Get instant access to this case solution for only $19

India Faces a Power Failure U.S. Financial Service Company Expansion Plans Case Solution

Before moving forward to the questions posed by the case, it is essential to carry out a detailed analysis from various economic and financial perspectives. The key four perspectives are examined below:

For the purpose of this research, the rigidity analysis focuses on the following important factors.

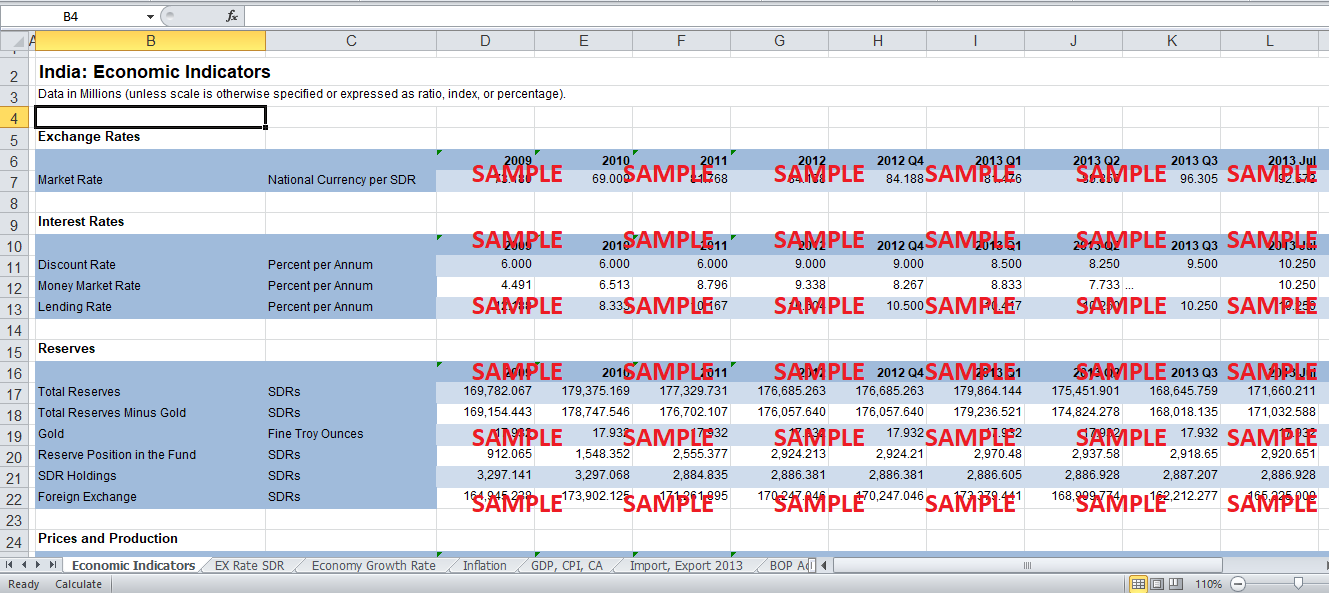

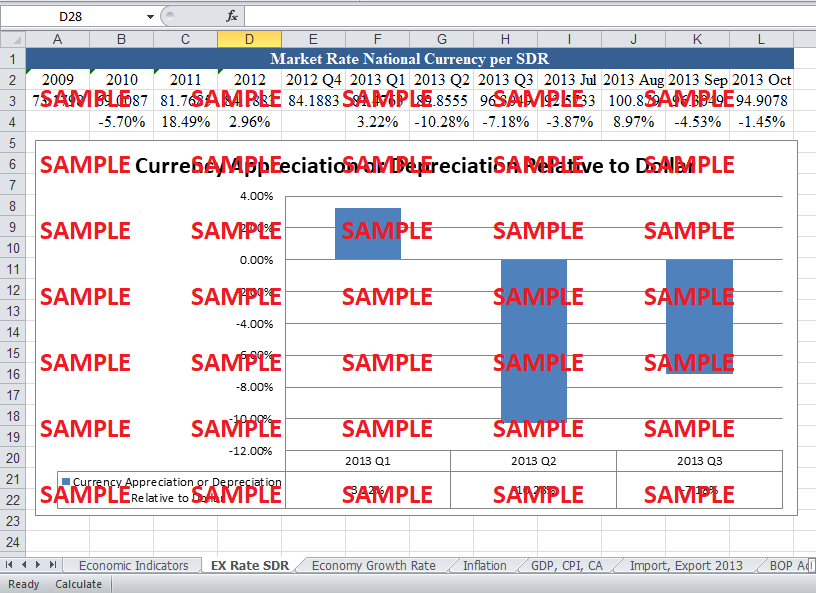

Exchange rates can change over a given time period and, there could be various causes of this currency increase and decrease. However, severe exchange rate fluctuations can affect the level of exports, imports and the current balance accounts along with a possible hike in inflation. The movement of Indian rupee in relation to US dollar for the last three quarters of 2013 is shown in the following figure. The data for the graph is taken from the official website of International Monetary Fund.

Following questions are answered in this case study solution:

-

Introduction

-

Rigidity Analysis

-

Target Setting

-

Monetary and Fiscal Policy

-

Management Decision Table

-

Short Term Crisis Analysis

-

Investment Decision

-

Production Decision

-

References

India Faces a Power Failure U S Financial Service Company Expansion Plans Case Analysis

With the exception of the first quarter, the average quarterly exchange rates show that the Indian Rupee is depreciating with respect to US Dollar.

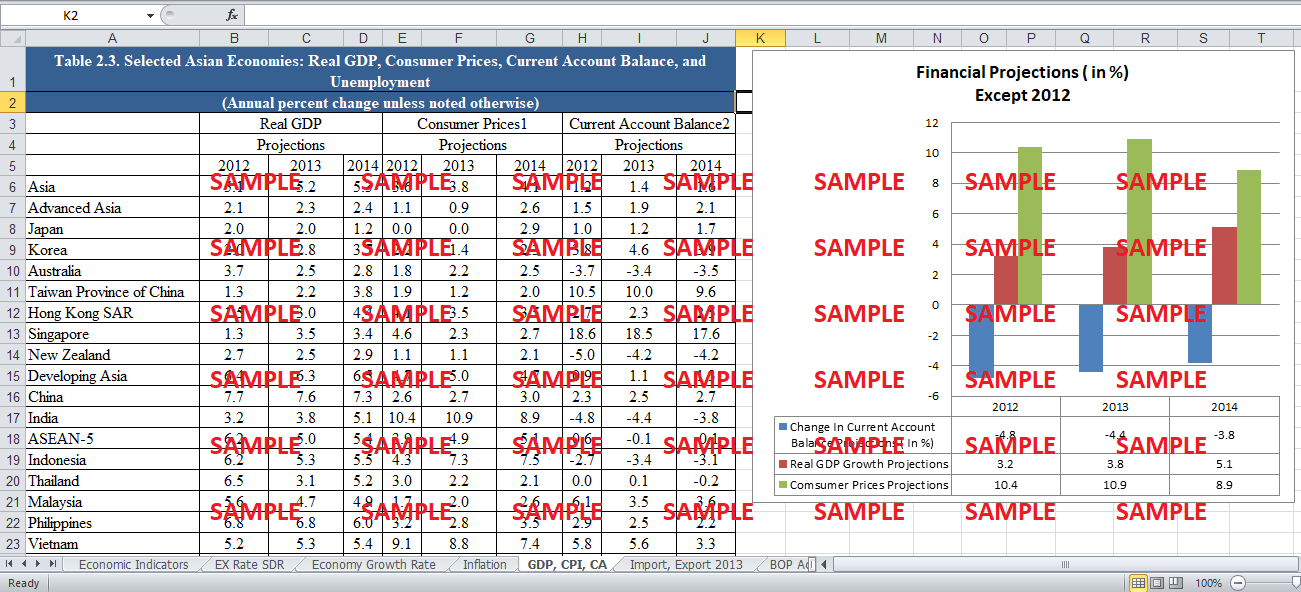

Consumer Price Index and Inflation

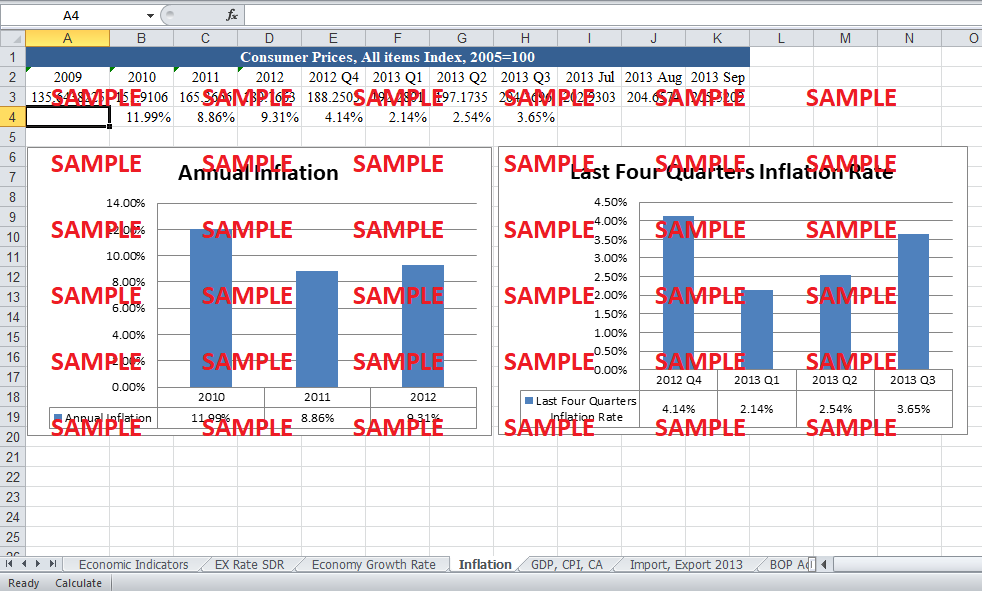

The inflation figures are derived from the annual or quarterly consumer price index. In the current calculations, the base year is assumed to be 2005. The inflation rate of India for last three years is shown below. The inflation figures of India are relatively quite high. From the perspective of the importance of ‘recency’, the inflation rates of last four quarters are also shown below (International Monetary Fund, 2011).

For the year 2013, the quarterly inflation rates clearly depict an increasing trend.

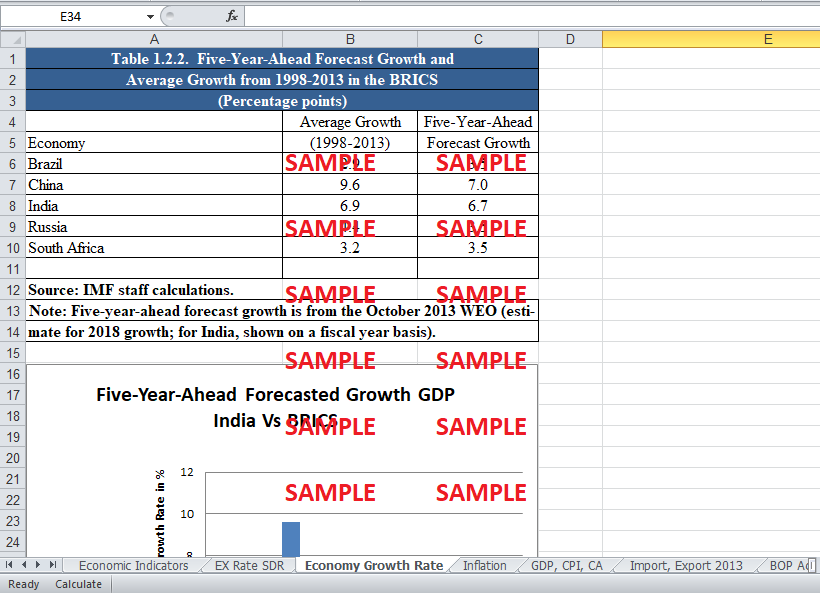

National Economic Growth

The economic growth of a country is also crucial in the determination of a success of a business. India is a member of BRICS countries. IMF has projected an average growth rate of 6.7% for the coming five years. There is a decrease of 0.2% from the average growth rate of the last five years.

The analysts of IMF are of the view that the Indian economy will suffer a slight decrease in its growth.

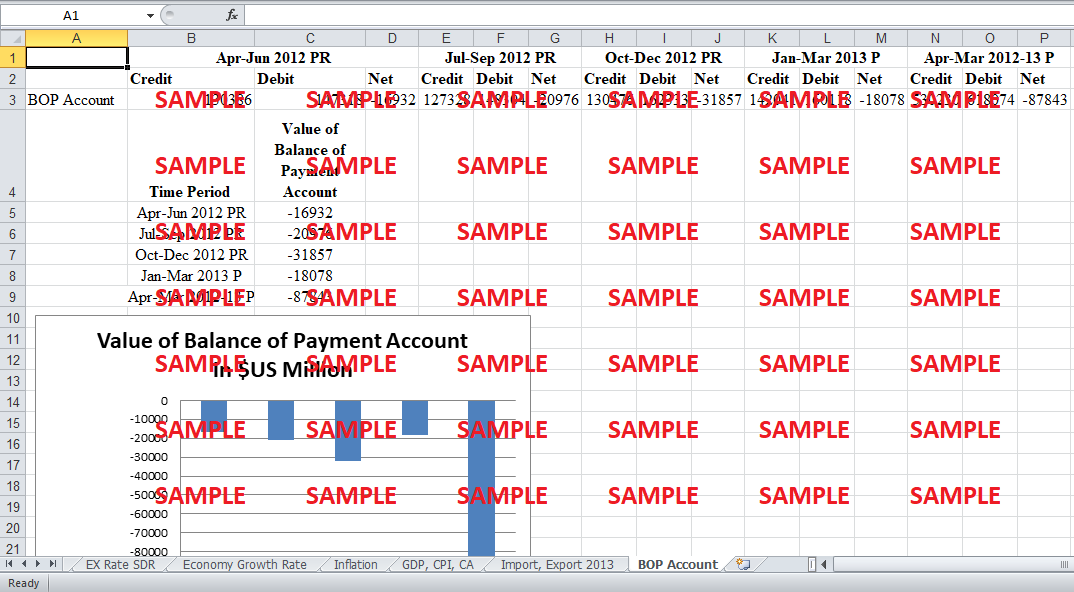

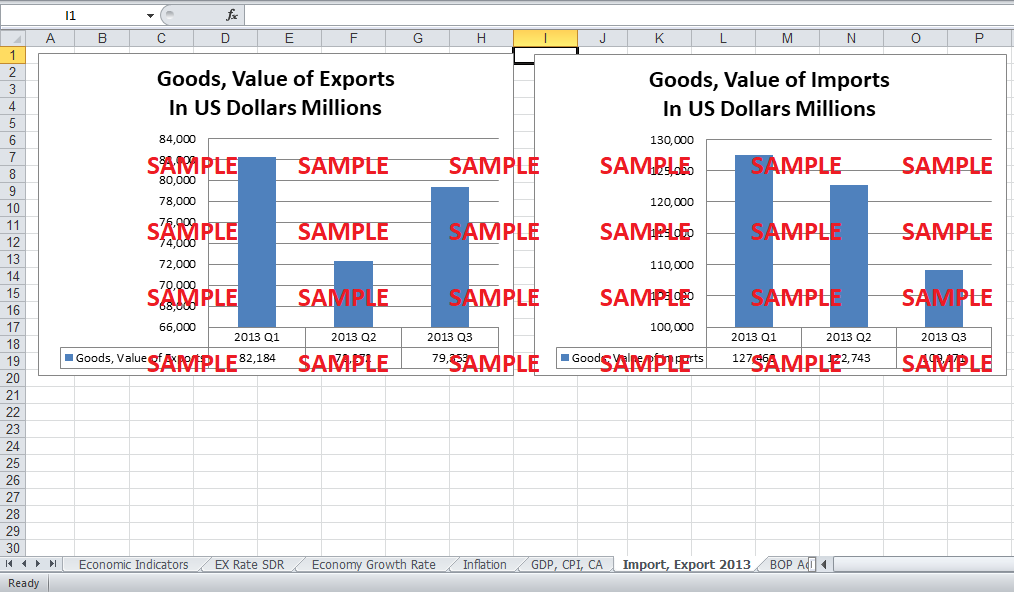

Import and Export Analysis

The monetary value of import and export of any country is crucial in many ways. Firstly, the value of import or export can affect the economic variables like the exchange rate and inflation because of their ability to increase or decrease the currency demand (Beck, 2002). The values of imports and exports of India are shown in the following graphs.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.