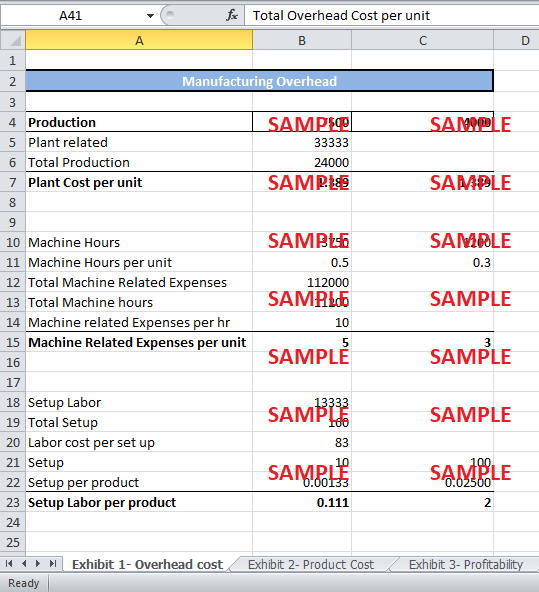

The product cost of Geoffrey doll, specialty-branded doll #106 and cradle is the sum of material cost, labor cost, and overhead cost. The overhead cost allocation of Geoffrey dolls and Specialty-branded doll #106 is shown in Exhibit 1. The overhead costs are divided based on the cost drivers using ABC costing. For Instance, the cost for plant related expenses was divided based on the units of production of each product line.

For the cradles, the allocation of overhead cost is based on production run direct labor cost. As the cradle is only a single product produced in Springfield plant; the overhead cost allocation will remain the same.

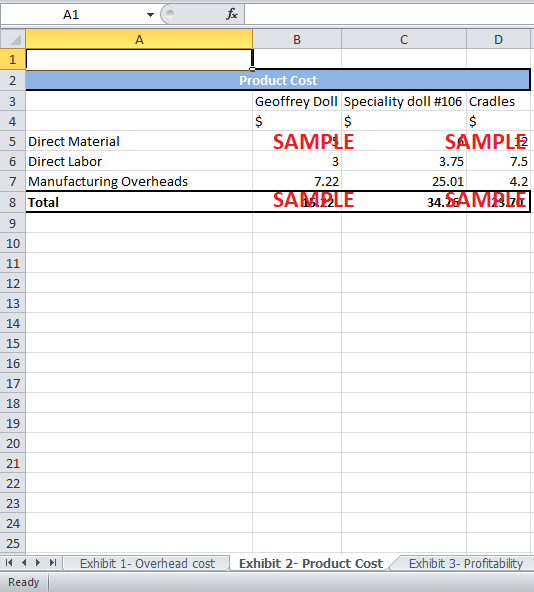

In Exhibit 2, the product cost of each product is shown. The cost per unit of Geoffrey doll is $15.22. For the specialty branded doll #106, product cost is $34.76. The cradle product cost is the same at $23.70. Hence, in the traditional costing, the product cost of Geoffrey dolls was overstated and the cost of specialty branded doll #106 was understated.

3. Compare and contrast the profitability of each doll under the new and old systems. Based on your recomputed product costs, what actions would you recommend the company consider to enhance its profitability? What additional information would you like to have to make these recommendations?

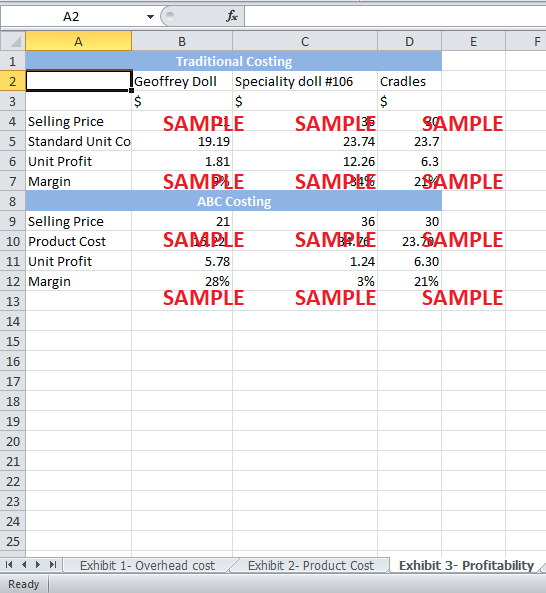

Exhibit 3 compares and contrasts the traditional costing system with the ABC system. The traditional costing system is appropriate for the cradle production in Springfield plant, the margin for cradle remains at 21%.

However, the margin for Geoffrey dolls and Specialty branded dolls show significantly different results under ABC costing. Geoffrey dolls had a 9% margin under traditional costing. However, the actual cost calculated using ABC costing shows a margin of 28%. This is because previously too many overhead costs were allocated to Geoffrey dolls. The production of these Geoffrey dolls requires lesser production runs, shipments, and setups than Specialty branded dolls. Under the new costing system, more overhead costs are allocated to the Specialty dolls. Hence, the margin for specialty dolls is 34% under the current system. ABC costing shows that actually the margin is only 3%.

Based on the margins calculated through ABC costing, it is obvious that Geoffrey dolls perform significantly better than the Specialty dolls. Hence, more Geoffrey dolls should be produced by G.G Toys. The production of Specialty toys should be ceased in order to increase profitability. Another way to increase profits would be to only accept large orders for Specialty toys. This is because as production units increase the fixed overheads are spread on more and more units and the unit cost decreases.

4. How should G.G. Toys account for the excess capacity created to produce the holiday reindeer dolls? Qualitatively, how will this impact your calculated cost of the Geoffrey doll and the specialty-branded dolls in question number 2? Explain your method and its impact.

The excess capacity created by the production of holiday reindeer dolls in July, August and September could be used the entire year to produce more Geoffrey dolls and large orders of Specialty dolls. As the production units increase, the fixed cost per unit will fall for these products. Hence, the overall product cost will also fall. G.G Toys will then earn more margin per unit.

Another way to use the excess capacity would be to introduce another kind of dolls and mass produce it so that the fixed costs are lowered. This will ensure that the fixed cost per unit remains low.

Furthermore, the Springfield plant is only used for the production of cradles in the company. The excess capacity in Chicago plant can be used for the production of these cradles and the Springfield plant can be closed down. Hence, the fixed cost related to the Springfield plant will no longer exist. The firm can produce the Geoffrey dolls and cradle both in Chicago plant using the excess capacity. This would save a lot of money off running the Springfield plant.

5. What explains the difference between forecasted and actual revenue for the Chicago plant during March of 2000? What other information would you collect to help explain this difference?

Forecasted revenue is calculated based on historical data and by making budgets to estimates costs and sales. The actual revenue is the revenue that is realized by the firm. The difference between the forecasted and actual income could be explained by the difference in the price of raw material, the labor cost, the quantity of raw material and labor and the expected overhead cost. The forecasted income statements need to be compared with the actual statement to know the actual difference between the two. G.G Toys were supposed to produce 24,900 units, but they produced 24,000 units. Hence, the firm fell short of its production target. This means a lower quantity of raw material and labor would be utilized, and the expected overhead cost per unit will be higher. The forecasted revenue was $765,000. However, the actual revenue was $786,000. This increase in revenue could be due to an increase in the selling price. The selling price in the calculation for the forecasted revenue would be lower than the actual selling price at which the products were sold. Unless expected costs and forecasted selling price are given, the exact reason for the difference cannot be determined.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.