Get instant access to this case solution for only $19

Lynchburg Foundry The Ductile Dilemma Case Solution

Anything that can negatively impact the profitability of a company is included in its business risk. Lynx faces many different types of business risks. It operates in many different countries hence it is exposed to political risk. The clothing industry is a highly regulated industry due to which regulatory risk is also an issue for lynx. The Licensing Agreement with NIKE has expired and is in the process of renegotiation. Also, Lynx faces major financial risk because if it loses NIKE its revenue will significantly go down. Financial risk is further enhanced by the presence of cheaper foreign market of Singapore and Korea. Trade infringement issue with another competitor has created reputational risk for Lynx.

Following questions are answered in this case study solution:

-

Investigate the clothing manufacturing industry (also retail clothing sales industry) and prepare a financial analysis on Lynx Clothing Company and the industry.

-

Identify the key audit risk areas based on your financial analysis and other information provided in the case. Why are they at risk?

-

What specific audit procedures would you recommend to address those audit risk areas?

-

What other information do you need from management at this meeting in addition to the information already provided and why do you need it?

-

There is no statement of cash flows included-is this a problem?

-

Are there any business risks which you can identify

-

What additional steps or inquiries should you make before accepting this engagement?

-

Would you accept this engagement?

Case Study Questions Answers

1. Investigate the clothing manufacturing industry (also retail clothing sales industry) and prepare a financial analysis on Lynx Clothing Company and the industry.

Applying Porter five forces to clothing manufacturing suggests that barrier to entry for new entrants is high as the capital requirement is huge and product differentiation needs to be there in order attract customers. Supplier bargaining power is high as the product being supplied is unique and undifferentiated. Competition among existing participants is very high, and profit margins are very low. Buyers are strong because there are numerous sellers and cost of switching is very low. The threat of substitute is also high as there are many alternative products that will satisfy consumer needs.

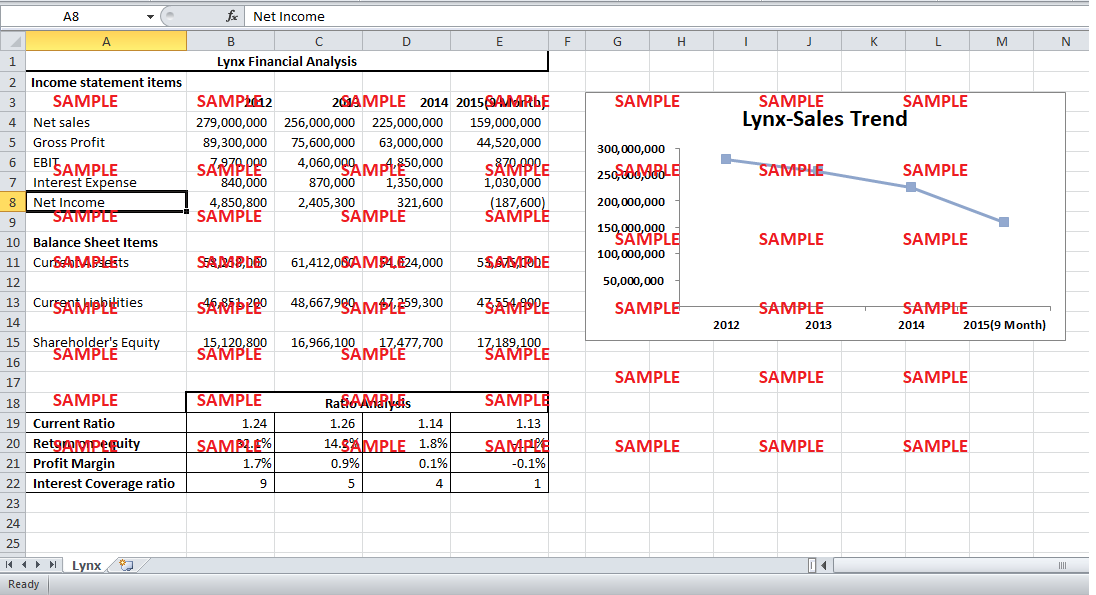

Financial analysis of Lynx clothing suggests that its performance is deteriorating every passing year. Revenue numbers show a declining trend (Exhibit 1), and sales have decreased by 19% during 2012-2014. Profit margins have also shrunk and as per 9 Month data of 2015, Lynx is making a loss resulting in negative profit ratios. Current ratio as of now is above 1, which suggests that company will meet its short term obligations, but it’s also showing a downward trend. Same can be observed regarding Interest coverage. The company’s debt increased significantly in 2014, but that additional capital has not resulted in increased revenue that is an alarming sign. Lynx needs to have a major turnaround in performance if it wants to remain as a going concern entity.

2. Identify the key audit risk areas based on your financial analysis and other information provided in the case. Why are they at risk?

-

Lynx sells its products to almost all the internationals markets and also has a foreign subsidiary in the United Kingdom which means it has to translate the revenue denominated in foreign currency. Audit risk, in this case, is that revenue maybe mistranslated if incorrect translation approach or exchange rates are used. Also, no information in the case suggests that Lynx is hedging exchange risk hence it is also exposed to exchange losses.

-

The risk of “first appointment” also exists as the firm will be conducting an audit of Lynx for the first time. Opening balances of the company maybe misstated and lack of firm’s knowledge about the company may result in a failure to identify events and transactions that impact lynx’s financial statements.

-

Lynx is in an infringement issue with another company, and this is a high level audit risk. It may result in deteriorating reputation that will adversely impact customer goodwill.

3. What specific audit procedures would you recommend to address those audit risk areas?

-

In order to address the risk of mistranslation, re-performance of sample foreign currency translation needs to be done. Exchange rates used in translation should also be checked for accuracy and appropriateness.

-

Procedures need to done to check if opening balances are properly brought forward, and corresponding amounts are correctly classified and disclosed. Inspect previous auditor’s working papers and read the most recent financial statements and auditor’s report thereon.

-

Review all documents related to infringement issue and asses the level of impact and consequences it will have on the business and its future operations.

4. What other information do you need from management at this meeting in addition to the information already provided and why do you need it?

Management should provide the following in addition to information already provided:

-

Detailed Business Plan of the company along with relevant computations and assumptions. This will tell if audit risk will remain same or fluctuate in future years or not.

-

Copies of internal audit reports issued during the period need to be shared to check what are the existing issues related to internal controls and how serious management has been in resolving those issues.

-

Lynx should share details of any non-compliance notices received from regulators. Such issues can have serious repercussions such as suspension of operations and auditors should be aware of them.

-

Management letter containing observations from outgoing auditors should also be shared, and this will also help the firm to gauge the attitude of management towards addressing those observations.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.