Get instant access to this case solution for only $19

Ocean Drilling Inc Case Solution

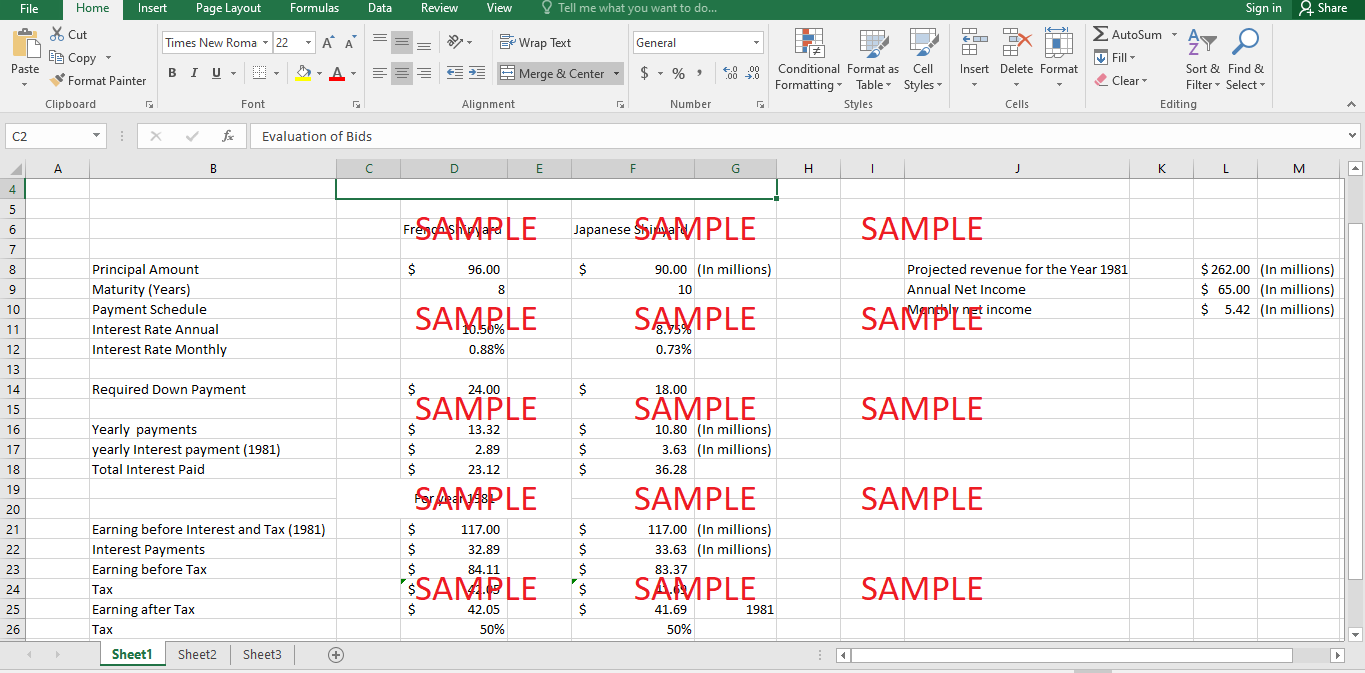

Ocean Drilling Inc. was a US based leading company in offshore industry, which was used as outsource by various other companies for drilling related projects. Now Ocean Drilling had to purchase two semisubmersibles drilling rigs, but due to lack of government featured loans. It had to choose between the two foreign bids, one was from Japanese shipyard for $90 Million and the other one was from French shipyard for $96 Million. These bids held great risk in them due to fluctuating exchange rates, as being in the foreign currencies.

Case Analysis for Ocean Drilling Inc

Mr. Moore was given the responsibility of making a choice between the two bids by weighting them. He had two possibilities to make decision for choice. Either to sell the US dollars in French or Japanese forward market or to borrow in US at 20% and then convert it to Francs or yen. Now in order to make an efficient decision, both these bids have to be evaluated.

In order to evaluate both the bids we have to weigh the cost of debt. How much Ocean Drilling Inc. has to pay for these bids and also the risk pertaining in every bid.

|

|

Evaluation of Bids |

||||

|

|

|||||

|

|

|||||

|

|

|

|

|

|

|

|

|

|

French Shipyard |

|

Japanese Shipyard |

|

|

|

|

|

|

|

|

|

Principal Amount |

|

$96.00 |

|

$90.00 |

(In millions) |

|

Maturity (Years) |

|

8 |

|

10 |

|

|

Payment Schedule |

|

|

|

|

|

|

Interest Rate Annual |

|

10.50% |

|

8.75% |

|

|

Interest Rate Monthly |

|

0.88% |

|

0.73% |

|

|

|

|

|

|

|

|

|

Required Down Payment |

|

$24.00 |

|

$18.00 |

|

|

|

|

|

|

|

|

|

Yearly payments |

|

$13.32 |

|

$10.80 |

(In millions) |

|

yearly Interest payment (1981) |

|

$2.89 |

|

$3.63 |

(In millions) |

|

Total Interest Paid |

|

$23.12 |

|

$36.28 |

|

|

|

For year 1981 |

|

|

||

|

|

|

|

|||

|

Earnings before Interest and Tax (1981) |

|

$117.00 |

|

$117.00 |

(In millions) |

|

Interest Payments |

|

$32.89 |

|

$33.63 |

(In millions) |

|

Earnings before Tax |

|

$84.11 |

|

$83.37 |

|

|

Tax |

|

$42.05 |

|

$41.69 |

|

|

Earnings after Tax |

|

$42.05 |

|

$41.69 |

1981 |

|

Tax |

|

50% |

|

50% |

|

|

After-Tax Cost of Debt |

|

42% |

|

44% |

|

Moore should also have to consider the Down Payment which the company has to pay at the start. According to the Financial Statement of Ocean Drilling, it has $8 million in cash at the end of the year 1980, but it has to make Down payment of $24 Millions if accept French Bid or $18 Million if accept Japanese Bid. In order to pay the amount, the company has to sell some of the assets as it can’t go for another loan.

By keeping under consideration, all the calculations like that of cost of Debt, Interest Payments and the Net Income after satisfying the tax.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.