Get instant access to this case solution for only $19

New Earth Minning Inc Case Solution

New Earth Mining Company is a growing mining and extraction company, which deals in only gold. However, because of such a non-diversified portfolio of operations, the company faces a lot of commodity price fluctuation risk. In order to diversify its portfolio, the company is looking to invest in an iron ore mining and extraction project, in South Africa. In order to determine the project’s viability, the company must determine the investment cash flow expectations and an appropriate risk-adjusted discount factor. This discount factor must take into account the elements in which the mining activities will be conducted and the implications of the financing deal made with different parties.

Following questions are answered in this case study solution

-

Introduction

-

The Project

-

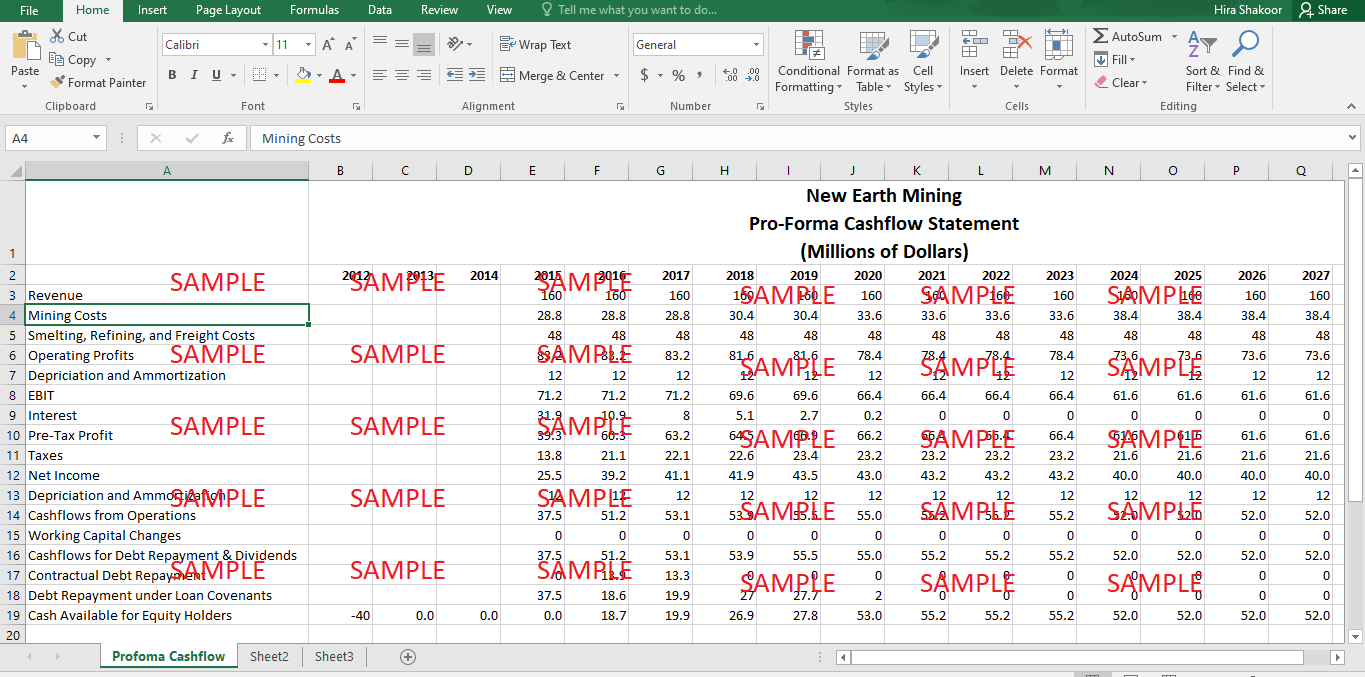

Pro Forma Cash Flow

-

Cost of Capital or Discount Factor

-

Conclusion

Case Analysis for New Earth Minning Inc

1. Introduction

New Earth Mining Company is a precious metal mining and extraction company that deals in gold. With operations in over three continents, the company is growing at an impressive rate. The company does, however, face one problem, and that is too much exposure to the gold price fluctuations. Since the company only deals in gold extraction, the commodity’s price in the open market directly impacts its financial position. Therefore, in order to diversify this risk, the company’s management has decided to add another extractions project to its portfolio. For this purpose, it is looking at the Iron Ore reserves in South Africa. The company, however, has to decide whether or not the project will be worth the additional investment. To this end, there are two questions at hand; one is what will be the projected cash flow from the mines, and second is what will be the most appropriate cost of capital for the project?

2. The Project

Gold is a commodity product whose price depends entirely on the supply and demand in the market. It is possible for the price to fall below the cost of extraction as companies compete to capture the maximum amount of market. Therefore, the revenue aspect for any gold mining company is very uncertain and varied, which impacts overall profitability even though operational costs remain unchanged. To counter this problem, New Earth Mining Company wishes to add another commodity to its portfolio. Iron Ore has been suggested as a possible candidate for this purpose. Iron Ore is used as the base material for the production of steel, which is the most consumed metal in the world. With consistently increasing demand expected for the foreseeable future, steel (and therefore iron ore) is expected to be in short supply till 2016. As a result, iron ore prices have consistently been increasing over the past decade (exhibit 2), and are expected to continue to increase. This makes iron ore an excellent commodity to diversify in as it has the potential to take some of the profitability variation off of the company’s financial statements.

The company has selected an Iron Ore mine located in Sishen, South Africa. The mine contains an estimated 30 million tons of iron ore with iron content of 60%. The large quantity of iron ore deposit means that the mine can sustain continued mining operations for at least 15 years. Also, the high quality of the ore imply lower processing costs with higher product yield, which will keep operational costs on the lower side. The location is also advantageous because it requires very little infrastructure development. The presence of other mining operations, in the area, mean that the necessary transportation network and other facilities have already been laid out. The area provides ease of access to ports as well, therefore, making transportation for export purposes relatively cheaper.

As already mentioned, the demand for iron ore is high in the market. New Earth Mining Company has already been able to seek out potential buyers based in China, Japan, and South Korea, who agree on purchasing the mine’s output. The potential buyers have also ensured of continuing the purchase of the mine’s output for a long term period.

The investment does, however, pose its unique risks, as well. The foremost risk is the political and economic stability of the region. The political system was unstable, and government policies completely unpredictable. There was always the looming threat that the government would nationalize all natural resources, leaving the private companies to fend for themselves. High corruption is also a concern since facilitating payments, and bribery are a common practice in the region.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.