Get instant access to this case solution for only $9

Rocky Mountain High Ski Resort Inc RMH Case Solution

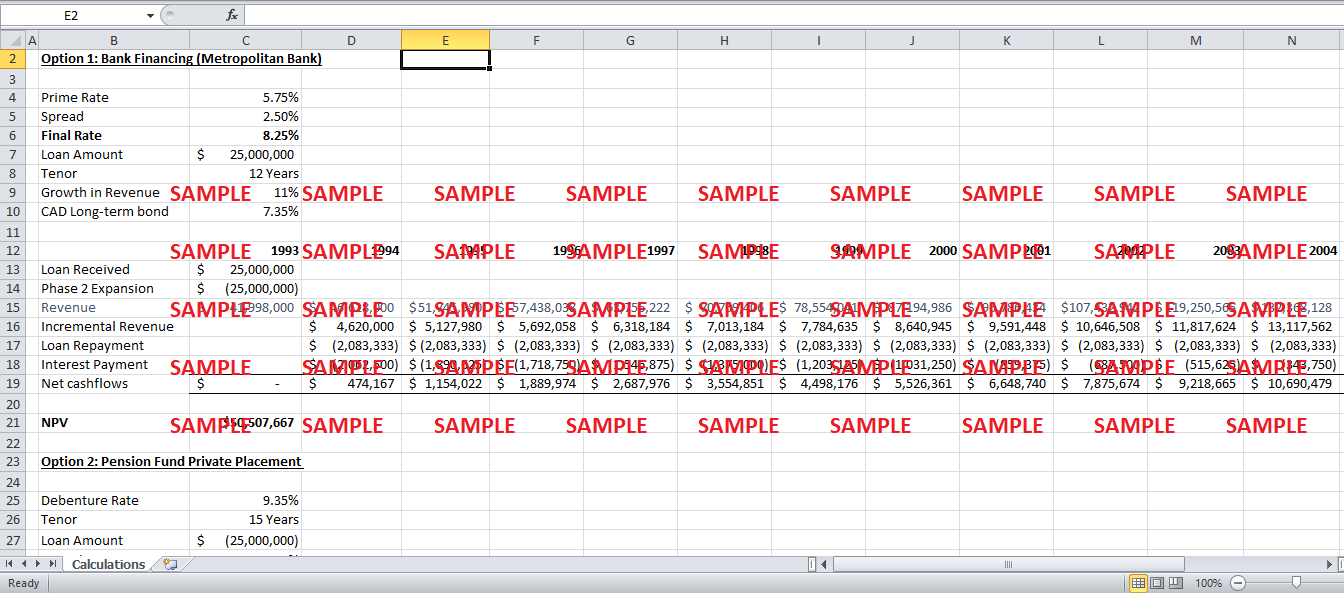

VP finance of RMH Skiing identified four options for phase 2 financing, namely bank debt, pension fund private placement, issuing ordinary shares, and issuing preference shares. After calculations of the net present value of the four options, it is concluded that going public with Preference Shares is the best option, as it has the highest NPV among the four options (see Excel file).

Case Analysis for Rocky Mountain High Ski Resort Inc RMH

Other than NPV, issuing preference shares is a good option because it would not increase the debt exposure of the company. As previously the company has obtained debt financing, taking on more debt could increase its leverage. Moreover, issuing preference shares would also not shift the ownership of the company from existing owners to new shareholders, and would allow the company to get rid of the preference share investment within 7 years.

If the Company would have chosen the debt options, it would have increased its debt to assets ratio, thereby making the company more leveraged. Further, their NPVs are also lower than the other options.

Get instant access to this case solution for only $9

Get Instant Access to This Case Solution for Only $9

Standard Price

$25

Save $16 on your purchase

-$16

Amount to Pay

$9

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

- Pharma Talent Paying Sales Force Bonuses Within A Fixed Budget Case Solution

- Lady Gaga B Case Solution

- Vida Gas Village Reach The Mozambican Foundation For Community Development Joint Venture Case Solution

- Asset Allocation At The Cook County Pension Fund Case Solution

- Toyota Motor Corp Heir Steers Carmaker Out Of Crisis Case Solution

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.