Get instant access to this case solution for only $19

Rob Evans Case Solution

Kevin and Alex is a couple in their forties. They have a variety of assets and liabilities as well as multiple sources of Income. They also expect more expenses, as well as, income in the future. They are, however, facing cash flow problems. Therefore, it is critical to analyze their financial position and cash flows and then propose a course of action.

Following questions are answered in this case study solution

-

Introduction

-

Financial Position

-

Problem

-

Financial Goals

-

Available Options

-

Recommended Action

-

Conclusion

Case Analysis for Rob Evans

2. Financial Position

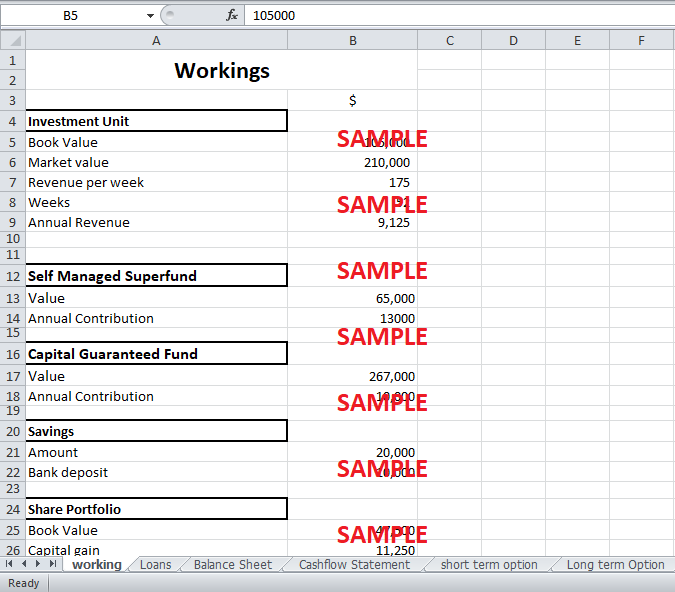

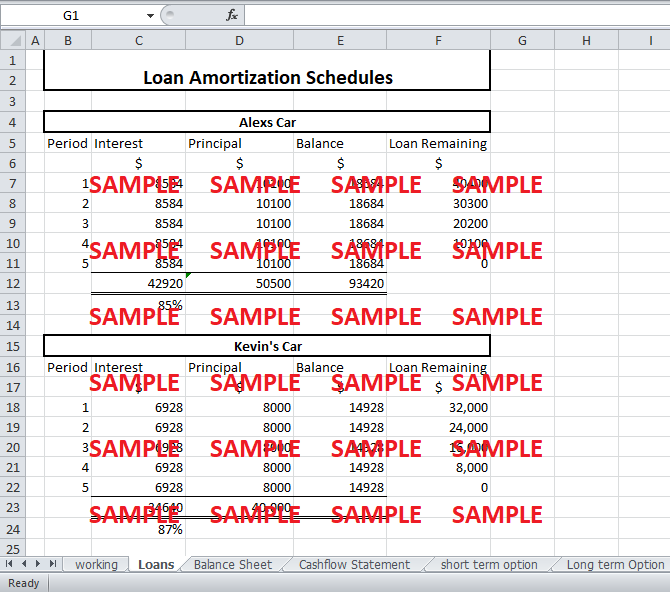

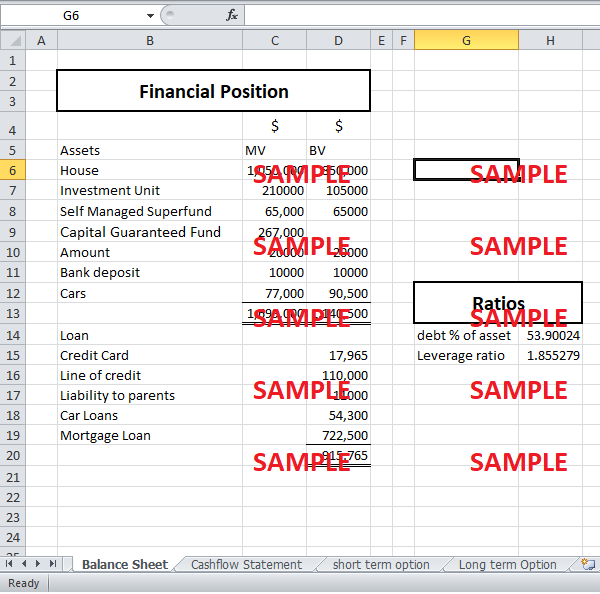

Kevin and Alex have a variety of assets. These include their House, cars, investment units, self managed funds, savings account and bank deposit. The assets totaled to about 1.1 million with a total market value of 1.4 million. The liabilities include the loans for Cars, House Mortgage, Parents loan and credit card liability. Assuming that the mortgage was 0.85 million dollars at a rate of 7.75 %, the liabilities total to around $ 0.92 million. This shows that debt financed 53 percent of the assets. The asset debt ratio is 1.85 which shows that the risk of solvency is low as debt can easily be covered with the assets.

3. Problem

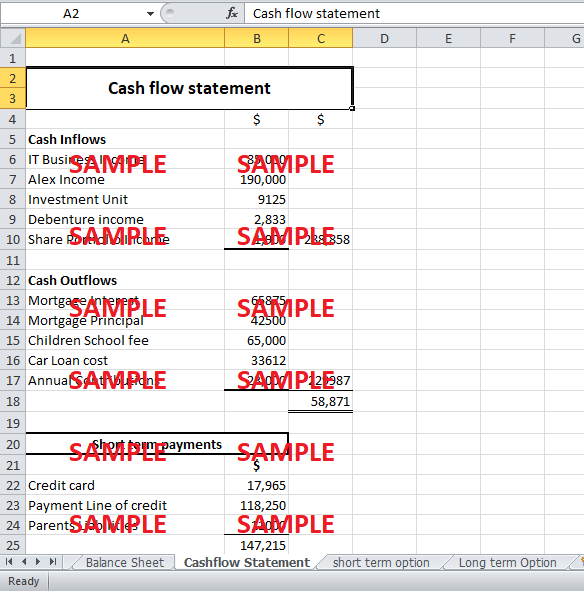

The Cash flow throughout the year is the core problem. The cash inflows are generated by income of Alex and Kevin and the income from the investment unit, debenture and share portfolio. The substantial cash outflows are payments of mortgage interest and principal, car loan interest and principal, children school fee and Annual contributions made to funds. The net cash flow is, therefore, about $ 58,871.

Other payments of short term liabilities will have to be made for Credit card and line of credit. Also, as Alex’s parents are going through financial difficulties, they will require the money Alex owes them soon. This means a payment totaling $147,215 will have to be made in the near future. Moreover, Taxes and household expenses, like food, cleaning and clothing, will also have to be paid. These expenses will be higher than usual considering that Kevin’s brother is staying at his house and not contributing to the household expenses. Kevin and Alex clearly do not have enough cash to pay off these debts and expenses. Therefore, they will require cash in the near future.

The cash inflows are expected to increase as Kevin’s father is executing his will. This might result into additional property or asset which earns revenue. On the other hand, on execution of the will, Kevin will have to arrange for his father’s debts to be paid. This might result into an additional liability for Kevin. Alex also expects a bonus of $ 20,000, but she might contribute this amount to her superannuation fund. The household expenses will also reduce as Kevin’s brother buys his own property and moves out.

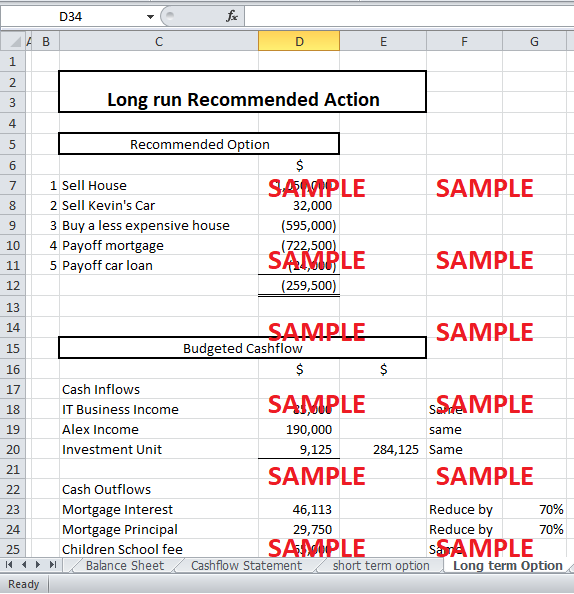

4. Financial Goals

After examining Kevin and Alex’s financial state, it is obvious that their first priority should be to generate enough cash to pay off the short term liabilities i.e. payment to creditors and Alex’s payments. Therefore, their financial goal for now should be to generate $ 147,215. The couple would at least have to accumulate an amount equal to the minimum payment requirement of its creditors. If their payments increase due to execution of his father’s will, the couple must revise their goal to changing their lifestyles by selling the cars and house and shifting to a smaller house. On the other hand, if Kevin inherits from his father, he will be able to maintain his lifestyle provided he manage his cash flows well.

5. Available Options

Following are the options available to Alex and Kevin if they want to increase their net cash flow:

-

Sell the Share Portfolio.

-

Sell Investment Unit.

-

Sell the both cars.

-

Sell the house and buy a less expensive house.

-

Alex does not contribute her bonus to the superannuation fund and use it to make payments.

-

Draw on the savings account.

-

Borrow money i.e. loan money to pay off short term debt.

-

Utilize Kevin’s Self managed Superfund.

-

Utilize Alex superannuation Capital Guaranteed Fund.

6. Recommended Action

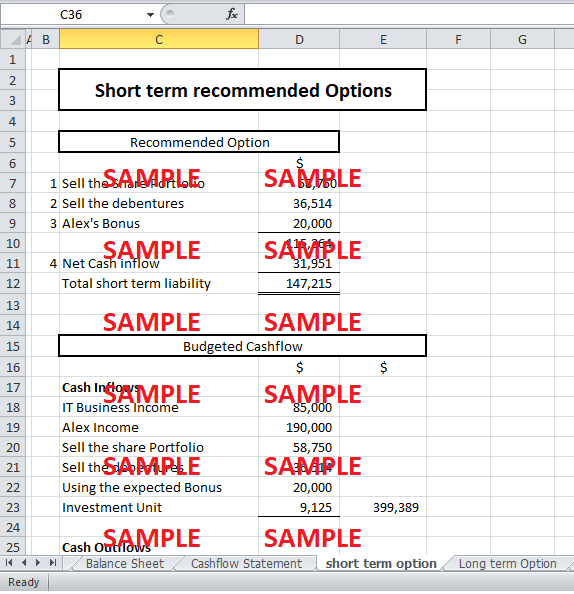

For short term increase in cash inflow, it would be best for Alex, and Kevin to sell the share portfolio, the debentures, use Alex’s bonus and draw on the savings in the saving account. The Market value of the share portfolio would be $ 58,750 and it would be feasible to sell it as it earns the least income. The income from this share portfolio is $ 1,900. The second asset, which earns the least income of $ 2,833, is the debentures. These can be sold for a market value of $ 36,514 which is determined using the yield of 7.75 %. These two assets generate a far lesser income then Kevin’s business, Alex’s job and the couple’s investment unit. Furthermore, Alex can use her bonus of $ 20,000 for paying off her parent’s liability and contribute the remaining to paying the creditors. Once these actions are carried out, a debt of $ 115,264 could be easily cleared. The remaining amount can be paid out using the net cash inflows of $ 58,871. The household expenses and tax, which were excluded from the calculations of cash flow, can be paid by drawing on the savings account and the bank deposit.

The investment unit is earning a healthy income of $ 9,125 and, therefore, it should not be considered for sale. Although this income is far less than the income generated by Alex and Kevin, it does add a material amount to the cash flow each year. Similarly, they should not use either Kevin’s self managed fund or Alex’s superannuation capital guaranteed fund. They will require these funds for retirement. Moreover, these funds make sure they maintain a habit of contributing to these funds each year. Once these funds are liquidated the saving habit might change.

If, the couple decides to pay only the minimum balance for credit card, it will have to pay interest of the outstanding amount. The net cash inflow after selling the share portfolio and debentures and using Alex’s bonus to settle the line of credit liability, Alex’s parent’s liability and minimum credit card balance would be approximately $ 47,773. This amount could be used for household expenses (like entertainment, bills, food and clothing), taxes, and interest on credit card amount outstanding.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.