Get instant access to this case solution for only $19

Murphy Stores Capital Projects Case Solution

The case talks about the Murphy Stores company, which had to decide between two options of where they should invest $ 7 million of funds. The company has identified the options of investing in hardware and EAS to reduce the number of robberies within their stores or to invest the same money in improving the lightning and the visibility within all their retail stores. Using various financial tools, for instance, IRR, NPV, etc. The option is chosen amongst the available ones, where the company should invest in hardware and EAS. However, it is important to understand the management that although the projects would yield positive financial results but are these in line with the management’s objectives and what are the underlying hypothesis being used? Furthermore, it is important that there lies a lot of uncertainty in the EAS project because of numerous assumptions and estimations, which cannot give an accurate picture of the figures calculated.

Following questions are answered in this case study solution:

-

Provide the synopsis of the case and state the issue(s).

-

Describe the two investment opportunities and why each of them has appeal for Murphy Stores.

-

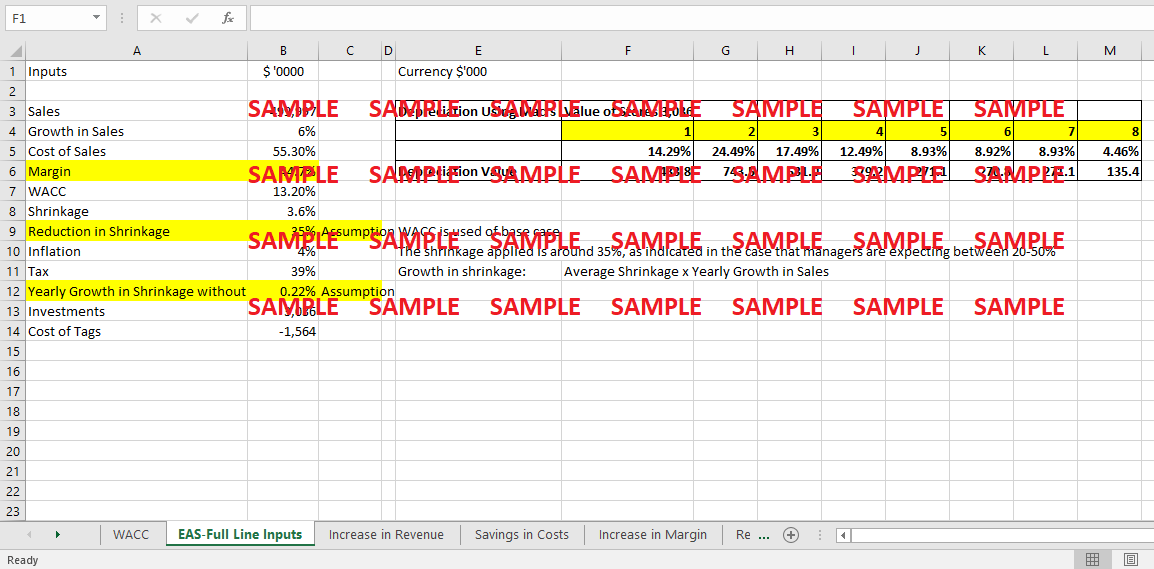

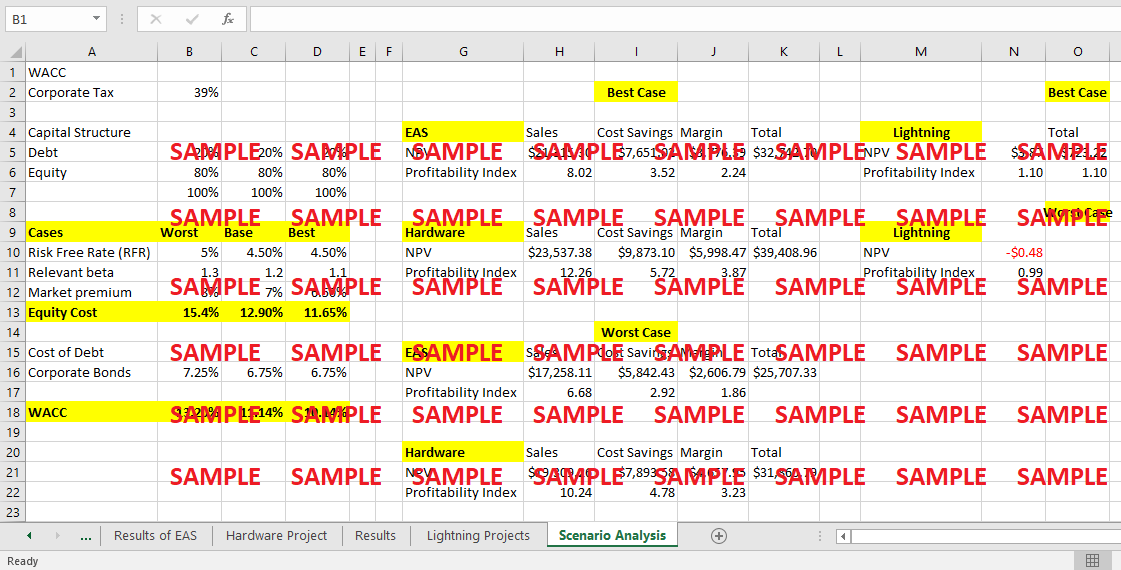

Calculate the WACC for Murphy Stores and compare it with the 12 % assumption the company made for project submissions.

-

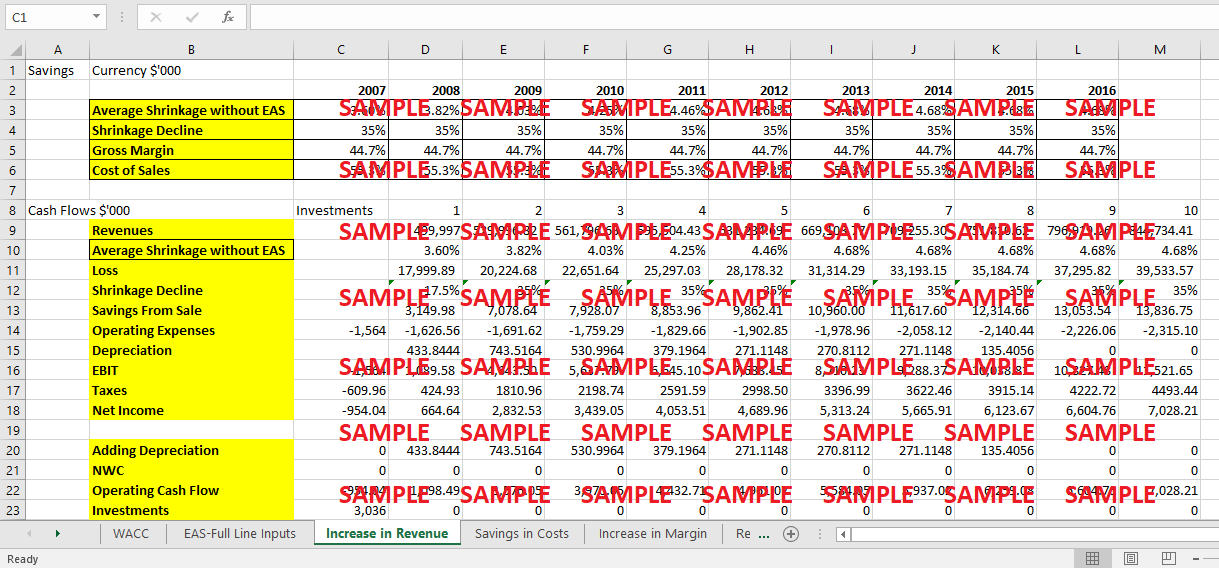

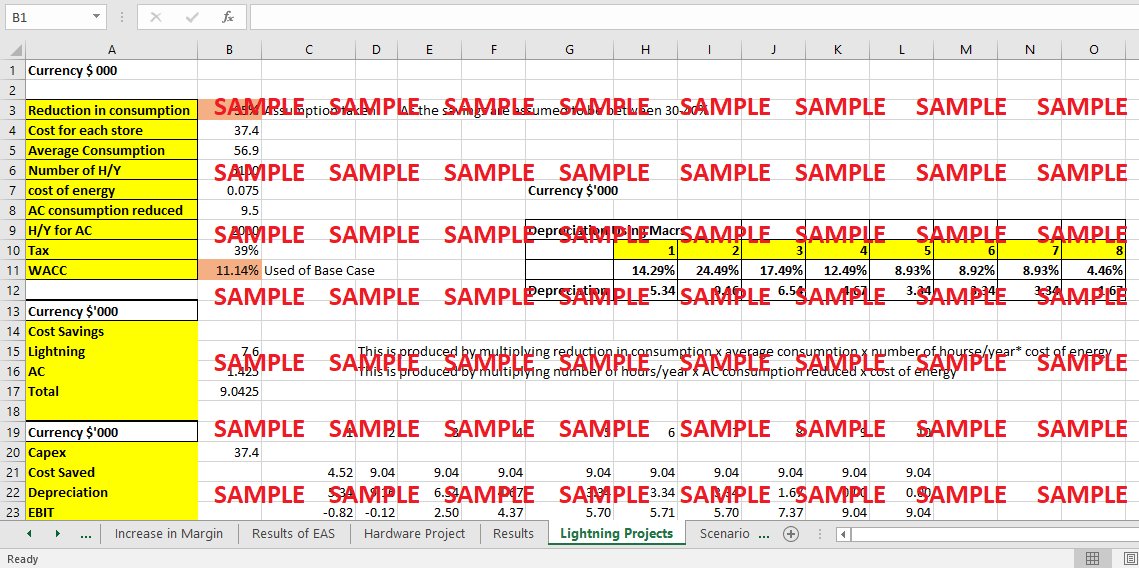

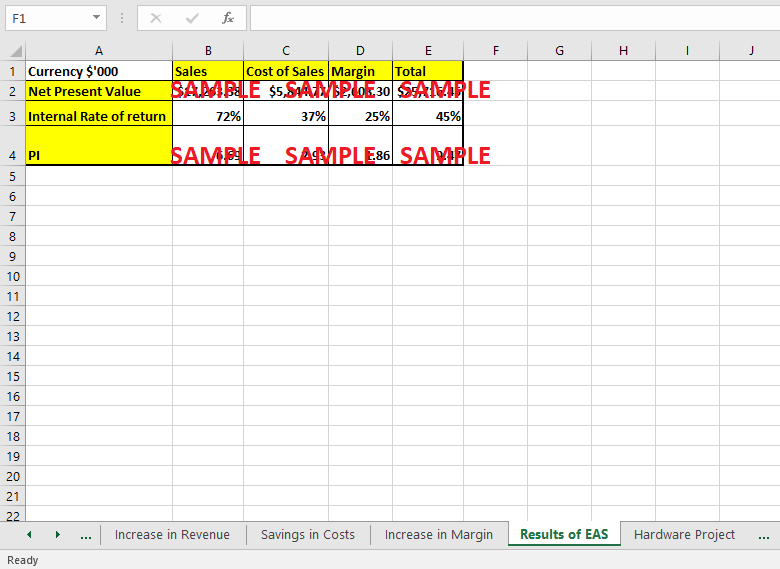

Evaluate the two EAS projects and the lighting proposal. Prepare and interpret a project analysis that includes NPV, IRR and Profitability Index calculations, as a starting point, you should assume

• that investments must be made upfront (at t = 0),

• you can evaluate the cash flows at the end of each year with a 10-year horizon)

• that only six months of benefits occur in year 1, because your investment is at t= 0

• is installed in the first 6 months of year 1

-

What are the key value drivers for each project? What are the major risks or uncertainties that you are concerned about for these projects?

-

From your analysis, prepare and discuss best and worst case scenarios for the projects.

-

What do you recommend that Murphy do?

Case Study Questions Answers

1. Provide the synopsis of the case and state the issue(s).

The main issue here for the Murphy Stores is what set of assumptions and estimations the company would incorporate, as any erroneous application would directly impact the profitability of the investment opportunities where the $7 million would be invested. Apart from the quantitative factors, it is vital that the stakeholders also inculcate the non-quantitative impacts in order to better realize whether these projects would be meeting the company’s future objectives and missions of sustainability and whether they are in line with the company’s values, which it endorses. The questions below further discuss the detailed opportunities and weaknesses of both of the available options in which Murphy Stores could invest their money and which would be the most suitable for their operations in the current scenario. The case mainly describes the thorough financial aspects of both prospects in terms of the WACC that the company has estimated and the costs related to these projects. These projects are then further analysed through various financial avenues. i.e., Net Present Value (NPV), Internal rate of return (IRR), and the profitability index and also carried out scenario analysis to better comprehend the prospects from a wide financial perspective. Apart from that, comprehensive risks and uncertainties are discussed, which are the non-quantitative characteristics deemed necessary for the final decision-making. And is concluded with recommendations for Murphy Stores to be successful at the end by ensuring that all of the risks are discussed and covered, to make sure that the fears involved are better catered to.

2. Describe the two investment opportunities and why each of them has appeal for Murphy Stores.

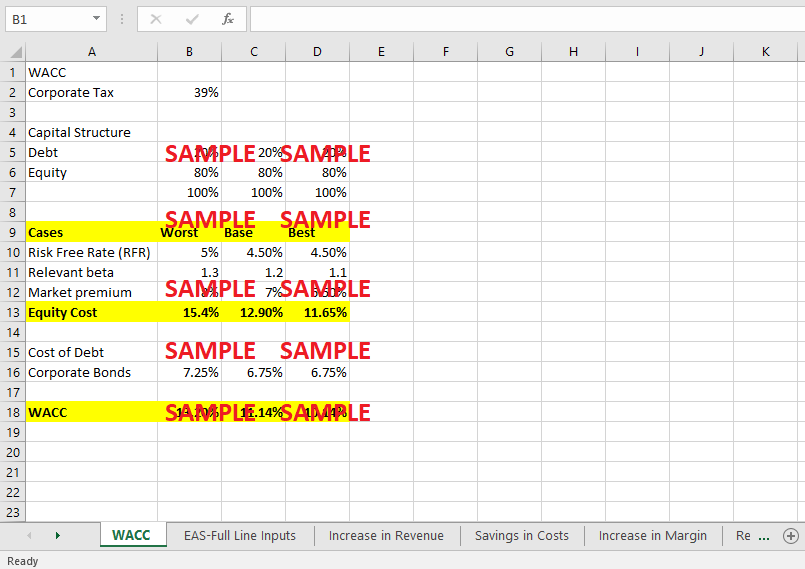

The company has around $ 7 million, which it has to invest, and according to the case, there are two investment opportunities available, which the finance manager of the company is evaluating. One of the projects is to invest in “Electronic Article Surveillance (EAS)”; this would be an advanced technology that would result in minimizing the number of burglaries from their retail outlets, which has recently become quite a big challenge for Murphy Stores to control. And with the implementation of this robust technology, the company would be able to enjoy several advantages. For instance, there will be better revenue in terms of “differential sales”, and the company would be able to save a substantial amount in terms of its “cost of sales” involved and, resultantly, would enjoy improved gross profits.

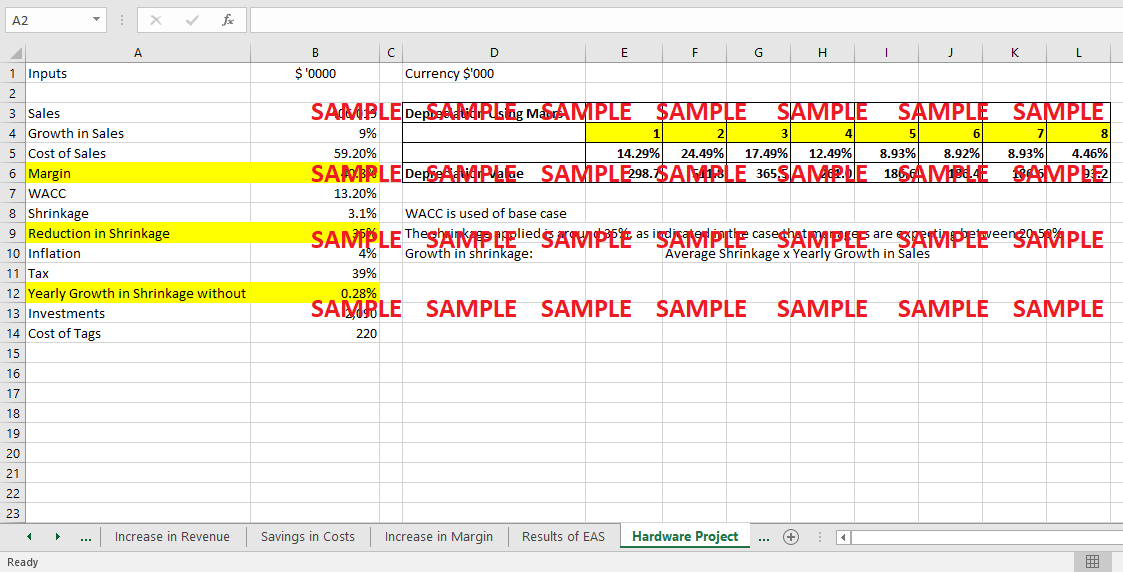

Secondly, the company has another option to invest its $ 7 million, and this is where the amount will be used for cost savings by installing “energy efficient lighting” in all of its warehouses and outlets involved. As a result, the demand for lighting resources would reduce by almost “30-40%”, and obviously would improve the visibility in the stores and warehouses and also reduce the consumption of the air conditioning installed, which are the major expenses comprising the total energy costs of the company. Furthermore, since the company has objectives, endorses energy conservation, and has multiple sustainability goals, implementing such technology will allow Murphy Stores to support the abovementioned objectives.

Both options are equally important and feasible and support the objectives of the Murphy Stores. However, it is important that the finance manager is able to carefully analyse strong financial numbers and also some of the non-quantitative factors that would be more fruitful in the longer time and be more sustainable for the company. As the money ($ 7 million) is a much big amount, and if not invested wisely currently, then this could have serious consequences for the company in the longer term, as the cost of energy and also the costs from the burglaries in their retail outlets are both major issues that company is currently facing.

3. Calculate the WACC for Murphy Stores and compare it with the 12 % assumption the company made for project submissions.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.