Get instant access to this case solution for only $19

Graybar Syndications Case Solution

Multiple factors may be considered while analyzing and projecting the rental income. At the time of the case, the property occupancy rate is critical since it will directly derive the cash flows from the property. A higher occupancy rate will indicate the effective utilization of the units and investors will be able to gain sufficient cash return. As of Jan 1958, the Graybar building was 99.86% occupied and historical analysis shows that the occupancy rate remained close to 99%. This is a healthy sign of the rental income for the future period since the building may not have to experience opportunity loss on account of vacant units going forward. In addition to the occupancy rate, rent per square feet is also an import driver of existing and future cash flows from the property. Higher per square foot rent which is market competitive as in this case competitive to Grand Central Area would also determine the sustainable and equitable cash flow projections.

Case Analysis for Graybar Syndications

In addition to the said factor’s other elements of successful operations on a current and go-forward basis may include the tax regime. As the existing tax regime allows the investors to take tax credits from depreciation allowance thereby deducting their overall tax liability. Since most of the potential investors in this property fall in the 50% tax bracket thereby tax is an important consideration while comparing it with tax implications of other investment tools both in money market and equity markets. It is also pertinent to mention that the operating expenses including maintenance expenses are also important drivers of the cash flows and rental income. A careful evaluation of the budgeted maintenance expenses required to provide a reasonable living experience to the tenants is also critical for the determination of rental income and cash flows of the property.

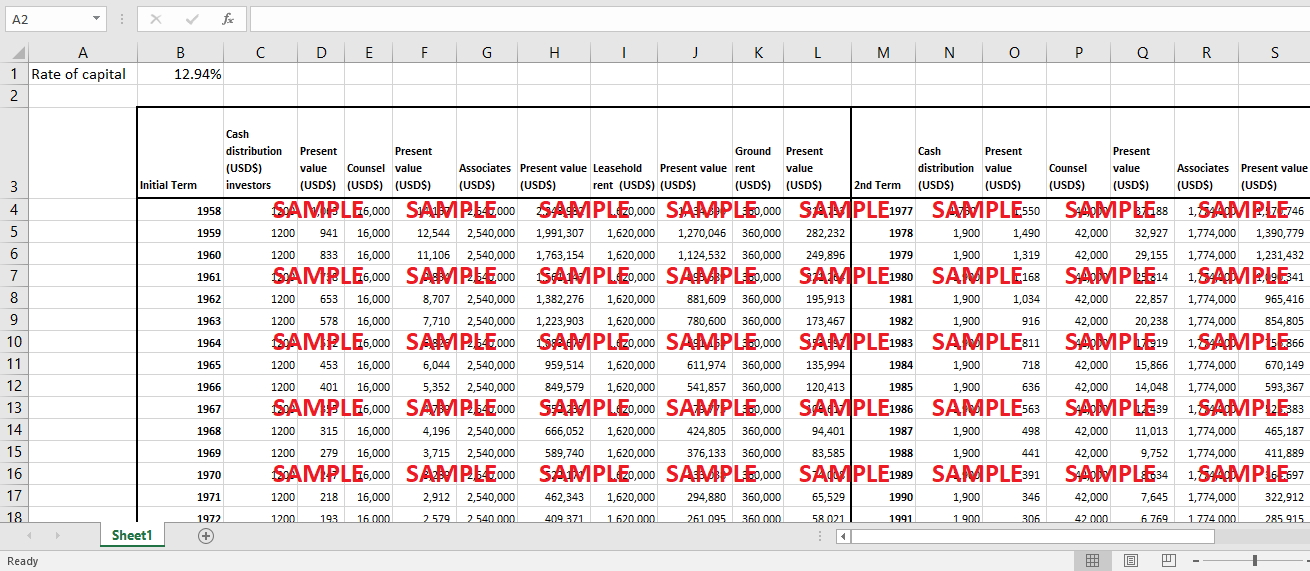

2. The associates which is the partnership concern consisting of Lawrence A. Wien and William F. Purcell will purchase a lease referred to as leasehold from lessor “The Metropolitan Life Insurance” company under a sublease agreement. The subleases will provide payment to associates covering all the rents included in the leasehold, account for administrative expenses. From the payment provided by subleases to the associate, a monthly cash payment of $1,200 per year will be paid to the participants for every $10,000 investment. The sublease is expected to be renewed in 1976, where after the rental cash payment to participants is expected to increase to $1,900 per year. The total rental income to be received by the sublease amounted to $2,540,000 out of which the rent expenses would be paid to the tune of $2,010,000 (consisting of $1,620,000 leasehold rent and $390,000 ground rent) and legal & accounting fee of $26,000. The net receipts of rents would after adjustment of the rent expenses, legal & accounting fee, and before leasehold amortization would amount to $504,000.

Since the association has contributed $2,090,000 and $10,000 each in the leasehold making a total of $4,200,000 in the capital for which suitable financing was availed with the tenor of 18 years and one month at an interest rate of 5.53%. The amortization for the repayment of the financing availed for the capital injection would call for payment to the tune of $232,258. The residual amount of $271,000 is available for allocation to the participants per $10,000 participants. This amount will lead to a $1,200 cash payment to the participants out of which $647 will account for reportable income and $553 will consist of non-taxable return of capital. In case of renewal of the sublease agreement at the end of the initial term, the rent requirement of the sublease and leasehold will change. As per the new rent requirements post-1976, associate rental income will be $1774,000 with rent expense to the tune of $930,000, legal, accounting, and consultant fee amounting to $46,000. Thus, the cash allocation for the participant would be different from the previous contract and would amount to $1,900 under the renewed contract.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.