Get instant access to this case solution for only $19

OptiGuard Inc Series A Round Term Sheet Case Solution

To summarize the case, it can see that WVPs do not really possess knowledge or any appropriate experience in the domain of technology, so the only way that the entrepreneur, Mannix, could actually leverage or make use of this situation is by negotiating on the governing rights. And this should mainly be done by asking WVPs to reduce or diminish the voting rights that were originally held by them. And overall, it is a good offer by WVPs, and it should be accepted by the company, as it was discussed in the case that Optiguard is quite weak in the industry and is not really in a solid position to actually negotiate in terms of financial aspects. However, if Mannix is able to play smart and is able to indicate what kind of capability he has and is able to make use of those capabilities, which are basically the administrative and general administration of the company, then this is the area where he would be able to better excel and be successful, as compared to the domain where he does not really have great understanding.

Following questions are answered in this case study solution

-

How attractive is the company to potential investors?

-

Does this term sheet favor MANNIX or the VC Investor?

-

If you were MANNIS, would you accept the offer as proposed, or attempt to negotiate terms of the offer? Which adjustments would you make?

-

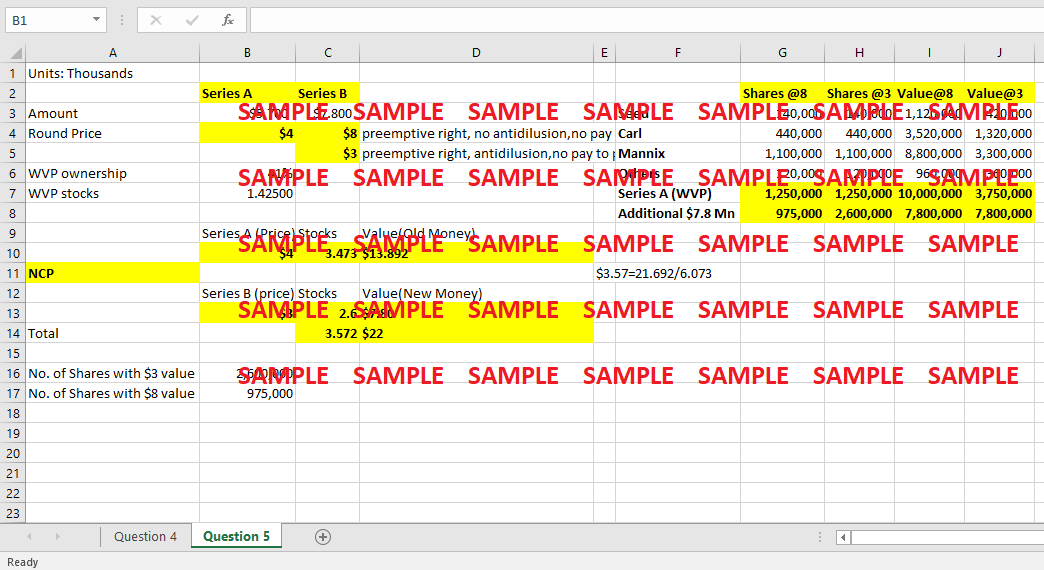

Before the Series A round, what is Optiguards POST MONEY Value? AFTER the Series A round, what is the Pre and Post money value if the offer is accepted as Proposed?

-

What are the implications of WVP if another investor offers to provide OptiGuard an additional $7.8 million in equity after the Series A round at a price of $8.00/share? $3.00/Share?

Case Analysis for OptiGuard Inc Series A Round Term Sheet

1. How attractive is the company to potential investors?

It can be observed from the information available that the company is not that attractive to the investors, as specified in the case. The company experienced that number of “Series A” fundings had substantially expanded in the cybersecurity sector, which in the year 2010 was around 42 but then upsurged to 161 in just a span of five years. Thus, there had been an increase in the amount of capital, which in the year 2010 was around USD 163 Million and rose to USD 652 Million within the next five years. However, the company tried to market itself to prospective investors, and they went to almost 25 capitalists, but none of them were interested in investing in the company and simply did not find the idea of investing in Optiguard interesting. And the primary reason for the lack of investment from these individuals was that the executive leadership did not have adequate experience in enterprising. Secondly, in the network safety industry, there had been a substantial increase in recent years, making the market more competitive, and also, already established companies had created a "niche" industry, thus for Optiguard, there was only a limited market share to capture and sell their products. And these well-established corporations already had an adequate share in the industry, and it was tough for a company like Optiguard to establish itself in a limited time period. And that also means that the company will only be able to promote or market its products to a few and limited customer base, and that may restrict its potential for growth opportunities.

2. Does this term sheet favor MANNIX or the VC Investor?

The term sheet favors both Mannix and the VC investor in different ways. It is pertinent to fully understand the term sheet and how it affects both the entrepreneur and the venture capitalists as well. The term sheet tends to benefit the parties in dissimilar ways, and it should categorize the whole system into four broad groups, specifically, "control attributes”, “liquidation”, “benefits provided to management," and “miscellaneous.”

Control Attributes: When discussing "antidilution provisions”, these tend to provide positive results for the investors because the “conversion price” of the preferred will require some sought of alteration due to a number of reasons, which are mainly: A) share dividends and splits and some other related proceedings. B) In order to stop the dilution in the circumstance where Optiguard issues extra stocks at a value lesser than the relevant "conversion price". The other positive aspect for the shareholders involved would be the "redemption" of the stocks. At the time when the holders would be elected of the preferred shareholding, Optiguard should repossess the preference stocks using three equivalent payments starting six years from the day of acquisition of stock, which would be paid using hard cash, equivalent to the value of the "original purchase price" including any formally asserted but unpaid stock dividends.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.