Get instant access to this case solution for only $19

MSDI – Alcala de Henares, Spain Case Solution

Merck & Co. is a multinational pharmaceutical company that has many subsidiaries operating in different countries. Alcala de Henares, Spain operates a subsidiary factory that provides a drug to the local population. The company is contemplating to buy new equipment for this factory. This equipment is used to handle a production process that involves filling with the drug and checking the glass containers for possible defects. The new equipment costs 61.525 million Pts, and it is important to evaluate if this investment will be useful for the company. Financial evaluation leads us to believe that the new equipment results in considerable cost savings in comparison to the old equipment and also benefits the company with the provision of greater depreciation tax shield. After consideration of exchange rate changes and the resulting change in the NPV of the investment, it is determined that this investment is valuable for the company.

Following questions are answered in this case study solution

-

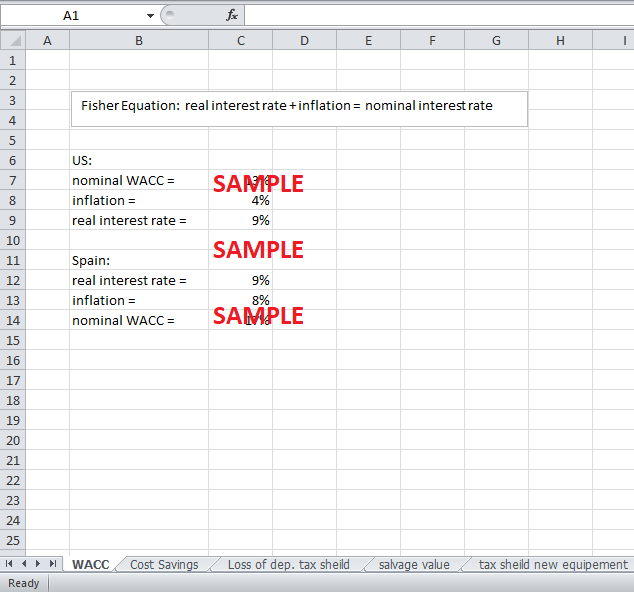

Assuming that the U.S. inflation rate is expected to be a constant 4% in the US (8% in Spain )and the U.S. nominal WACC is 13%, use the International Fisher Effect (real interest rates are the same in all countries at any one time) to calculate the Spanish nominal WACC.

-

Calculate the cash flow from the after-tax cost savings from the new equipment in years 1-10 (from exhibit 2 in the case).

-

Calculate the cash flow from the loss of the depreciation tax shield of the old equipment.

-

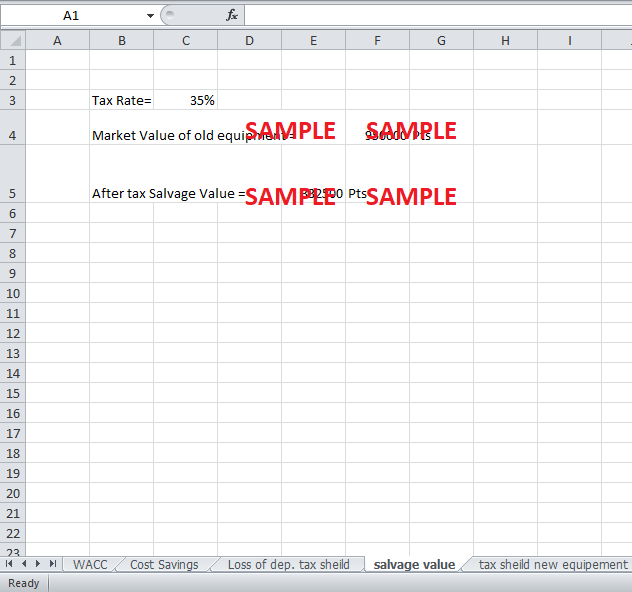

Calculate the after-tax salvage value of the old equipment 5. Calculate the depreciation tax shield from the new equipment.

-

Calculate the NPV (in pesetas) of this project.

-

Using Relative Purchasing Power Parity, determine the expected exchange rate for each of the next ten years.

-

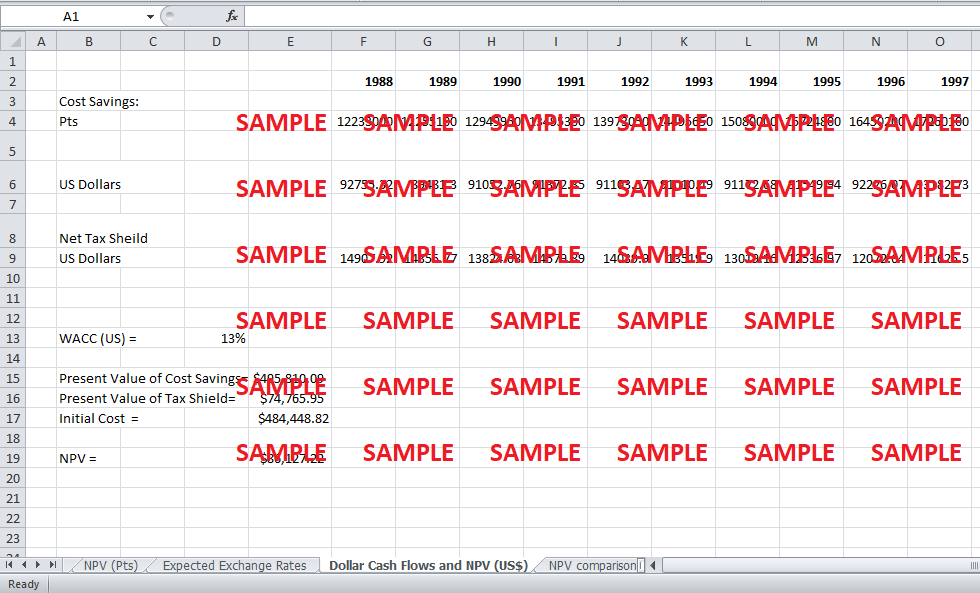

Calculate the dollar cash flows based on the exchange rates you came up with.

-

Calculate the NPV (in dollars) of this project.

-

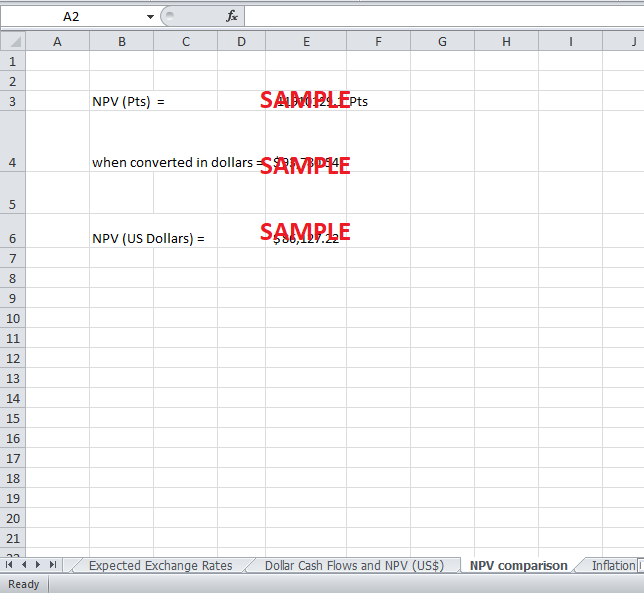

Look at the NPVs you calculated in pesetas and in dollars. Look at the current peseta/dollar exchange rate. Based on this exchange rate, is one NPV higher than the other, or are they both the same? How do you interpret these results?

-

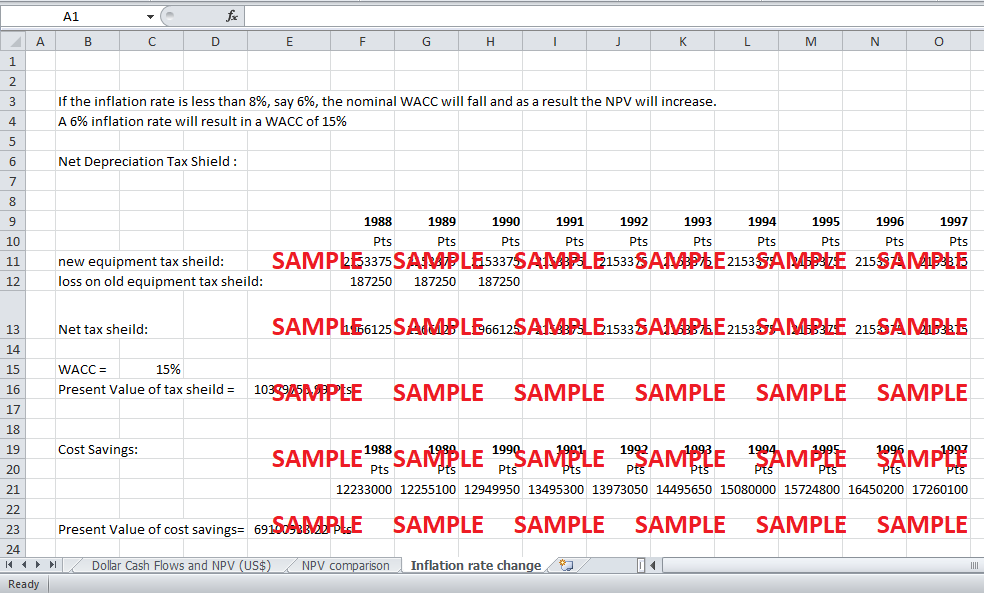

How sensitive is the NPV of the new equipment to changes in the peseta/dollar exchange rate? What happens to the NPV if Spanish inflation is assumed to be less than 8% per year (assume that expected dollar inflation remains at 4% per year) 4) Should Merck headquarters approve the equipment purchase

Case Analysis for MSDI – Alcala de Henares, Spain

1. Assuming that the U.S. inflation rate is expected to be a constant 4% in the US (8% in Spain) and the U.S. nominal WACC is 13%, use the International Fisher Effect (real interest rates are the same in all countries at any one time) to calculate the Spanish nominal WACC.

The International Fisher Effect supports the theory that at a particular time, countries have the same real interest rates. It is also known that the nominal WACC is made up of the real interest rate plus inflation. Subtracting the WACC of the US (13%) from the inflation rate that prevails in there (8%), the real WACC can be determined, which is 9%. According to the International Fisher Effect, it is known that this 9% is also the real WACC in Spain. Adding Spain’s inflation (8%) to this will give the nominal WACC of Spain, which comes to 17%.

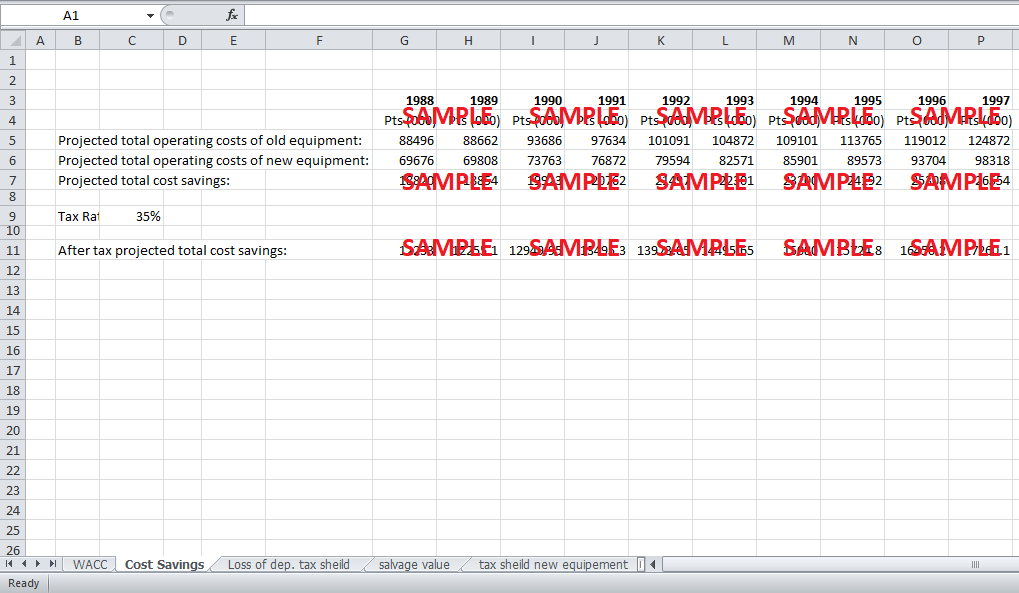

2. Calculate the cash flow from the after-tax cost savings from the new equipment in years 1-10 (from Exhibit 2 in the case).

The cash flows from cost savings yielded can be calculated by subtracting the total costs of operating with the new equipment from the total costs of operating with the old equipment. The respective costs have been given in exhibit 2. The cost savings are then subjected to the Spanish tax rate of 35%. Calculations (Excel file) show that the use of new equipment results in cost savings each year for the next ten years.

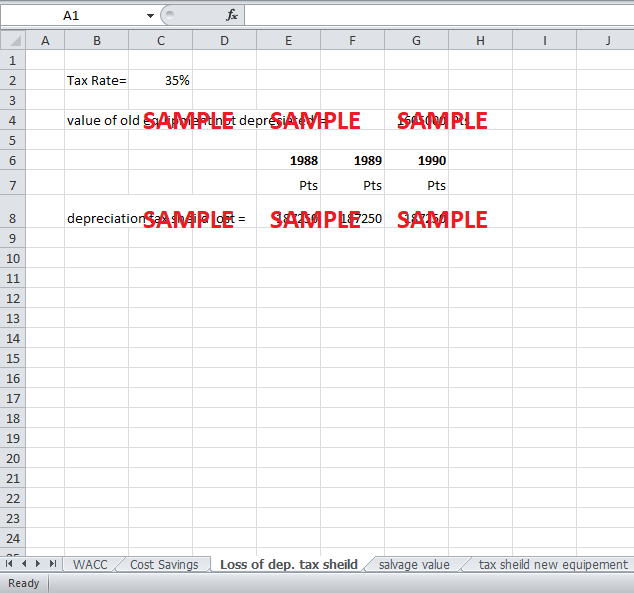

3. Calculate the cash flow from the loss of the depreciation tax shield of the old equipment.

It is known that the old equipment has three years of useful life left, which means that it currently has a book value that is to be depreciated for three more years before going nil. The current book value of Pts 1605000 can be divided into three equal parts to determine the depreciation for the next three years since the straight-line method of depreciation is used. After calculating the depreciation for each of the next years, the amount of depreciation should be multiplied by the tax rate (35%) to determine the tax shield that this depreciation would provide. Since it is being contemplated that the old equipment is sold, these values of tax shields will be a loss to the company, as they will be forgone.

4. Calculate the after-tax salvage value of the old equipment 5. Calculate the depreciation tax shield from the new equipment.

The after-tax salvage value of the old equipment is the market value of the equipment, after deducting the tax. Applying the 35% tax on the 950000 pesetas market value gives the salvage of 332500 pesetas.

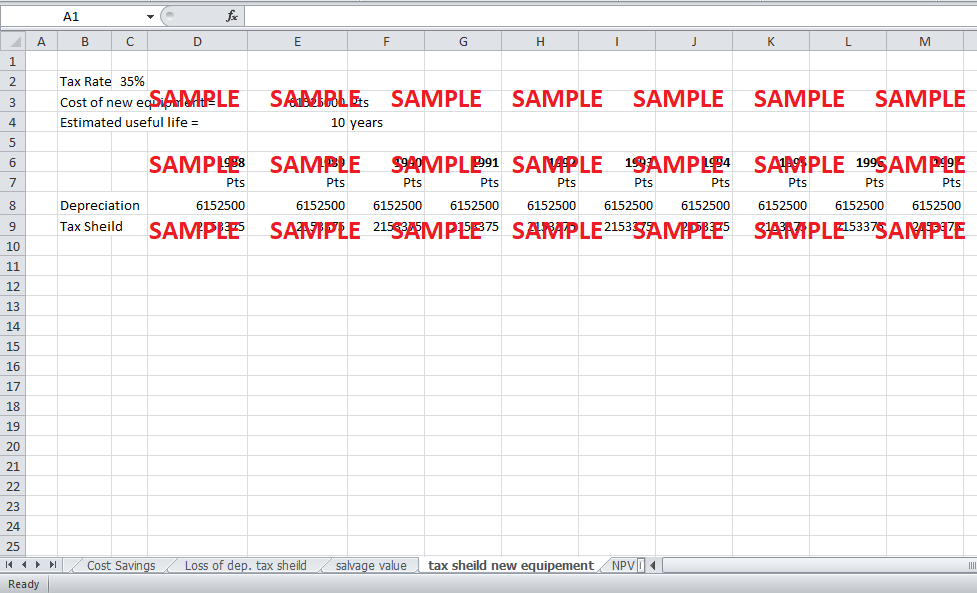

The cost of the new equipment is given as Pts 61525000, and it is estimated that the new equipment will have a useful life of 10 years. Using the straight-line depreciation method we can calculate the annual depreciation to be equal to Pts 6152500. Using the 35% tax rate, the annual depreciation tax shield is calculated to be Pts 2153375.

5. Calculate the NPV (in pesetas) of this project.

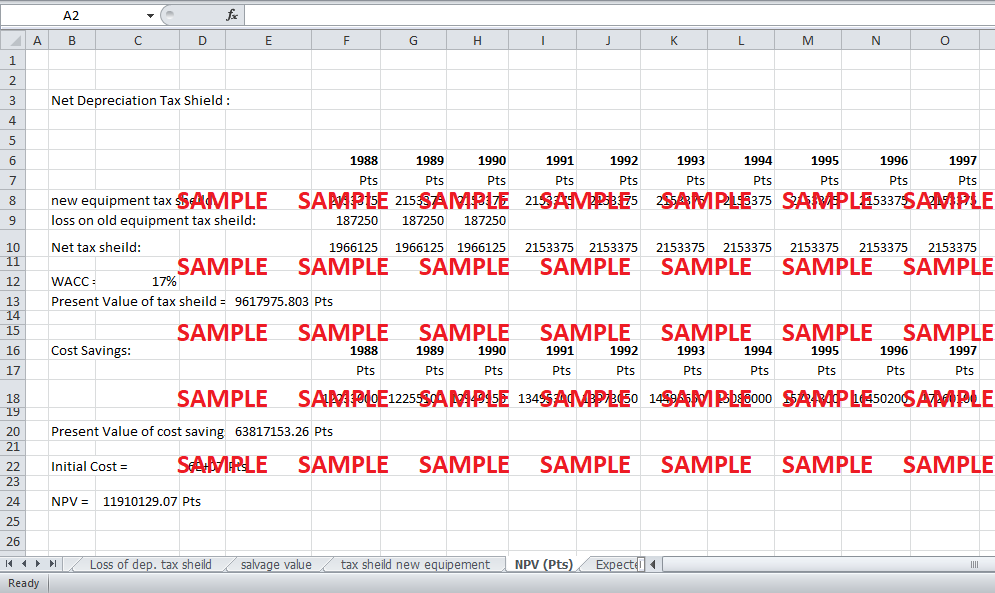

In the calculation of the net present value, the cash flows from the tax shield gained from the depreciation of the new equipment and the cash inflows provided by the cost savings have to be discounted to the current period. The only complication being that the old equipment is being replaced with the new machinery. This makes it important to calculate the net tax shield from depreciation. Also, note that the old machinery could only provide 3 more years of the tax benefit from depreciation compared to 10 years of tax benefits provided by the depreciation of the new equipment. Discounting cash flows of the tax shield yields the value of 9617976 pesetas, while the discounted cash flows of the costs saved equals to 63817153 pesetas. Summing up these two values and then subtracting from it the initial cost of the new equipment, Pts 61525000, results in the NPV of 11910129 pesetas.

6. Using Relative Purchasing Power Parity, determine the expected exchange rate for each of the next ten years.

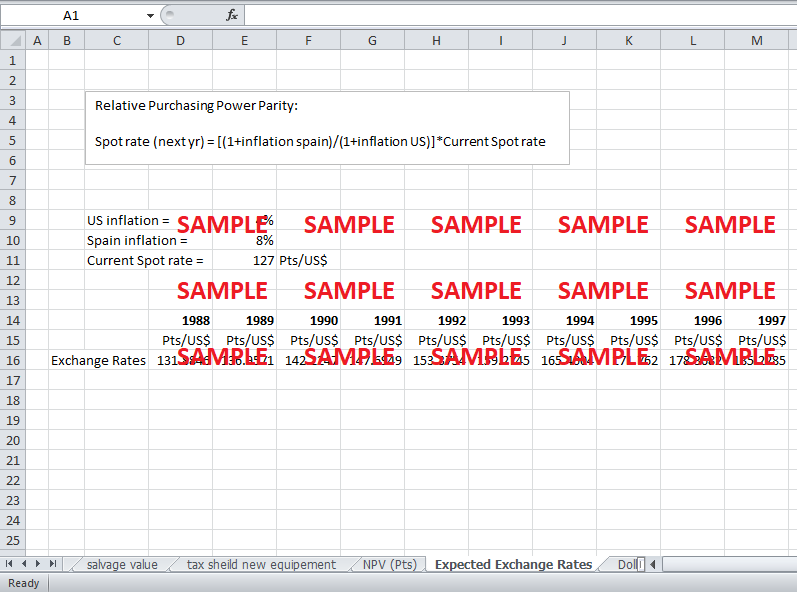

The relative purchasing power parity helps to show the interconnectedness of the exchange rate and the level of inflation between two different countries. It can be used to calculate the expected spot rates of the years ahead. The following formula can be used to do the calculations required by this question:

Spot rate (next year) = [(1 + inflation Spain) / (1 + inflation US)] * Current Spot rate

Information given in the case study includes the Spanish inflation rate (8%), the US inflation rate (4%), and the current spot rate of 127 Pts/US$. Using these values and the formula of the Relative Purchasing Power Parity, the spot rates for each of the next ten years have been calculated.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.