Get instant access to this case solution for only $19

StarTech.com Supply Chain Strategy Case Solution

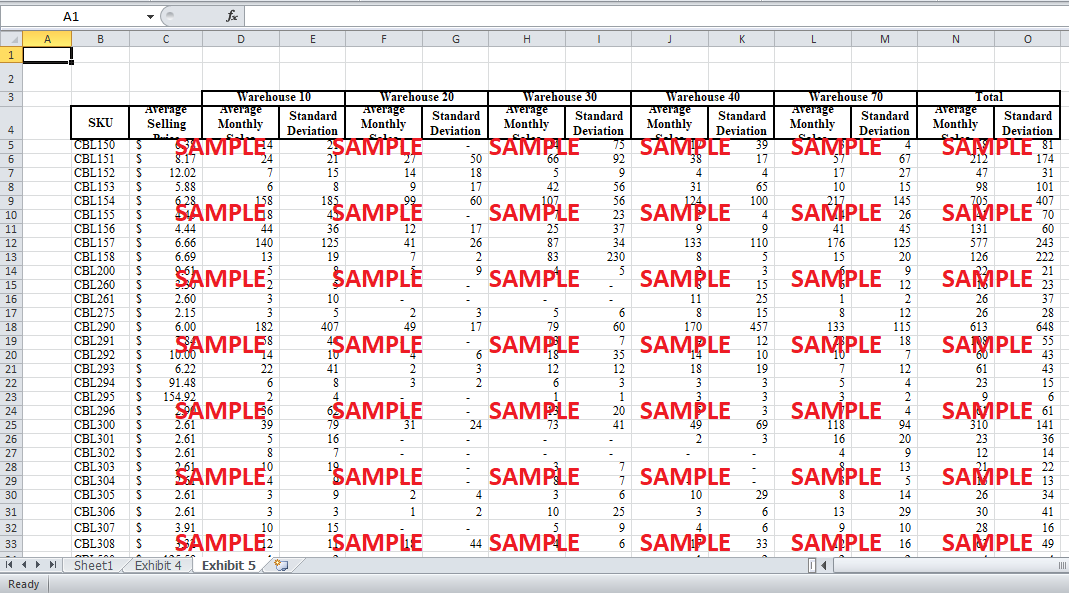

The widespread warehouses of StarTech will help ensure that the products can be quickly delivered to customers in different regions. However, it is critical to note that by having many warehouses company might lose on its cost efficiencies in the form of inventory handling and storage costs (Goh, et al., 2001). Considering the large total size of warehouses, StarTech needs to weigh the costs and benefits associated. Also, this might give rise to storage and handling costs, but the resulting reduction in transportation costs and timely deliveries positively impacting the company's goodwill might offset the negative impact.

Following questions are answered in this case study solution

-

Key Facts

-

Symptoms

-

Problem Statement

-

Analysis

-

Recommendations

-

Action Plan

Case Analysis for StarTech.com Supply Chain Strategy

1. Key Facts

-

StarTech was founded in 1987, when its CEO and COO, Paul Seed and Ken Kalopsis entered into the business of manufacturing and marketing of computer peripherals.

-

Its product line comprises of hard to find technological products and latest technological products targeting the niche market segment.

-

Rapidly changing technology requires constant updating of connectivity items relating to it like ports and cables, leading to continuous demand for connectivity devices which were supplied by third-party manufacturers.

-

The distributors have a significant influence on companies, customers and IT professionals who buy from them due to timely delivery and convenience offered by them.

-

StarTech's distinguishing factor was helping customers identify, find, get and then use hard to find technology by providing them with the right products at the right time to maximise customer satisfaction.

-

StarTech heavily relied on distributors for sales with 80% sales made to them. Sales to online direct marketers like Amazon accounted for 5%. 12% of its sales were to value added resellers who made sales through installation services or retail stores. Direct sales to end consumers were only 3% of total sales.

-

Almost 30% of the revenue of StarTech came from sales of hard to find product line because it ensured that it kept a stock of peripheral devices that were discontinued in the market or were past the maturity stage.

-

StarTech has a widespread supply chain network comprising of 190,000 warehouse space across London, US, UK and Canada.

-

StarTech follows a vendor managed inventory system which varies according to distribution centres and is based on projected demand so that it has sufficient inventory all the time.

-

The company is a product-focused company with cables being its largest product category.

2. Symptoms

-

The market is continuously evolving in response to advanced technological developments by the original equipment manufacturers such as Apple and others.

-

The company has reduced its inventory as a percentage to sales from 50% to 35% through working capital utilisation.

-

The company is moving towards the business model where its sales pace is faster from its investment in inventory.

-

StarTech's gross margins were higher than the normal distributors which ranged from 5% to 20% to StarTech's 20% to 30%

-

StarTech’s product line has two broad categories. However, it still does not distinguish between the two as separate items- commodity items and hard to find. By doing so, it would be able to segment its market clearly.

-

The company is consignment-based, which requires extensive inventory managing.

-

Just in time production and delivery of items implementation are a challenge, but efforts are being made to implement it effectively.

-

With continuous growth in sales revenue, there is a need to take steps to retain its market and further grow its sales, the company.

-

Increased warehouses of StarTech are there to ensure the effective flow of goods to the consumers at the right time.

-

Challenges ahead are a smooth transition from commodity to hard-to-find categories and to strategize supply chain to cater to growing sales and demand.

3. Problem Statement

Having established itself as a Manufacturing and Distribution Company of connectivity devices for equipment manufactured by Apple and other companies, StarTech faces a problem of continually meeting the ever-growing demand. Considering the growing demand and not so well adapted inventory management system, this is a problem because timely unavailability of items would cause the distributors to shift to other manufacturers pulling down its sales volume. Also, inefficient inventory management might raise costs of handling and transportation shrinking the profitability. Secondly, the value proposition of the products in the minds of customers' needs a lot of working so that the switching costs can be reduced. This is a problem as in future when further competition is expected to grow, StarTech might face declining sales volume.

4. Analysis

StarTech has seen an increase in its sales due to rapid technological advancement which has significantly raised demand for connectivity devices associated with the new technology being introduced and also with technology discontinued in the market but still being used by the consumers. Their demand is an ongoing demand which is why the company is involved in selling in two broad categories- commodity and hard to find technology. The company's reducing inventory to sales ratio reflects how quick and effective it is in converting its inventory. This is an important measure to ensure that the company is on the right track to profitability and is effectively working on reducing its storage and handling costs by inventory minimisation and at the same time achieving revenue maximisation (Tersine & Wacker, 2000).

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.