Get instant access to this case solution for only $19

Netflix Continues To Change The Face Of In Home Movies Around The Globe Case Solution

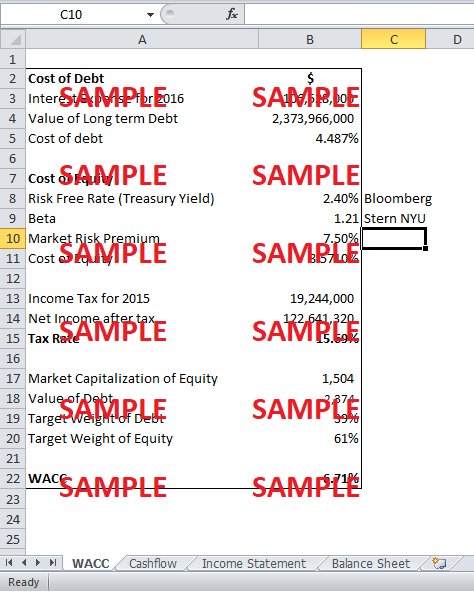

The cost of capital for Netflix is calculated by using the cost of debt and cost of equity. The cost of debt is calculated using the current interest expense of the company for September 2016. It is then divided by the value of long term debt.

Case Analysis for Netflix Continues To Change The Face Of In Home Movies Around The Globe

The cost of debt comes out to be 4.487%. The cost of equity calculation is done through capital asset pricing model. The risk-free rate used is the 12 months rate on US Treasury Bonds which is 2.4% (Bloomberg, 2016). As the Netflix is an entertainment oriented company.

Therefore, the average beta of the entertainment industry is used as an approximate estimate for Netflix. The beta is 1.21 for this sector (Stern NYU, 2016). The market risk premium used is 7.5% which Netflix requires from the market. This prudent rate is assumed but can be varied. The cost of equity comes out to be 8.57%. The value of debt and equity is reported in Table 1 to calculate the weights of debt and equity. The value of debt is the value of long term debt as at September 2016.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.