Get instant access to this case solution for only $19

Hill Country Snack Foods Co Case Solution

Major focus of the Hill Country was on building shareholder value, which was applied, at every level of the organization and in all operating decisions. Company also showed a strong commitment to efficiency and controlling costs. Management also tried to reduce costs even when cost increases were due to external factors. Another major component of company culture was caution and risk aversion, which also explains the current capital structure of the company which avoided debt and investments were funded internally. Growth of the company was low risk and incremental, driven by investments in existing products and acquisition of small companies. As compared to the industry, Hill Country was unique with zero debt finance while other peers obtained the benefits of the debt financing. Many members of the investment community were frustrated by the company’s excess liquidity position and lack of debt finance. In the near future, it is expected that there might be a more aggressive capital structure in the near future and hence here current situation of the company would be evaluated along with three other scenarios with debt in capital structure and optimal debt to capital ratio would be selected for Hill Country.

Following questions are answered in this case study solution

-

Introduction

-

Current Financial Performance

-

Comparison of Financial Performance with the Industry

-

Alternative Capital Structures and Optimal Debt to Capital Ratio

-

Recommendation

Case Analysis for Hill Country Snack Foods Co

2. Current Financial Performance

Company showed strong financial results through the combination of the efficient and low costs operations and all equity financing. It has high cash flow and paid regular dividends. But as the company has huge cash and capital structure without debt, it showed very low returns. Return on Assets and return on equity were quite low due to low returns, high assets and complete reliance on equity. Reduced cash increased debt financing and reduced equity financing can bring great returns. Hence, company is paying huge opportunity cost by having low returns on equity due to current capital structure. Company needs to have an aggressive capital structure by adding debt to its capital structure as this would increase the stock price and market value of the company by sending a positive signal to the market. Hence, shareholder would benefit a lot from this change.

3. Comparison of Financial Performance with the Industry

Competitors of the company carried high debt to capital ratios while Hill Country was totally dependent on equity financing. Both Snyder and PepsiCo, Inc. had very high annual growth rate of sales, in contrast to Hill Country. Net Profit of the company is 7.2%, keeping in view the efficient, and low cost structure while that of Snyder is 2.3% and PepsiCo 9.7%. Return on equity of Pepsi was 30.8% while that of Hill Country was 12.5%. P/E ratio of the both companies was also quite higher than Hill Country. Stock price of PepsiCo is $66.35 per share while the stock price of Hill Country is $41.67 per share. By having, debt structure, share price of the company and P/E ratio would increase due to positive evaluation of the investment community, to make these measures more competitive to PepsiCo and the industry. Return on equity would also increase making it more comparable to the giants in the industry.

4. Alternative Capital Structures and Optimal Debt to Capital Ratio

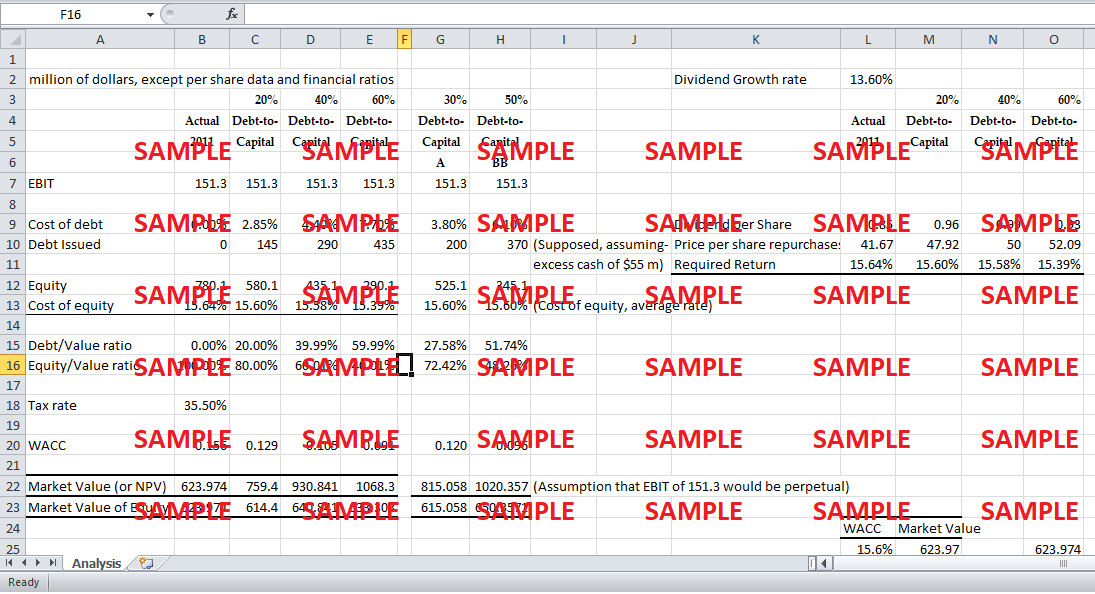

In Exhibit 4, there are Pro Forma Statements for Hill Country based on three different scenarios of Capital structure i.e. 20%, 40%, 60% debt to capital ratio. Earnings per Share in the case of 40% debt is higher than other two scenarios. Dividend per share of $0.99 in this case is also higher than other two cases. High dividend per share indicated that the company shows positive prospects and hence its market value would increase due to high stock prices. Interest coverage ratio of 36.90 in case of 20% Debt to Capital explains that company again has huge liquidity and debt to capital ratio must be increased. In case of 60% debt to capital, interest coverage ratio is 4.52 which show that the company might be in a difficult situation to pay its debt. If we look at the industry interest coverage ratios, interest coverage ratio of Snyder’s Lance, Inc. is 6.67, and that of PepsiCo, Inc. is 11.25. So, interest coverage ratio of 11.82 in case of 40% debt to capital can be optimal.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

- Vivendi Revitalizing A French Conglomerate A Case Solution

- Does IT Payoff Strategies Of Two Banking Giants Case Solution

- TomTom New Competition Everywhere Case Solution

- Sri Lankas Aitken Spence Hotel Holdings Competitive Strategy And Sustainable Tourism Case Solution

- Levendary Cafe The China Challenge Case Solution

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.