Get instant access to this case solution for only $19

Gemini Electronics Case Solution

Gemini Electronics was an up-start American Electronics company founded by Dr. Frank Wang. Initially, the firm was financed by venture capitalists, but it went public in 2004. The firm faced competition from major Korean and Japanese producers like Sony and Samsung. In 2009, the competitors of Gemini Electronics started to reduce prices. To combat them, Wang proposed to diversify and expand. Sarah McIvor, a junior partner at Price Waterhouse Coopers, was to conduct an independent review on Gemini’s Financial Condition.

Following questions are answered in this case study solution

-

Introduction

-

Income Statement

-

Balance sheet

-

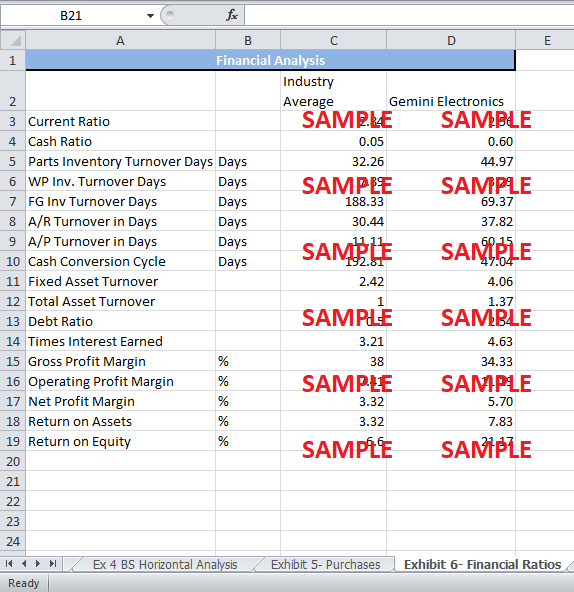

Financial Ratios of Gemini Electronics

-

Conclusion

Case Analysis for Gemini Electronics

2. Income Statement

Vertical Analysis

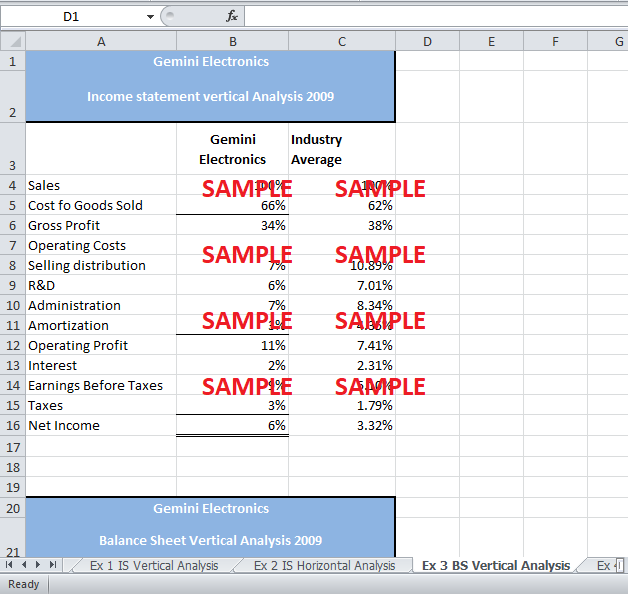

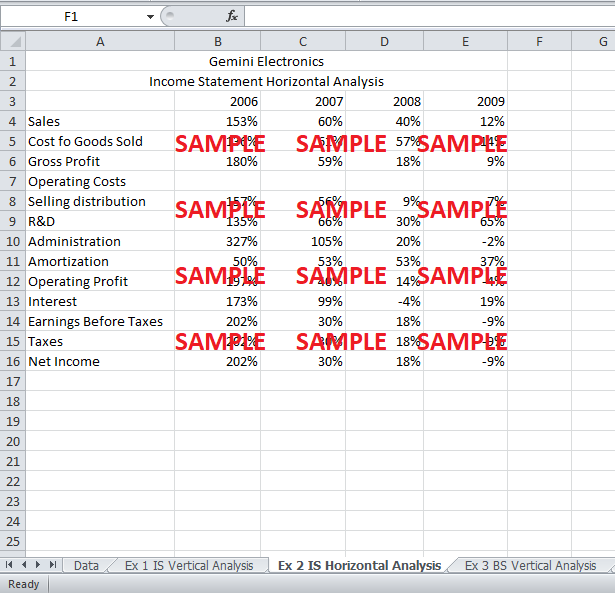

Vertical analysis of Gemini is done for the year 2009 to understand the distribution of revenue and compare it with the industry average. Exhibit 1 shows the vertical analysis of Gemini Electronics’ Income Statement.

The analysis shows that, in 2009, 66% of the revenue is the cost of goods sold. The manufacturing cost of the products is higher by 4% at Gemini compared to the industry average. Wang could make efforts to reduce this manufacturing cost. The manufacturing cost could be reduced by reducing the cost of parts, labors, and overheads. The cost might be higher due to the production in America where the labor costs are higher.

However, Gemini has been able to control the selling and administrative expenses. The selling and administrative expenses at Gemini are 23% of the revenue compared to the industry average of 31%. Therefore, Gemini earns a higher net profit of 6%. This profit is 2.68% higher than the industry average.

The vertical analysis of Gemini shows that Gemini is a profitable firm and is doing considerably better than the competitors.

Horizontal Analysis

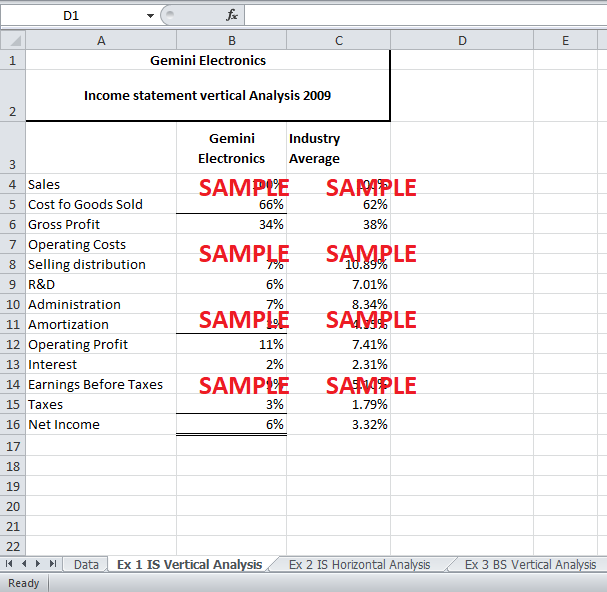

Horizontal analysis of the income statement is also done to determine the changes in the profitability of Gemini over the years. Hence, the percentage change in the income statement items of Gemini Electronics from the year 2006 through 2009 is calculated in Exhibit 2.

The horizontal analysis shows that the sales growth of Gemini has reduced drastically over the years from 153% increase in 2006 to 12% increase in 2009. The fall in sales could be due to the reduced attractiveness of Gemini’s products.

Due to this continuous reduction in the rise of revenue, the cost of sales rises at a decreasing rate. Other costs have also been rising at a decreasing rate. Only the administrative cost has reduced in 2009 by 2%.

The gross profit rose in 2009 by 9%, but the research and development expenses and amortization expenses rose by more than 9%. Consequently, in 2009, the net income decreased by 9% from the previous year.

The horizontal analysis shows that the rise in sales of Gemini has fallen dramatically. The rises in costs are higher than the rise in sales resulting in a fall in net income in 2009 compared to income in 2008. This is a cause of concern for Wang. He will need to develop a new products to boost sales and profits.

3. Balance sheet

Vertical Analysis

The vertical analysis has also been done on the balance sheet to determine the proportion of each asset. Exhibit 3 shows the vertical analysis done on the balance sheet. This vertical analysis is later compared to the industry’s average.

60% of Gemini’s assets are current assets. It is significantly higher than the industry average of 52%. Hence, the fixed assets at Gemini are significantly lower than the industry average. The cash held by Gemini is 14% of the asset while the industry average is 4.54%. Wang could reduce this idle cash by investing it in short term projects to earn a return. The receivable of Gemini is also high at 15%. Wang should make sure that receivables are reduced by reducing the credit period offered to customers. Tighter control over receivable is needed at Gemini.

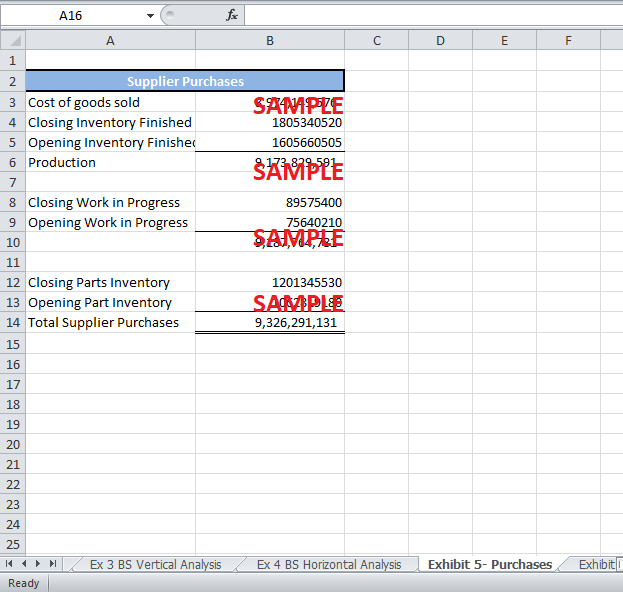

Gemini has a lower inventory of finished goods compared to the industry average. This is beneficial for Gemini as it leads to a lower storage costs of inventory. The reason for lower inventory could be the just-in-time production at Gemini’s plants. The Just-in-time operation discourages inventory accumulation. However, the parts inventory is significantly high at 12% of the assets. Wang should reduce the part inventory and negotiate with suppliers to deliver parts promptly when required. This would reduce the fixed storage costs of the firm.

The vertical analysis shows that the firm is highly leveraged as only 37% of the firm is based on shareholders’ equity. 39% of the assets are financed from long term loans. The current liabilities are 24% of the assets with significantly higher accounts payable at 16%. Wang would need to change his policy about financing the expansion only through debt. This will not be favorable for the firm in the long term.

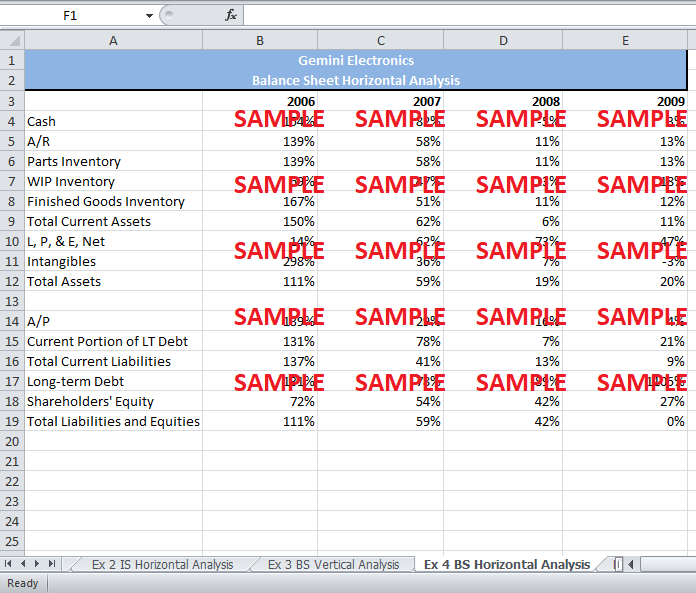

Horizontal Analysis

The horizontal analysis of Gemini is necessary to determine the changes in the financial position of the firm since 2005. The horizontal analysis is shown in Exhibit 4. The horizontal analysis indicated the following:

-

The growth of cash at hand has decreased tremendously since 2005. From 2008 to 2009, cash at hand only grew by 3%. The reason for this could be an investment in new products like Blue Ray DVD.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.